– Daniel Wu

Chinese payments and fintech giant Ant Group is expected to IPO in October at a valuation exceeding US$200 billion. Being investors in Alibaba Group, which owns 33% of Ant, it was imperative for us to form a view on the Ant business. This also marks the first time a large Chinese payments platform has filed standalone financials publicly, which should provide investors with some interesting insights.

Ant Group separates its operations into two broad segments – digital payments and digital finance. The digital payments business is comprised of the main Alipay consumer payments business. Alipay is a ubiquitous mobile payments platform with over 1 billion annual users, 711 million monthly active users, and accepted by over 80 million merchants in China. The platform processed RMB 118 trillion in total payments volume in the twelve months to June 30, 2020 and held 55% market share of the China mobile payments market, with Tencent-owned WeChat Pay holding substantially all the remaining share in a duopoly market structure.

Nearly 730 million Alipay users also make use of Ant’s digital finance businesses – CreditTech, InvestmentTech and InsureTech. The CreditTech business is the largest online consumer and SMB credit services provider in China and leverages Alipay’s extensive consumer payments data to originate loans that are underwritten by approximately 100 partner banks. Ant doesn’t use its own balance sheet for these loans and generates revenue as a percentage of banks’ interest income on loans enabled by its platform. The InvestmentTech business is the largest online investment services platform in China by AUM distributed and provides money market funds and other investment products to Alipay users. InsureTech is the largest online insurance services platform (see the pattern here?) in China as measured by insurance premiums, providing a wide-ranging online distribution platform for over 90 insurance partners. Where Ant and Tencent are similarly-sized in payments, Ant is 2-4x larger than Tencent in fintech.

In a sentence, Ant’s business model can be summarized as leveraging vast volumes of proprietary payments data to feed asset-light credit, investment and insurance platforms. But instead of diving into the details of the prospectus, we thought it would be more relevant to highlight what we believe are the key considerations for potential investors in Ant Group.

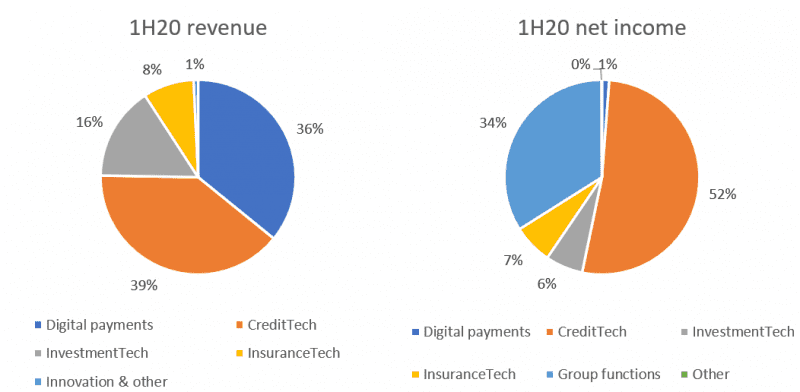

Firstly, investors outside of China can be forgiven for thinking digital payments is the key driver of Ant Group based on our exposure to Alipay in the West as a payments app. But in reality, the payments business is not profitable and only serves as a “hook” or feeder into the lucrative fintech businesses. Even though the Chinese mobile payments market is effectively a duopoly, fierce competition between Ant and Tencent has driven payments take rates down to c.20 bps in 2019 from c.40 bps in 2017, compared to Paypal take rates of over 200 bps. As such, despite contributing 36% of Group revenue in H1 2020, the payments business contributed just 1% of net income. Recent regulatory initiatives such as unified QR code and the central bank’s DC/EP digital currency which aim to promote payment system interoperability and reduce barriers to entry may put further long-term pressure on payments take rates.

What is perhaps less obvious is that even though Alipay processed RMB 118 trillion of total payments in the twelve months to June 30, 2020, only “consumption payments” contribute materially to revenue, which we estimate to have been c. RMB 27 trillion during the period. China final consumption expenditure was c. RMB 55 trillion in 2019 and considering Alipay and WeChat Pay have a similar share of mobile payments, it appears that the consumption payments addressable market is already highly penetrated. Even if our estimates are off by a few trillion, the mobile payments market is still in maturity and we believe future growth should decelerate meaningfully compared to the recent past.

On the other hand, the CreditTech business is a unique crown jewel that cannot be replicated by competitors or partner banks, because no one else has Ant’s proprietary data (except Alibaba through a 50 year data sharing agreement). The value of CreditTech (and Ant more generally) is not in its huge user base or the loans it originates, but rather in the proprietary consumer payments and behavioural data that feeds into Ant’s closed-loop credit scoring system, Sesame Credit. This credit scoring system is what enables Ant to originate loans to underserved consumer and SMB segments at lower interest rates than non-bank competitors, and with lower delinquency rates than the large state-owned banks.

The InvestmentTech and InsureTech businesses are more nascent in their leveraging of Ant’s payments data to provide differentiated services and products to users, and largely function as scale distribution platforms today. While the opportunity to apply user data to InvestmentTech appears limited, we believe there is significant opportunity to use behaviour insights from payments data to design new insurance products, or at the very least improve the pricing of risk. This is likely a longer-term opportunity, and the key challenge will be migrating complex but high-margin health and protection products online which currently requires face-to-face meetings with the customer.

The greatest uncertainty to Ant’s ecosystem is regulatory risk. Given that payments is the strategically vital but financially unprofitable funnel into the lucrative fintech businesses, investors should be most concerned about regulatory intervention in the consumer credit space that may limit the extent to which Ant can monetise its payments data. While extending consumer and SMB credit to underserved borrowers is part of the government’s financial inclusion initiatives, regulators have also clamped down on unchecked credit growth in the past. And recently, PBOC officials have called for more supervision of “payment+fintech” businesses that leverage payments to cross-sell financial products in closed-loop ecosystems – if not by regulating the likes of Ant directly, then by regulating the banks that fund the loans.

Montaka owns shares in Alibaba Group

Daniel Wu is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.