|

Getting your Trinity Audio player ready...

|

-Chris Demasi

Most investors think of Amazon as an amazing online ecommerce business. The business, of course, is the ultimate ‘flywheel’ – it has powerful advantages, such as scale, that creates a virtuous cycle of ever-increasing advantages and growth.

What is better than a flywheel business? The answer of course is multiple flywheels.

So, while some investors may balk at Amazon’s stock, after its meteoric rise over the last two decades has created nearly $US2 trillion dollars in market cap, we view Amazon as a portfolio of several flywheels that are just beginning to turn.

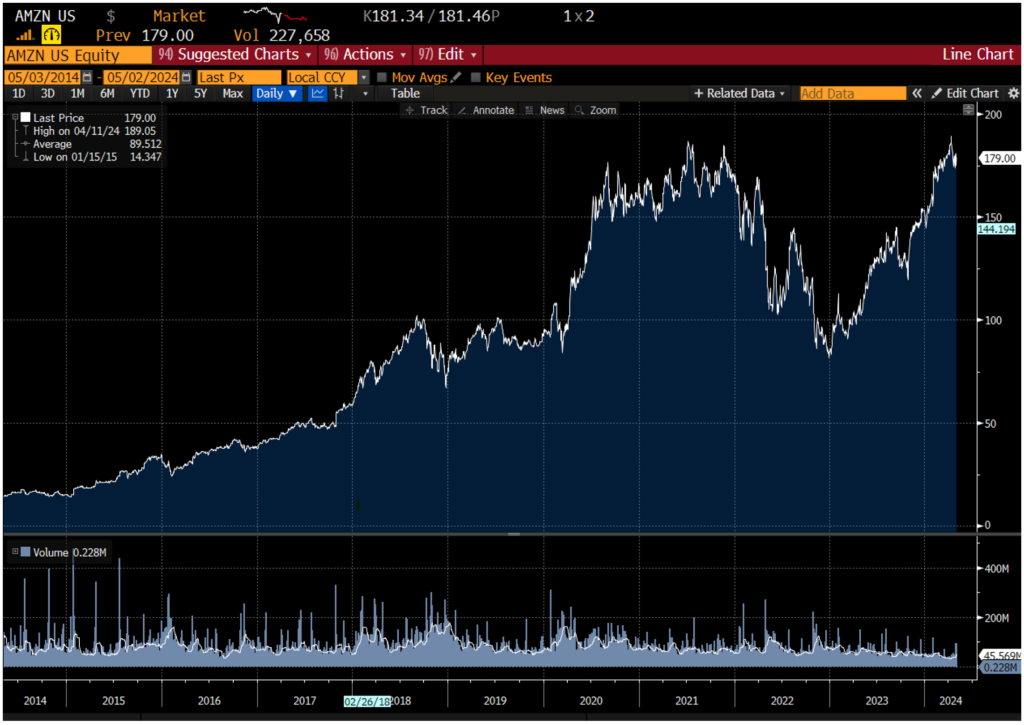

Amazon stock has been more than a 10-bagger over the last decade

Source: Bloomberg

When Amazon is parsed this way, it becomes clear that it has many businesses which are dominating massive markets with the potential to create trillions of dollars of value in each. And drive the share price much higher over the course of this decade.

Below we look at Amazon’s original flywheel, and an additional four underappreciated flywheel businesses that Amazon has built along the way.

Flywheel 1: E-commerce

Amazon’s original flywheel came in the Amazon.com e-commerce business and turns with the power of ‘scale economics shared’. That’s where the benefits of scale are shared with customers in the form of lower prices and greater selection.

For more than two decades, the more customers Amazon has reached, the more Amazon has lowered prices, increasing the appeal even more customers.

This large customer base is very attractive to third-party merchants who have been increasingly lured to sell on Amazon, broadening the selection of products available for sale on the site, and, in turn, further increasing Amazon’s attraction to customers.

Amazon’s e-commerce flywheel

In the process Amazon has become a giant and ecommerce has become ubiquitous. However, online sales still represent the minority of retail spending, accounting for just 15% of total retail sales in the US. But that’s changing quickly.

We estimate that more than 50% of retail sales in the US could ultimately take place over the Internet. That amounts to several trillions of dollars, which Amazon is well positioned to capture as its flywheel spins harder.

Source: Montaka

And international markets are following the same path as the US, which could add several trillions of dollars more flowing through Amazon’s online store.

That means the global opportunity for Amazon is many times the estimated one trillion dollars in gross merchandise value that is sold by Amazon around the world today.

Flywheel 2: Cloud Computing

Amazon’s cloud business, Amazon Web Services (AWS), is a flywheel based on pooling the cost of computing infrastructure and software research and development costs across a massive user base.

The more customers AWS has, the lower the unit cost of the infrastructure and the software, which benefits all the customers, driving even more customers to use the platform.

Cloud computing has been growing rapidly in recent years and annual cloud sales have reached around a quarter of a trillion dollars, of which Amazon leads the industry with $100 billion of annualized revenues.

However, the shift to cloud computing is only just getting started. Amazon’s CEO Andy Jassy estimates that up to 90% of $6 trillion in IT spending is still done ‘on-premise’ by companies that buy their own data centers, networking and storage equipment, and software systems.

Jassy expects that to flip over the course of the next decade, so that cloud computing becomes the dominant IT platform for corporations and governments worldwide.

And as this paradigm shift plays out, trillions of dollars in cloud computing sales will go to just three leading providers: Amazon’s AWS, along with Microsoft’s Azure and Alphabet’s Google Cloud Platform.

And that’s before adding in the upside from the AI revolution.

Already AWS has added several billions of dollars in annualized revenues from AI services and Jassy projects that’s going to grow to tens of billions of dollars over the next few years.

Flywheel 3: Fulfillment and Distribution

Amazon’s fulfillment and distribution flywheel succeeds because the enormous volume of packages handled by Amazon’s network allows it to keep reducing unit shipping costs while speeding up delivery times across a broader selection of goods available for delivery.

That has led to more third-party sellers choosing Amazon to provide fulfillment services for them, increasing the number of packages that move on Amazon’s trucks, through their warehouses and to their fulfillment centers, and further reducing their costs.

Last year Amazon managed to reduce unit costs dramatically while delivering more than seven billion items on the same, or next, day.

Merchants now spend almost $140 billion on third-party services with Amazon, including fulfillment and distribution. We think there is room for this to expand as the level of third-party sales grows, and sellers choose Amazon for distribution of their parcels more often.

Customer benefit, too.

Amazon’s massive distribution system allows for an even wider assortment of products, like groceries and essential items, to be packed together and shipped faster and cheaper. Customers have responded by shopping more and more frequently which has sped up the e-commerce flywheel.

Flywheel 4: Prime Subscriptions

The Prime flywheel operates because Amazon already has a large base of customers that pay subscription fees for a range of benefits, starting with free delivery.

The more subscribers paying subscription fees, the more services Amazon can offer, including TV streaming, movies, music, games, and books. That makes the subscription program even more attractive, which drives more subscribers.

Amazon earns around $40 billion in subscription fees today, mainly from charging its Prime members up to $140 per year. However, that represents extraordinary value that doesn’t necessarily end up in the price.

In a research report in 2022, JPMorgan estimated the value of all the services bundled into the Prime offering on a standalone basis was around $1,100 per year. With a base of more than 200 million members worldwide, that means Prime could be worth over $200 billion each year.

And the Prime flywheel also boosts the e-commerce and fulfillment businesses because prime subscribers tend to spend more on the retail platform, generating more profits that can be shared with merchants, customers and Prime members.

Flywheel 5: Advertising

Amazon has grown its advertising business into one of the largest digital ads platforms in the world with the power of flywheels.

By combining its massive consumer base on Amazon.com and Prime with AI capabilities from AWS, Amazon serves targeted ads with high levels of performance that can be effectively measured.

This lowers customer acquisition costs and drives additional sales. It also generates personalized transaction data that can be used for even better ads in future.

As merchants have seen increasing returns on their ad spend, more merchants have allocated a greater share their advertising budgets to Amazon, enjoying higher sales and better data, which has encouraged even more advertising with Amazon.

From a standing start a few years ago, Amazon’s advertising business has reached almost $50 billion in annualized revenues today, which is more than a third of Meta’s advertising business that includes both Facebook and Instagram.

But so far Amazon has only offered sponsored ads on its retail platform.

Recently Amazon has introduced ads on its Prime Video streaming service which we expect will open up a massive new growth channel as advertisers directly reach Prime’s high-spending audience.

And there’s more to come …

If that isn’t enough, we think there may be even more flywheel businesses in Amazon’s future. We are seeing three more flywheels emerging today, including:

- Generative AI tools that can improve things like product listings, ad creatives and personalized shopping assistants, and get better with more usage.

- Like other tech giants, Amazon is designing its own AI chips, the Trainium and Inferentia series, which will improve with increasing adoption.

- Project Kuiper is Amazon’s project to use satellites to provide broadband connectivity to 400 million new customers that will drive more online retail sales, as well as capture more data for better advertising.

Amazon’s stock has been a multi-bagger over the last decade, powered by its remarkable e-commerce ‘flywheel’ business. Some investors might now be fearful that the stock can’t go any higher from here.

But we think Amazon’s portfolio of multiple flywheels will continue to propel superior compound growth over the long term and reward investors with a much higher share price in future. That makes Amazon just the stock that we look for at Montaka.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us:

Note: Montaka is invested in Amazon.

Chris Demasi is the Portfolio Manager for Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or leave us a line on montaka.com/contact-us