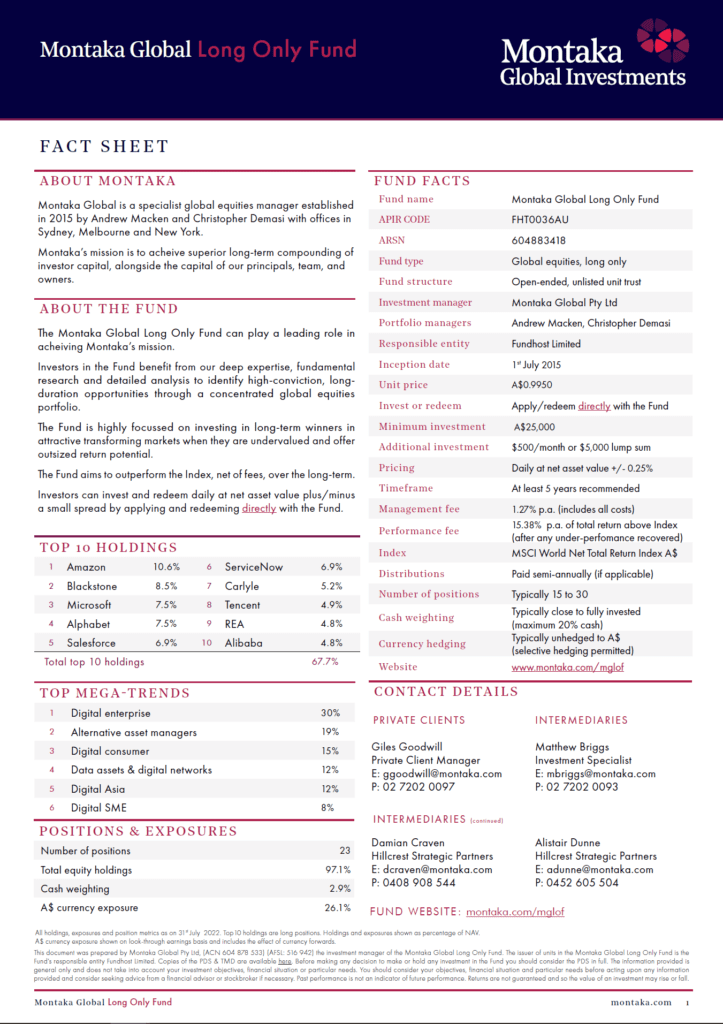

Montaka Global Long Only Fund

FUND OVERVIEW

The Montaka Global Long Only Fund is highly focussed on investing in long-term winners in attractive transforming markets when they are undervalued and offer outsized return potential.

The Fund aims to outperform the Index, net of fees, over the long-term. Investors can invest and redeem daily at net asset value plus/minus a small spread by applying and redeeming directly with the Fund.

- Unlisted managed fund

- Concentrated portfolio of typically 15-30 long positions

- Long-term capital growth

- Inception July 2015

- View the Fact Sheet for more information

Zenith Product Assessment (Nov 2024)

“[Our] conviction in the Fund is underpinned by the highly capable investment team.”

HOW TO INVEST

-

Invest directly with the Fund

Invest directly with the Fund

-

Speak to a Financial Adviser

Speak to a Financial Adviser

Please click below to complete the online application form

Or please fill out the form contained in the PDS

Speak with your Adviser or Broker and let them know the ASX ticker code ‘MGLOF’.

To locate an Adviser in your area you can visit one of the below associations:

Additional information:

For assistance in completing the application form, please get in touch with the Administrator, Fundhost Limited on 02 8223 5400 or email admin@fundhost.com.au

PRICE

Buy

$1.8030

Mid

$1.7985

Redeem

$1.7940

As at 30 June 2025. This fund is forward-priced. The price you receive is based on the close of market prices.

Performance

| Montaka Global Long Only Fund | MSCI World Net Total Return Index | Out/Under performance | |

|---|---|---|---|

| 1 month | 3.8% | 2.4% | 1.39% |

| 3 months | 9.1% | 6.0% | 3.15% |

| 6 months | -4.3% | 3.4% | -7.70% |

| 12 months | 19.5% | 18.5% | 1.02% |

| 2 years p.a. | 25.5% | 19.1% | 6.34% |

| 3 years p.a. | 24.3% | 20.2% | 4.11% |

| 4 years p.a. | 10.5% | 12.9% | -2.43% |

| 5 years p.a. | 12.4% | 15.7% | -3.28% |

| Since inception p.a. | 10.4% | 12.3% | -1.89% |

As at 30 June 2025

Fund inception date: 1 July 2015

Performance is net of fees and assumes distributions are reinvested. Past performance is not an indicator of future performance.

Growth of $100,000 invested since inception

INVESTOR CENTRE

Our administrator, Fundhost, has a portal that investors can access to see their balance and download all statements. Once invested, you will be given registration details.

By visiting the above link, investors can:

- View their holding detail

- Access and update information relating to dividend and transaction history

- View balances, download tax statements, access all forms.

Fundhost Limited

P: 02 8223 5400

F: +61 2 9251 3525

W: https://fundhost.com.au/fund/montaka-global-long-only-fund

DISTRIBUTION

| Date | Distribution (A$) per unit | Reinvestment per unit |

|---|---|---|

| June 2025 | 17.7618 cents | $1.6209 |

| June 2022 | 8.6869 cents | $0.9359 |

| June 2021 | 1.0462 cents | $1.32 |

| June 2020 | 2.3207 cents | $1.10 |

| June 2019 | 15.5592 cents | $1.17 |

| June 2018 | 7.5200 cents | $1.23 |

| June 2017 | 12.0993 cents | $1.09 |

FAQs

The Montaka Global Long Only Fund will typically invest in an all-cap portfolio of 15 to 30 high quality businesses listed on major global stock exchanges with a focus on North America, Western Europe, the United Kingdom, Japan, Hong Kong, Singapore and Australia.

If an insufficient number of individual company names are appealing in terms of the prevailing share price relative to the Montaka Global’s assessment of their intrinsic value, we may consider the overall market ‘expensive’ and in an effort to preserve the market value of the portfolio, may allow the cash component of the portfolio to build.

The component of The Fund that can be held in cash has a hard limit of 20% of funds under management.

Montaka Global may, on occasion, hedge the Fund against movements in the Australian Dollar and other currencies, but the default position is to remain unhedged.

Montaka Global Long Only Fund is an unlisted managed fund that issues you with units.

While the Montaka Global Fund – Active ETF (ASX-MOGL) is a listed fund, quoted on the ASX, and issue investors with units that can be traded at any time through an online trading account or through a stock broker.

While they are completely different trusts under separate investment vehicles, both these funds share the same common investment strategy and we expect that performance will closely follow the equivalent listed Montaka Global Fund (ASX:MOGL), as it maintains the same investment strategy, investment process and substantially the same portfolio.

Montaka Global Long Only Fund is an unlisted managed fund that issues you with units.

While the Montaka Global Fund – Active ETF (ASX-MOGL) is a listed fund, quoted on the ASX, and issue investors with units that can be traded at any time through an online trading account or through a stock broker.

While they are completely different trusts under separate investment vehicles, both these funds share the same common investment strategy and we expect that performance will closely follow the equivalent listed Montaka Global Fund (ASX:MOGL), as it maintains the same investment strategy, investment process and substantially the same portfolio.

A minimum initial investment of $25,000 is required.

You may also arrange to add to your initial investment through a lump sum additional investment, for which there is a minimum of $1,000, or direct debit monthly savings plan, requiring a minimum investment of $500 per month. This is processed on the 15th of each month or the next business day.

Any income distributions are paid semi-annually (as at 30 June and 31 December each year) and can be reinvested in full or paid out entirely to the financial institution account nominated on your application form. We distribute all taxable income to investors each year, including any taxable capital gains. Distributions may also carry imputation or other tax credits. There may be periods when net income could be negative and no distribution is made.

Our administrator, Fundhost, has a new investor portal that investors can access to see their balance and download statements. Once invested, you will be given registration details. For any historical statements, prior to FY23, statements can be requested by emailing admin@fundhost.com.au

Access the Fundhost client log in here: Log In.

To redeem your holding, simply fill out the form and have it signed by the relevant signatory on the account. If Fundhost are paying to a bank account they have on file, they can accept a faxed or scanned copy of the redemption request. If not, then you need to return the original to the below address:

Fundhost Ltd.

PO Box N561

GROSVENOR PLACE NSW 1220

Click below to download:

For any questions, please call Fundhost on 02 8223 5400

Notice period: In normal circumstances, redemptions are processed daily, with funds generally received back to the investor within 2 business days. The cut off to receive your redemption request to receive that days price is 4pm Sydney time. Please refer to the PDS for more information.

If you do not have an SMSF and want to invest your personal superannuation into the Montaka funds, you can get in touch with us and we will be happy to guide you through the process.

No commissions are paid by us to any financial advisers or brokers.

DOCUMENTS & LINKS

GET IN TOUCH

If you are a current investor and need assistance with change of details, tax statements, additional investments or redemptions, please log in to Fundhost by clicking the button below. Alternatively, you can contact Fundhost on admin@fundhost.com.au or 02 8223 5400.

Montaka Global Pty Ltd AFSL: ABN 62 604 878 533, AFSL No. 516942 (previously known as MGIM Pty Ltd) is the investment manager and can be reached on 02 7202 0100 or email at office@montaka.com

Disclaimer :

- Zenith Rating Disclaimer:

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned November 2024) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines.

This research rating requires to be read with the full research report that can be found on the issuers website (or upon request) together with our full disclaimer that is found on the front cover of our research note. We require readers of our research note to obtain advice from their wealth manager before making any decisions with respect to the recommendation on this note. The note is not general advice just financial information without having regard too the financial circumstances of the reader.

- You should read the Product Disclosure Statement (PDS) and Target Market Determination (TMD) before deciding to acquire the product.

- The issuer of units in Montaka Global Long Only Fund is The Fund’s responsible entity Fundhost Limited ABN 69 092 517 087 (AFSL 233 045). The Product Disclosure Statement (PDS) contains all the details of the offer.

- Copies of the PDS and TMD are available for download on this web page under the ‘Documents’ header. Before making any decision to make or hold any investment in the Fund you should consider the PDS in full. An investment in the Fund must be through a valid application form attached to the PDS. You should not base an investment decision simply on past performance. Past performance is not an indicator of future performance. The investment returns of the Fund are not guaranteed, and so the value of an investment may rise or fall.

- The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon this information and consider seeking advice from a licensed financial advisor if necessary.

- This Fund is appropriate for investors with “High” risk and return profiles. A suitable investor for this Fund is prepared to accept high risk in the pursuit of capital growth with a medium to long investment timeframe. Investors should refer to the Target Market Determination (TMD) for further information.