|

Getting your Trinity Audio player ready...

|

By Andrew Macken

Before it evolved into today’s credit ratings powerhouse, Moody’s was founded way back in 1900 by John Moody as a manual that provided statistics on stocks and bonds.

“What do you think the average revenue growth over those 100 years has been [for Moody’s]?”

So asked legendary billionaire English investor, Sir Chris Hohn, in his recent interview with Nicolai Tangen, CEO of Norway’s sovereign wealth fund.[1]

The answer is that Moody’s has grown sales by around 10% per annum – that’s a staggering growth rate for such a long period.

To put that performance into perspective, the nominal GDP of a typical economy grows at, say, 6% per annum. So over 100 years, Moody’s revenue would have outperformed that typical GDP growth by more than 40x!

Hohn founded the London-based hedge fund, The Children’s Investment Fund, known for its philanthropy: the fund donates to a charity that works with children in developing countries.

Hohn is also famed for his activist approach and his concentrated, long-term portfolio that has delivered stellar returns.

While many market participants are fixated on short-term performance metrics, Hohn’s focus is on owning and holding long-term compounders, like Moody’s.

When he spoke with Tangen about his investment strategy, Hohn said that truly great companies continue to compound intrinsic value over extended periods.

That’s why Hohn holds stocks in his portfolio longer than most investors: on average for more than eight years.

Hohn believes, as we do at Montaka, that the key to building sustainable wealth is not focusing on short-term changes in prices and multiples, but owning high-quality businesses that consistently expand over extended time horizons.

It’s not a strategy suited to everyone, however.

Advantaged Businesses Have the Power to Generate Consistent Growth

For a company to grow so reliably like Moody’s is very unusual. Only the most ‘advantaged’ businesses can.

In credit ratings, Moody’s and S&P Global (which Montaka owns) are the industry standards. All publicly traded bond issuances require Moody’s and S&P’s ratings. Their revenues, therefore, grow with issuance – which itself grows at or above the broader economy.

Would-be competitors have tried (and failed) over the years to break into the industry.

But the more the finance industry consolidated around the two large credit ratings agencies, the more their ‘flywheel’ has given them greater scale and greater reputational trust amongst investors; and that, in turn, has strengthened their competitive advantages.

Managing Market Noise

Investing in a business like Moody’s or S&P Global might sound straightforward, but it’s not so easy because of short-term noise and volatility around share prices and multiples.

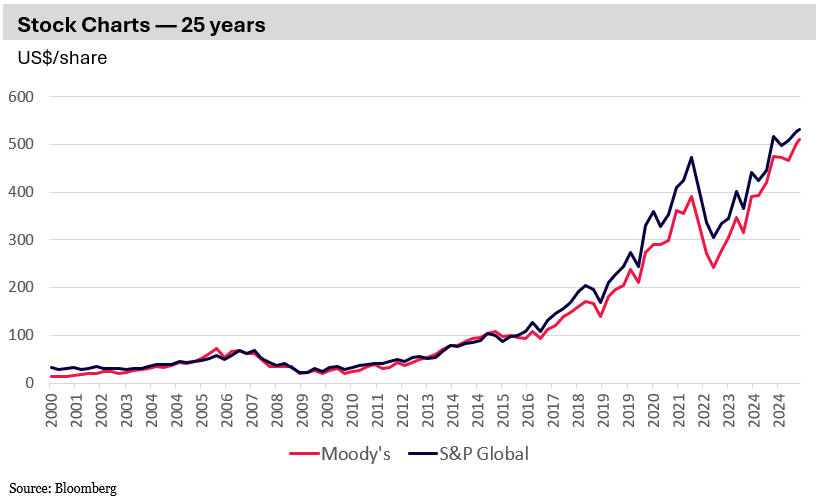

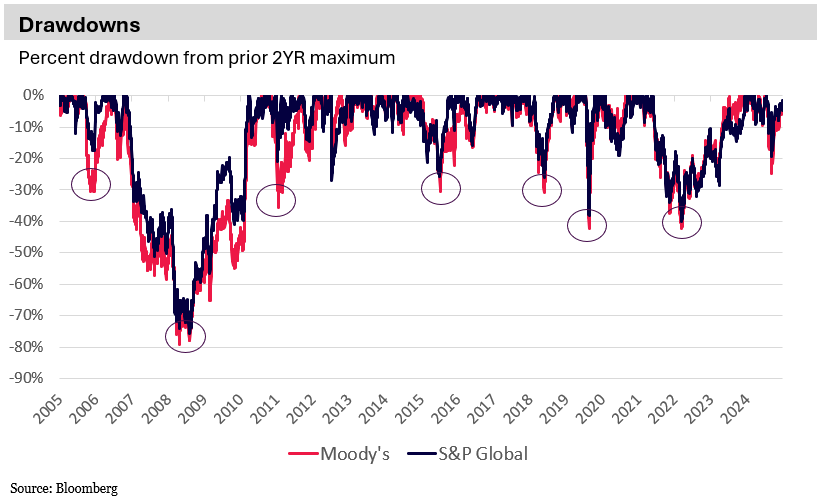

Despite being such advantaged businesses – which have proven themselves time and time again – Moody’s and S&P’s stock prices have been anything but smooth.

As is the case for most publicly listed companies, their stock prices have routinely declined by at least one-third. And during the GFC, the stocks declined by as much as 80%!

Yet, despite these frequent drawdowns, Moody’s shares have delivered an 18% return per annum over the last 25 years – or an increase of 63x!

This is materially higher than the S&P 500 Index, for example, which returned 8% per annum over the same period – or an increase of 7x.

The Perils of Short-term Investing

Many investors are either unwilling or unable to invest on a long-term time horizon, perhaps lacking the requisite investing framework, conviction, or even corporate structure to ride out market volatility.

Yet the short-term investor is at an enormous disadvantage because a company’s earnings power typically doesn’t change much over a short period of time, so the short-term investor is simply betting on a near-term increase in valuation multiple.

Valuation multiples, however, are driven by all kinds of factors – many of which have little to do with the investee company.

A simple comment from the Chair of the Federal Reserve (or the US President these days) can substantially decrease valuation multiples. Such a short-term proposition is arguably much more uncertain and harder to be successful on a sustainable basis.

The Long-Term Investor’s Advantage: Prioritizing Intrinsic Value

Hohn’s solution to short-term noise is to focus on a high-quality business’s intrinsic value and its inherent capacity for long-term growth.

“If you have a great company, it will grow intrinsic value,” says Hohn.

It is sustainable earnings growth – if a company has it – that is generally the dominant driver of intrinsic value over the long term, rather than changes in valuation multiples.

A long-term investor investing in a company that can grow reliably over extended time periods can worry a lot less about valuation multiples.

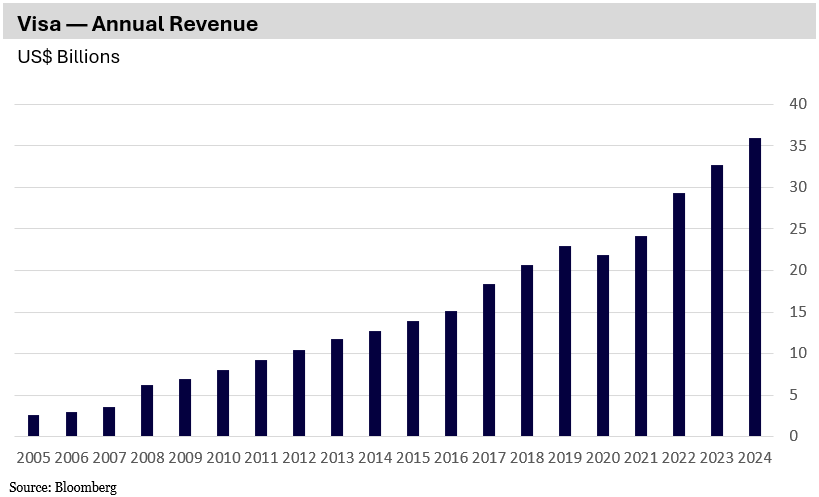

Consider Visa, for example. This highly advantaged payments network has grown its revenues at an average rate of 14% per annum over the last 20 years.

That’s an increase in annual revenues of more than 13x. And as profit margins have expanded over the same 20 year period, earnings have increased by even more.

If valuation multiples were to increase or decrease by, say, 0.5x, the effect pales in comparison to the overwhelming compounding of earnings over the long term.

This is the advantage for long-term patient investors.

A Long-term Focus

It’s hard to imagine, but the fair price-to-earnings (PE) ratio of Moody’s a century ago was north of 200x.

Investors – had they known the company’s duration of double-digit growth that lay ahead – would have (or should have) been willing to pay an extremely high multiple of the company’s earnings power at the time.

“Investors have always underestimated its [Moody’s] value, including myself,” said Hohn.

And yet Hohn was skilled and fortunate enough to buy shares in Moody’s at 10x earnings during the GFC.

By focusing on the underlying quality and growth potential of a business – rather than its fluctuating market price or current multiple – long-term investors like Hohn and Montaka can unlock substantial value that others, caught in the short-term cycle, often miss.

Note:

[1] (Norges Bank Investment Management) Sir Chris Hohn: Strategic Investing, Long-Term Value and Purposeful Philanthropy, May 2025

Montaka is invested in S&P Global and Visa.

Andrew Macken is the Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100 or leave us a line at montaka.com/contact-us

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stock picks. To listen, please click on this link.