|

Getting your Trinity Audio player ready...

|

By Andrew Macken

Montaka loves flywheel business models.

These business models have symbiotic relationships with customers (or users). When one party gets more value, the other gets more value. This causes a powerful, self-fulfilling feedback loop that drives continued expansion.

Flywheel business models are so valuable because they tend to grow annual earnings at solid rates over extended periods. And when a company compounds earnings on a sustained basis, it generates supernormal returns.

Flywheel business models, however, are routinely underestimated by markets and therefore throw up attractive investment opportunities for patient capital.

So it was music to our ears back in May this year when Tencent President, Martin Lau, told investors that he sees a very long runway of growth ahead for his company – and that all Tencent tries to do is “extend the runway”.[1]

These comments demonstrate that Tencent understands why flywheels are so valuable.

Below, we explore Tencent’s many flywheels and how they are driving growth and earnings power.

The conclusion from our analysis is clear: Despite its share price rallying over the past few years, the market is still underestimating Tencent’s intrinsic value.

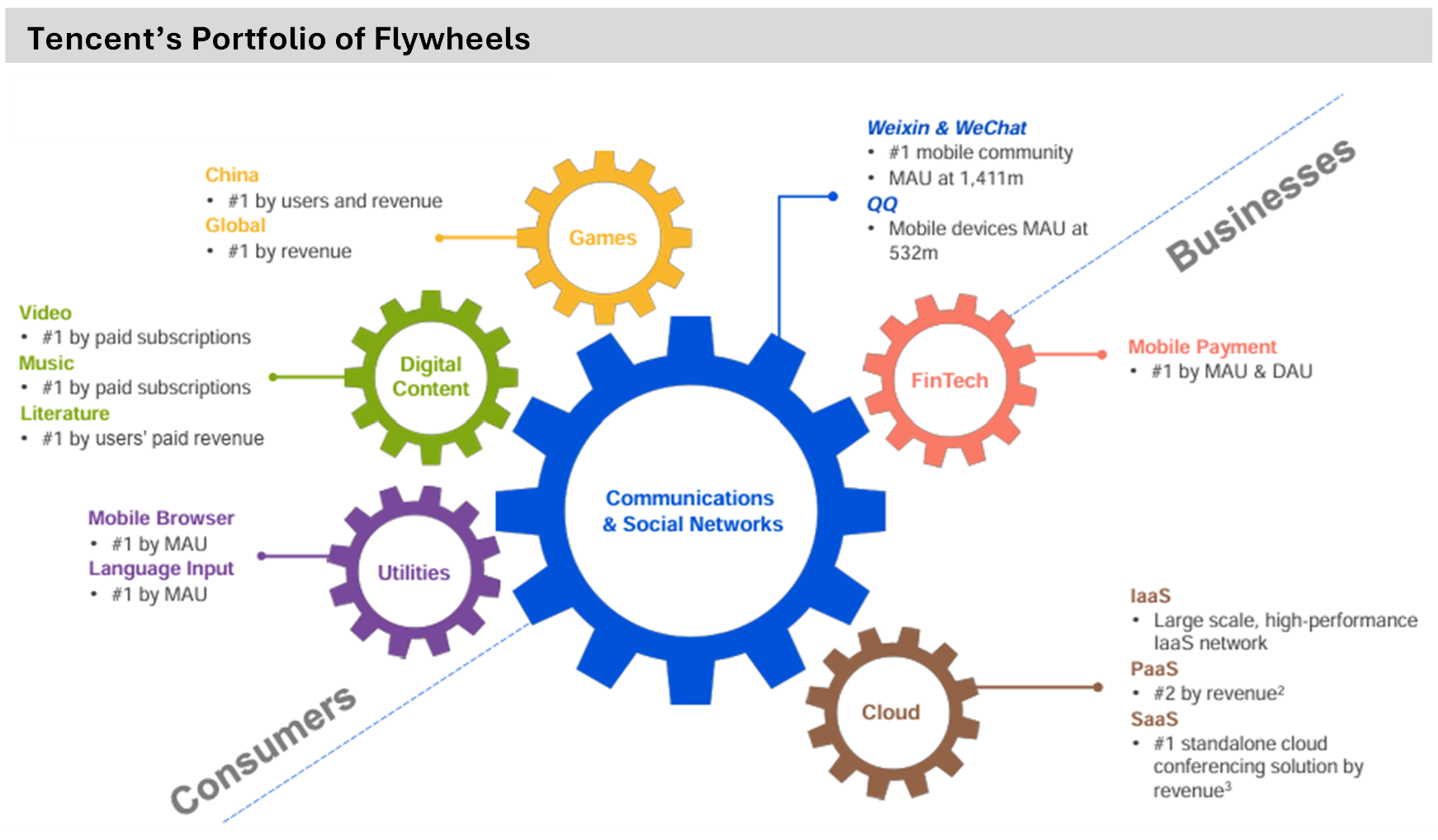

Tencent’s Flywheels

Tencent is almost like a mix of Meta and Microsoft.

It owns a wide range of complementary and highly privileged consumer and business-facing platforms.

Tencent’s consumer-facing crown jewel is its Weixin (or WeChat) mobile app, which boasts more than 1.4 billion monthly active users (covering almost the entire Chinese population).

Chinese people live their personal and professional lives through the app.

Unlike Western apps, WeChat has millions of internal ‘mini programs’ (sub-applications) developed by third parties. These mini programs provide users with services ranging from e-commerce, gaming, entertainment, to public services, transportation and payments.

The flywheel dynamic here is fairly obvious: the more users that engage with the platform, the greater the opportunity for third-party mini programs to monetize services to WeChat’s huge audience.

Tencent provides marketing, advertising, commerce – and increasingly AI services – to these mini-programs, so the symbiotic relationship between opportunity and growth is clear.

On the business-facing side, Tencent – as owner of some of the most privileged datasets in China – is a leader in Chinese AI and a major player in cloud computing.

This, too, has a flywheel dynamic. Like the western hyperscalers, the more businesses use Tencent’s cloud computing, the greater Tencent’s scale and the lower its fixed costs – including in R&D – become as a percentage of revenue.

Source: Tencent Company Filings (Q2 2025 Reults presentation)

AI strengthens flywheels

Over recent years, Tencent has started to strengthen its flywheels by deploying AI within its core businesses.

Like Meta, Tencent has used AI to successfully improve several areas:

- Content recommendations and search capabilities – both of which increase user engagement and ad inventory;

- Its ad targeting and closed-loop measurement within the Weixin ecosystem, which drives fantastic returns for marketers;

- Ad creation, placement, and performance analysis, which boosts click-through conversion rates; and

- Tencent’s gaming businesses is also benefiting from AI through improved coaching of new players as well as accelerating game-creation productivity.

Perhaps the most underappreciated aspect of Tencent’s strengthening flywheel is Weixin’s privileged ecosystem data and the extreme value this has in the age of AI.

For example, Tencent will soon launch a new agentic AI that has unique access to WeChat’s 1.4 billion users. It can communicate across the entire ecosystem and can transact within the millions of mini programs on the platform.

Without access to the internal data (which Tencent keeps private), a competitor simply could not replicate anything like it.

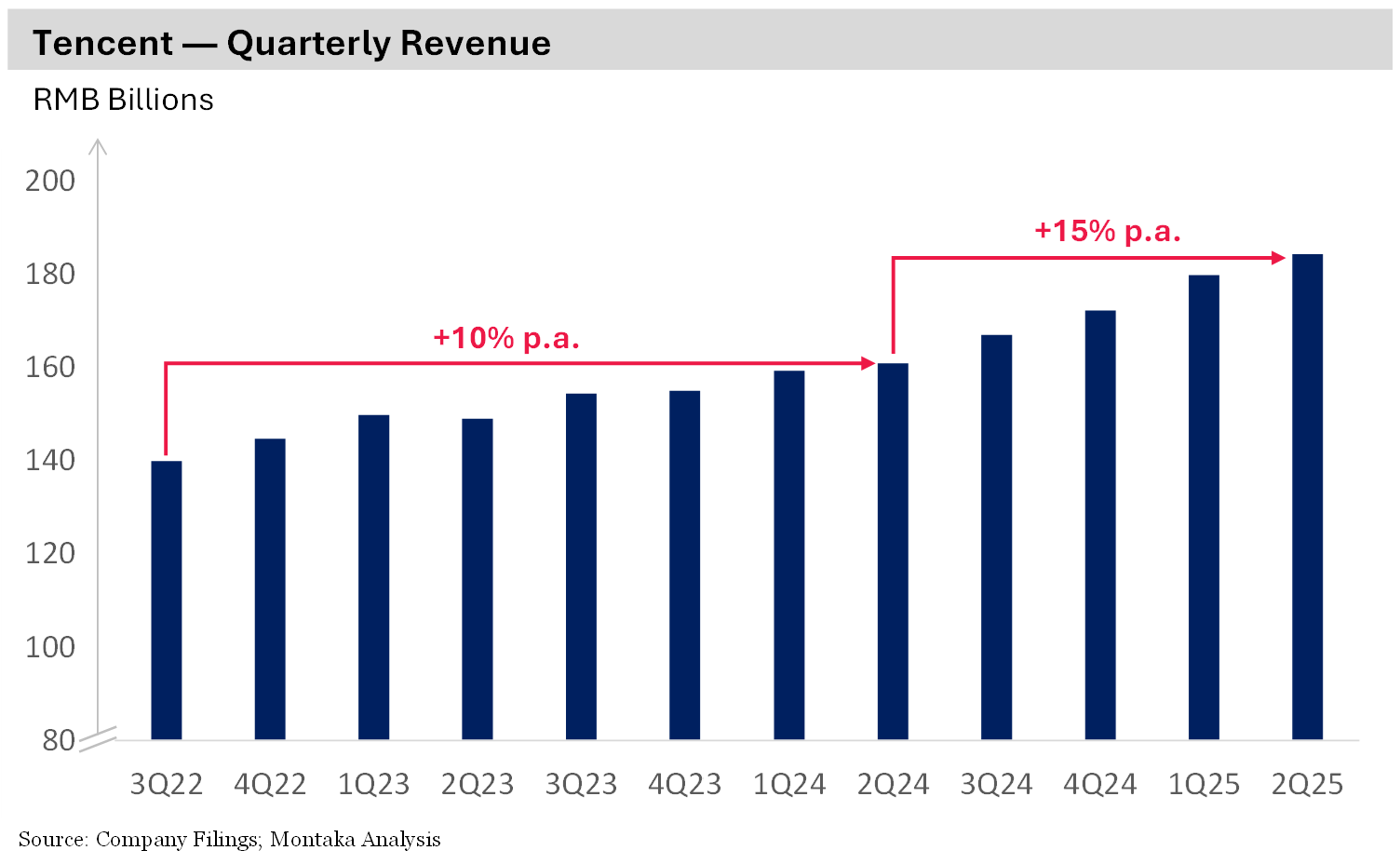

Sustainable revenue growth

Tencent’s flywheels strengthen its competitive advantages over time and enable it to sustainably grow into (and expand) several large markets in China, including digital marketing, e-commerce, search, gaming, cloud computing, AI, and even financial services.

While these markets are at different stages of development, revenue growth in each contributes to an aggregate annual revenue growth in the double digits.

And, as you can see from the chart above, over the last year, growth has accelerated.

New and emerging revenue streams are growing much faster than the company average:

- International gaming is growing at +35% per annum;

- Video accounts marketing revenue is growing at +50% per annum; and

- Cloud computing revenue is growing in the teens percentage per annum, despite being capacity constrained on AI chips.

Tencent remains in the early days of chasing some very large markets in China and has a long runway ahead.

Tencent also has other levers to pull to drive greater revenue growth. For example, its ad load within short videos is a mere fraction of competitors and can be gradually ratcheted up over time.

Overall, this gives us confidence that Tencent will generate solid growth over a much longer time horizon than many expect.

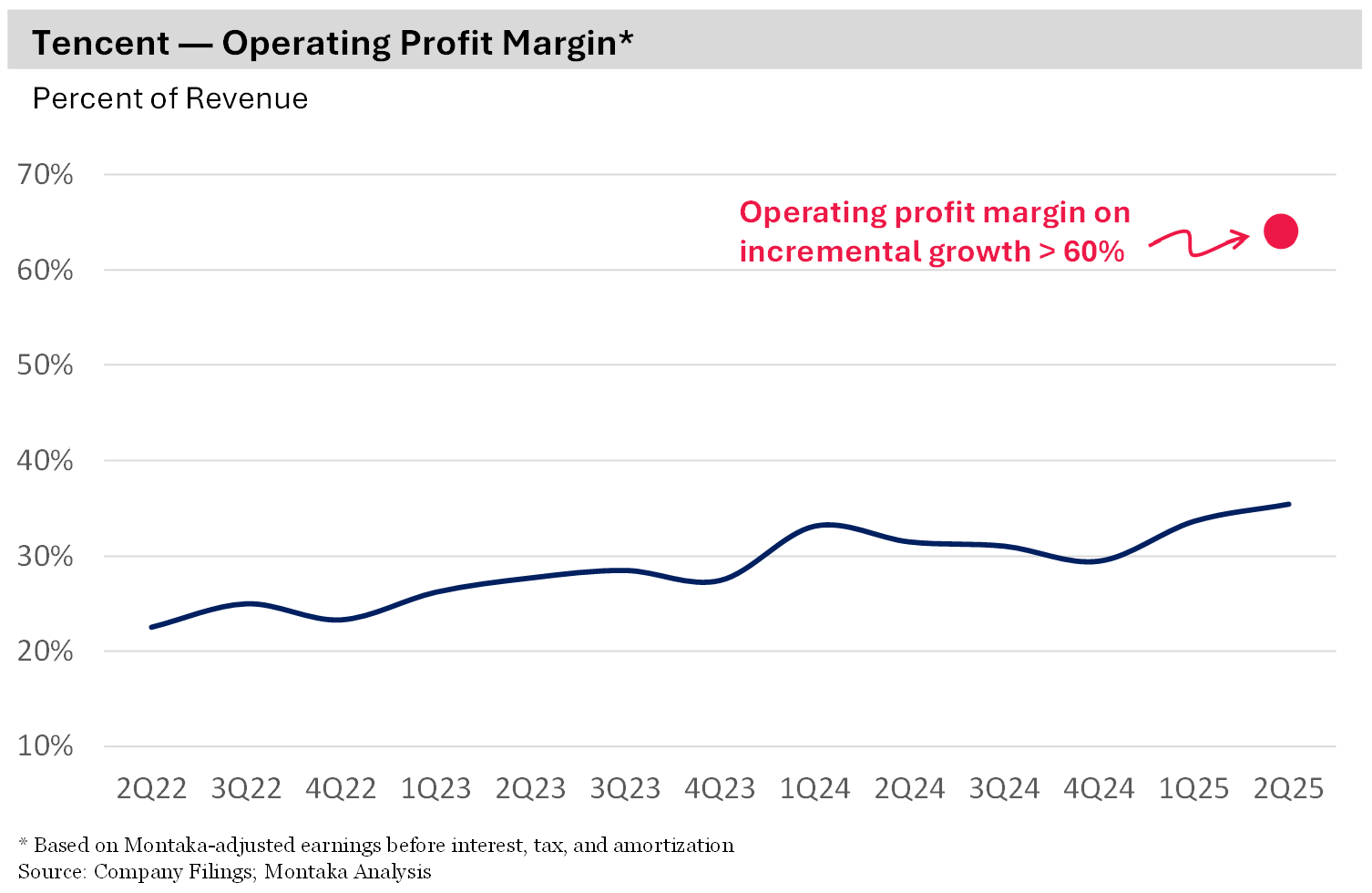

Turbocharged earnings growth

In addition to revenue growth, Tencent’s future earnings power is also materially underestimated.

Over the last three years, Tencent’s operating profits have more than doubled.

This was partially driven by revenues (which increased by approximately 40%), but mostly by profit margin expansion (which increased from 22.5% to 35.5%, as shown in the chart below).

Hidden in these numbers is a vital insight: the operating profit margin on the incremental revenue growth over the last three years has been more than 60%!

That’s because most of the incremental revenues have been built on top of the existing (mostly fixed cost) technology platform. So the incremental variable costs required to earn these new revenues are much lower.

To the extent this incremental profit margin holds, the overall company operating profit margin will gradually approach this level. The incremental margin works like a ‘magnet’ that slowly attracts the average margin towards it over time.

The combination of strong revenue growth and expanding margins gives rise to turbocharged earnings growth for Tencent.

Still undervalued

But the equity market is failing to appreciate this earnings power.

Despite Tencent’s stock price increasing by 3x over the last three years, Montaka estimates the ratio of Tencent’s operating enterprise to operating earnings to be just 17x.[2]

For readers in Australia, this makes Tencent cheaper than Telstra – a mature business that is expected to only grow its revenue by approximately 1-2% per annum and operating earnings by less than 5% per annum over the coming years.

It’s also worth noting that Tencent owns a portfolio of direct equity investments in third-party businesses – Spotify, Tencent Music, Universal Music, Epic Games and many others – which are worth nearly US$150 billion (representing approximately 20% of the company’s market capitalization).

Tencent’s perceived undervaluation is perhaps due, in part, to the geopolitical risks of investing in China.

These are not trivial and deserve careful attention.

But Montaka has managed this risk by deliberately limiting the size of our aggregated portfolio allocation to the country. (Tencent is Montaka’s only Chinese investment).

Note:

[1] (Tencent) Q1 2025 Earnings Call, May 2025

[2] Based on Montaka’s adjusted enterprise value (excluding net investments) and adjusted earnings before interest, tax and amortization as of 2Q25.

Andrew Macken is the Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100 or leave us a line at montaka.com/contact-us

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stock picks. To listen, please click on this link.