|

Getting your Trinity Audio player ready...

|

– Lachlan Mackay

I recently had a fascinating lesson in the counterintuitive economics of the ultra-luxury world during an interview with a prominent Ferrari collector.

He revealed the unique psychology behind Ferrari’s ‘Tailor Made’ customisation service – an exclusive program that allows top-tier clients to personalise their vehicles, right down to the stitching, paint and materials.

In most consumer categories, heavy customisation is a double-edged sword.

When you personalise a product to your specific taste, its resale value usually falls. The market for a bright blue sedan with yellow lining, after all, is inevitably smaller than for a standard black vehicle.

But, as the collector explained, when it comes to a Ferrari, the opposite is true.

Far from reducing the car’s value, customisation can dramatically increase the vehicle’s value.

That’s because clients, often spending hundreds of thousands, work alongside Ferrari’s in-house designers creating authentic and tasteful specifications. They often pay homage to a historic Ferrari race car or an iconic moment in the brand’s 70-year heritage.

In the resale market, these unique specifications can raise the price by millions. The more expensive, unique and therefore exclusive the car becomes, the more desirable.

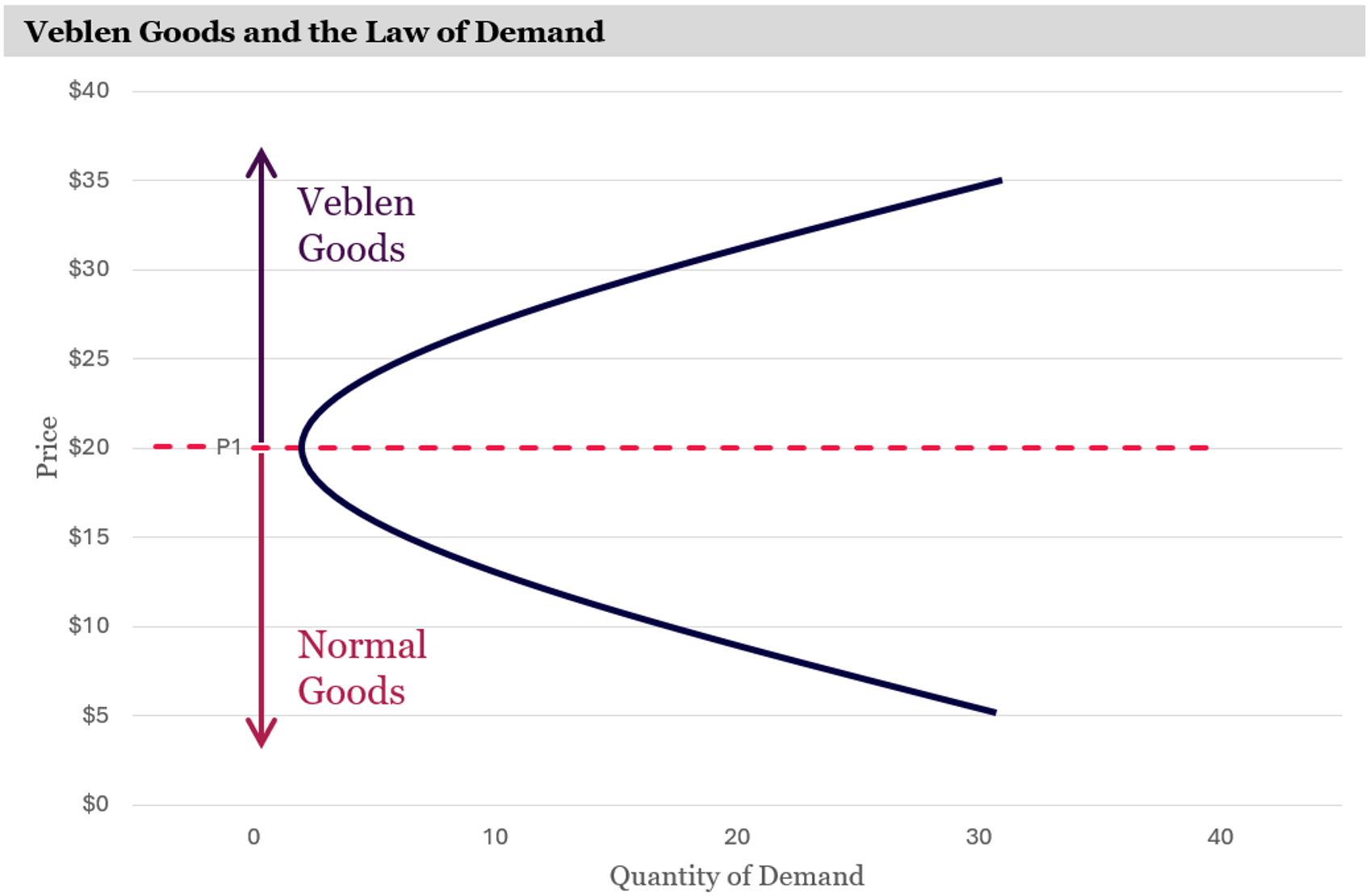

And this brings us to the curious economic anomaly known as the ‘Veblen good’, a little-known but powerful phenomenon that underpins one of Montaka’s core portfolio businesses.

Defying the Law of Demand

You may have heard of the American economist Thorstein Veblen, who in his 1899 book The Theory of the Leisure Class, coined the term ‘conspicuous consumption’ – where people buy goods and services to signal status.

In the book, Veblen identified a type of luxury commodity – like the highly customised Ferrari – where demand increases as the price increases. They have subsequently become known as a ‘Veblen good’.

Typically, when prices rise, consumers buy something else, and demand falls.

But for Veblen goods – such as a Ferrari Daytona SP3, Rolex Submariner or Hermès Birkin – the high price is not a deterrent; instead, it is a prized feature that signals quality and exclusivity.

A high price transforms the item into a ‘positional good’ – one that few others can afford to own, giving it high social status.

This gives businesses with true Veblen characteristics enduring pricing power.

Source: Montaka

The LVMH Connection

At Montaka, nowhere do we see the powerful economic dynamic of the Veblen good playing out more clearly than in one of our core portfolio investments: LVMH.

Much like Ferrari, LVMH sells heritage, exclusivity and social signalling.

Louis Vuitton handbags have been manufactured for over a century, yet they have consistently commanded premium, steadily increasing prices.

The genius of LVMH has been to expand this pricing power across each of its 75 luxury houses, or ‘maisons’, and to expand each maison across the world.

Vuitton, for example, has brand equity built over many decades, allowing the company to charge a premium, not just for their flagship bags, but for every category they touch – from ready-to-wear clothing, to fragrances, to beauty products.

The Uncrowded Advantage of LVMH

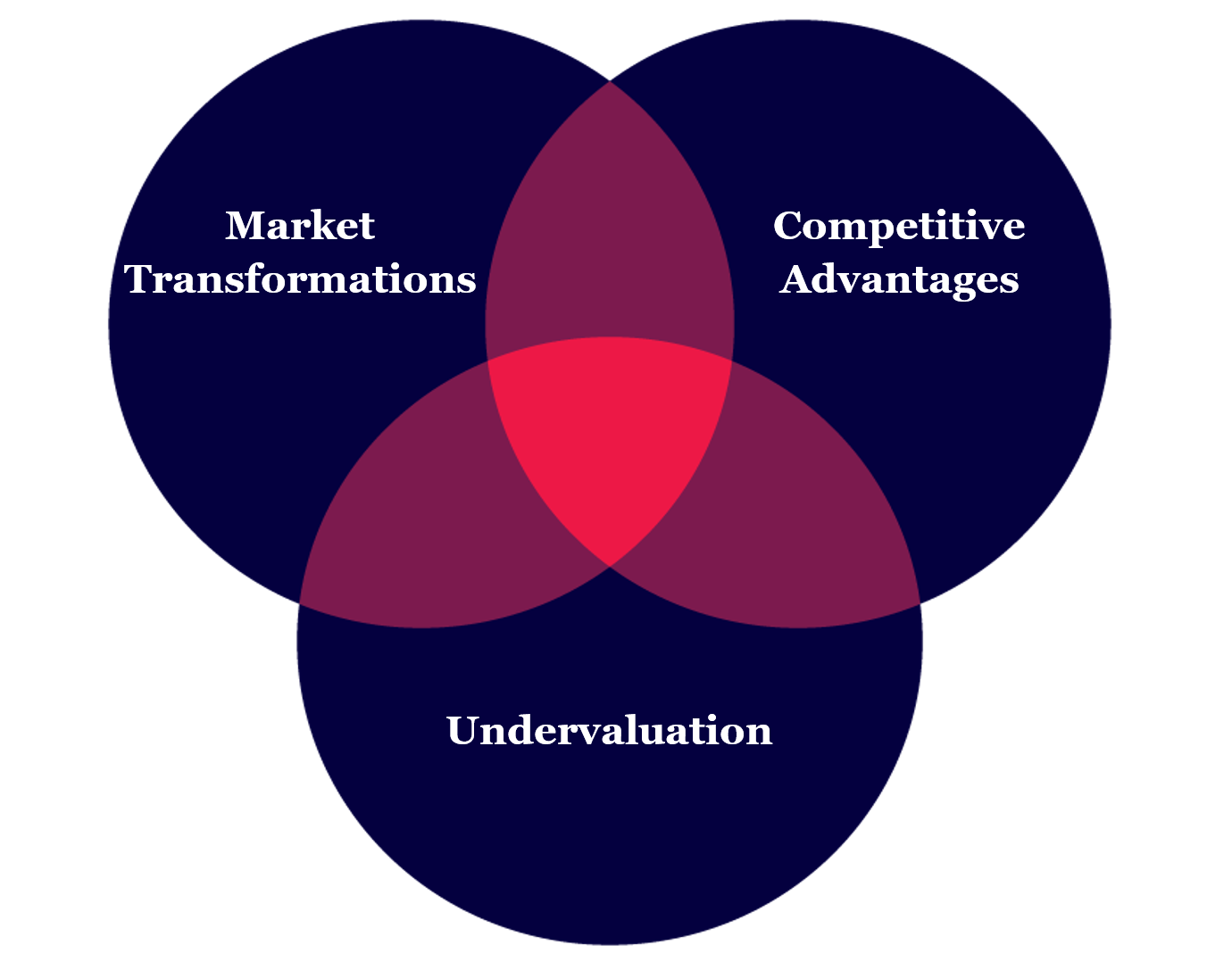

To identify long-term winners, Montaka uses a three-point framework: structural market transformations; enduring competitive advantages; and undervaluation.

The Veblen dynamic and durable pricing power are at the heart of our investment thesis for LVMH across all three factors.

I. Structural Transformation: Global Wealth Creation

Underpinning LVMH and its Veblen dynamic is a multi-decade structural transformation in global wealth.

Despite short-term macroeconomic wobbles, the wealthy continue to get wealthier.

Most importantly, the ranks of the middle and upper-middle class in Asia, avid consumers of luxury goods, are expanding rapidly.

China’s middle-income cohort expanded from 3.1% of the total population in 2000 to over 50% in 20181. By 2030, another 80 million people are expected to be elevated into the middle-income class2.

As these consumers cross certain income thresholds, their consumption basket shifts. They move from buying goods for pure utility to buying goods for status and identity.

With 75 of the world’s most prominent luxury brands, LVMH is the primary beneficiary of more people graduating into luxury consumption.

II. Competitive Advantage: Irreplicable Brand Power

LVMH has advantages that are practically impossible to replicate.

A trendy new entrant can manufacture the latest bag, but it will never manufacture a century of heritage.

LVMH houses a portfolio of historic brands, such as Vuitton, Dior, Tiffany and Bulgari, which consumers trust deeply because of their enduring quality and prestige.

Because, as we discussed above, these are Veblen goods, the higher price reaffirms the product’s lasting value and exclusivity in the customers’ minds, increasing their desirability.

LVMH’s immense pricing power gives it a strong competitive advantage and resilience.

When inflation drives up costs, for example, or consumers become more aspirational with their spending, LVMH can raise prices accordingly and limit access to its most unique products.

LVMH can durably grow revenues while protecting and expanding margins, a hallmark of a high-quality compounder.

III. Undervaluation: The Arbitrage of Time

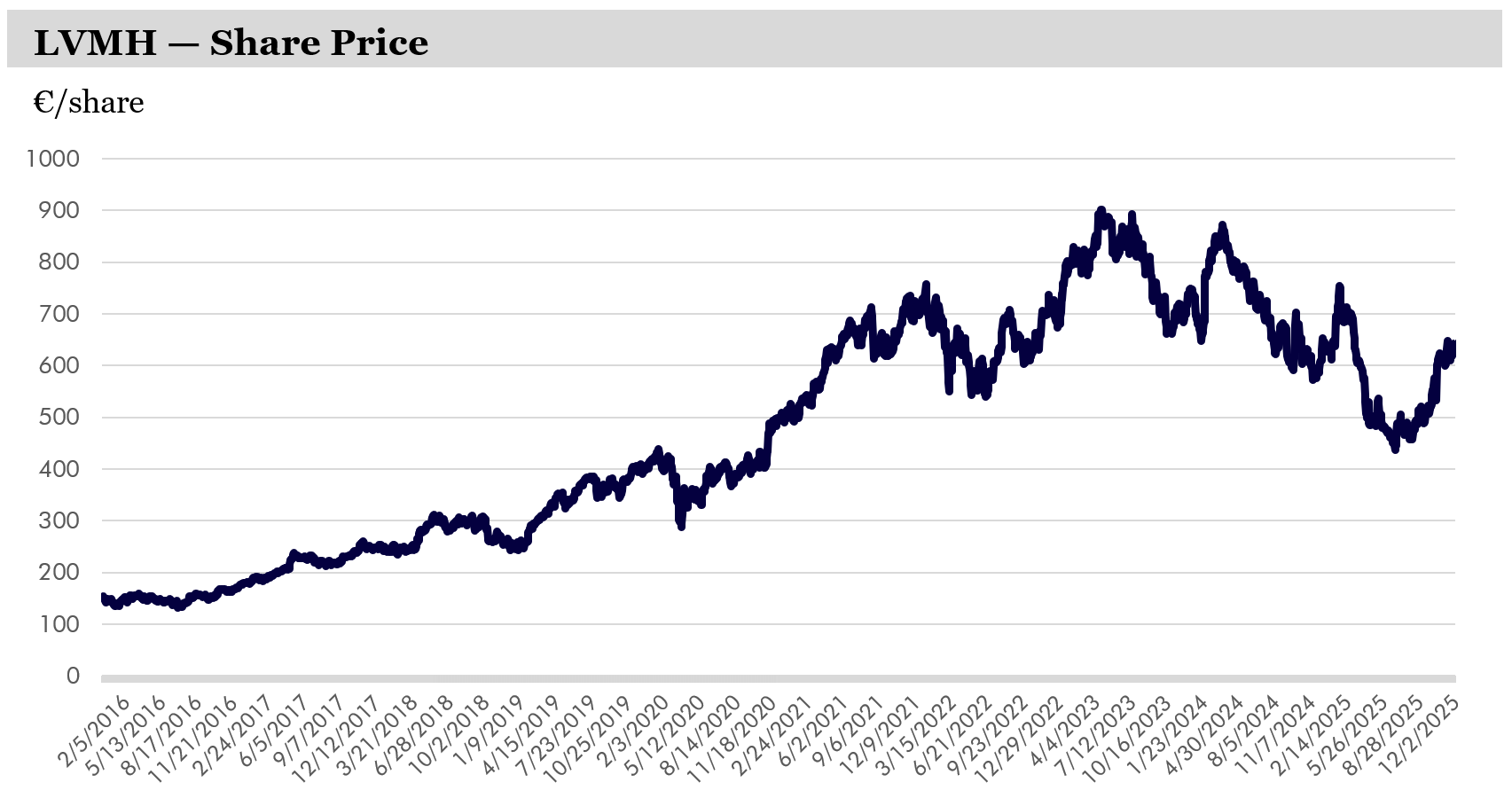

Not only does LVMH have strong structural foundations, but the stock is fundamentally undervalued.

In July, LVMH reported that for the first half of 2025, revenue fell 4% and operating profit was down 15%, as shoppers in China and the US pulled back spending.

The stock plummeted to levels not seen since 2020, when the business was 40% smaller than today. Yet LVMH’s long term competitive advantages remain as strong as ever.

Driven by short-termism, the market can obsess over quarterly fluctuations in organic growth rates or temporary slowdowns in specific regions (like the recent normalisation of post-COVID spending).

But the market is ignoring LVMH’s structurally growing addressable market, and, importantly, the company’s Veblen durable pricing power. And it’s therefore underestimating the company’s ability to deliver strong compounding earnings growth over the long term.

Source: Bloomberg

At Montaka, we seek to exploit this time arbitrage. When the market reacts to issues we regard as short-term noise (such as happened to LVMH in July), we regard that as an opportunity to buy a premium business at a discounted price, whilst having strong confidence in the potential of the company to be significantly larger and more profitable years and decades from now.

If the “discounted” share price then adjusts to a level that reflects our investment thesis then Montaka will reassess the portfolio accordingly.

Owning the Rare Few

Investors will always seek comfort by questioning and predicting the near-term, even for LVMH.

But the long-term economics of LVMH are underpinned by a powerful and curious anomaly in capitalism, the Veblen good, whereby on some rare occasions, higher prices create stronger demand.

Just as when the Ferrari collector spends more on customisation and ultimately creates more value, LVMH has long proven that maintaining high prices and exclusivity makes the company durable and highly profitable over the long run.

In a world where most goods face deflationary pressure and commoditisation, at Montaka we seek to own the rare few – such as LVMH – that defy the law of demand and have distinct advantages that will allow them to deliver superior long-term compounding.

1Pew Research Centre, The Guardian

2Boston Consulting Group, The Guardian

Note: Montaka is invested in LVMH.

References:

1: https://open.spotify.com/episode/5H1BcSBTrqb7Bzv4FlZNyk?si=999dec8a006c4a0e

2: https://www.alliedmarketresearch.com/algorithmic-trading-market-A08567

3: https://open.spotify.com/episode/1Sg2NJkSnwexFT0XRJ9RRt?si=6400abf39fde4a3b

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stock picks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us: