By Andrew Macken

In 2025, several developments led many to begin to question some of the most established underlying assumptions of the global political economy.

2025 confirmed that we have entered a new era of great power competition for scarce resources, the destruction of old technology models, rising uncertainty around employment, and political upheavals linked to inequality and an uncertain future, particularly for younger cohorts.

At the heart of most of these developments, of course, is AI.

Daily users of Gemini, ChatGPT or Claude will know just how useful these large language models (LLMs) can be in daily life – and this is driving growth in LLM tokens (i.e. the smallest unit of LLM output) north of 200% per annum.[1]

This, in turn, is driving enormous capital investments in new data centres in the US and around the world.

While investment in capital infrastructure is wonderful for current and future economic growth, the sheer scale and growth of new demand is creating bottlenecks and competition for scarce resources – including between world powers who view AI dominance as a national security imperative.

Two of the most critical inputs for data centres are advanced semiconductor chips and power generation capacity. (In the case of embodied AI – where artificial intelligence is integrated into physical systems like electric vehicles, drones and robots – special commodities like lithium and rare earth elements are also critical).

The rising compute-intensity of AI software is driving enormous demand for specialised, high-performance semiconductor chips. The world’s most advanced chips are overwhelmingly produced by TSMC in Taiwan – a potential geopolitical flashpoint. Meanwhile, the US has restricted the most advanced chips from being exported to China on national security grounds.

Power generation is equally critical. As the global data centre buildout continues, electricity is no longer an insignificant operating cost – it directly limits how much capacity can be built and how profitable that capacity can be. Regarding power generation, the positioning of the US and China is very different:

- In the US, there are long delays in building out new generation capacity; grid modernisation efforts remain in their early stages; and the marginal price of electricity will continue to be set by the economics of (rapidly inflating) gas-fired capacity for the foreseeable future.

- In China, on the other hand, capacity is abundant, and the marginal cost of electricity is tied to the deflating cost curves of domestic renewable energy sources.

What an irony that there are ample resources for the world’s AI build out – it’s just that they’re split between two competing hegemons, so they cannot be easily ‘shared’.

Energy mixes are evolving all around the world to include more remote, intermittent sources, such as solar and wind, and this is driving substantial demand for commodities that help transmit and store electricity – such as copper and lithium. Medium-term supply growth of these commodities will unlikely keep up with demand growth, in our view, pushing their prices higher.

The fast-rising physical costs of delivering AI at scale have also led many to ask if the age of zero-marginal-cost traditional software is over, to be replaced by higher-marginal-cost AI software.

The marginal costs of software are indeed increasing. But the key question is: to what extent can the marginal revenues of associated software also increase? The promise of AI, of course, is that the software itself will become exponentially more powerful and valuable – replacing the need for relatively higher-cost humans.

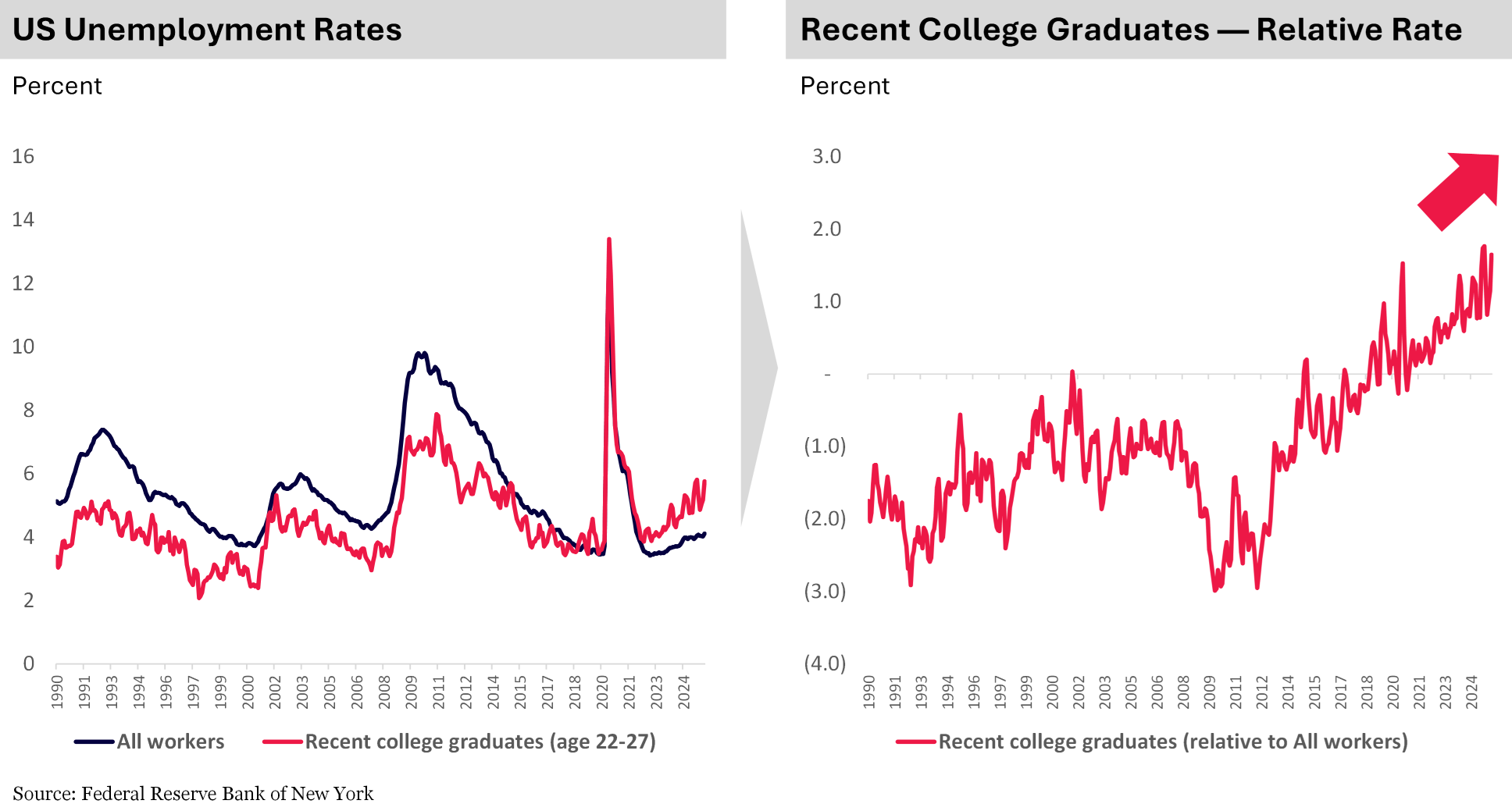

Already, we have AI technology that is so effective that a $20/month subscription can replace scores of young graduate employees in certain roles. Is this why the unemployment rate of recent college graduates in the US has ticked up above the national average in recent years, after decades of remaining below it?

Perhaps this is why young people are three times more likely to believe that AI will take away more opportunities than it creates. And likely related, support for capitalism continues to erode amongst young people. Just 39% of young Americans support capitalism, down from 45% in 2020. [2] These trends represent significant long-term risks for societies and economies.

And just as we are on the cusp of replacing more human labour with AI labour, militaries across the world are racing to replace more human soldiers with autonomous systems.

The race to do so is creating competition for scarce resources. Maps of the world are increasingly viewed through eyes hungry for natural resources and strategic locations.

We now know (at least partially) why 15,000 US troops and a dozen naval ships were relocated to the Caribbean eyeing Venezuela. Greenland appears to be the next focus of the Trump Administration, while ambitions for Panama and Canada have been aired previously.

This intensifying global competition perhaps helps explain why China is increasingly eying the Arctic (and Antarctic for that matter).

Compounding this instability is the swift pace of political change worldwide.

The US has become accepting of Russia’s landgrab in Ukraine. As a result, the Europeans are scrambling to prepare for war.[3] The Brits believe they are already in the ‘grey zone’ just below the threshold of war.[4]

Meanwhile, their democracies are fragmenting, with far-right parties, particularly, increasing in popularity – especially with young men.[5]

Inequality is also growing more extreme in many countries. And at the same time, unaffordability – especially for the young (whose employment is arguably at greatest risk near-term) – has become the defining political issue in many countries. Several leaders have already been ousted by Gen Z protests around the world.[6]

At times it feels as though the world is drifting towards sharper fault lines – economic, political and geopolitical. Yet the technological advances at the heart of this disruption represent a generational opportunity for productivity and progress. With the right choices, the same forces now driving instability can be harnessed to support growth and resilience in the years ahead.

Note:

[1] Alphabet Q3 2025 Earnings Call, October 2025

[2] Harvard Youth Poll of 2,040 18-to-29-year-olds, Fall 2025

[3] (The Economist) Europe’s generals are warning people to prepare for war, December 2025

[4] Speech by Blaise Metreweli, Chief of SIS (MI6), December 2025

[5] (BBC) Why more young men in Germany are turning to the far right, February 2025

[6] (Bloomberg) Gen-Z Revolts Against Dystopian Future as Protests Sweep the Globe, December 2025

Andrew Macken is the Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100 or leave us a line at montaka.com/contact-us

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stock picks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

State of the Union: AI, resource competition and inequality increase geopolitical instability

By Andrew Macken

In 2025, several developments led many to begin to question some of the most established underlying assumptions of the global political economy.

2025 confirmed that we have entered a new era of great power competition for scarce resources, the destruction of old technology models, rising uncertainty around employment, and political upheavals linked to inequality and an uncertain future, particularly for younger cohorts.

At the heart of most of these developments, of course, is AI.

Daily users of Gemini, ChatGPT or Claude will know just how useful these large language models (LLMs) can be in daily life – and this is driving growth in LLM tokens (i.e. the smallest unit of LLM output) north of 200% per annum.[1]

This, in turn, is driving enormous capital investments in new data centres in the US and around the world.

While investment in capital infrastructure is wonderful for current and future economic growth, the sheer scale and growth of new demand is creating bottlenecks and competition for scarce resources – including between world powers who view AI dominance as a national security imperative.

Two of the most critical inputs for data centres are advanced semiconductor chips and power generation capacity. (In the case of embodied AI – where artificial intelligence is integrated into physical systems like electric vehicles, drones and robots – special commodities like lithium and rare earth elements are also critical).

The rising compute-intensity of AI software is driving enormous demand for specialised, high-performance semiconductor chips. The world’s most advanced chips are overwhelmingly produced by TSMC in Taiwan – a potential geopolitical flashpoint. Meanwhile, the US has restricted the most advanced chips from being exported to China on national security grounds.

Power generation is equally critical. As the global data centre buildout continues, electricity is no longer an insignificant operating cost – it directly limits how much capacity can be built and how profitable that capacity can be. Regarding power generation, the positioning of the US and China is very different:

What an irony that there are ample resources for the world’s AI build out – it’s just that they’re split between two competing hegemons, so they cannot be easily ‘shared’.

Energy mixes are evolving all around the world to include more remote, intermittent sources, such as solar and wind, and this is driving substantial demand for commodities that help transmit and store electricity – such as copper and lithium. Medium-term supply growth of these commodities will unlikely keep up with demand growth, in our view, pushing their prices higher.

The fast-rising physical costs of delivering AI at scale have also led many to ask if the age of zero-marginal-cost traditional software is over, to be replaced by higher-marginal-cost AI software.

The marginal costs of software are indeed increasing. But the key question is: to what extent can the marginal revenues of associated software also increase? The promise of AI, of course, is that the software itself will become exponentially more powerful and valuable – replacing the need for relatively higher-cost humans.

Already, we have AI technology that is so effective that a $20/month subscription can replace scores of young graduate employees in certain roles. Is this why the unemployment rate of recent college graduates in the US has ticked up above the national average in recent years, after decades of remaining below it?

Perhaps this is why young people are three times more likely to believe that AI will take away more opportunities than it creates. And likely related, support for capitalism continues to erode amongst young people. Just 39% of young Americans support capitalism, down from 45% in 2020. [2] These trends represent significant long-term risks for societies and economies.

And just as we are on the cusp of replacing more human labour with AI labour, militaries across the world are racing to replace more human soldiers with autonomous systems.

The race to do so is creating competition for scarce resources. Maps of the world are increasingly viewed through eyes hungry for natural resources and strategic locations.

We now know (at least partially) why 15,000 US troops and a dozen naval ships were relocated to the Caribbean eyeing Venezuela. Greenland appears to be the next focus of the Trump Administration, while ambitions for Panama and Canada have been aired previously.

This intensifying global competition perhaps helps explain why China is increasingly eying the Arctic (and Antarctic for that matter).

Compounding this instability is the swift pace of political change worldwide.

The US has become accepting of Russia’s landgrab in Ukraine. As a result, the Europeans are scrambling to prepare for war.[3] The Brits believe they are already in the ‘grey zone’ just below the threshold of war.[4]

Meanwhile, their democracies are fragmenting, with far-right parties, particularly, increasing in popularity – especially with young men.[5]

Inequality is also growing more extreme in many countries. And at the same time, unaffordability – especially for the young (whose employment is arguably at greatest risk near-term) – has become the defining political issue in many countries. Several leaders have already been ousted by Gen Z protests around the world.[6]

At times it feels as though the world is drifting towards sharper fault lines – economic, political and geopolitical. Yet the technological advances at the heart of this disruption represent a generational opportunity for productivity and progress. With the right choices, the same forces now driving instability can be harnessed to support growth and resilience in the years ahead.

Note:

[1] Alphabet Q3 2025 Earnings Call, October 2025

[2] Harvard Youth Poll of 2,040 18-to-29-year-olds, Fall 2025

[3] (The Economist) Europe’s generals are warning people to prepare for war, December 2025

[4] Speech by Blaise Metreweli, Chief of SIS (MI6), December 2025

[5] (BBC) Why more young men in Germany are turning to the far right, February 2025

[6] (Bloomberg) Gen-Z Revolts Against Dystopian Future as Protests Sweep the Globe, December 2025

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stock picks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

This content was prepared by Montaka Global Pty Ltd (ACN 604 878 533, AFSL: 516 942). The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should read the offer document and consider your own investment objectives, financial situation and particular needs before acting upon this information. All investments contain risk and may lose value. Consider seeking advice from a licensed financial advisor. Past performance is not a reliable indicator of future performance.

Related Insight

Share

Get insights delivered to your inbox including articles, podcasts and videos from the global equities world.