By Amit Nath

For decades, the lucrative realms of private equity, private credit, real estate, and infrastructure were predominantly the domain of large institutional investors and the ultra-wealthy.

But now a quiet revolution is underway: the “democratization” of alternative assets.

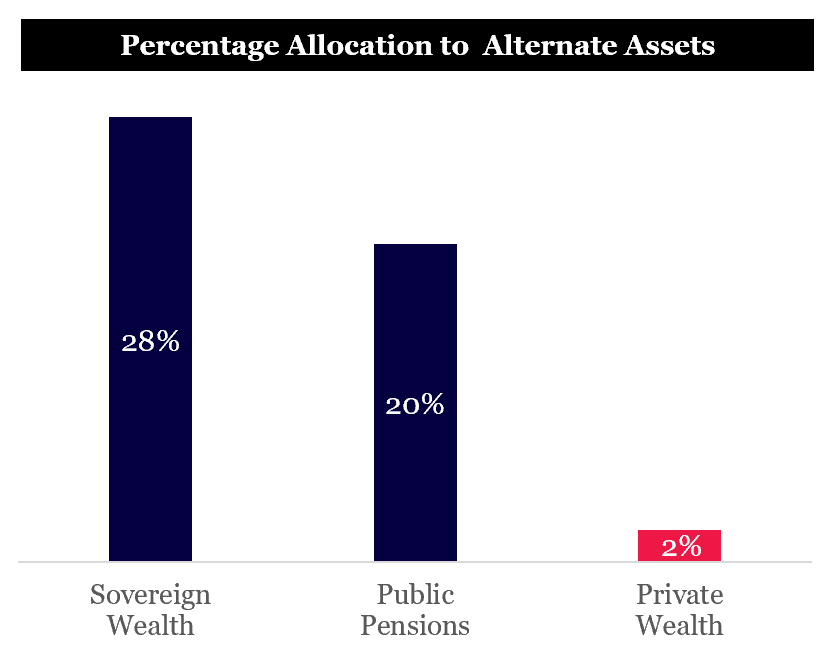

Ambitious, forward-thinking alternate asset managers like Blackstone and KKR are spearheading a strategic expansion into the vast, largely untapped territory of private wealth, which has lagged in the uptake of alternates relative to other long-term investor portfolios like sovereign wealth and pension funds.

Source: KKR, Montaka

A particular focus is channeling private assets into the retirement accounts of retail clients, such as employer sponsored 401(k) plans in the US (similar to Australian superannuation).

Fueled by the prospect of managing trillions in new assets, along with a once in a generation tailwind from potential deregulation under the current US administration, the migration of private assets into retirement accounts is poised to reshape the alternate asset management landscape.

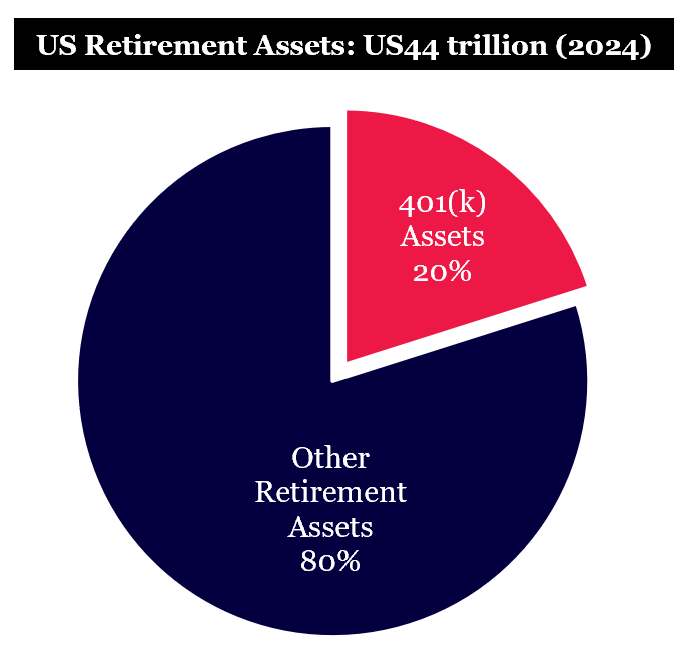

Source: US Department of Labor, Montaka Global.

This new pool of capital has favorable economics for alternative managers like KKR and Blackstone, with the direct-to-consumer margins much higher than institutional channels. Along with the potential to drive growth for decades to come.

Trillions on the Table: The Case for Private Assets in Retirement Funds

The sheer scale of the opportunity is staggering.

In the US there is $US12-13 trillion invested in defined contribution retirement plans – where employees pay into the program from their wage – of which ~75% or $9 trillion are 401(k) assets.

These funds are largely invested in daily priced, liquid index funds, which mirror the increasingly concentrated S&P 500.

Not every investment requires a real-time quote with the ‘feature’ coming at price – including short-term volatility and increased likelihood of investment mistakes – and are not necessary for retirement assets which are usually invested for 30-40 years, creating a significant duration mismatch.

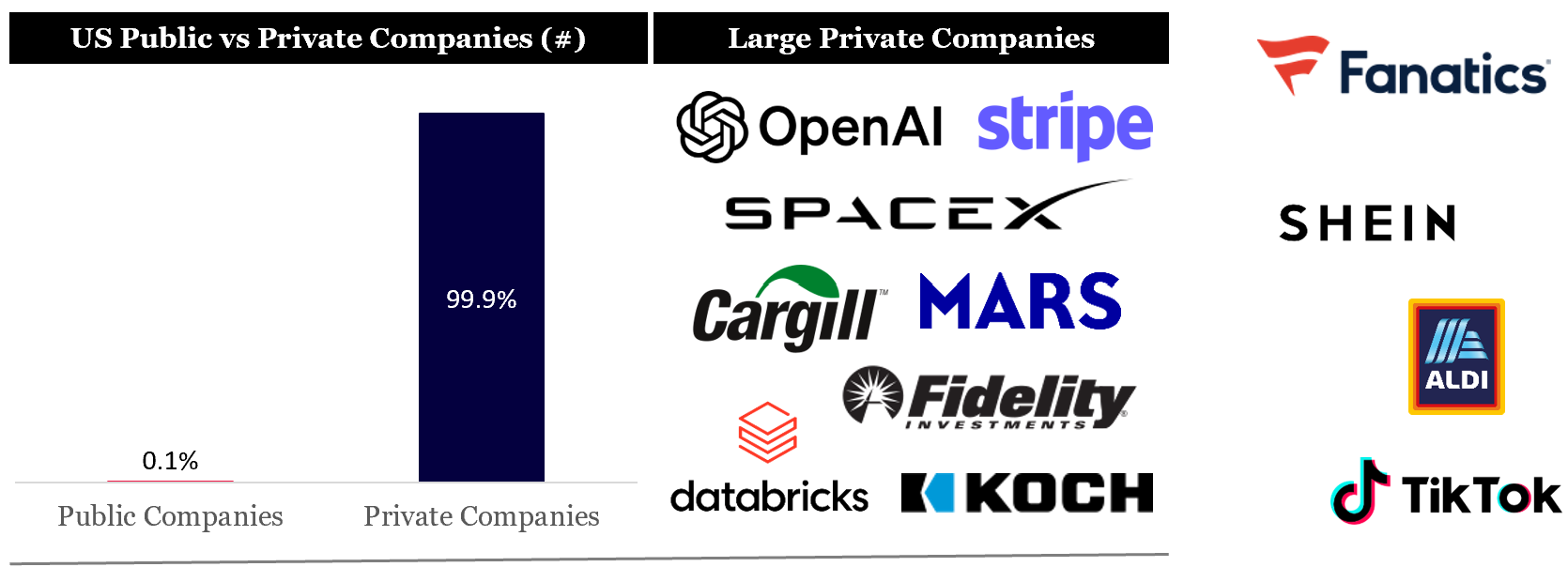

Additionally, while there are 4,000 listed public companies in the US, there are over 25 million private ones which contribute meaningfully to the economy and make up 99.9% of US firms.

This imbalance is growing because even very large companies are electing to stay private longer or permanently (e.g. Mars, SpaceX, Stripe, OpenAI, etc). This increasingly separates the S&P 500 from real, underlying US economic growth which is largely what retirement assets are looking to capture.

“I jokingly say sometimes, we levered the entire retirement of America to Nvidia’s performance. It just doesn’t seem smart. We’re going to fix this”- Marc Rowan (CEO of Apollo Global Management)

Source: CATO Institute, Montaka Global.

Titans Team Up: Strategic Alliances Reshape Access

Recognizing this, the titans of alternate assets are making bold moves to capture the opportunity by forging strategic alliances that combine their private market expertise with the established distribution networks of corporate retirement planning and allocation.

Blackstone has been a first mover in the private wealth space and now manages over $270 billion (around 23% of its total AUM) in this segment (Q1 2025).

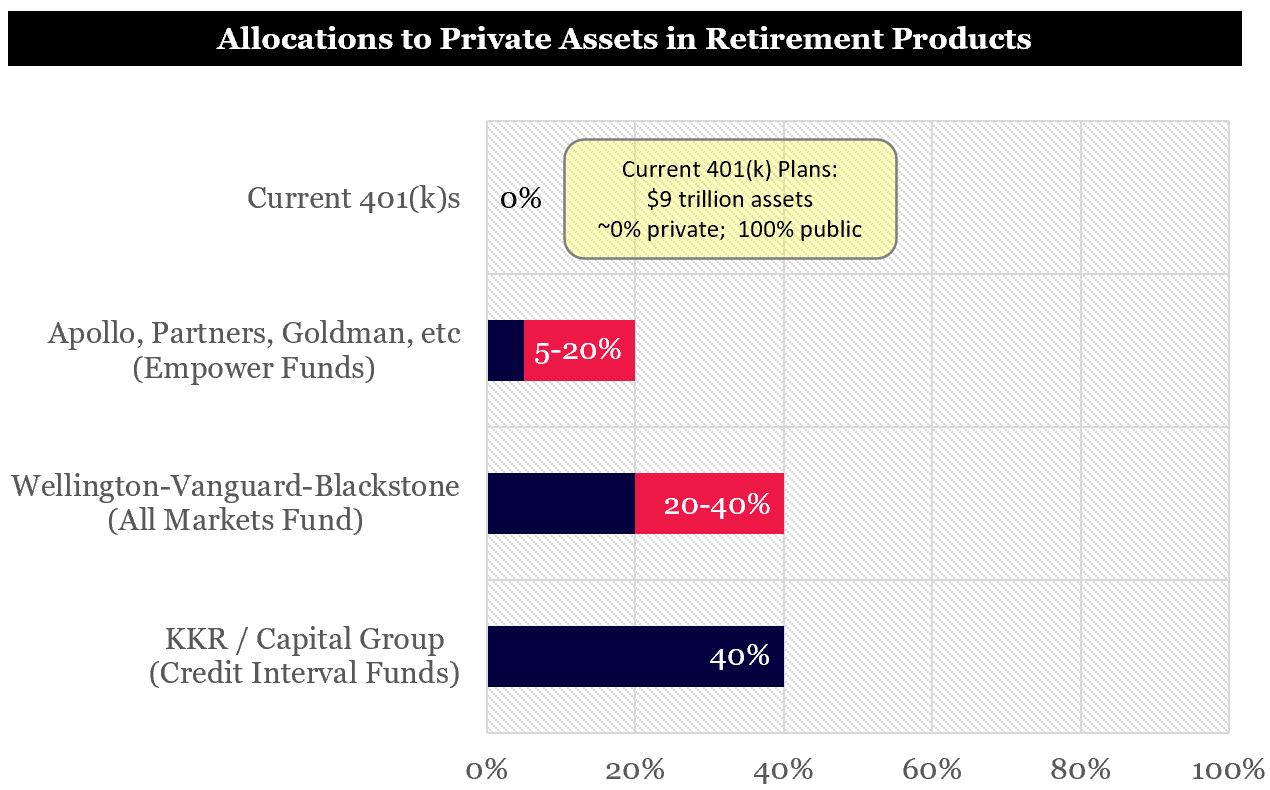

Blackstone also recently announced a landmark partnership with Vanguard and Wellington Management. Their first collaborative product is the quarterly redeemable, semi-liquid WVB All Markets Fund. It aims to allocate 25-40% in private markets, which is significantly higher than the 0% allocated in 401(k) plans today.

Similarly, KKR, with over $660 billion in AUM, has joined forces with Capital Group, a giant with over $2.8 trillion in AUM with deep distribution into American retirement accounts.

In April 2025, KKR and Capital Group launched their initial public-private fund focused on fixed income, with equity-oriented solutions expected in 2026. Their stated goal is to reach “95% of Americans” who historically have lacked access to private market investments.

Apollo Global Management has also been active, notably partnering with Empower, the second-largest (after Fidelity) retirement plan provider in the US with 19 million participants and $1.8 trillion in retirement assets.

In May 2025, Empower announced it will offer its participants access to private market investments managed by seven firms including Apollo, Partners Group, and Goldman Sachs starting in Q3 2025.

Source: KKR, Blackstone, Empower, Montaka Global.

Opening the Floodgates: The Evolving Regulatory Landscape

A major catalyst for this move is the evolving regulatory landscape in the United States.

Historically, the Employee Retirement Income Security Act of 1974 (ERISA) and its stringent fiduciary duties made plan sponsors (the organization that sets up retirement plans for its employees), cautious about including illiquid, complex, and often opaque private assets in 401(k) lineups.

However, a June 2020 information letter from the Department of Labor (DOL) under the first Trump administration signaled a potential opening after it suggested private equity could be included as a component of professionally managed multi-asset-class vehicles.

While the Biden administration urged caution and advised against this approach, it did not reverse the guidance but effectively froze the industry in place.

More recently, in May 2025, reports emerged that the second Trump administration is contemplating an executive order to direct federal agencies, including the DOL, Treasury, and the Securities and Exchange Commission (SEC), to further explore pathways for private capital investments within 401(k)s.

Such deregulation could indeed open the floodgates with private equity industry executives telling the Financial Times newspaper, the deregulation could result in “doubling demand” for their alternate asset funds.

Goliaths’ Grip: Brand & Distribution Still King

Even with regulatory easing, success in the retail channel will heavily depend on brand recognition and distribution capabilities. The “shelf space” on 401(k) platforms and with financial advisors is finite and fiercely contested.

Here, established Goliaths like Blackstone, KKR, Vanguard, and Capital Group possess distinct advantages. Their well-known brands inspire a degree of trust crucial in attracting retail investors, many of whom are unfamiliar with alternate investments.

The partnerships are a testament to this: alternate asset managers gain access to vast distribution networks (Capital Group, for instance, has relationships with over 200,000 financial advisors); while traditional managers can offer their clients access to potentially higher-returning, diversifying private assets.

The Flip Side: Fees and Investor Education

However, the path is not without obstacles. The higher fees associated with private market investments (Empower’s new funds, for example, are expected to charge between 1% and 1.6%, compared to a public market average of 0.28%) are a primary concern and could invite scrutiny and litigation.

Educating both financial advisors and end-investors about the unique characteristics, risks, and potential benefits of these assets is paramount.

Blackstone for example has had 16,000 financial advisers attend Blackstone University (BXU) over 14 years educating participants on the merits of alternate assets and the products it offers.

The Long Game: Transforming Asset Management

Driven by the allure of a product gap in the enormous retail retirement market, facilitated by innovative product structuring, and a potentially more favorable regulatory environment, firms like Blackstone, KKR, and Apollo are laying the groundwork for a new era of retail access to private assets.

The winners will likely be those who can effectively leverage strong brands and secure robust distribution channels, all while navigating the complexities of fees, liquidity, investor education, and fiduciary responsibility.

If successful, this initiative could profoundly alter how Americans save for retirement and reshape the asset management industry for decades to come, which could deliver outsized value creation for industry leaders like Blackstone and KKR.

Amit Nath is the Director of Research at Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Note: Montaka is invested in KKR, Blackstone.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stock picks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us:

Alternate Asset Managers Eye the Retirement Prize

By Amit Nath

For decades, the lucrative realms of private equity, private credit, real estate, and infrastructure were predominantly the domain of large institutional investors and the ultra-wealthy.

But now a quiet revolution is underway: the “democratization” of alternative assets.

Ambitious, forward-thinking alternate asset managers like Blackstone and KKR are spearheading a strategic expansion into the vast, largely untapped territory of private wealth, which has lagged in the uptake of alternates relative to other long-term investor portfolios like sovereign wealth and pension funds.

Source: KKR, Montaka

A particular focus is channeling private assets into the retirement accounts of retail clients, such as employer sponsored 401(k) plans in the US (similar to Australian superannuation).

Fueled by the prospect of managing trillions in new assets, along with a once in a generation tailwind from potential deregulation under the current US administration, the migration of private assets into retirement accounts is poised to reshape the alternate asset management landscape.

Source: US Department of Labor, Montaka Global.

This new pool of capital has favorable economics for alternative managers like KKR and Blackstone, with the direct-to-consumer margins much higher than institutional channels. Along with the potential to drive growth for decades to come.

Trillions on the Table: The Case for Private Assets in Retirement Funds

The sheer scale of the opportunity is staggering.

In the US there is $US12-13 trillion invested in defined contribution retirement plans – where employees pay into the program from their wage – of which ~75% or $9 trillion are 401(k) assets.

These funds are largely invested in daily priced, liquid index funds, which mirror the increasingly concentrated S&P 500.

Not every investment requires a real-time quote with the ‘feature’ coming at price – including short-term volatility and increased likelihood of investment mistakes – and are not necessary for retirement assets which are usually invested for 30-40 years, creating a significant duration mismatch.

Additionally, while there are 4,000 listed public companies in the US, there are over 25 million private ones which contribute meaningfully to the economy and make up 99.9% of US firms.

This imbalance is growing because even very large companies are electing to stay private longer or permanently (e.g. Mars, SpaceX, Stripe, OpenAI, etc). This increasingly separates the S&P 500 from real, underlying US economic growth which is largely what retirement assets are looking to capture.

“I jokingly say sometimes, we levered the entire retirement of America to Nvidia’s performance. It just doesn’t seem smart. We’re going to fix this”- Marc Rowan (CEO of Apollo Global Management)

Source: CATO Institute, Montaka Global.

Titans Team Up: Strategic Alliances Reshape Access

Recognizing this, the titans of alternate assets are making bold moves to capture the opportunity by forging strategic alliances that combine their private market expertise with the established distribution networks of corporate retirement planning and allocation.

Blackstone has been a first mover in the private wealth space and now manages over $270 billion (around 23% of its total AUM) in this segment (Q1 2025).

Blackstone also recently announced a landmark partnership with Vanguard and Wellington Management. Their first collaborative product is the quarterly redeemable, semi-liquid WVB All Markets Fund. It aims to allocate 25-40% in private markets, which is significantly higher than the 0% allocated in 401(k) plans today.

Similarly, KKR, with over $660 billion in AUM, has joined forces with Capital Group, a giant with over $2.8 trillion in AUM with deep distribution into American retirement accounts.

In April 2025, KKR and Capital Group launched their initial public-private fund focused on fixed income, with equity-oriented solutions expected in 2026. Their stated goal is to reach “95% of Americans” who historically have lacked access to private market investments.

Apollo Global Management has also been active, notably partnering with Empower, the second-largest (after Fidelity) retirement plan provider in the US with 19 million participants and $1.8 trillion in retirement assets.

In May 2025, Empower announced it will offer its participants access to private market investments managed by seven firms including Apollo, Partners Group, and Goldman Sachs starting in Q3 2025.

Source: KKR, Blackstone, Empower, Montaka Global.

Opening the Floodgates: The Evolving Regulatory Landscape

A major catalyst for this move is the evolving regulatory landscape in the United States.

Historically, the Employee Retirement Income Security Act of 1974 (ERISA) and its stringent fiduciary duties made plan sponsors (the organization that sets up retirement plans for its employees), cautious about including illiquid, complex, and often opaque private assets in 401(k) lineups.

However, a June 2020 information letter from the Department of Labor (DOL) under the first Trump administration signaled a potential opening after it suggested private equity could be included as a component of professionally managed multi-asset-class vehicles.

While the Biden administration urged caution and advised against this approach, it did not reverse the guidance but effectively froze the industry in place.

More recently, in May 2025, reports emerged that the second Trump administration is contemplating an executive order to direct federal agencies, including the DOL, Treasury, and the Securities and Exchange Commission (SEC), to further explore pathways for private capital investments within 401(k)s.

Such deregulation could indeed open the floodgates with private equity industry executives telling the Financial Times newspaper, the deregulation could result in “doubling demand” for their alternate asset funds.

Goliaths’ Grip: Brand & Distribution Still King

Even with regulatory easing, success in the retail channel will heavily depend on brand recognition and distribution capabilities. The “shelf space” on 401(k) platforms and with financial advisors is finite and fiercely contested.

Here, established Goliaths like Blackstone, KKR, Vanguard, and Capital Group possess distinct advantages. Their well-known brands inspire a degree of trust crucial in attracting retail investors, many of whom are unfamiliar with alternate investments.

The partnerships are a testament to this: alternate asset managers gain access to vast distribution networks (Capital Group, for instance, has relationships with over 200,000 financial advisors); while traditional managers can offer their clients access to potentially higher-returning, diversifying private assets.

The Flip Side: Fees and Investor Education

However, the path is not without obstacles. The higher fees associated with private market investments (Empower’s new funds, for example, are expected to charge between 1% and 1.6%, compared to a public market average of 0.28%) are a primary concern and could invite scrutiny and litigation.

Educating both financial advisors and end-investors about the unique characteristics, risks, and potential benefits of these assets is paramount.

Blackstone for example has had 16,000 financial advisers attend Blackstone University (BXU) over 14 years educating participants on the merits of alternate assets and the products it offers.

The Long Game: Transforming Asset Management

Driven by the allure of a product gap in the enormous retail retirement market, facilitated by innovative product structuring, and a potentially more favorable regulatory environment, firms like Blackstone, KKR, and Apollo are laying the groundwork for a new era of retail access to private assets.

The winners will likely be those who can effectively leverage strong brands and secure robust distribution channels, all while navigating the complexities of fees, liquidity, investor education, and fiduciary responsibility.

If successful, this initiative could profoundly alter how Americans save for retirement and reshape the asset management industry for decades to come, which could deliver outsized value creation for industry leaders like Blackstone and KKR.

Amit Nath is the Director of Research at Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Note: Montaka is invested in KKR, Blackstone.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stock picks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us:

This content was prepared by Montaka Global Pty Ltd (ACN 604 878 533, AFSL: 516 942). The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should read the offer document and consider your own investment objectives, financial situation and particular needs before acting upon this information. All investments contain risk and may lose value. Consider seeking advice from a licensed financial advisor. Past performance is not a reliable indicator of future performance.

Related Insight

Share

Get insights delivered to your inbox including articles, podcasts and videos from the global equities world.