State of the Union: AI, resource competition and inequality increase geopolitical instability

Artificial intelligence, widening inequality, and intensifying competition for critical resources are converging to create a more volatile global landscape. This article explores how these forces intersect and what they mean for the future of geopolitical stability.

Quarterly Video: Q4 2025

We unpack the major structural shifts shaping the global landscape, review 2025’s highly dispersed market returns, discuss key portfolio augmentations during Q4, and share a preview of Montaka’s latest ‘AI Bubble’ whitepaper

Update from the PM – December 2025

Volatility returned in Nov: Bitcoin -20%, S&P 500 -5%, Tech down while Healthcare & Energy surged. Amid the noise, Alphabet soared +14% on Gemini 3’s AI breakthrough. Bubble fears? We break them down.

Update from the PM – November 2025

Earnings season is here: Meta & Blackstone show strong fundamentals, yet stocks dip on short-term narratives. Do short-term moves matter when long-term AI-driven growth is clear?

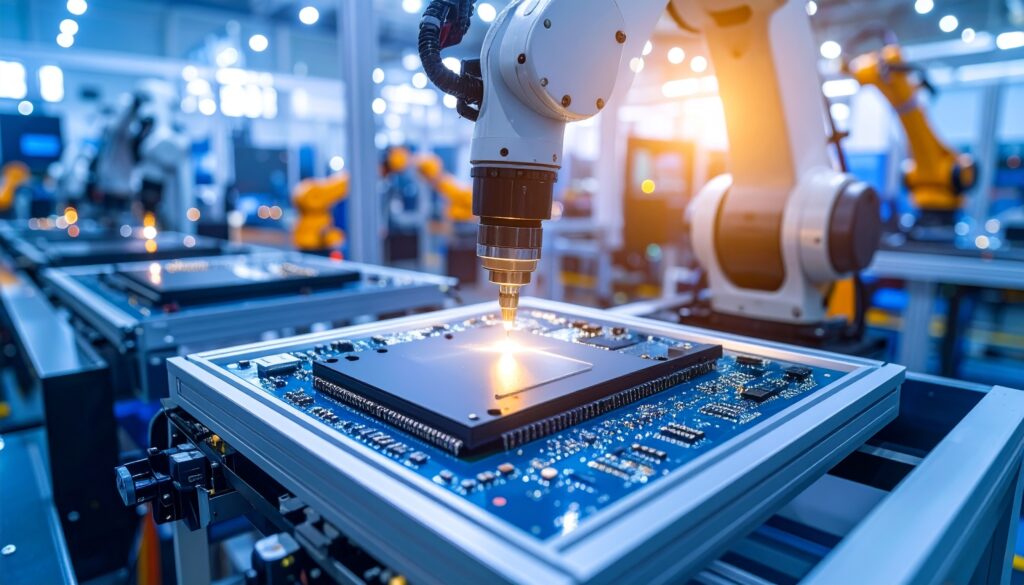

From Transistors to Transformations: Building AI’s Digital Backbone

As AI demand explodes, the industry has pivoted to something even more powerful: advanced packaging technologies that deliver up to 40x better performance than traditional scaling.

My investing story: Introducing our new Senior Analyst, Tim Le

Discover how Montaka’s new Senior Research Analyst, Tim Le, went from medical student to investment professional and why he wanted to join Montaka.

Quarterly Video: Q3 2025

We share our investment strategy and portfolio performance amid recent political and macroeconomic uncertainty. We maintain focus on long-term opportunities and shed light on several key holdings beyond our core positions.

Update from the PM – October 2025

Global equity markets are more complex than ever—traditional metrics like P/E ratios can mislead in a world of rapid change. First-principles thinking is key to spotting real opportunities.

Update from the PM – September 2025

As AI makes novel discoveries, facts become outdated much faster. As investors, we will need to adapt even faster to uncover the many mispricings (i.e. opportunities) that will result from this new reality.

The Adaptable Investor: Only adaptive investment teams will win in this new AI world

Markets are shifting faster than ever as AI accelerates the discovery (and invalidation) of facts. The investors who thrive will be those who adapt. Andrew Macken explores how adaptability will unlock opportunities in this new era.