The Other Side of The SaaS Apocalypse

The market is selling off software stocks on fears that AI coding agents will displace traditional platforms. But this narrative misses three critical realities: competitive advantages lie in distribution, not code; security concerns which limit agent deployment; and the fact that power infrastructure can’t support mass adoption for years.

Update from the PM – March 2026

The SaaS-pocalypse dominated February, but Andy explains why market fears miss three critical realities about enterprise software, AI capabilities, and power constraints. Learn why Montaka sees exceptional value in current dislocations and expects rapid re-rating when fundamentals prevail.

State of the Union: AI, resource competition and inequality increase geopolitical instability

Artificial intelligence, widening inequality, and intensifying competition for critical resources are converging to create a more volatile global landscape. This article explores how these forces intersect and what they mean for the future of geopolitical stability.

Update from the PM – February 2026

2026’s extraordinary start—featuring armed intervention in Venezuela, NATO rifts over Greenland, historic Japanese bond yield spikes, and a precious metals bubble- signals a new era of geopolitical instability. We also cover why the enterprise software sell-off misses the critical value of distribution and orchestration.

Update from the PM – January 2026

This update also includes Montaka’s Summer Investing Guide for 2026- featuring three selected essays from 2025, a recent podcast, and a book recommendation. Perfect preparation for the year ahead.

Update from the PM – December 2025

Volatility returned in Nov: Bitcoin -20%, S&P 500 -5%, Tech down while Healthcare & Energy surged. Amid the noise, Alphabet soared +14% on Gemini 3’s AI breakthrough. Bubble fears? We break them down.

Update from the PM – November 2025

Earnings season is here: Meta & Blackstone show strong fundamentals, yet stocks dip on short-term narratives. Do short-term moves matter when long-term AI-driven growth is clear?

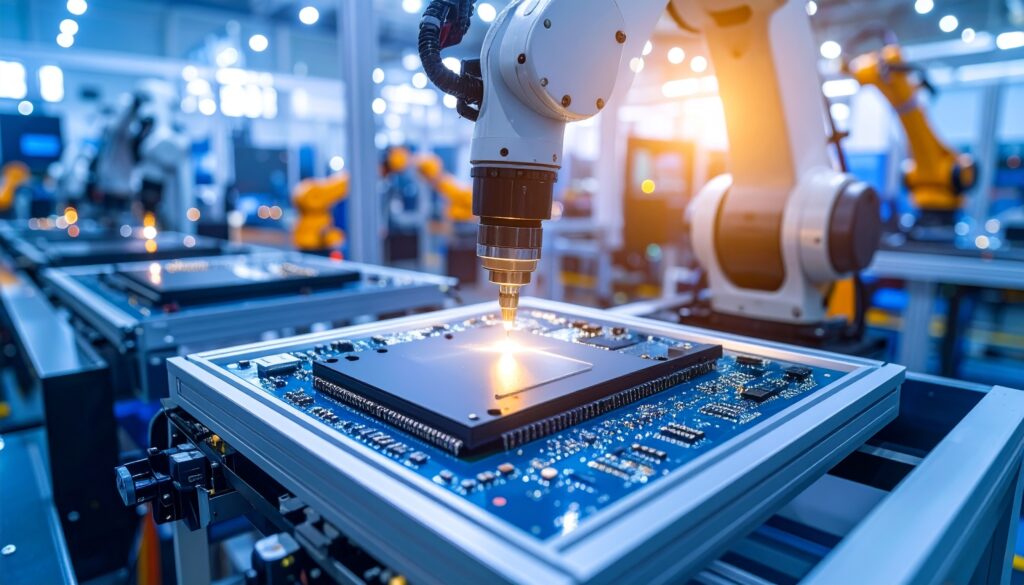

From Transistors to Transformations: Building AI’s Digital Backbone

As AI demand explodes, the industry has pivoted to something even more powerful: advanced packaging technologies that deliver up to 40x better performance than traditional scaling.

Update from the PM – October 2025

Global equity markets are more complex than ever—traditional metrics like P/E ratios can mislead in a world of rapid change. First-principles thinking is key to spotting real opportunities.

Update from the PM – September 2025

As AI makes novel discoveries, facts become outdated much faster. As investors, we will need to adapt even faster to uncover the many mispricings (i.e. opportunities) that will result from this new reality.