Beyond the Beach: Montaka’s Summer Investing Guide

While most people use the summer to switch off, we suggest a different approach: plugging in. This year’s Summer Investing Guide highlights three key essays from 2025, one podcast, and a book recommendation to get you set for the new year.

LVMH & the Curious Case of Veblen Goods

Discover how LVMH leverages the Veblen effect to defy traditional economics. Learn why higher prices increase demand for luxury goods and what makes LVMH a compelling long-term investment opportunity.

Beyond stock picking: The 3 big ideas that underpin Montaka’s portfolio construction

Most investors focus solely on which stocks to buy. But at Montaka, we believe how you construct your portfolio is equally critical. Discover how we build concentrated portfolios using Compounders, Outliers, and risk-based capital allocation to deliver sustainable long-term returns.

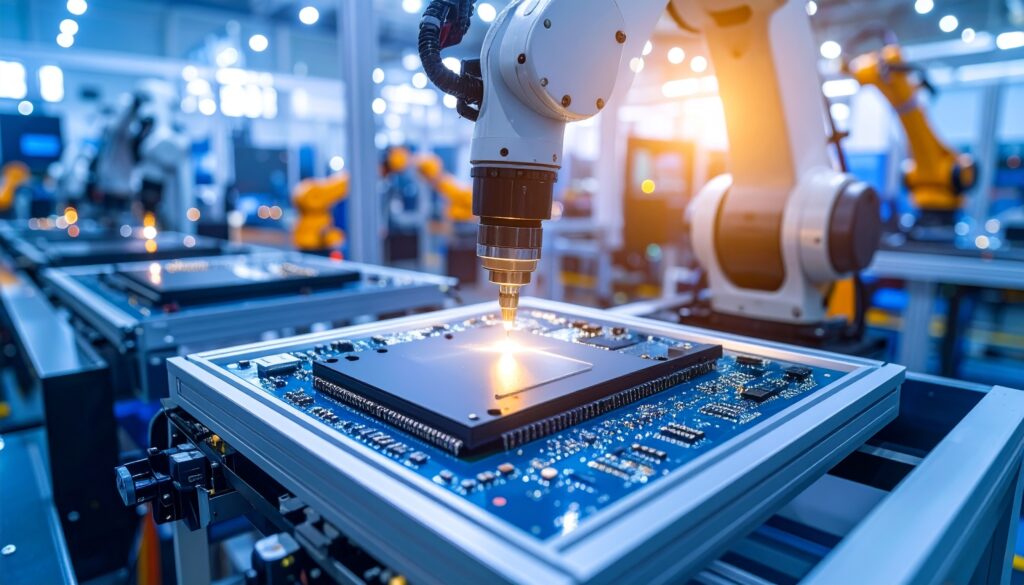

From Transistors to Transformations: Building AI’s Digital Backbone

As AI demand explodes, the industry has pivoted to something even more powerful: advanced packaging technologies that deliver up to 40x better performance than traditional scaling.

My investing story: Introducing our new Senior Analyst, Tim Le

Discover how Montaka’s new Senior Research Analyst, Tim Le, went from medical student to investment professional and why he wanted to join Montaka.

Quarterly Video: Q3 2025

We share our investment strategy and portfolio performance amid recent political and macroeconomic uncertainty. We maintain focus on long-term opportunities and shed light on several key holdings beyond our core positions.

How Cloud and AI Fuel the Next Wave of Hyperscale Growth

For over a decade, hyperscalers like Amazon, Microsoft, and Google have reshaped business. Despite doubts about slowing growth, first-principles analysis reveals the opposite: we’re just at the start. With cloud migration, AI adoption, and unmatched economies of scale, the hyperscalers’ golden age has only begun.

Quarterly Letter: Q2 2025

At the heart of this letter is a deep exploration of competitive advantage and the ‘flywheel’ conceptual model. Flywheels are the dynamic that enables a select few companies to generate unusually high and reliable growth over extended periods. It is these companies that make us extremely confident that Montaka will continue to deliver outsized returns for our investors well into the future.

Invest in Better Businesses in Better Neighborhoods

Explore Montaka’s investment philosophy, drawing parallels with Blackstone’s shift from classic value investing to targeting “better businesses in better places.” This article delves into two high-growth sectors: alternative asset management and enterprise digital transformation.

The Tyranny of the Narrative: Why Long-Term Investors Should Ignore the Headlines

Short-term narratives like the 2022 “Year of Oil” and “Tech Wreck” misled investors, but those who focused on long-term principles emerged victorious. Learn why ignoring the headlines is crucial for long-term success.