Don’t forget the keys to unlocking big wealth are compounding and time

In the current environment of heightened volatility, it’s vital that investors keep in mind the power of compounding. We use Buffett’s example in this article to highlight that the key to becoming very wealthy is strong compounding, repeated over time.

Drawdowns: Even ‘God’s portfolio’ can’t avoid them

Investors have been promised an elixir of big returns and low volatility. But the truth is that to achieve outstanding long-term returns, investors must be prepared to endure large drawdowns along the way – even for the best-performing stocks and portfolios.

Buckle up: This market is throwing up amazing companies at amazing prices

Investors are well aware that equity markets have commenced 2022 with severe volatility and big price declines. Certain long-term winning businesses have recently become a lot cheaper. That is, less risky. We acknowledge that the drawdowns have been uncomfortable, as they always are. But understanding these as part of the natural journey to strong long-term compounding gives peace of mind to stay the course.

Behind the Scenes – Q&A with Andy & Chris on bringing Montaka’s new AI whitepaper to life

Investment specialist Matthew Briggs interviews Andy and Chris about our latest whitepaper on AI (artificial intelligence) and the reasons for selecting this topic.

Why R&D masks earnings & value in today’s mega-techs

– Andrew Macken In the eyes of many investors, today’s mega-techs – Amazon, Microsoft and Alphabet, for example – are way overvalued. A cursory glance at the valuations of the North American majors suggests they are more expensive, say, than most of the big non-financial ASX-listed companies. You need to pay a higher multiple […]

Monocle’s 5 most important articles

From misunderstood valuation multiples, to winning portfolio construction and investment cultures, and some of our top investment themes. These articles were some of our most read and shared last year – and we believe they hold important lessons for how to navigate the year ahead.

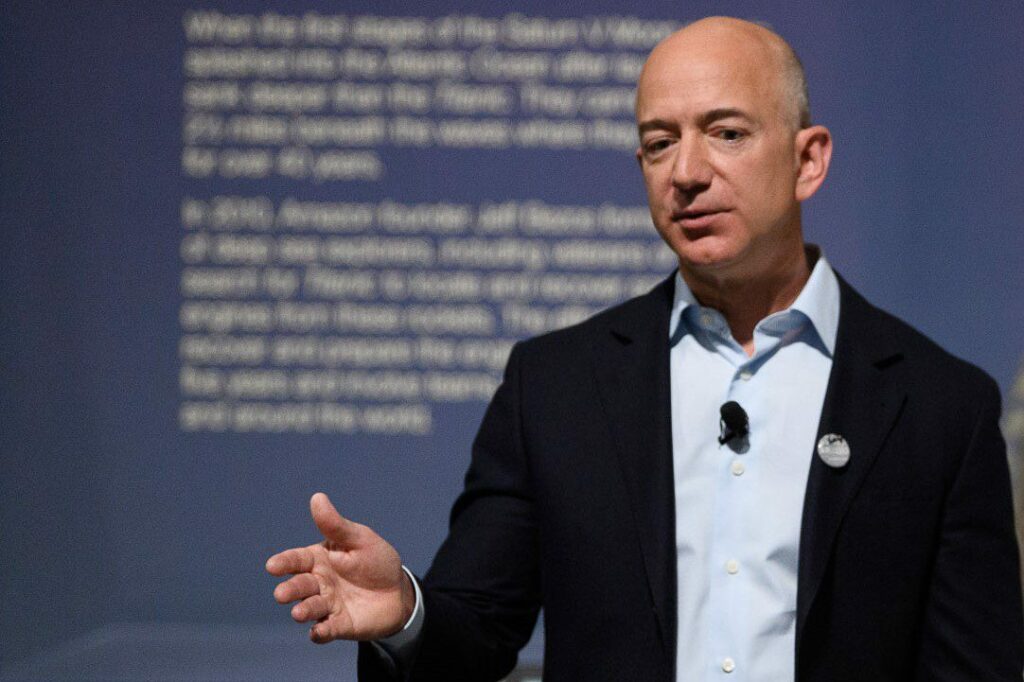

How Amazon founder Jeff Bezos’ shareholder letters made me a better investor – 7 lessons learnt

Investment legend James Anderson said something interesting: that an investor today needed to read not just Buffett’s words, but also the shareholder letters of Amazon founder, Jeff Bezos. I took note of Anderson’s tip and immersed myself in Bezos’s shareholder letters, getting inside the great man’s thinking, and here’s what I learnt.

3 market myths that threaten to derail investors’ long-term wealth

We continue to believe that the stock market offers materially better value than bonds, in general today. And this belief is based on detailed, ‘first-principles’ analysis. Though many stocks are overvalued today, some are still materially undervalued.

Does your fund have a winning investment culture?

Given its opacity and difficulty to understand from an outsider’s perspective, culture is often underrated within investment firms. But at Montaka we believe culture is one of the most vital components in delivering superior long-term investment returns.

Barbarians in your portfolio: The best way to access the private markets boom

Of the private market giants, our preferred option is Blackstone, the world’s number one player with $US731 billion of assets under management (AUM) across all asset classes. The company has grown its AUM by 16% per annum for the last decade. It has created a ‘flywheel’ where its success allows it to attract the best talent and best deals, that lead to further success.