|

Getting your Trinity Audio player ready...

|

By Andrew Macken

What a ride.

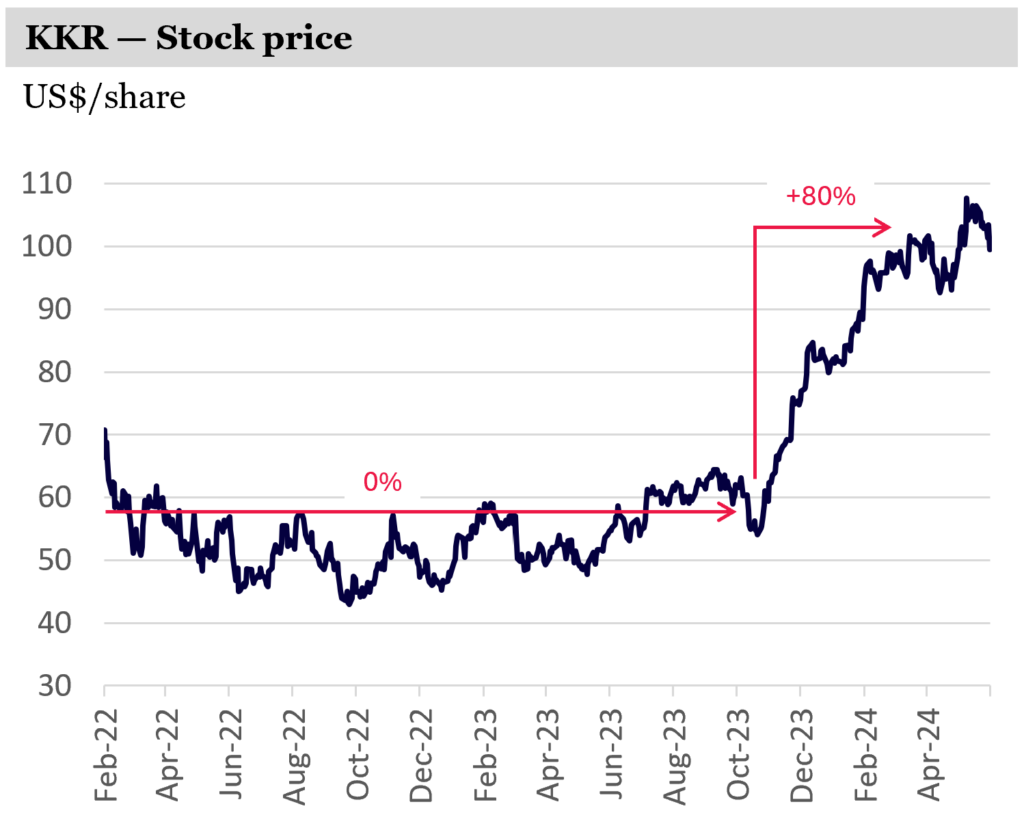

For 18 long months, through 2022 and most of ’23, KKR’s stock price meandered sideways. The torpor, which continued for month after month and quarter after quarter, came despite the alternative asset management giant consistently reporting solid double-digit growth in core fee-related earnings, with large additional growth opportunities also building in likelihood.

You could forgive investors for feeling perplexed.

But then in late 2023, without warning, KKR’s stock price rocketed 80% in just three months.

Source: Bloomberg

Equity investing is a wonderful source of long-term returns. But returns are not evenly spaced – especially for businesses pursuing large, transformative growth opportunities, like KKR – which can be particularly challenging for investors.

Investors in transformative businesses such as Amazon, Tencent and Meta, need to understand the inherently uneven ‘lumpy’ returns of these businesses.

If they don’t, they can easily become impatient, make hasty sell-decisions (like selling out of KKR), and miss the potential for massive, outsized returns that are needed to generate superior long-term compounding.

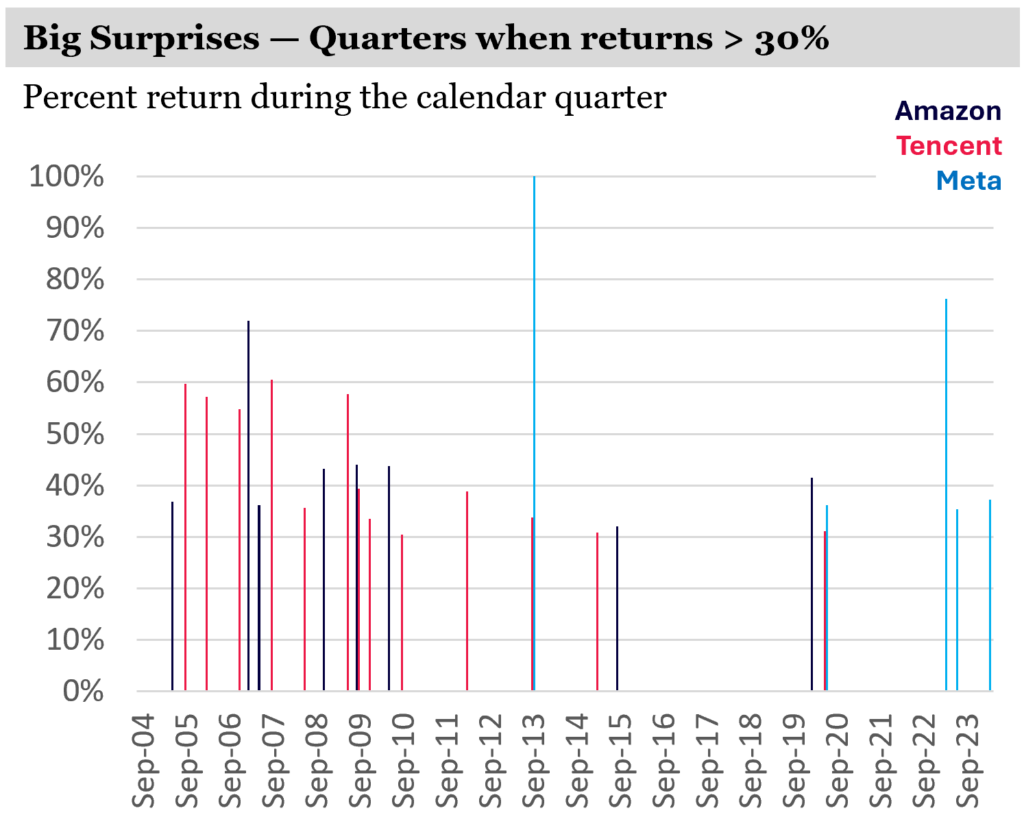

An anatomy of 30%-plus quarterly stock price moves

Stock price moves of more than 30% in a quarter are essentially out of the question for many businesses.

No ‘relatively predictable’ non-discretionary retailer, like Costco, or consumer packaged goods company, like Procter & Gamble, for example, has returned more than 30% in single quarter for the last 20 years.

For a stock price to move 30% over a short period of time, it means the market’s collective expectations for that business have changed quickly and substantially.

Such changes are not likely to occur for more predictable, slow-changing businesses like Costco and Procter & Gamble.

But some businesses are leading new large transformations. These transformations, often in the technology space, are complex and uncertain, and that can mean markets and analysts have periods of misunderstanding.

What often follows periods of misunderstanding, however, are big surprises. A sudden update to the expectations of the collective, perhaps as the result of new information, can trigger large stock price changes.

Amazon, Tencent and Meta deliver big surprises

Three businesses which are leading new large transformations in the technology space are Amazon, Meta and Tencent. All have experienced lumpy, uneven returns over time.

Source: Bloomberg; Montaka analysis

History shows that during one quarter in every 10, on average, Amazon and Meta will deliver a return of more than 30%. For Tencent, it’s nearly one quarter in five. The catch, however, is that you don’t know in which quarter that will happen.

The sheer size and complexity of the opportunities these businesses are unlocking has consistently led to misunderstandings on the part of equity investors … then big surprises.

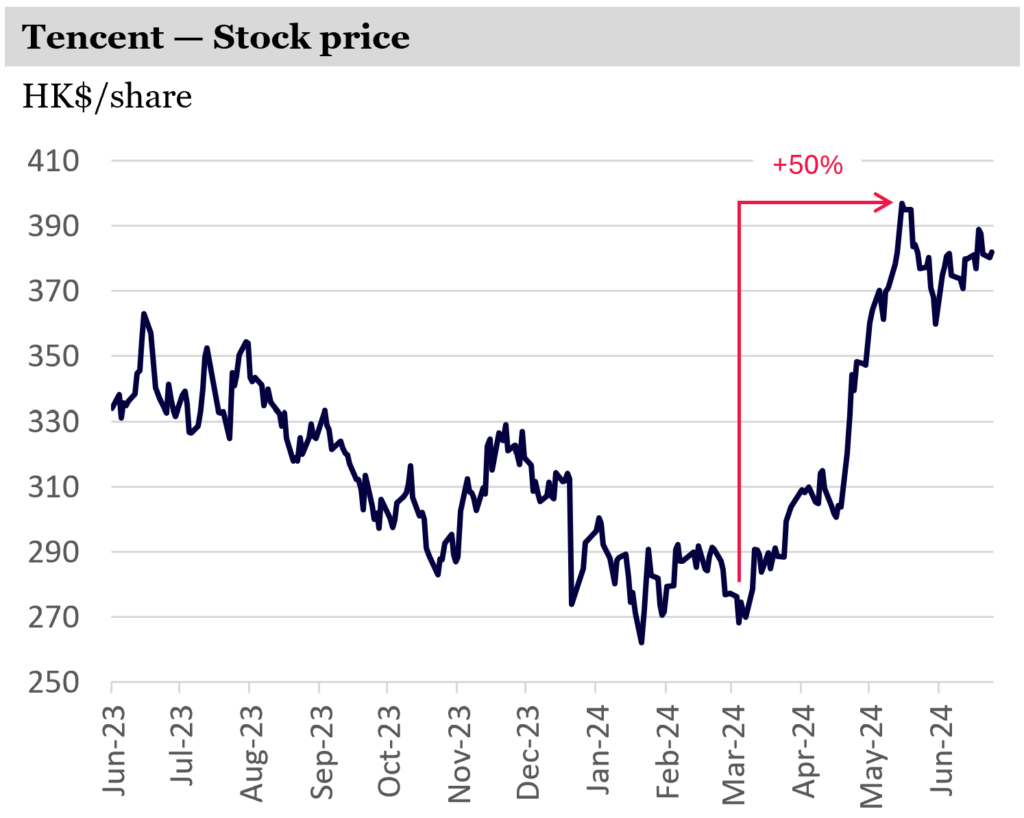

Prolific surpriser, Tencent, surprises again last quarter

If we look closer at Tencent, you can see that after drifting lower for most of the past year, over the past few weeks, Tencent returned nearly 50% with very little warning.

Source: Bloomberg

We view Tencent as something akin to a coiled spring.

While pessimism has built towards Chinese technology businesses due to concerns around Chinese policy, Tencent has been quietly building several levers for earnings growth which appear to have gone unnoticed by many investors. For example:

- Just as Meta transitioned user engagement to video format Reels over recent years, so too has Tencent transitioned its engagement to Video Accounts, where user time is up 80% year-on-year in the first quarter of 2024.

- And just as Meta ramped up Reels monetization more recently, Tencent remains in the very early stages of value-capture in its Video Accounts. Indeed ad-loads are currently just one-quarter the ad-loads of short-form video competitors.

- And outside of digital advertising, let’s also not forget that Tencent is one of China’s cloud computing, enterprise SaaS, and AI leaders. These opportunities also are yet to begin real monetization.

We see more positive large surprises ahead for Tencent, which will likely trigger more big share price spikes. Though, of course, we don’t know when.

The transformational investor mindset

For businesses like KKR, Amazon, Meta and Tencent, investors need to remain patient and preserve their long-term perspective. History shows that returns will be lumpy – unevenly distributed over time.

If you are to successfully invest in these transformative businesses, you need to be patient, have the mindset that allows you to look through short-term periods of market misunderstanding, and remain focused on the long-term opportunity.

If you can do that, the rewards can be enormous.

Note: Montaka is invested in KKR, Amazon, Meta and Tencent.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us:

Andrew Macken is Chief Investment Officer with Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or leave us a line on montaka.com/contact-us