|

Getting your Trinity Audio player ready...

|

-Andrew Macken

Benjamin Graham, the father of ‘value investing’, once famously said that in the short run the market is a “voting machine”, but in the long run it is a “weighing machine”. Graham meant that investor emotion and sentiment determine short-term share prices. In the long run, however, a company’s underlying business fundamentals and performance determine its price.

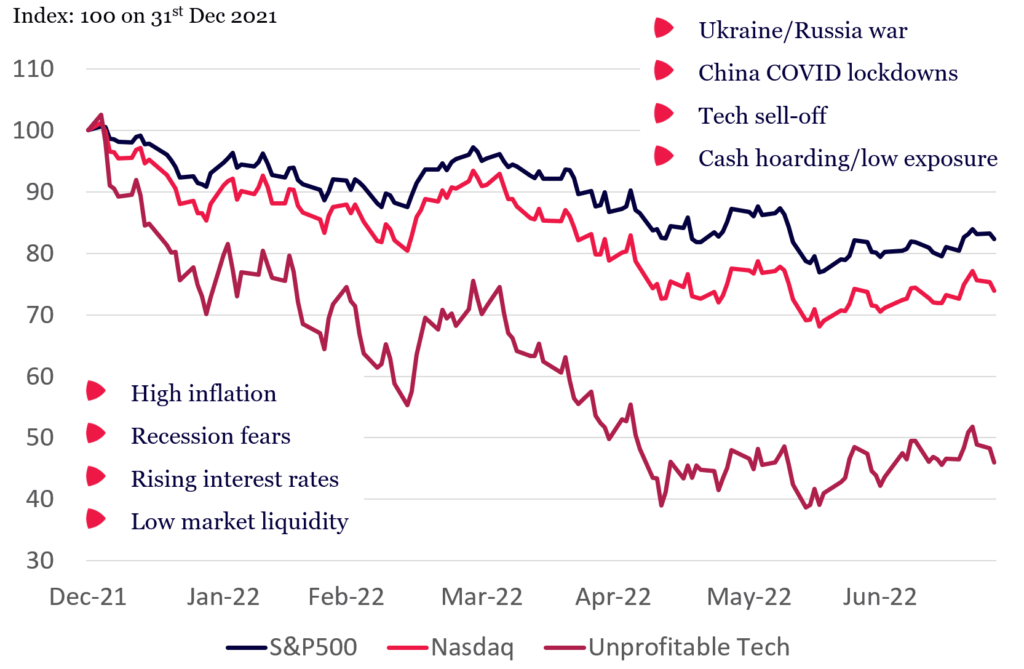

As investors know, today’s equity markets are certainly voting in an emotional way. This year alone, investors have wiped one-fifth off the value of the S&P 500 index and nearly one-third off the Nasdaq. The ASX200 has fared a bit better, down only around 9%.

Investors are worried about the likes of inflation, interest rate hikes, a possible recession, Covid impacts and geopolitical risks. But investors are really spooked by a double-whammy hit to near-term profits stemming from higher costs and weakening customer demand.

Stock market declines 2022 YTD

Source: Bloomberg

But with its focus on near-term profits, the market is being myopic in its “voting”. In its emotional state, it is forgetting Graham’s long-term “weighing” and the importance of long-term earnings. The market, as a result, is punishing the stock prices of lots of great businesses, which is throwing up great opportunities for investors.

Short-term hit to earnings don’t justify huge declines

Even if the market is right that many businesses experience some near-term earnings pressures, that still doesn’t justify the savagery of recent price declines.

Finance theory tells us that short-term, one-off earnings hits have a surprisingly limited effect on the long-term value of a business. Let’s say a company’s earnings this year are entirely wiped out. But then the following year earnings bounce to pre-wipe-out levels. The value of the business is only reduced by around one-tenth.

Through this lens, it seems hard to justify year-to-date declines of 20%, 30%, and in many cases, much more. This is particularly true for higher-margin businesses with strong competitive positions for which earnings compression this year will remain far from complete earnings elimination.

The share prices of the world’s leading alternative asset managers, including Blackstone, for example, have declined by around one-third. And yet, over this same period, Wall Street’s consensus earnings expectations for this year have actually increased by 23%.

It has been a similar case for the world’s leading cloud computing and digital transformation platform businesses. Indeed, many long-term winning technology businesses have fallen by much more. Compared to this time last year, for example, consensus earnings expectations for Salesforce are up by 5%, while its stock price is down by 25%.

No, many stocks were not overvalued

Some investors might counter that the large price declines have been justified because stocks were overvalued. In many cases, this was highly likely. But not in all cases.

The market has not made a distinction between overvalued and undervalued stocks. The sell-off has been indiscriminate. As such, the market has been throwing lots of babies out with the bathwater.

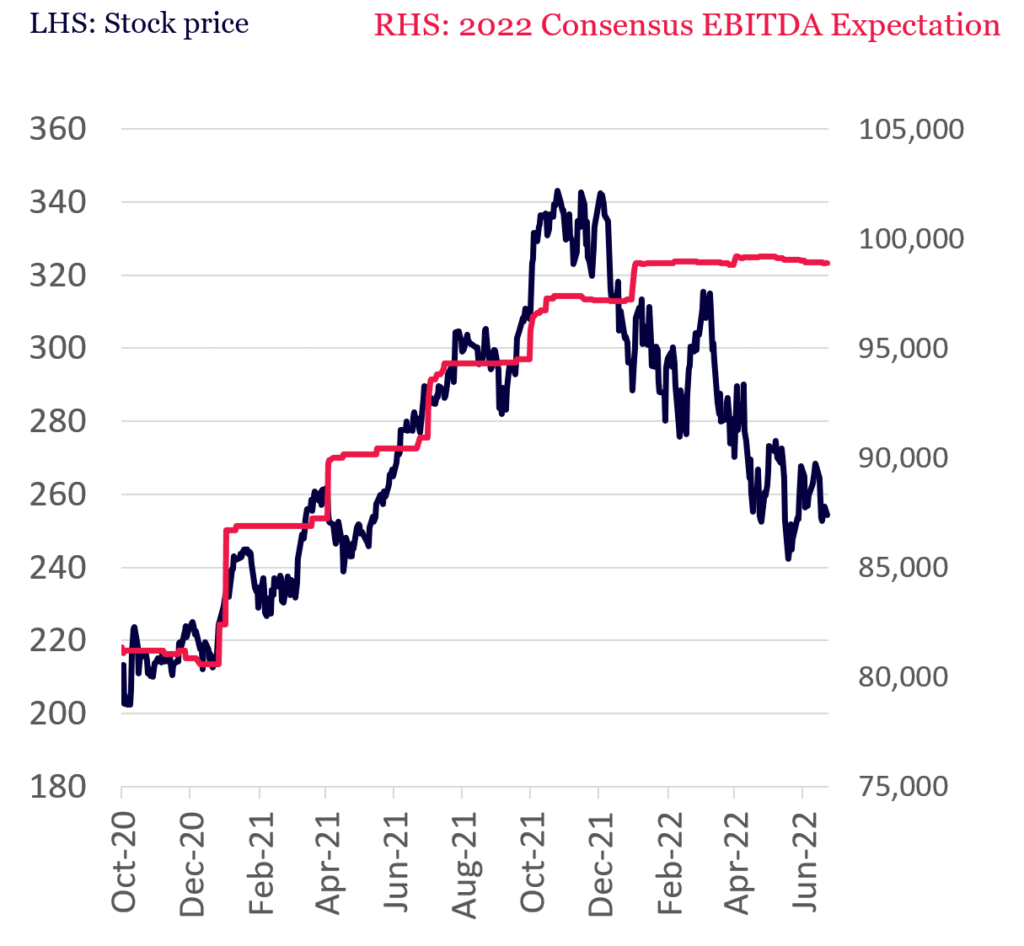

Microsoft is a case in point. Here is one of the most important technology platforms for any enterprise. Microsoft is reliably growing, mostly non-cyclical, with high profit margins. Its business is fairly well insulated against high interest rates, an economic downturn, input cost inflation and Covid, to name just a few of today’s favourite risk factors.

Not surprisingly, Microsoft’s expected earnings have not materially changed in the face of this year’s barrage of bad economic news. And yet, its stock price is down by around 25%.

Microsoft- Stock price vs expected earnings

Source: Bloomberg

The market should be focusing on long-term earnings power

In this market, investors should be reminding themselves that a company’s long-term earnings power – and the amount of capital investment required to get there – will be the primary determinants of long-term value. They should be focusing on Benjamin Graham’s long-term ‘weight’ of company earnings, rather than short-term popularity or unpopularity of its shares.

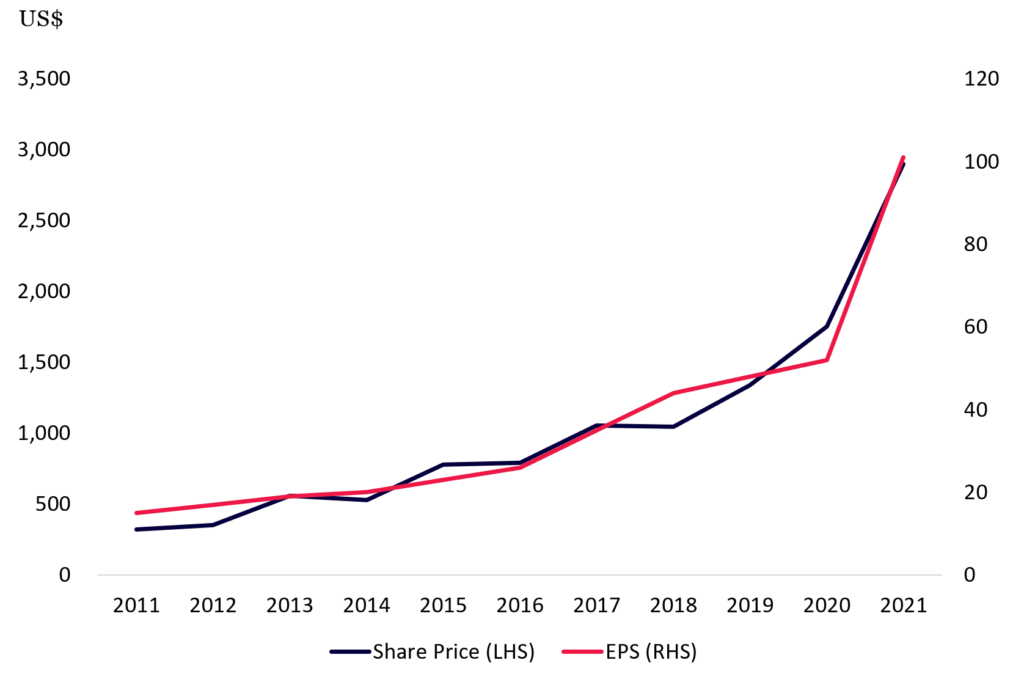

We can see the importance of long-term earnings for history’s great compounders, such as Alphabet. As you can see in the graph below, when we move aside the daily, weekly and monthly stock price gyrations, it is a company’s long-term earnings power that ultimately drives value.

Alphabet share price and EPS over the last decade

Source: Bloomberg

While investors have been fretting about short-term earnings, the world’s best CEOs are not as easily frazzled. In recent weeks, JPMorgan Chase CEO, Jamie Dimon, calmly addressed investor concerns about a deteriorating economic environment and his company’s stock price, which has declined by one-third.

“It’s not going to change how we run the company,” Dimon said. “The economy will be bigger in 10 years. We’re going to run the company. We’re going to serve more clients.”

And JPMorgan’s stock price will almost certainly be much higher in 10 years as well.

In time, history shows that while the market might “vote” in the short term and punish stocks, over the long run it is the “weighing” and earnings growth that will determine the stock price. Investors should be exploiting the opportunities created by the disconnect we are seeing in the current market.

Montaka has been using this opportunity to add to several portfolio holdings in long-term winning businesses that we assess to be significantly oversold. These include Amazon, Microsoft, Blackstone, Salesforce, Alphabet and others.

Montaka is invested in Alphabet, Amazon, Microsoft, Blackstone and Salesforce.

Andrew Macken is the Chief Investment Officer at Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or contact us on https://montaka.com/

Read our latest whitepaper on why AI is the most important theme today: