|

Getting your Trinity Audio player ready...

|

By Amit Nath

For the past decade, the ‘hyperscalers’ – Amazon, Microsoft and Alphabet (Google) – have delivered staggering growth.

Yet many investors believe the hyperscalers’ best days are behind them and the businesses are close to falling victim to the ‘law of large numbers’ – the concept where growth becomes increasingly hard once a system has achieved steady-state or saturation; said another way, “trees don’t grow to the sky”.

This view is seductive from a macro or top-down perspective.

But it is fundamentally flawed if an investor analyses the companies using first principles.

A first principles analysis shows that the growth of cloud hyperscalers is not a cyclical technology trend. It is a durable, structural shift in how the world does business.

There are 3 compelling reasons why the Golden Age of the hyperscalers isn’t over but just beginning.

1. The Cloud Migration is Just Getting Started

The first reason is, we are still at the start of the cloud revolution.

The foundational driver of cloud growth – which has underpinned the hyperscalers’ growth – is the multi-decade migration of computing from private, on-premises data centers to the public cloud.

This is not about a temporary trend. It represents a fundamental re-platforming of the global economy, aiming to create greater agility, innovation and efficiency.

This IT overhaul is not a short sprint. It’s more like a five-day cricket Test match.

By any measure, we are likely just finishing the first day’s play.

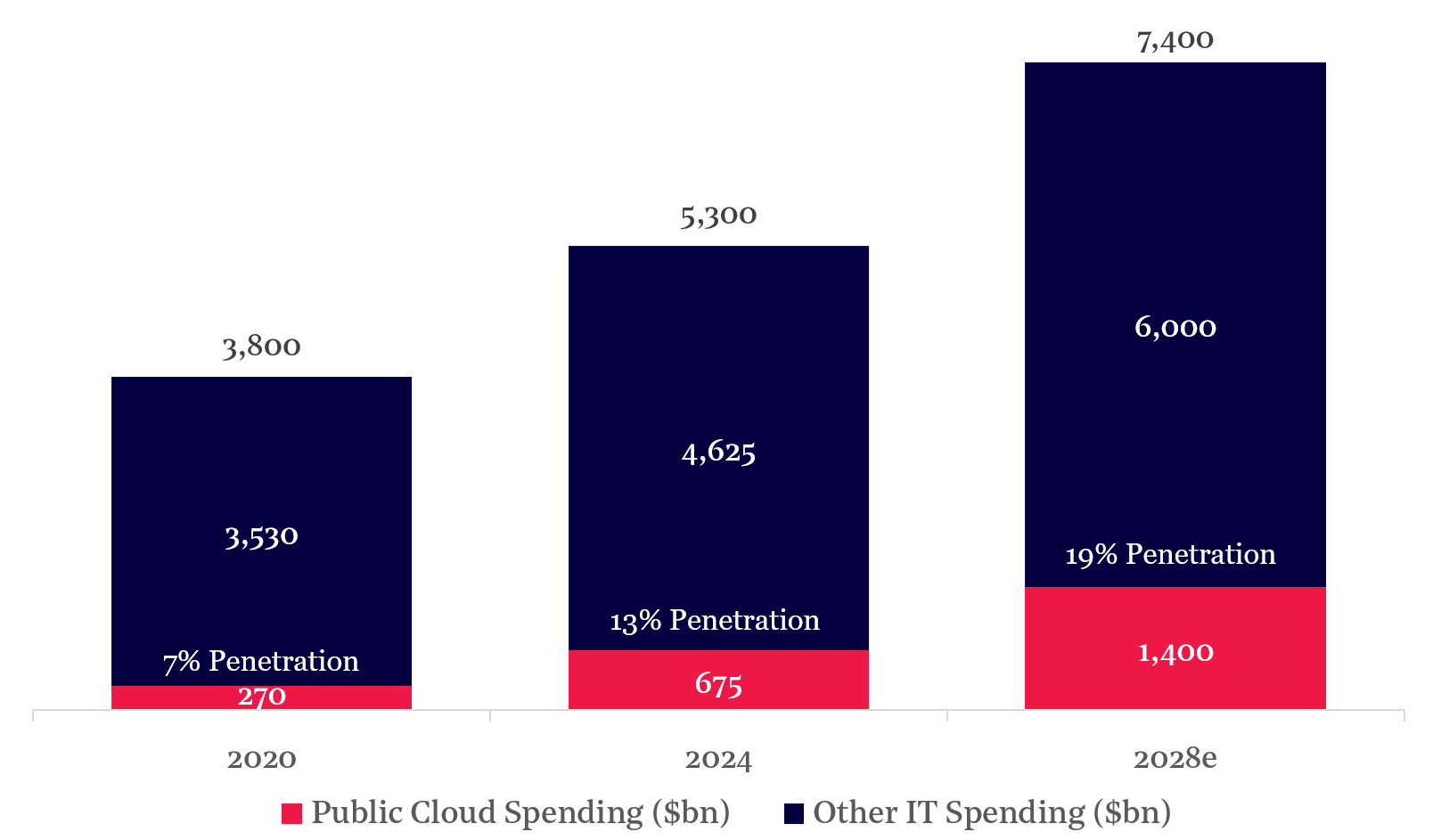

Technology consultancy, Gartner, estimates that the amount spent worldwide by end users on public cloud services exceeded US$675 billion in 20241.

While this is a massive number, it represents only ~13% of the estimated US$5.3 trillion total enterprise IT market.

For every dollar spent on public cloud today, nearly seven dollars are still being spent on traditional IT infrastructure.

This legacy spending is the massive, untapped reservoir that will fuel cloud growth for the next decade and beyond.

As Satya Nadella, Microsoft CEO, says2: “We are in the midst of a once-in-a-generation platform shift…and the very shape of the digital economy is being remade with a new generation of AI-powered applications and tools.”

Cloud Penetration of Total IT Spending (in USD)

Source: Gartner, IDC, Montaka Global

2. Data, Analytics, and Artificial Intelligence will Fuel Hyperscaler Growth

The second reason hyperscalers’ growth will continue to be strong is their role in the AI revolution.

If Digital Transformation is about moving the world’s digital factories to a better location, the AI revolution is about building entirely new, hyper-advanced assembly lines inside those digital factories.

You can’t have one without the other.

Artificial intelligence and the massive datasets that fuel it are not simply another IT workload.

They are immensely complex and evolve at astronomical speed. AI requires a mix of infrastructure and compute power at a scale impossible for almost any single enterprise to build and maintain, creating significant barriers to entry.

This leads to a second, even more powerful, growth engine for the hyperscalers.

The hyperscalers are not just landlords renting out digital space anymore; they are becoming indispensable platforms for AI innovation and development.

Companies are not coming to the cloud just to run payroll systems anymore; they are coming to build generative AI models, conduct complex simulations, and analyze petabytes of customer data in real-time.

The numbers behind this shift are staggering.

According to the International Data Corporation (IDC), worldwide spending on AI is expected to grow at a compound annual growth rate (CAGR) of 29% between 2024 and 2028, reaching over $632 billion3.

A huge portion of this spending will be on cloud infrastructure because it is the only practical way to access the specialized chips, networking architectures, scalable power resources and critical software required for AI.

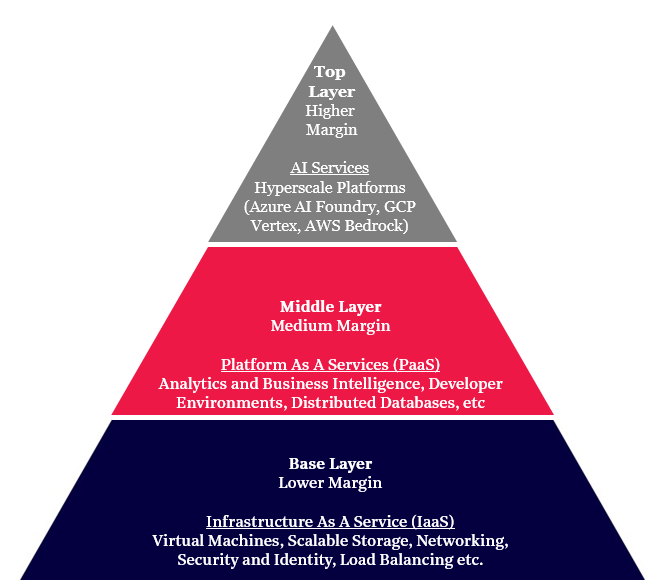

Hyperscaler growth is driven by new customers and existing customers moving up the stack to higher-value, higher-margin, software services including AI.

To enable these higher functioning AI capabilities, the foundations must be laid via traditional Digital Transformation in the public cloud (i.e. data cleaning, on-demand resourcing, cybersecurity, governance, etc). Digital Transformation is the core value-proposition in the shift from the client-server model to the public cloud ecosystem.

Furthermore, Microsoft’s CEO recently noted that the margins on the AI side of the business are “better than they were at this point by far” compared with the transition from client-server to public cloud.

Moving Up the Value Stack

Source: Montaka Global

Thomas Kurian, the CEO of Google Cloud, makes a critical point: by leveraging massive scale, hyperscalers are building “a very open platform” that serves customers any AI model (OpenAI, Anthropic, DeepSeek, Mistral, etc) and combines it with their own proprietary data in a safe, reliable and repeatable way4.

This is a very attractive value proposition, as it allows companies and developers to keep pace with the rapidly evolving AI industry, incorporate best-in-class tooling and do it in an evergreen fashion.

Said another way, the hyperscalers are not competing to be the best AI model; they are competing to be the perpetually evolving ecosystem where businesses use their own enterprise data, select any AI model, provision the latest hardware and build applications using the most cutting edge set of software tools. This makes the hyperscalers the ultimate arms dealers of the AI revolution.

3. The Magic of Scale and Profitability

The third reason is that, while the hyperscalers’ revenue growth is impressive, it’s their underlying unit economics and profitability that make them truly generational businesses.

Their ability to deliver operating leverage, which allows profits to grow much faster than revenue once a certain scale is achieved, is truly remarkable.

Think of it like a global toll-road.

The initial cost to build the highways is astronomical.

But once they are open, every additional car that pays a toll adds revenue at virtually no extra cost, causing profits to soar.

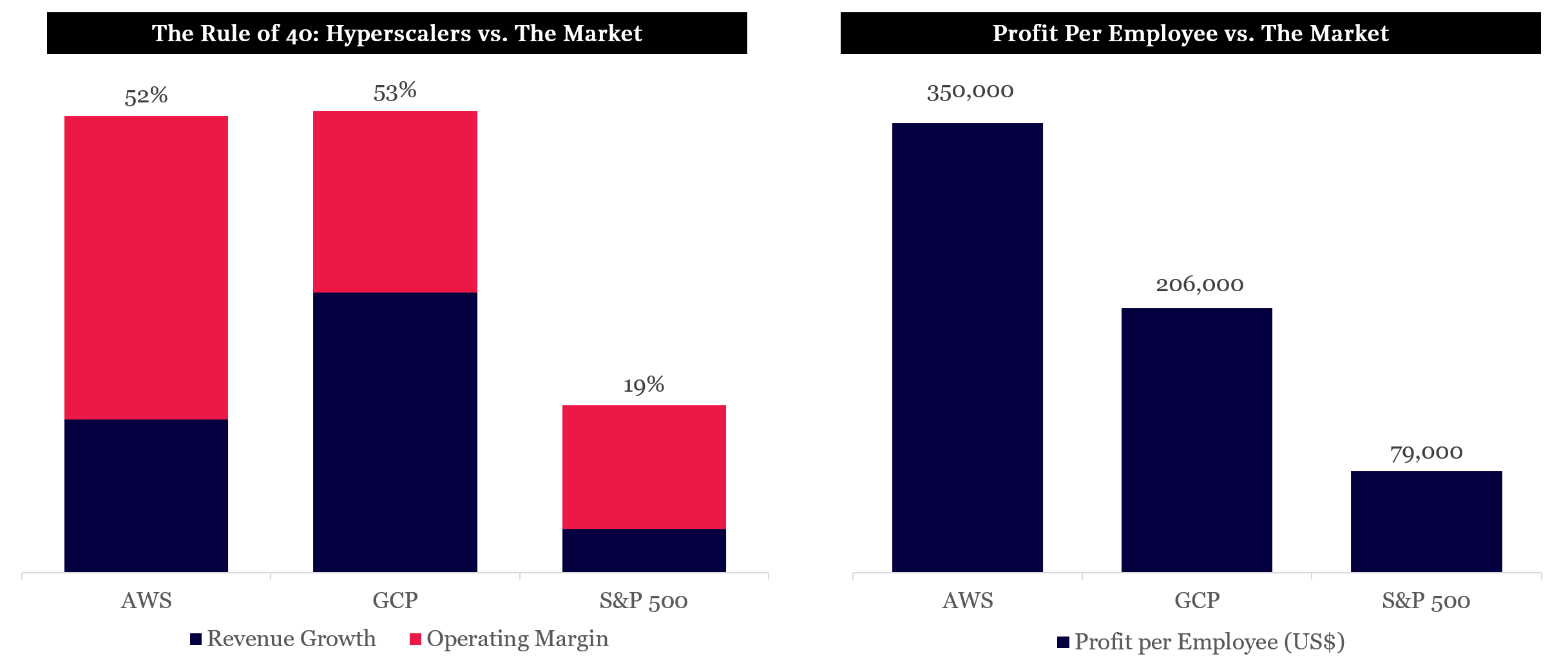

We can see this dynamic in the hyperscalers when we benchmark the S&P 500 against the two hyperscalers that disclose cloud segment profitability separately, namely Amazon (AWS) and Alphabet (GCP).

The ‘Rule of 40’ is a key metric used to identify exceptional businesses by adding revenue growth and operating profit margin.

Anything above 40% is considered outstanding and often highlights a quality mix of growth and profitability.

As you can see, the cloud businesses operate at a level nearly three times that of the average S&P 500 company.

Their technology-leveraged businesses also require far less human labor, translating into nearly 5x more profit per head in the case of AWS relative to the S&P 500.

Source: Amazon, Alphabet, Bloomberg, Montaka Global

Source: Amazon, Alphabet, Bloomberg, Montaka Global

The Valuation Disconnect: Wall Street Still Misses the Big Picture

If the case is so clear, why don’t the hyperscalers trade at even higher valuations?

The market’s persistent undervaluation potentially stems from three cognitive biases:

- The conglomerate discount

- The law-of-large-numbers fallacy, and

- The market unfairly extrapolates short-term investment cycles into permanent ‘headwinds’ reflected in the share price

The Long-Term Signal is Clear

Forget the false narrative that cloud’s golden age is over. It’s just beginning.

The investment case is simple:

- First, a multi-trillion-dollar migration from legacy IT is still in its early innings, with nearly 90% of the opportunity still ahead.

- Second, the AI revolution is pouring fuel on this fire, making hyperscale infrastructure indispensable.

Finally, and most critically, this is not just growth; it is uniquely profitable growth. These cloud businesses operate at a level of efficiency and scalability that are multiples of the S&P 500. This is why Amazon’s AWS, Microsoft’s Azure, and Alphabet’s GCP, must be seen for what they truly are.

They are not merely divisions of larger corporations; they are the foundational platforms of the digital age – the shipping lanes for data and the power grid for AI.

While the market remains distracted by quarterly noise, the long-term signal is clear.

An investment in the cloud titans is not a bet on a stock; it is a direct stake in the primary economic engine of the 21st century and beyond.

As Amazon CEO, Andy Jassy, says5: “When you have a market that big, and it’s still so early in the adoption curve…we have a lot of growth in front of us. It is very much Day 1.”

Note:

1: Gartner Forecasts Worldwide Public Cloud End-User Spending to Surpass $675 Billion in 2024

2: Microsoft’s Inspire conference on July 18, 2023

4: Goldman Sachs Technology Conference on September 10, 2024

5: Andy Jassy’s CNBC Interview on August 4, 2023

Amit Nath is the Director of Research at Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Note: Montaka is invested in Amazon, Alphabet and Microsoft.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stock picks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us: