|

Getting your Trinity Audio player ready...

|

– George W Hadjia

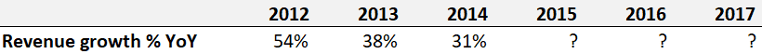

Consider the revenue growth of the following company.

What would you guess the revenue growth of this company will be for the next three years? Your guess probably involves some sort of tapering of the growth rate. In other words, you extrapolated the trend of the past three years to inform your view for the next three years.

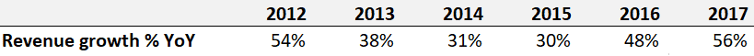

The revenue growth profile above is actually that of Tencent, the Chinese company that owns the WeChat app. Tencent has a virtual monopoly over internet traffic, with its Weixin/WeChat super-app being an indispensable tool for Chinese netizens to conduct their everyday lives.

Below is the actual revenue growth that Tencent achieved.

So what drove the growth inflection in Tencent? Part of it was cloud computing and payments.

But back in Tencent’s 2014 Annual Report, there was no discussion of the cloud business at all; it was bundled into the company’s ‘Other’ business segment. The savvy investor, however, could have seen the ‘optionality’ — the potential of a company’s current and future investments to create business value — in Tencent’s cloud operations.

Fast forward to 2020 and cloud and payments now exist in a separate business segment called ‘FinTech and Business Services’ which generated RMB 128.1 billion in revenue, or 26.6% of Tencent’s total revenues.

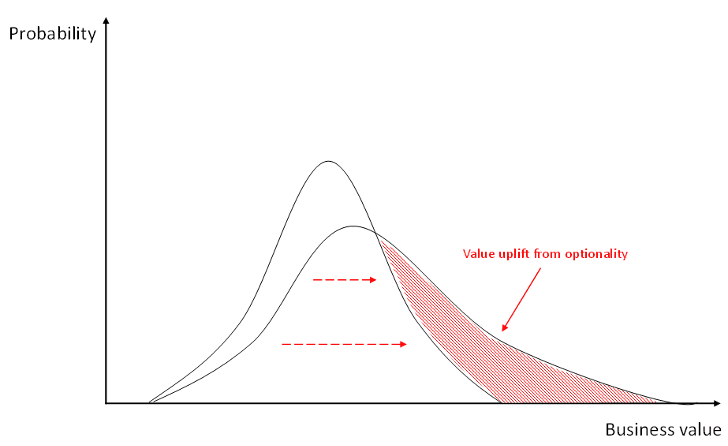

Optionality gives firms a higher chance of achieving a significantly higher future business value outcome

Insights around optionality are a rich source of variant perception for a stock. The market routinely overlooks this avenue of value creation until evidence of it begins to materialise in the financial statements and earnings commentary.

While the risks from Tencent being based in China are salient in investor’s minds at present, with many Chinese tech stocks seeing material share price declines, we believe over time the narrative will refocus on the positive revenue and earnings developments that should spring from Tencent’s optionality.

3 reasons Tencent is primed for optionality

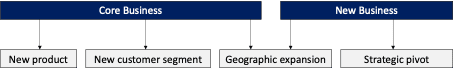

We can think of optionality manifesting across a number of dimensions for Tencent.

Tencent is primed for optionality due to three key reasons:

1. A large, sticky user base

Tencent has 1.2 billion monthly active users across Weixin and WeChat, spanning not just consumer applications but also penetrating into corporate China as an enterprise communication platform with other ancillary business applications. This enormous existing user base obviates the need to acquire new customers from scratch and creates a wedge for introducing new products to users that can then be monetised.

2. Internet economics

Tencent is a digital business, with its various applications housed inside a mobile app. This means that Tencent’s business model is governed by internet economics, where there are zero marginal costs of distribution. Unlike an old world, linear business that requires spending money to build a new factory and physical distribution channels to support the launch of a new product, Tencent’s products are distributed digitally which means that new revenue streams can be scaled up in short order.

3. Visionary management team

Tencent has an incredible management team that has a demonstrable track record of pivoting the business to capture new opportunities. Whether it was shifting from what was originally a chat app into gaming, or building out in-app payment capabilities, Tencent’s management team has shown no fear of shifting the business to new areas. Tencent’s leaders had the vision to foresee value generating opportunities before the competition did, and had the courage and aptitude to pivot to these areas, some of which were remarkably different from the core business.

A key ‘option’: pushing up the cloud stack

One ‘option’ worth focusing on is Tencent pushing up the cloud stack, which could generate enormous value that is being underappreciated by the market.

We’ve spoken about Tencent’s immense cloud growth, but we believe the company is only getting started in terms of building out the cloud stack. We can think of the cloud stack being broken up into three layers: Infrastructure as a Service (IaaS), Platform as a Service (PaaS) and Software as a Service (SaaS).

The Chinese cloud market has historically been mostly IaaS, which offers compute, storage, and networking resources on a pay-as-you-go basis. This layer of the cloud is commoditised and any advantage stems from scale allowing for a lower cost of compute. There has also been a recent shift among Chinese cloud vendors into the PaaS layer.

However, the SaaS layer in China is still at a very nascent stage, and here lies the opportunity for an enormous value unlock. In the West there is a developed industry of SaaS companies. Think of salesforce.com, ServiceNow, Adobe, Workday, Shopify, Intuit, Zoom, Square, etc. In China there are no scaled pure-play SaaS companies. None.

There is $1.8 trillion of market capitalisation from just the top 20 U.S. pure-play SaaS companies alone. Outside of the top 20 U.S. SaaS companies there’s a long tail of companies representing roughly another $1 trillion of market capitalisation. There is a roadmap in the West for tremendous value creation via the development of consumer and enterprise SaaS solutions. China is just getting started.

A condensed phase

It is hard to imagine a world where Chinese firms do not lean into the power of cloud-enabled applications which are able to provide lower-cost turnkey solutions, workflow automation and a range of other benefits. The longer-term productivity and cost efficiencies from SaaS products will be too great for Chinese firms to ignore, and those that do will ultimately put themselves at a competitive disadvantage.

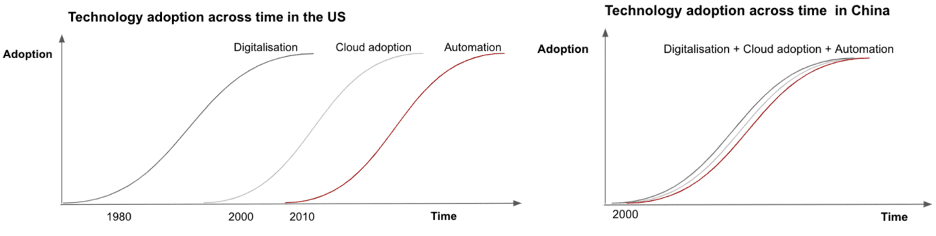

Many Chinese businesses are still in the digitalisation phase and must progress up this curve for cloud adoption to hit critical mass. However, unlike the U.S. which had a temporally distinct phase of digitalisation followed laggardly by cloud adoption, China is condensing these technology adoption phases into a shorter time span which will see Chinese digitalisation and cloud adoption happen concomitantly.

Source: Chinese Characteristics analysis

In addition to the need for digitalisation, there are further barriers to cloud adoption in China that must be overcome, including no established ecosystem of system integrators around SaaS offerings to assist cloud deployments, Chinese firms’ scepticism of the ROI software can generate, with the cost of cloud migrations due to IT infrastructure build-outs and customisations making the value proposition seem even less clear. But while it might mean that the development of China’s cloud ecosystem unfolds differently to the experience of the U.S., we do not view these barriers to cloud adoption in China as insurmountable.

Supercharge returns

When investing in a business that possesses genuine optionality, the growth of your investment will likely surpass what you thought was ever achievable at the outset. This is because typical approaches to business valuation centre around what is observable and knowable.

A discounted cash flow valuation, for example, captures the future cash flows the business of today is expected to generate. It would be highly irregular to start including cash flows in the analysis from business segments that have not yet been created or even dreamed of. But does this mean that this uncertain future business value should be ignored?

This brings to mind the aphoristic question of if a tree falls in the forest, and there’s nobody around to hear it, does it make a sound? Much like the tree, just because we cannot presently observe the form in which this embedded optionality might take within a business, it does not mean that it doesn’t exist.

This failure of the market to properly reflect the value of real options in a stock means that optionality can supercharge the returns of an investment as this value is unlocked.

We won’t know the exact ways in which value will transpire from Tencent’s stable of options, and there will likely be additional unforeseen business segments that materialise over time, but we believe investors should be mindful that optionality could provide a sizeable boost to Tencent’s future returns.

Note: Montaka owns shares in Tencent

George Hadjia is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.