|

Getting your Trinity Audio player ready...

|

– Lachlan Mackay

What is your edge?

In the perpetual quest for superior investment returns, this has always been the central question.

Legendary investor Bill Miller famously distilled the sources of competitive advantage into three categories:

- Informational: knowing something others don’t

- Analytical: interpreting public information better

- Psychological: behavioural discipline

For decades, the professional investment industry was built almost entirely on the first.

Today, however, the informational edge has all but vanished, leaving a profound opportunity for those who can master the other two – especially over long-time horizons.

Another era

The evolution of the investment landscape tells the story.

As Charley Ellis, a sage of our industry, recounted on a recent podcast1, the early days of professional investing were a vastly different game.

With only a handful of buy-side analysts, and information difficult and slow to acquire, investors could exploit genuine information asymmetries.

“Over 90% of trading volume2 was individual investors with little access to information,” Ellis noted.

For the professional, simply getting the information first was a durable competitive advantage.

This fueled the explosive growth of the active management industry, as firms were built to exploit these increasingly short-term informational imbalances for profit.

Table stakes

Fast forward to today, and that world is unrecognisable.

The industry now employs millions of professionals globally, all armed with rigorous training and the same real-time data from Bloomberg terminals, instant news flow, and powerful search tools.

Trading volumes have multiplied 2,000-fold, with up to 75% now driven by algorithms and high-frequency strategies.

The fierce competition has effectively arbitraged away the traditional informational edge in fundamental investing.

Furthermore, the modern analyst can be leveraged significantly through the intelligent use of technology.

At Montaka, for example, we systematically employ internally designed AI query sets across every sector. This allows us to rapidly identify emerging trends and transformations that might represent fertile ground for future investment opportunities.

While this is a powerful tool, it underscores a critical point: information at scale is already table stakes.

Yet, astonishingly, the bulk of the active management industry remains fixated on the same old game: chasing quarterly mispricings and other fleeting, information-based advantages.

This is a crowded trade with diminishing returns.

Playing roulette

So, where does that leave the thoughtful investor? The answer lies in shifting the focus from areas of intense competition to those that are structurally neglected.

Successful Australian investor Paul Moore recently articulated this perfectly when he said that successful investors differentiate themselves through a willingness to standalone, which allows them to think longer term3.

“The only true arbitrage in markets is duration,” Moore said.

He noted that the short term is so efficient and noisy that it’s “like playing roulette – black or red.”

But “the further you look out, you find these big anomalies … that can unwind over a ten-year period.”

Long-term investing is more akin to playing poker; patience affords us the opportunity to make big bets only when the odds are heavily in our favour.

‘Duration arbitrage’ is the advantage gained by investing patiently in long-term opportunities that other market participants, constrained by short-term pressures, perpetually overlook.

Holding Amazon

Why does long-duration investing remain a persistent source of opportunity?

Primarily because so many industry participants cannot pursue it.

The relentless pressure for quarterly performance, fear of career risk, and impatient clients with misaligned expectations, create powerful structural impediments that force most managers into the crowded, noisy, short-term arena.

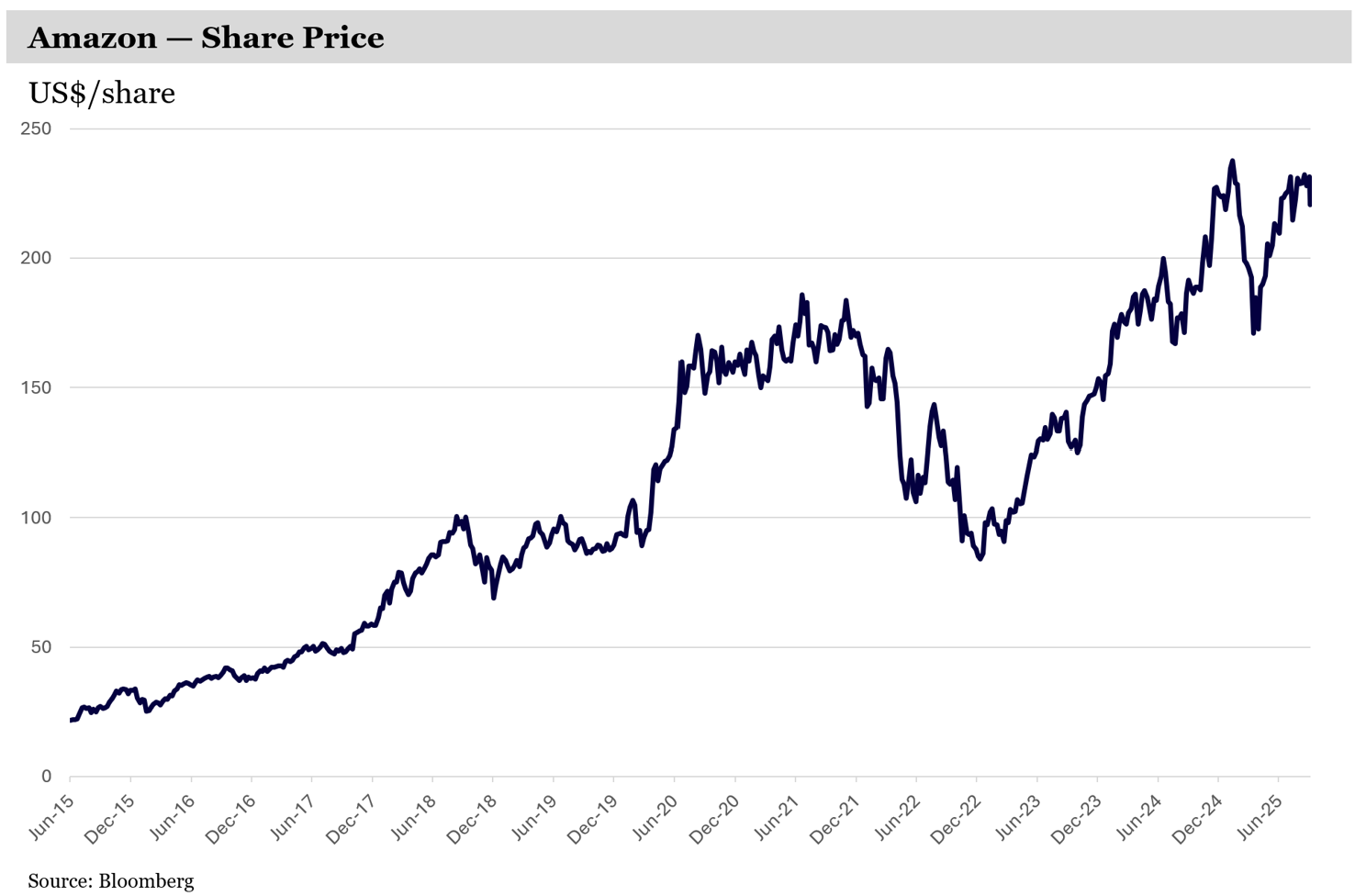

Ironically, with so much information available, it has become hard to just hold Amazon for the last ten years. Yet you were rewarded handsomely for your patience.

The ability to genuinely invest for the long-term is a scarce resource. It is an uncrowded advantage, enabled by the right structure, culture and investing formula.

Finding the big long-term winners

At Montaka, we have built our philosophy on this foundation.

We focus on our analytical and psychological advantages and apply them where there is the least competition: the very long term.

Our process is designed to identify the few advantaged businesses poised to be the big winners from long-term structural transformations, including:

- Amazon, Microsoft and Alphabet from the global enterprise adoption of cloud computing;

- Blackstone and KKR from the democratisation of private markets and alternative assets; and

- LVMH from the expanding purchasing power of the global middle class

We believe the market routinely underestimates just how long these truly exceptional companies can continue to grow and compound value.

By combining deep analytical work with the psychological strength to be patient, investors can exploit the market’s inherent short-term focus and unlock the continually underappreciated power of long-term compounding.

Note: Montaka is invested in Amazon, Microsoft, Alphabet, Blackstone, KKR and LVMH.

References:

1: https://open.spotify.com/episode/5H1BcSBTrqb7Bzv4FlZNyk?si=999dec8a006c4a0e

2: https://www.alliedmarketresearch.com/algorithmic-trading-market-A08567

3: https://open.spotify.com/episode/1Sg2NJkSnwexFT0XRJ9RRt?si=6400abf39fde4a3b