|

Getting your Trinity Audio player ready...

|

-Andrew Macken

There is so much information available today that investors can often feel like they are drowning. Never before has the skill of separating the ‘signal’ from the ‘noise’ been so important for investment success.

Ironically, despite its rapid advances, the world of AI is only now incorporating this power of ‘relevance realization’: the ability to extract important insights … without being overburdened by excessive and needless information.

The world’s AI Godfathers, such as Meta’s Chief AI Scientist, Yann LeCun, have recently pushed for AI models trained on – not what they directly see – but rather the ‘features’ contained in the data that reflect important meanings or concepts behind what is seen. [1]

We immediately know that each picture below is of a car. Yet the individual pixels and their color combinations contrast greatly between the two images. The excessive detail of the relativity of each individual pixel is pretty useless information. And so our brains naturally focus on the salient features of the images: the wheels relative to the chassis, the headlights, the hubcaps, and the driver’s window.

Just as AI models are now focusing on important features hidden in data, so too can investors become more explicit about focusing on what’s relevant, and deprioritizing what’s not.

This relevance realization – capturing the ‘signal’ amidst the ‘noise’ – is a core skill of a proficient investor. In a noisy, information-flooded market, it’s a skill that’s become even more vital.

Below, we explore some of the ‘features’ of a high-quality business. Investors can use them to efficiently scan the universe of investment opportunities and filter for businesses that have a high probability of delivering above-average returns over the long term.

1. Look for these two features of high-quality businesses

When examining a business for potential investment, one can immediately become overwhelmed with information. From reported financial information, to stock market-related data, to industry data, to press reports, management interviews and so on.

How on earth can anyone absorb it all and arrive at a quality assessment?

To cut through the noise, here are two ‘features’ that, if they exist, indicate good business quality credentials:

- High organic revenue growth — Without acquiring other businesses, at what annual percentage rate will the business typically grow? 3% is ok. 8% is very nice. And anything in the double digits is outstanding. But sustainability is key. Higher organic growth rates can only be sustainable if they are backed by some kind of structural transformation. Otherwise, they will generally revert towards the average growth rate of the economy over time.

- High returns on incremental invested capital[2] — As business earnings grow, how much investment is required to attain this growth? If earnings increase faster than invested capital, that’s great. If very little investment is needed to support higher earnings levels, this is extraordinary. This characteristic is often domain-dependent, with certain winners in domains like asset management and software development able to deliver very high returns on incremental capital invested.

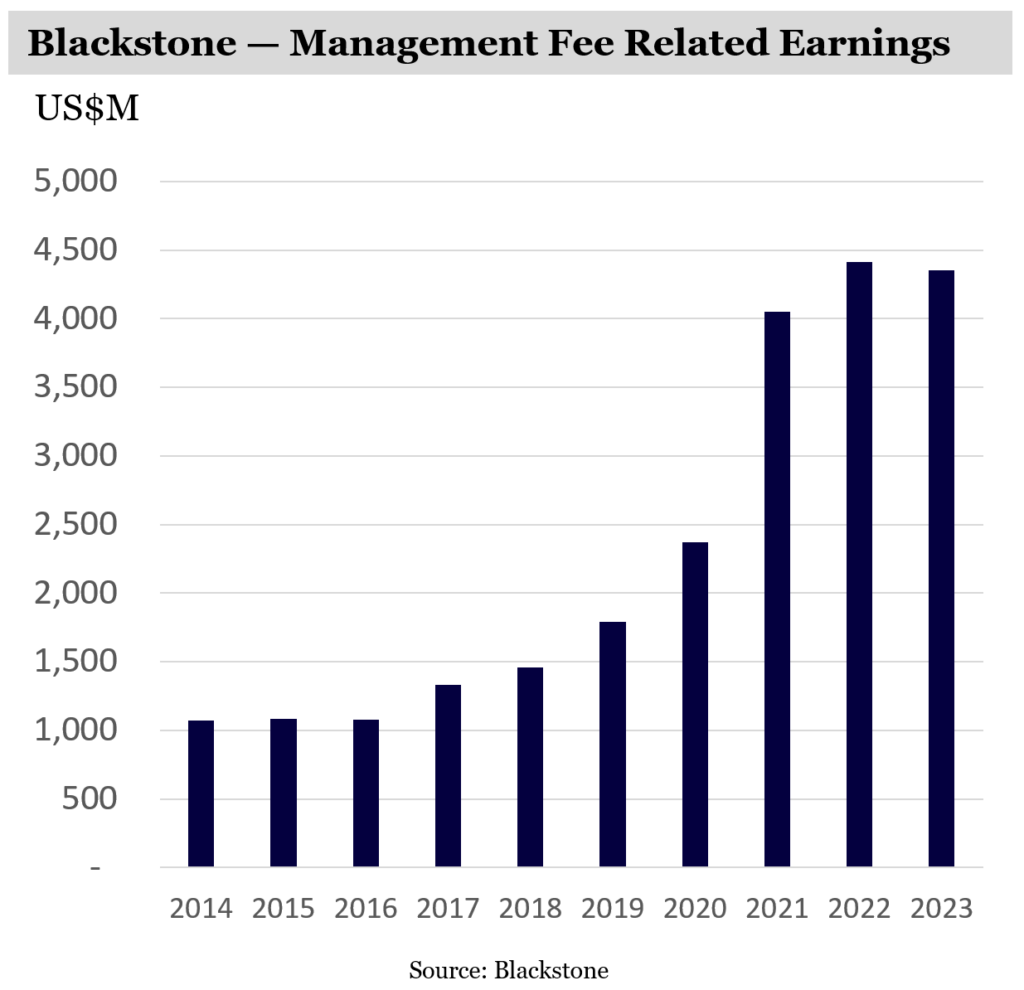

If a business has both these attributes, as does Blackstone, for example, there is a good chance its ‘quality’ is high.

Driven by structurally increasing investor allocations to private alternative assets, as well as by natural market valuation growth, Blackstone will likely continue growing its fee-related revenues and earnings at double-digit annual percentage rates for an extended period of time. At the same time, Blackstone does not need to invest significant capital to capture this growth.

2. Find the source of quality by identifying ‘enablers’ (competitive advantages)

To accurately assess the quality of a business at a deeper level, we need to understand the source, or sources, of its quality by looking at its competitive strategy.

Of all the disciplines investment analysts are required to master – from finance, to economics, to accounting, to marketing – a deep understanding of competitive strategy is by far the most important.

It is the very nature of competition – or more specifically, the extent of any protection from competition – that enables a business to be high quality within an industry.

Here are three sources of competitive protection – or ‘enablers’ – that investors should be analysing to find quality businesses:

- Scale — Two clear advantages accrue to businesses of large scale. First, costs per unit volume tend to be lower than competitors because any fixed costs are divided over a larger volume base, and the larger scale often also results in better procurement terms. Second, as a direct consequence of the first advantage, large scale businesses can usually take advantage of their privileged cost structure to grow their market share. Over time, industry concentration increases (i.e. fewer, larger players) which itself acts as a barrier to entry for new potential competitors. Australia is all too familiar with this dynamic, with examples ranging from the major supermarkets, to the telcos, and the major banks.

- Customer captivity — Businesses that are already embedded into an existing customer base that cannot easily switch away have a powerful advantage. They have a metaphorical ‘distribution pipe’ into the customer. Think of the more than one billion customers of Microsoft Office, for example, who are unlikely to switch any time soon. Without an equivalent distribution pipe, would-be competitors are essentially forced to share their own economics with the owners of the pipe. An industry with entrenched players that have very strong and resilient customer relationships is difficult for new potential competitors to enter.

- Irreplicable assets — Certain businesses are fortunate to own assets that essentially cannot be recreated by competitors. These are monopoly-like assets. For example, LVMH owns exquisite brands like Louis Vuitton which has been carefully nurtured for 170 years. This brand cannot be recreated and enables LVMH to earn high, sustained economic returns. Examples in other domains include owners of protected IP, owners of irreplicable datasets, and owners of protected mining tenements. Irreplicable assets, by their very definition, are difficult to compete with for potential new industry entrants.

Business quality can stem from any one of these enablers (though some businesses are fortunate to exhibit more than one). The stronger the enabler, the stronger the business quality. And the more sustainable the enabler, the more sustainable the business quality. To understand business quality is to understand its enablers.

And there is one more enabler that rules them all. One that enables other enablers.

3. Seek businesses with ‘flywheels’

A ‘flywheel’ is a metaphor for a powerful dynamic that makes the above enablers of a business stronger over time.

The dynamic is self-reinforcing: the business employs the benefits of today’s enablers to make tomorrow’s enablers a little bit stronger. The cumulative result is even stronger, more resilient enablers – leading to even greater business quality.

Like a flywheel in the physical world, a heavy revolving wheel rotates slowly at first while gradually building up momentum. But once it gathers steam, it’s very difficult to stop.

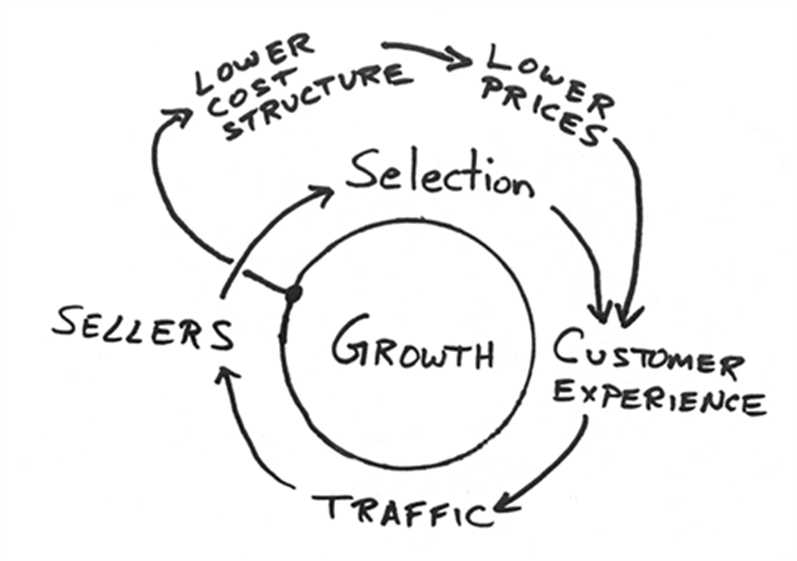

Amazon represents one of the great flywheel case studies. In 2001, Amazon founder Jeff Bezos famously sketched on the back of a napkin the following schematic. It illustrates the self-reinforcing dynamic where quality benefits are deliberately employed to further enhance quality.

Source: Jeff Bezos, 2001

Amazon has used scale to lower prices and improve customer experience. This not only drives further scale, but also makes the platform more attractive to merchants. This, in turn, further improves the customer experience, which drives scale, but also customer captivity. As a result, Amazon’s platform ultimately grew to become a truly irreplaceable asset.

What’s so remarkable about Amazon is that it has applied ‘flywheel thinking’ into everything they do. Today, Amazon is essentially a portfolio of many flywheels:

- In cloud computing, greater customer adoption enables AWS to improve the offering for everyone – benefiting future scale and customer captivity.

- In retail fulfillment and distribution, scale lowers delivery costs and improves delivery speeds. Both merchants and consumers love this, driving further scale and customer captivity. Prime subscribers spend more money, enabling Amazon to invest more in scalable benefits (e.g. Prime Video). Merchants love that Prime subscribers spend more, further increasing scale and customer captivity.

- And now advertising leverages Amazon’s privileged datasets to offer merchants highly effective ad impressions, further driving merchant adoption and captivity.

Not all information is created equal. Focus on the relevant.

In computer vision, Yann LeCun and his team are finding that AI models based on important ‘features’ perform better and are much more computationally efficient than traditional computer vision.

The same is true in investing.

In a noisy world, prioritizing the important features of high-quality businesses is an effective way for investors to use their time efficiently and effectively.

Montaka’s portfolio is dominated by businesses with features that reflect great business advantages. And most also exhibit flywheels that self-reinforce to enhance business quality over time.

Note:

[1] (Meta) I-JEPA: The first AI model based on Yann LeCun’s vision for more human-like AI, June 2023

[2] Conceptually, this is the ratio of (A) change in annual earnings power, to (B) change in invested capital, over the same time period. An attractive ratio is anything over 15%.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us:

Andrew Macken is Chief Investment Officer with Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or leave us a line on montaka.com/contact-us