|

Getting your Trinity Audio player ready...

|

– Andrew Macken & Chris Demasi

>

In this Q2 2025 investor update, we explore:

- How extreme market volatility created opportunity

- Why we added to our KKR position despite price swings

- The three timeless sources of competitive advantage How companies like LVMH, Spotify, KKR, and Blackstone harness flywheel dynamics for outsized long-term growth

This also marks the 10-year anniversary of Montaka, reflecting on a decade of evolution and looking forward to the next.

* * *

As you know, our primary goal at Montaka is to sustainably compound our portfolio over the long term.

We already have a well-established portfolio of advantaged businesses with a lot of runway for future compounding.

Additionally, we want to remain fully invested, or very close to it.

To continue to maximise the probability of sustained compounding of the Montaka portfolio, we see our key tasks going forward as including several things:

- To continually re-analyse and test business cases – including the trajectories of competitive advantages and flywheel dynamics (which we will come back to in a moment). Deep, insightful analysis is Montaka’s most important strength and the bedrock of future wealth generation for our investors.

- To compare market prices for our portfolio holdings with our realistic assessments of fair value, and to

- Continually evaluate opportunity costs – that is, to compare potential investment opportunities against our existing portfolio companies. These comparisons become particularly important during market moves and when key company value drivers change – both of which can impact prospects or probabilities (for both risks and opportunities).

Our goal is asymmetric portfolio payoffs (significant upside potential with limited downside potential). We achieve this by having high weightings in companies with strong prospects to materially increase their earnings power over the medium and longer term, while bearing only modest risk of permanent capital impairment.

In the June quarter, we extensively examined the business cases for our portfolio holdings. And despite a very noisy backdrop, in the vast majority of cases, they pleasingly continue to improve, which sets the portfolio up nicely for continued strong performance.

Volatility creates opportunity

The June quarter was certainly an interesting time for investors.

In the first week, thanks to Trump’s ‘Liberation Day’ tariff policy announcement, the S&P500 experienced a double-digit percentage decline.

But then over the subsequent weeks, the index bounced back by nearly 25% notwithstanding an extraordinary Israeli and US attack on Iran along the way.

The good news is that, while uncomfortable, such market volatility can create (even more) attractive investment opportunities.

One recent example relevant to Montaka’s investors has been KKR. This year alone, KKR’s stock price declined by 44%, then bounced back 50%. Yet, in our assessment, KKR’s long-term business prospects remain unchanged, and we used this period of volatility to successfully add to Montaka’s position in KKR.

The recent whipsawing of markets, and the KKR example, remind us that investors are better off looking well beyond short-term headlines and remaining focused on long-term business earnings power.

This approach is certainly serving Montaka well. Our annualized 1-year, 2-year and 3-year performance metrics are all tracking at or above 20% p.a. net of fees.

The three powerful elements of competitive advantage

We would like to spend some time exploring a deeper dynamic of our strong performance: a focus on competitive advantage.

Overall, Montaka’s portfolio companies remain highly profitable and cash generative. But, above all, they remain ‘advantaged’.

Competitive advantages

When a company is competitively advantaged, they face less intense competition and are better protected from new competition. They have a greater chance of delivering higher returns on invested capital over time.

There are three broad categories of competitive advantage – each of which increase the probability of unusually high returns on invested capital:

- First, economies of scale. The larger a business, the better it can spread its fixed costs across greater sales volumes to reduce unit costs. This can even include R&D. Larger companies can spend a lot more than smaller companies on R&D, yet still maintain their average profit margins. Large companies also have greater bargaining power over their suppliers, which can further reduce costs and expand profit margins.

- Second, customer captivity, where businesses have a large, entrenched customer base that cannot easily switch to an alternative supplier. A locked-in customer base is highly valuable. It can increase pricing power, enable cross-selling opportunities, and often represent a significant barrier to entry for new competitors.

- And third, irreplicable assets which are monopoly-like assets that cannot be recreated by competitors. LVMH, for example, owns exquisite brands like Louis Vuitton, which has been carefully nurtured for 170 years. This brand cannot be recreated and enables LVMH to earn high, sustained economic returns. Other examples include owners of protected IP, owners of privileged datasets, and owners of protected mining tenements. By their very definition, potential new industry entrants find it very difficult to compete against these irreplaceable assets.

A self-reinforcing cycle that strengthens advantages — a flywheel

An important question for investors (as well as business executives) is: How can a business build and strengthen these advantages discussed above?

The answer is: flywheels.

A ‘flywheel’ is a dynamic where a company shares its economics with its customers. That sharing creates a powerful symbiotic relationship where both the company and customers benefit.

When the customer and company win together, we typically see several things:

- Greater customer adoption and retention,

- Increased market share,

- Greater scale, and

- Greater enhancement of the product or service offering.

Plus, importantly, the advantages grow in strength over time because the dynamic is self-reinforcing: i.e., the more a business shares with its customers, the faster its advantages grow.

Like a flywheel in the physical world, once it gathers steam, it’s very difficult to stop.

How we employ our flywheels model to identify opportunities in disparate places

In a recent presentation to investors, I asked what the companies on the left (below) all have in common.

It’s perhaps not immediately obvious what a payments company has in common with a retailer; or what an asset manager has in common with an audio streaming platform. (Of course, all of these companies are owned by Montaka at present.)

It is only with the conceptual model of ‘flywheels’ that investors can connect these seemingly disparate businesses.

Let’s look at three examples from the list above:

- Firstly, Spotify. With a free ad-supported tier and a low subscription price, customers get enormous value at minimal cost. As more people use the service, Spotify learns more about consumer preferences. This data informs the company about how it can further improve the value of the service for all users.

- Or consider the retailer, Floor & Decor. By specializing only in hard surface flooring, they can leverage greater scale when ordering directly from manufacturers. By sharing these reduced costs with customers through lower prices, and by offering the widest range of SKUs (stock keeping units) on the retail floor, more customers adopt and are retained … which in turn further increases market share and scale.

- Even Blackstone and KKR, the world’s leading alternative asset managers, exhibit flywheel dynamics. With the greatest scale around the world, and full-service offerings across the entire capital structure, they can source the most attractive deals. These attributes attract the world’s largest clients, as well as the highest-caliber deal-making talent – all of whom mutually benefit from greater investment returns over time. Furthermore, with some of the largest investment portfolios in the world, Blackstone and KKR can leverage their proprietary data sources to identify new investment trends before they are recognized by the competition, further increasing expected investment returns.

From conceptual models to investment returns

Competitive advantages and flywheels have a direct effect on long-term investment returns.

When a company has competitive advantages, they can capture superior returns from business investments. That investment could be expanding their core businesses, or leveraging their core advantages to expand into new, adjacent markets. Superior returns in turn manifest as higher growth in earnings power (relative to the capital investments required to achieve said growth).

Flywheels build and strengthen competitive advantages of companies, making them more resilient to the ebbs and flows of economic and political cycles. And they increase the probability of more reliable growth over extended time horizons.

Yet markets routinely undervalue this dynamic. And many asset managers are not structured to exploit their potential.

If an asset manager is to capture the inefficiencies in long-duration opportunities, academic and empirical research1 has found they need to adopt active management strategies characterised by two things:

- High active share (a large difference between the portfolio and benchmark) – the result of a highly concentrated portfolio, and

- Long fund duration (positions held for extended periods) – the result of long-term patience in individual investments.

This is why Montaka believes that owning a long-term, high-conviction portfolio of high-quality global companies – companies with strong and strengthening competitive advantages – represents a persistent long-term alpha opportunity.

And we build and hold that portfolio by using models of competitive advantages – as well as the flywheel model – to help us understand the true ‘reality’ of powerful businesses.

Portfolio augmentations & market outlook

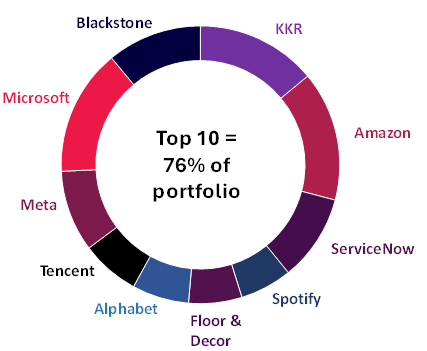

As a result of the limited number of companies with these true competitive advantages, and our high active share, Montaka’s portfolio remains highly concentrated, with our top-10 investments representing 76% of the portfolio. Our top holdings have not changed materially during the June quarter.

We also remain a long-duration fund. Annualized portfolio turnover remains quite low at approximately 18%, notwithstanding some small changes to the portfolio following our internal ‘price to value’ and opportunity-cost assessments, as described above. Our portfolio turnover implies an average holding period within Montaka’s portfolio of greater than five years.

The following is a summary of Montaka’s top 10 investee companies at quarter-end.

Montaka’s Top10 Investee Companies

Looking to the medium term, investors face a wide range of possible outcomes, exacerbated by the unpredictable policymaking style of the Trump Administration.

From wars, to tariffs, to central bank interventions, there is plenty of fodder for those pondering disruptive economic and market scenarios.

This is all against a backdrop of remarkably rapid ongoing technological change, particularly around artificial intelligence (AI), change that always carries both positive and negative implications.

But there are also plenty of scenarios conducive to favorable investment returns. It’s possible, for example, that armed conflicts are paused, disruptive trade wars are resolved, regulations become deregulation, and high interest rates are lowered over time.

The underlying US economy remains quite strong for the time being, so it is certainly possible, though far from guaranteed, that the investing environment could be quite positive going forward.

We don’t predict. Instead, we rely on the business advantages (and flywheels) of the companies we invest in to increase our chances of durable success, irrespective of the economic and geopolitical backdrop that emerges.

* * *

This letter marks the 10-year anniversary of Montaka. We are so humbled by the ongoing support and patience of Montaka’s investors, particularly those who have partnered with us since the early days.

Montaka has had its fair share of ups and downs over the years, but we take immense pride in our commitment to learning and evolution and to continually seek better outcomes for investors.

And we have evolved a great deal over the last decade, including amongst other things:

- Our 2020 repositioning as a fully invested, high-conviction, long-duration investment manager,

- Our 2025 merger with MFF Capital Investments, and our

- Recent integration of the latest AI tools into our investment processes.

We are always looking for opportunities – large and small – to improve, whilst at the same time retaining existing elements we know are critical for success, such as our deep fundamental research, our disciplined valuation processes, and our ongoing adherence to our risk controls.

At the heart of this letter is a deep exploration of competitive advantage and the ‘flywheel’ conceptual model.

This might strike some readers as a rather narrow topic for a 10-year anniversary letter. Yet our relentless focus today is not on the last 10 years, but rather the next 10 years, and the 10 after that.

Flywheels are the dynamic that enables a select few companies to generate unusually high and reliable growth over extended periods.

It is these companies that make us extremely confident that Montaka will continue to deliver outsized returns for our investors well into the future.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link:

Note: Montaka is invested in Amazon, Blackstone, KKR, Spotify, Floor&Decor, and Tencent.