|

Getting your Trinity Audio player ready...

|

By Amit Nath

The incredible performance of the ‘Magnificent 7’ has left many scratching their heads. The market is expecting just a concentrated handful of businesses to capture outsized economics in the Artificial intelligence (AI) era.

But another big AI winner that the market and many investors may be underappreciating is ServiceNow.

The company may not be a household name like many of the Magnificent 7, but its IT services are on the tip-of-the-tongue and mission-critical to 85% of the Fortune 500.

ServiceNow has become the ‘central nervous system’ of almost every major corporate IT department, and increasingly government department, across the globe.

As the central repository of an organization’s IT assets – including hardware, software, and data – the company helps customers uncover hidden competitive advantages and cost-efficiencies.

Source: Bloomberg

However investors are not sufficiently valuing that AI has dramatically increased the value of this unique volume of customer data that ServiceNow possesses.

While ServiceNow’s share price has run solidly in the past year, we believe the stock has a lot more runway ahead as its unique, operational advantages become clearer to investors.

World-Class Artificial Intelligence Team

In the fast-moving world of AI, data analytics is suddenly seen as a major source of corporate competitive advantage.

Yet for some time ServiceNow has been working to become an early leader in AI. The company dramatically accelerated its use of AI after it acquired a small AI startup, Element AI, more than three years ago.

The acquisition saw ServiceNow bring in one of the world’s leading AI experts, the Turing Award-winner (aka the Nobel Prize of computing), Yoshua Bengio. Bengio won the Turing for his work on deep neural networks, a foundation of ChatGPT and today’s AI explosion.

(Bengio’s collaborators, Geoffrey Hinton and Yann LeCun, worked at Alphabet and Meta over the last decade. They are credited with developing big online advantages and helping the two internet giants multiply their market caps.)

Significant data advantages

ServiceNow derives most of its revenue from IT-related products, but the real power of its technology and business model lies within its platform offering (Now-Platform).

The Now Platform integrates hundreds of current and legacy software applications, allowing a company to streamline operations, improve efficiency, and collect troves of data. The platform effectively serves as the ‘connective tissue’ for IT within almost every large enterprise.

Given ServiceNow’s position at the core of the enterprise IT stack, it has significant data advantages, which is vital for AI.

Not only can ServiceNow automate a lot of manual processes for customers and solve problems, but its latest product updates are leveraging generative AI to deliver huge improvements in capability.

What sets the company apart from the industry is its ability to train unique large language models (LLMs), keep data segregated, and create what is referred to as ‘domain’ and ‘customer’ specific models. This allows its clients to keep data private, while maximally extracting insights, which is the highest commercial priority for corporations and governments across the world at present.

ServiceNow has used AI to create powerful new services, such as Now Assist, ServiceNow’s version of Microsoft’s Co-Pilot, Alphabet’s Duet and Amazon’s Q. Now Assist makes employees far more productive and organizations significantly more cost-efficient.

AI will enhance all ServiceNow products and create brand new use-cases not contemplated today. In fact, NVIDIA mentioned ServiceNow eleven times on its Q3 2023 earnings call and gushed at the company’s AI opportunity. NVIDIA’s CEO, Jenson Huang, said ServiceNow is “sitting on a gold mine”. We wholeheartedly agree.

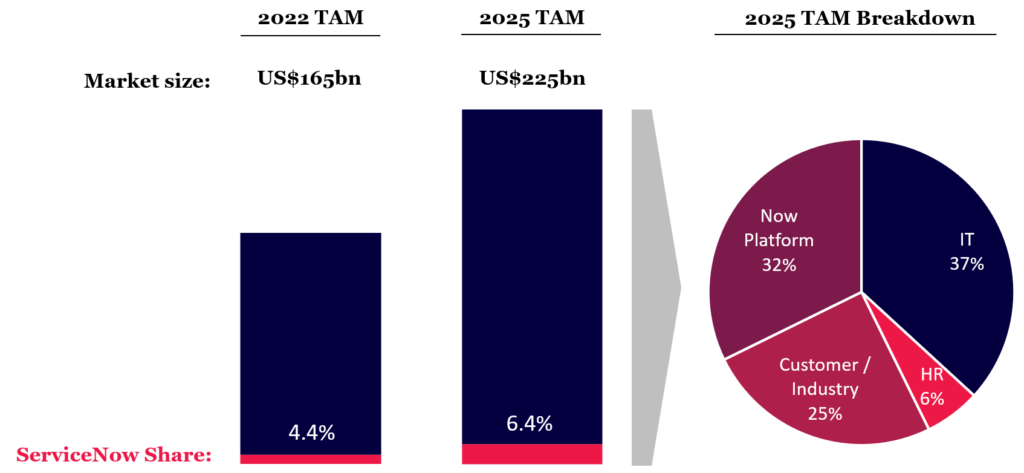

An enormous total addressable market and monetization opportunity

Importantly, ServiceNow has only penetrated ~4% of its Total Addressable Market (TAM), which provides it with titanic growth potential.

Significant Runway Remains within Total Addressable Markets

Source: ServiceNow, Montaka

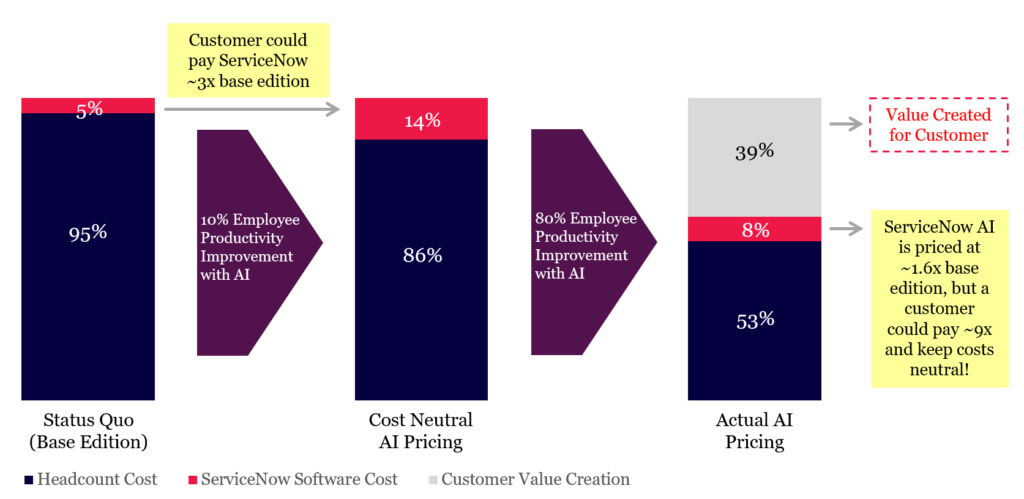

ServiceNow’s software represents just 1-5% of the total cost of a company’s IT spend on a given technology (e.g., IT ticketing, operations management, HR, etc.). The balance is largely headcount (95-99% of the expense is labor).

This imbalance creates remarkable monetization opportunities for ServiceNow.

ServiceNow says its generative AI offerings deliver an estimated 60-80% increase in productivity to customers. A business unit with 16-18 employees can now be operated with just 10 staff.

Given headcount expense represents 95-99% of the total cost of ownership for a ServiceNow product, even small productivity gains will result in huge cost savings.

So ServiceNow’s ability to charge a customer for its generative AI applications is incredibly high because the cost of its applications is dwarfed by the value of the improved productivity.

As a thought experiment, if the AI edition makes employees just 10% more efficient (rather than 60-80%), then the customer could reduce headcount by 10% and maintain productivity levels.

Simultaneously, the customer could pay ServiceNow ~3x more (200% price hike) for its software and remain cost-neutral.

Given ServiceNow’s generative AI editions are only priced at a 60% increase to the base volumes, customers will take the lion’s share of the value released, enabling them to lower their bill by ~39ppts in this scenario.

Over time, however, this imbalance creates significant pricing power for ServiceNow given the vast value it is delivering to the customer. In fact, if the full 80% productivity gains were priced then the customer could pay ServiceNow ~9x more and remain even.

Thought Experiment: ServiceNow’s AI Pricing Power

Source: ServiceNow, Montaka

A long-term winner

While the market has focused on the Magnificent 7 as the big winners from AI, investors should also be focused on the potential for ServiceNow to also capture a huge upside from the AI revolution.

ServiceNow is a structural growth story and is expected to be among a handful of major winners in enterprise software over the long term.

ServiceNow unleashes significant data advantages for customers, and AI is now allowing it to deliver an unparalleled value-creation equation.

AI is just one of the secular trends that are providing powerful tailwinds for ServiceNow’s business opportunity, which will underwrite its mission-critical position within enterprises and governments for many years to come and help power the stock’s performance.

Amit Nath is the Director of Research at Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us:

Note: Montaka is invested in ServiceNow.