|

Getting your Trinity Audio player ready...

|

– Lachlan Mackay

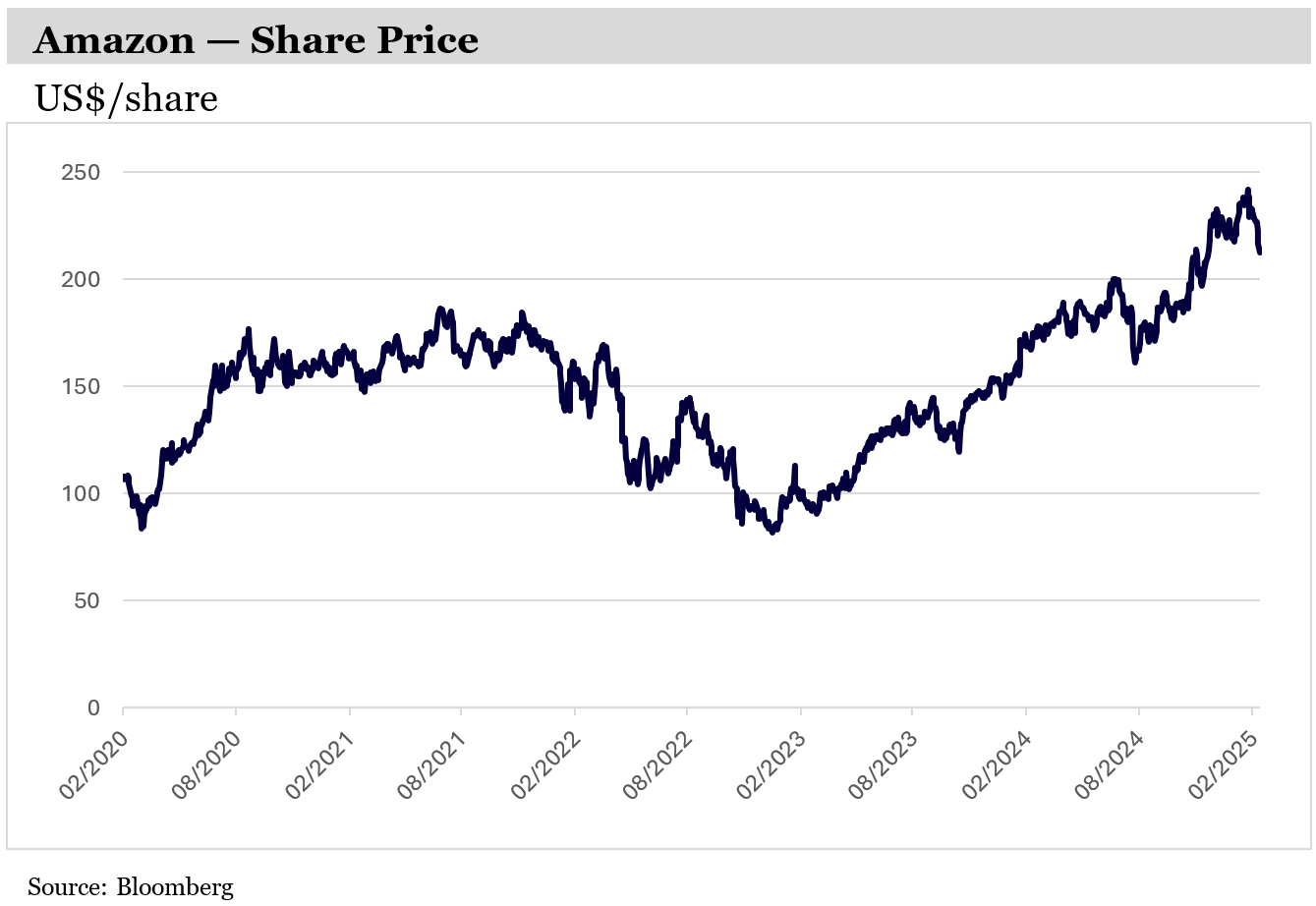

When the covid crisis struck, Amazon faced unprecedented demand for online products. It was forced to undertake a gargantuan effort to double its US fulfillment network in just two years. But when the world returned to normal, Amazon then faced another challenge – overstaffing and overcapacity – and the company was forced to launch a major efficiency overhaul.

Yet from these crises emerged one of Amazon’s hidden flywheels: their robotics-driven fulfillment network. A new fulfillment facility in Louisiana has highlighted how cutting-edge robotics is transforming Amazon’s business, enabling tens of billions of dollars of future cost savings.

Amazon has historically used such cost savings to lower prices for customers, forgoing near-term margin expansion to reinforce their flywheel and extend the duration of their growth for the long-term.

Amazon’s 12th Generation Fulfillment Centre

Amazon is well known for its e-commerce flywheel that succeeds by sharing the benefits of scale economies with customers. It uses scale to lower costs and passes those cost savings on to customers by lowering prices, which drives more customer purchases. This in turn attracts more vendors to the platform, further expanding scale… and the cycle continues.

The flywheel is now in its 30th year and has shown no sign of slowing down.

But beneath this well-oiled machine, a new, less visible flywheel is quietly accelerating: its fulfillment and logistics infrastructure’s increasing use of robotics and automation.

This is not just about incremental improvements; it’s a fundamental reshaping of Amazon’s cost structure and service capabilities.

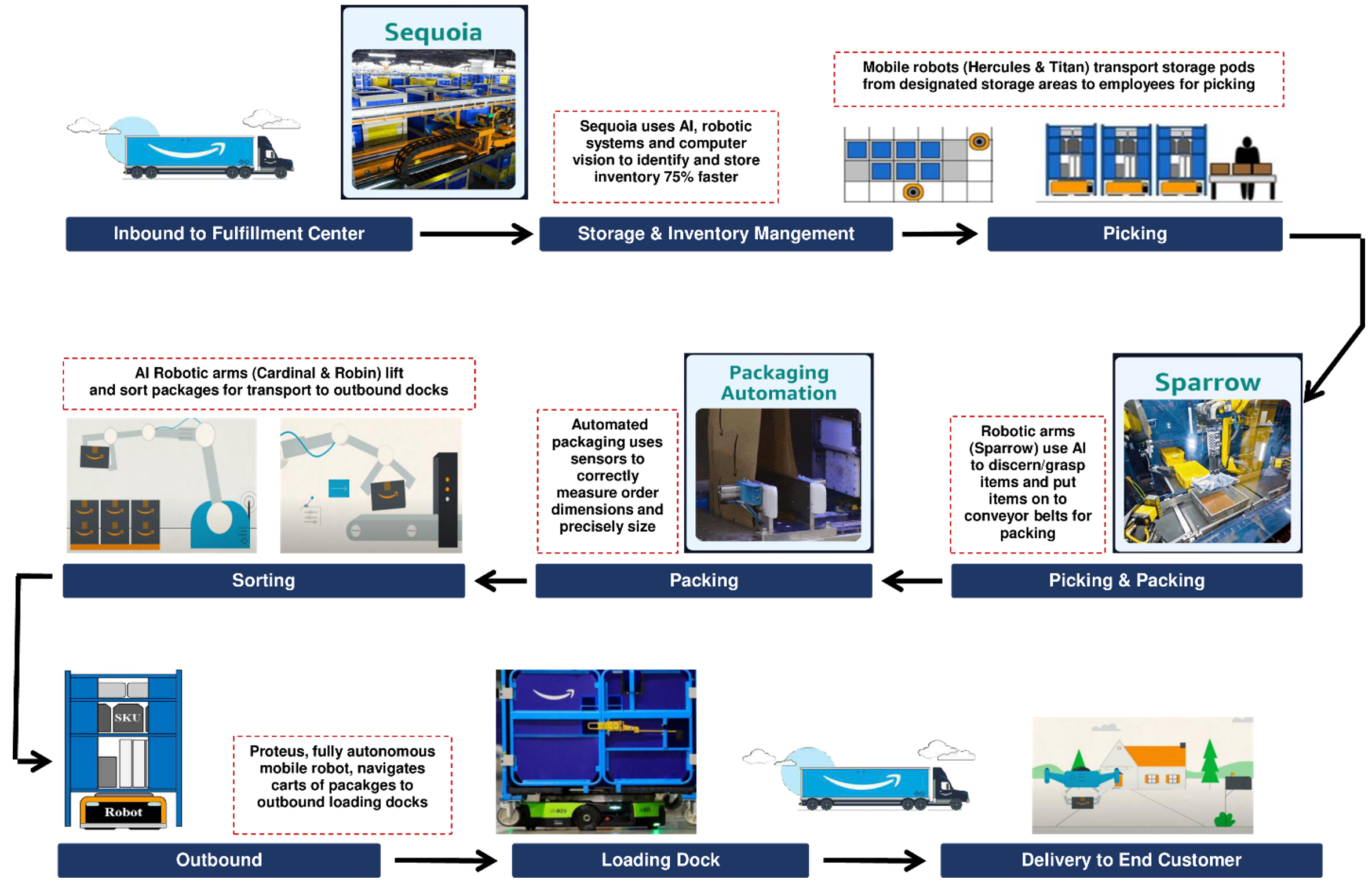

For years, Amazon has been incorporating robotics into its operations, but in 2024 they launched a 12th-generation fulfillment centre design in Shreveport, Louisiana.

Shreveport incorporates eight significant new robotics capabilities in the areas of stowing, picking, packing, and shipping, working together across the entire workflow. The facility is five storeys high, the size of 55 football fields, employs 2,500 employees and thousands more robots.

Source: Morgan Stanley

Early results are compelling.

The cost to serve an e-commerce order is how much Amazon spends to get the item from a vendor to your door. This requires coordinating shipping, fulfillment, distribution and last mile transportation, an incredibly complex task.

Yet Amazon has found that during the busiest periods of the year, the cost to serve orders through the robotics network at Shreveport is 25% lower than the rest of Amazon’s facilities.

Crucially, Shreveport’s robotics also reduces the time to process an order by 25%, which dramatically increases the number of items available for same-day and next-day delivery.

The central nervous system of this critical transformation is AI.

AI guides robots in tasks such as identifying items, picking and placement. Data from these functions is used to train and optimise future robotic models, forming its own flywheel of efficiency.

Given AI is rapidly becoming both cheaper and more effective, we expect this flywheel to accelerate.

Robotics is adding value across Amazon’s entire network

More broadly, Shreveport offers a glimpse into the value Amazon’s robotics flywheel is generating across its entire network.

Robotics is delivering two core benefits that directly feed back into Amazon’s overarching flywheel: lower per-unit cost to serve and increased delivery speed.

-

Lower Cost to Serve

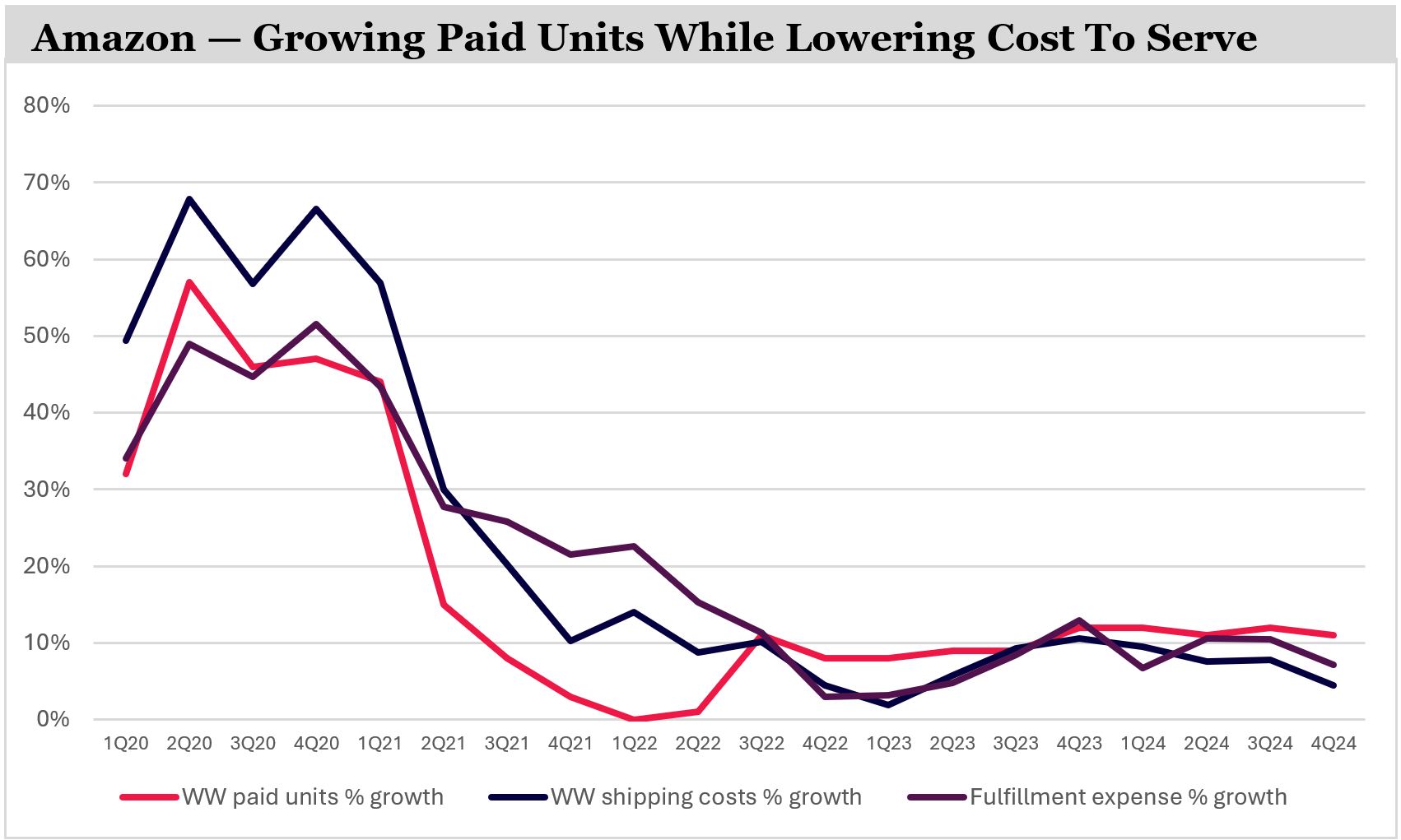

Amazon’s leadership has consistently emphasised their focus on reducing the cost to serve customers. The primary lever to achieve this is through optimisation of their vast fulfillment network, including through robotics.

Amazon is already benefitting from having distributed its US network into eight separate regions in recent years. This improved its ability to spread inventory across its fulfillment centres, which gets items closer to customers, by 25% year-over-year.

Combined with robotics and other automation, these initiatives reduced global cost to serve for the second consecutive year in 2024. In the US alone, cost to serve fell by more than $0.45 per unit in 2023 compared to the prior year.

As such, global shipping and fulfillment costs have decelerated relative to retail unit growth.

Source: Company, Montaka analysis; WW = Worldwide

In 2024, Amazon spent approximately US$100 billion in fulfillment and US$90 billion in shipping expenses.

Amazon plans to apply the Shreveport robotics model across its vast network in the coming years. Achieving the same 25% reduction in cost to serve could be worth tens of billions of dollars to the business.

-

Increased Delivery Speed

Robotics and automation don’t just allow Amazon to expand margins. They deliver a critical competitive advantage in today’s e-commerce landscape – faster delivery speeds.

Compared to 2023, in Q4 2024 Amazon delivered 65% more items to US Prime members the same day or overnight.

They expanded same-day delivery sites by over 60% in 2024 and now serve over 140 metro areas.

Overall, Amazon delivered over nine billion units the same or next day globally in 2024.

Amazon’s Customer Flywheel Accelerates

Lower costs and faster delivery are fundamentally changing Amazon customers’ purchasing behaviour.

As Amazon highlighted, “People choose to buy from us more frequently when we’re able to deliver to them much more quickly, and it leads to actually using us for more of their everyday purchases when we can deliver more quickly.”

This is particularly true for everyday essentials – including Amazon’s pharmacy and grocery businesses – where same-day or next-day delivery is a key feature for customers.

Lower costs also allow Amazon to offer a wider selection of lower-priced items that were previously uneconomical to stock.

A notable proof point, independent studies consistently rank Amazon as the lowest-priced retailer in the US.

So robotics is unlocking a new universe of product selection, which further enhances Amazon’s value proposition and keeps the flywheel spinning.

AWS could also win from robotics

The Shreveport facility is not the finish line; it’s another step on the journey. Amazon plans to roll out these robotic innovations across its network, both in new facilities and through retrofitting existing ones.

And the automation roadmap extends far beyond the four walls of the fulfillment centre. Consider the potential of autonomous vehicles and drones (Prime Air) for last-mile delivery, further compressing delivery times and costs.

Moreover, the efficiency gains from robotics and automation are not limited to retail fulfillment. Amazon recognises that AWS, its cloud computing giant, is also a “massive logistics challenge.”

Managing capacity across thousands of data centres in 130 availability zones, all while anticipating demand, are logistical puzzles that are increasingly being addressed with sophisticated AI models.

Robotics and automation principles honed in the fulfillment network could well find applications in AWS data centre operations and management, driving further efficiencies across the business.

Robotics underpins Amazon’s long-term growth

Amazon’s robotics and fulfillment network is more than just a cost-cutting initiative; it’s a strategic flywheel in its own right.

By relentlessly automating and optimising its logistics infrastructure, Amazon is driving down costs, increasing delivery speed, expanding selection, and fundamentally changing customer purchasing behaviour.

This creates a powerful self-reinforcing loop, attracting more customers, driving more volume, and further justifying investment in automation – spinning the flywheel faster and faster.

Understanding this hidden flywheel is crucial to appreciating the continued long-term growth potential of Amazon. The age of robotics-driven fulfillment is already here and Amazon is firmly at the forefront, poised to reap the rewards for decades to come.

Note: Montaka is invested in Amazon.