|

Getting your Trinity Audio player ready...

|

The following is a summary of Montaka’s latest whitepaper titled: The Amazing Hyperscalers: Why epoch-defining AI is today’s most important investment theme

The Australian Financial Review’s prestigious Chanticleer column by Tony Boyd has referenced our whitepaper too. You can access the AFR article by clicking here.

Most investors are aware that artificial intelligence, or AI, is an important transformation. But many still underestimate the sheer world and life-changing power of this revolution and its investment potential.

AI will recast and refashion every aspect of life: how we consume, how we work, how we monitor industrial machines, how we deliver healthcare, how wars are won, and how we solve climate change.

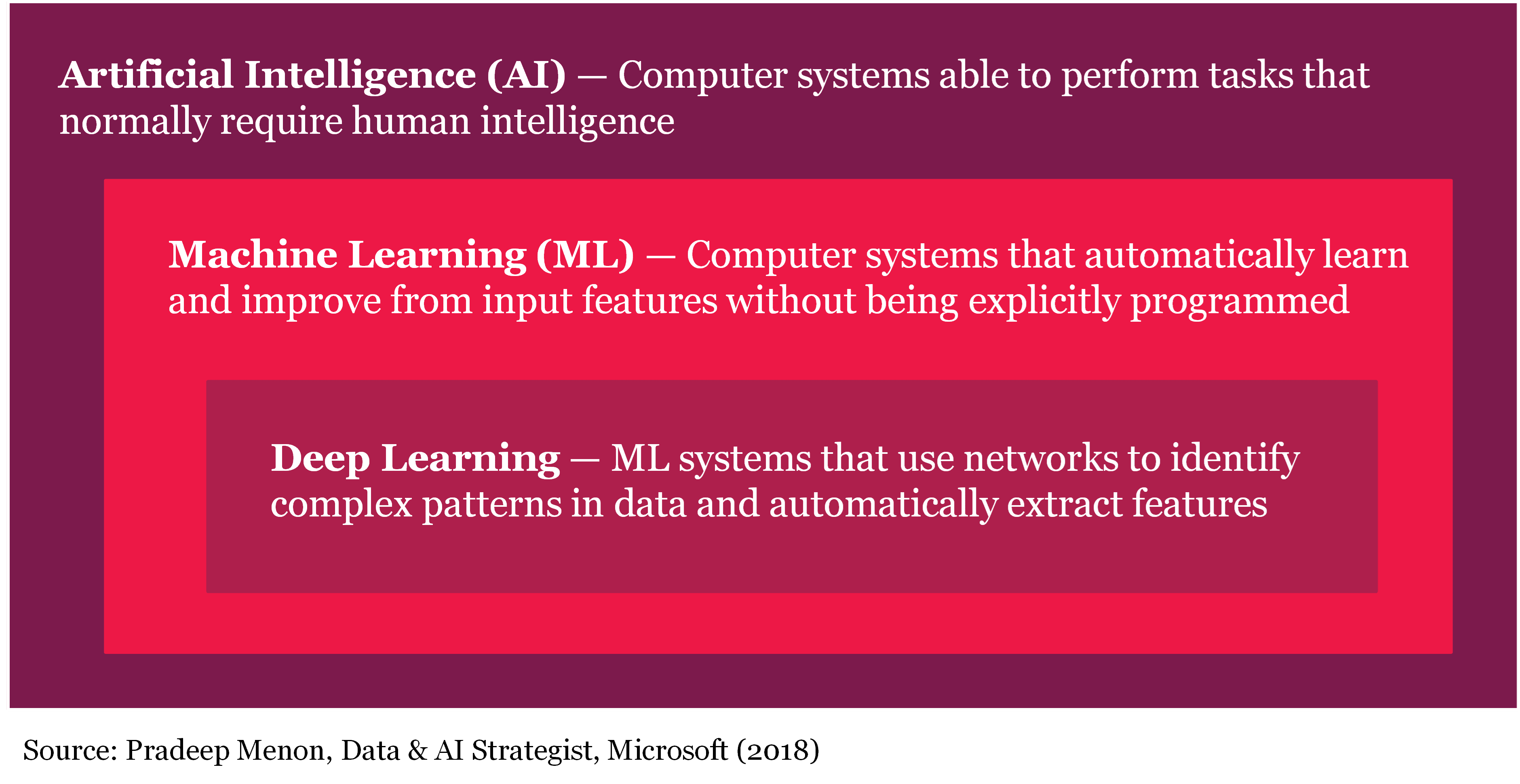

Not only is software eating the world, but it is becoming a lot smarter at an accelerating rate and will continue to do so. Why? Because of AI – and more specifically, machine learning (ML), the most common and practically applicable subset of AI today.

There are myriad ways investors can profit from this AI transformation, but Montaka believes the world’s leading cloud computing providers, or ‘hyperscalers’, particularly Amazon, Microsoft and Alphabet (owner of Google) are one of the safest and surest ways to win.

Many investors perceive these mega-tech businesses as ‘well-understood’, ‘mature’ and sometimes even ‘boring’. We disagree. We believe AI will spark a new phase of hypergrowth for these companies that will take investors by surprise and trigger a big re-rating of their shares.

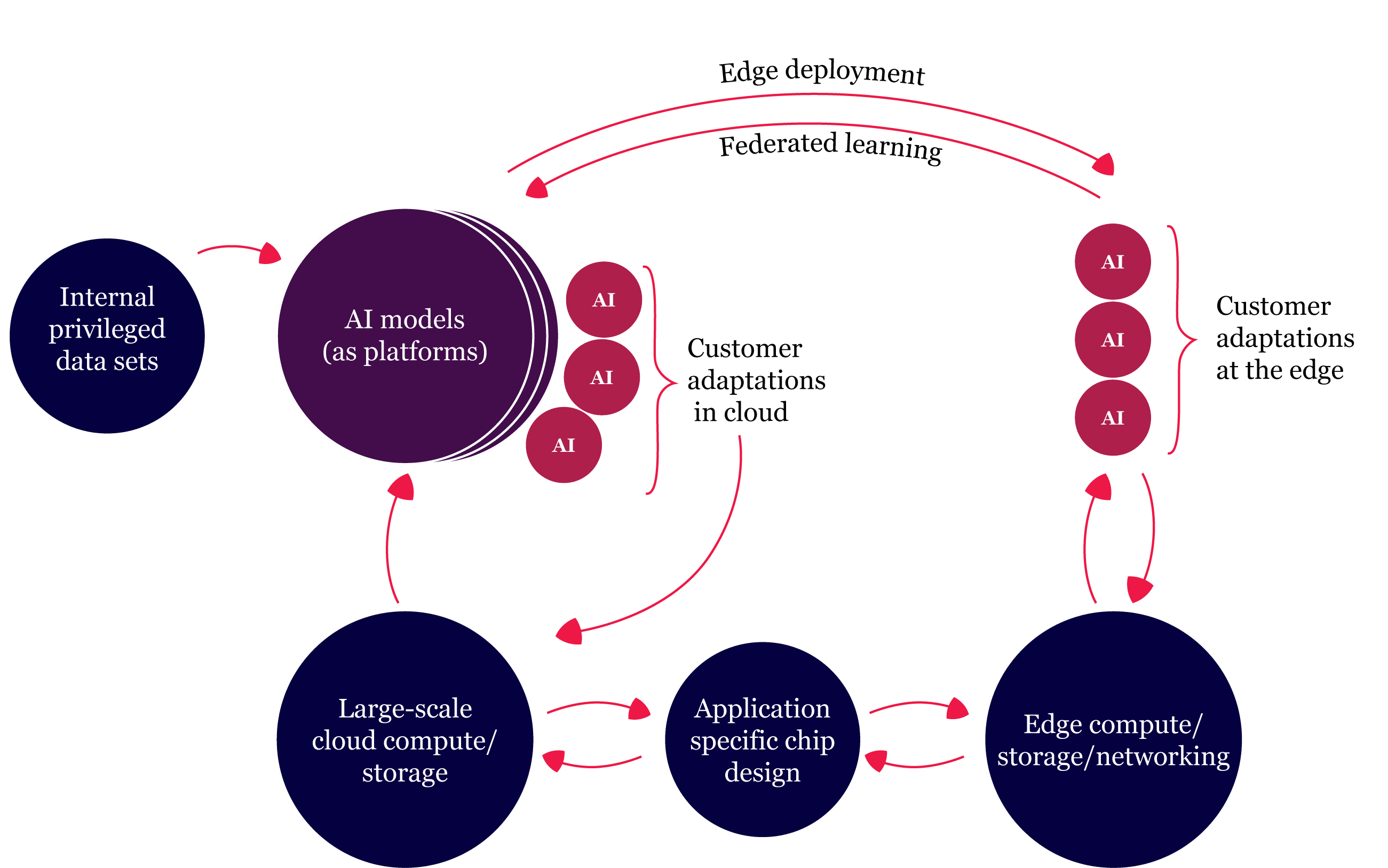

The hyperscalers are uniquely positioned to create an ‘AI fly-wheel’

Source: Montaka

The hyperscalers are uniquely positioned to create an ‘AI fly wheel’ – a virtuous cycle where they use their existing scale, technological advantages, huge R&D spending, and barriers-to-entry to both drive and dominate the surging demand for compute and storage that AI creates.

There are 6 forces underpinning the AI revolution, how these benefit the hyperscalers, and why the market is significantly undervaluing the potential of AI to spark a new growth phase for Amazon, Microsoft and Alphabet, which creates a major opportunity for investors to safely profit from AI.

1. Hyperscalers are democratising AI

The world’s hyperscalers are investing heavily in low code/no code interfaces (including, for example, drag and drop interfaces and natural-language-to-code translators) to democratise the development of AI-based enterprise applications so they are used by more and more employees of the cloud providers’ customers.

The highly-complex and expensive ML models underlying these applications have largely been developed by the hyperscalers and are essentially ‘given away’ free. Any customer can essentially take an ML model ‘off the shelf’ and relatively easily and cheaply adapt and customise it to their own needs using their own internal datasets.

The quid pro quo? The customer must use the hyperscaler’s compute and storage services.

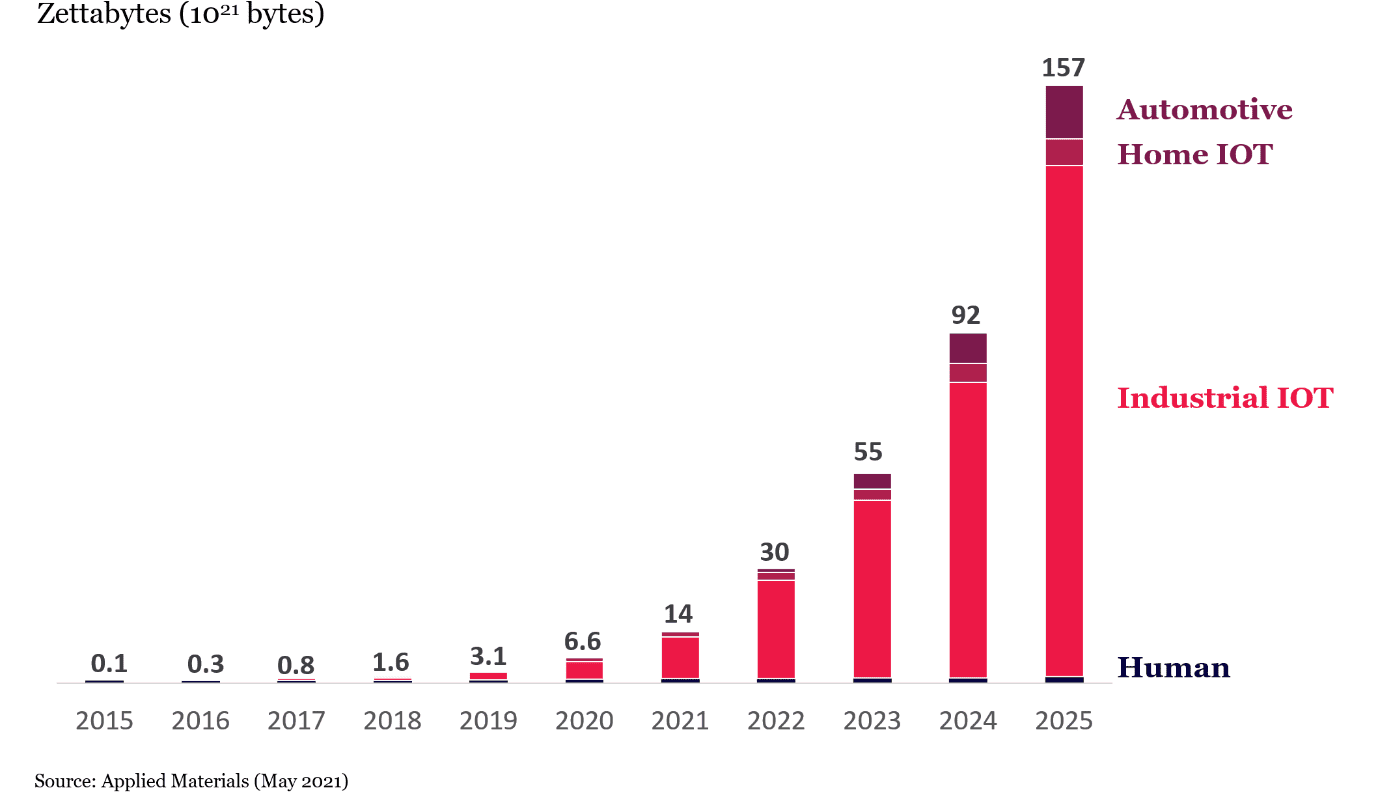

2. The Internet of Things (IoT)/’edge’ reaches a tipping point

The second driver of massive demand for compute and storage services delivered by hyperscalers is that AI is increasingly being incorporated into every software application in every device. This includes IoT for which we are about to see an explosion in smart devices, deployed at the ‘edge’, built to be used across all aspects of life.

Data Generation – By category

Source: Applied Materials (May 2021)

The sheer volume of edge devices, as alluded to by the chart above, will ensure that AI on the edge is going to be a much bigger business than AI in the cloud.

3. ML drives surging demand for compute and storage

The effect of incorporating ML into applications is a significant increase in compute and storage intensity, which will benefit hyperscalers. The more successful an AI application is at continually extracting additional relevant data to virtuously improve the accuracy of the embedded ML models, the vastly more compute and storage that is required.

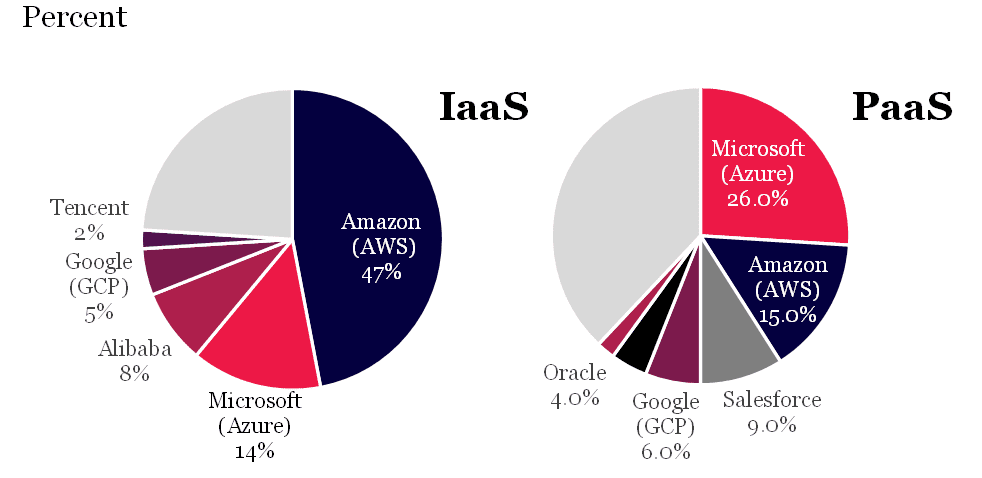

This is great news for the global hyperscaler oligopolies that supply the world’s compute and storage, in particular Amazon, Microsoft and Alphabet (Google). It is similarly positive for China’s cloud oligopoly, Alibaba, Tencent and Huawei, though the Chinese addressable cloud market is considerably smaller and some years behind in development.

4. Hyperscalers set to dominate ‘ASICs’ – the new wave of chips powering AI

Another reason that hyperscalers are positioned to win from AI is that they are at the cutting edge of developing new chips – Application Specific Integrated Circuits (ASICs) – that will dominate in coming years.

AI applications are simply becoming so large and complex that traditional chips are increasingly too slow, energy intensive and expensive for these purposes. So increasingly compute is becoming application-specific – both in the cloud and at the edge. This form of compute is being delivered by ASICs, which are designed on a more bespoke basis so they are more economical for the specific nature of the task to be undertaken.

5. Hyperscalers lead race to develop energy efficient compute, an important driver of our planet overcoming climate change challenges

Successful innovation on chip energy efficiency is an imperative for the long-term proliferation of AI. Given the enormous economic incentives at play, there is a high probability the hyperscalers will lead this innovation. Not only will this have a positive direct impact on the world’s physical environment, but the enabling of increasingly powerful AI will likely, itself, resolve many of the challenges the world needs to overcome to mitigate climate change risks.

Montaka expects today’s hyperscalers to continue to invest heavily in ASIC design at a scale that will not be matched even by today’s leading chip designers. Not only will ASIC improvements reduce the energy intensity of compute – clearly a first-order positive for the world’s climate – but the enabling of increasingly powerful AI resolve many of the challenges the world needs to overcome to mitigate climate change risks. That will include climate risk detection models to grid scheduling algorithms, new fuel-material discovery, waste-reduction algorithms, supply chain optimisations, shared mobility, precision agriculture, and infrastructure design.

6. Hyperscalers will benefit from growing barriers-to-entry that makes them long-term winners from AI

Today’s hyperscalers have a significant lead over competitors and it is highly likely this lead will only extend over time. The ‘barriers to entry’ in the space are already very high – and rapidly growing higher, all but eliminating the realistic prospects of a major new competitor materialising.

Most of the world’s large corporates and governments already rely on these businesses for their cloud infrastructure and many of their mission-critical IT platform and enterprise application services. But as powerful ML models are increasingly built into services, these services become ‘must haves’ for customers, driving greater adoption.

Second, the scale advantages enjoyed by today’s hyperscalers are much more significant than many investors appreciate and will likely continue to strengthen over time. These represent enormous barriers to entry by enabling investments in capex and R&D (such as the expensive training of powerful ML models, for example) that cannot be rivalled by competitors. It is these investments that have created the early lead in AI for today’s hyperscalers. And this lead is growing rapidly thanks to new investments in the space each year.

2020 Market Share

Source: Bernstein, Montaka

Own today’s hyperscalers to win in AI

Montaka believes AI will drive much, much more demand for compute and storage – both in the cloud and at the edge – than many are expecting today. Furthermore, this growth is largely assured, the long-term winners are already known today with a high degree of certainty, and we believe the current stock prices of these businesses are failing to adequately reflect what Montaka’s sees on the horizon.

It appears highly plausible that hyperscaler revenue expectations are far too low in the context of the scale of the AI-based opportunity that lies ahead. If so, then Amazon, Microsoft and Alphabet – as well as Alibaba and Tencent – will likely surprise investors substantially to the upside over the coming years.

Investors should also remember that the enormous R&D being incurred by the hyperscalers, while expensed fully each period to satisfy accounting rules, represents an economic investment in future earnings power. Through this lens, hyperscaler earnings power today is ‘artificially’ understated – and valuation multiples, therefore, overstated.

The conclusion is clear: to win from the AI revolution, own today’s hyperscalers, Amazon, Microsoft and Alphabet (Google).

To request a copy of the detailed whitepaper, please share your details with us:

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us: