From Transistors to Transformations: Building AI’s Digital Backbone

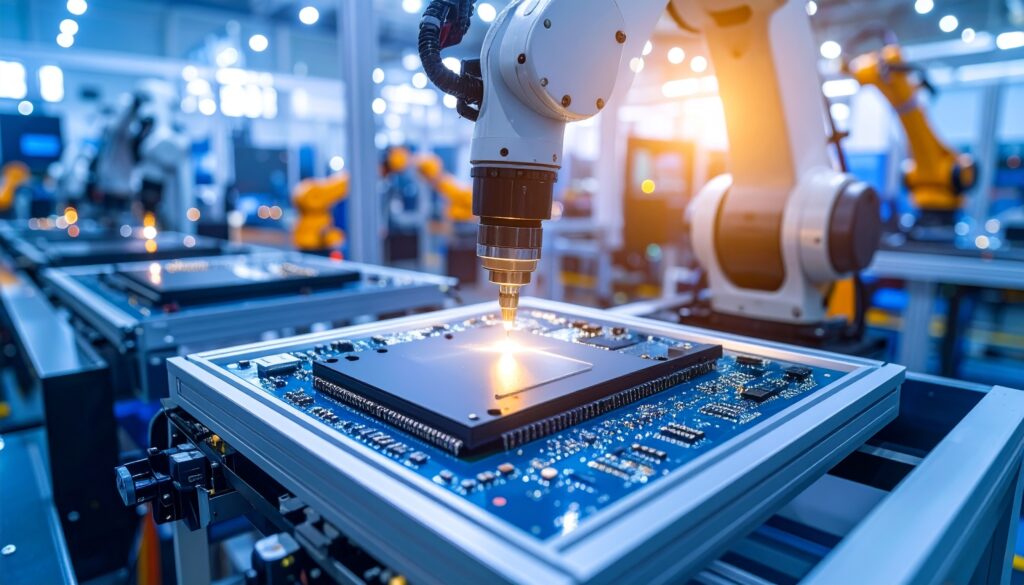

As AI demand explodes, the industry has pivoted to something even more powerful: advanced packaging technologies that deliver up to 40x better performance than traditional scaling.

My investing story: Introducing our new Senior Analyst, Tim Le

Discover how Montaka’s new Senior Research Analyst, Tim Le, went from medical student to investment professional and why he wanted to join Montaka.

Quarterly Video: Q3 2025

We share our investment strategy and portfolio performance amid recent political and macroeconomic uncertainty. We maintain focus on long-term opportunities and shed light on several key holdings beyond our core positions.

Update from the PM – October 2025

Global equity markets are more complex than ever—traditional metrics like P/E ratios can mislead in a world of rapid change. First-principles thinking is key to spotting real opportunities.

Uncrowded Advantage: Investing Where Others Cannot

As markets grow noisier and data becomes universal, genuine edges are harder to find. Lachie Mackay shares how the smartest investors gain the uncrowded advantage — by thinking longer term than everyone else.

“Extend the runway” – Why Tencent is still undervalued

Tencent’s flywheel model is driving sustained growth — and the market still doesn’t fully appreciate it. Andrew Macken explains why Tencent’s long-term runway is far from over.

Podcast | The $500 Billion AI Bet: Can OpenAI’s Massive Infra Push Ever Pay Off?

OpenAI committed to an extra $300 billion of revenue for Oracle — and just 12 days later, Nvidia announced a $100 billion data center investment to support OpenAI’s expansion. The scale is staggering… and a little baffling.

Podcast | Buy stock- Floor & Decor could be the next big compounder

Floor & Decor – a U.S. retailer with undervalued potential. You’ll learn why flywheels matter, how cyclical lows create opportunity, and what makes this business a possible long-term compounder.

Update from the PM – September 2025

As AI makes novel discoveries, facts become outdated much faster. As investors, we will need to adapt even faster to uncover the many mispricings (i.e. opportunities) that will result from this new reality.

The Adaptable Investor: Only adaptive investment teams will win in this new AI world

Markets are shifting faster than ever as AI accelerates the discovery (and invalidation) of facts. The investors who thrive will be those who adapt. Andrew Macken explores how adaptability will unlock opportunities in this new era.