|

Getting your Trinity Audio player ready...

|

– Lachlan Mackay

At Montaka, we believe we have an edge by owning businesses that are high probability winners in attractive markets for the long-term. When investing through periods of economic uncertainty, it’s helpful to reinforce how and why we have such confidence in our competitive advantage.

We draw inspiration from investment greats such as Nick Sleep, building on his core analytical and psychological principles to create and maintain a competitive edge.

Those principles are highlighted in two of our top 10 holdings – Amazon and Spotify.

Concentrated, aligned and robust: Nick Sleep’s core principles

Sleep, with his partner Qais Zakaria, took a first-principles approach to managing the highly successful Nomad Partnership from 2001-2014. Much like us, Nomad ran a concentrated, long-term oriented portfolio that focused on the highest quality businesses that they understood deeply.

This included managing through deep downturns with unusually high confidence and low turnover.

In identifying their edge, Sleep cites Bill Miller’s three potential advantages in investing:

- Informational: knowing something others don’t

- Analytical: interpreting public information better

- Psychological: behavioural discipline

But Sleep recognised that sustainable advantages typically arise from a combination of analytical and psychological strengths.

Underpinning these sustainable sources of edge were three key principles:

-

Fund managers and their investors need to be aligned

Critically, Sleep highlighted the alignment between the manager’s disposition and the patience of the investor base as Nomad’s overwhelming advantage. Nomad’s job was to pass custody of investments “at the right price and to the right people,” acknowledging the trust and intense patience required. Psychological fortitude is key.

-

Embrace the ‘cone of uncertainty’

Nomad embraced the concept of the ‘cone of uncertainty,’ popularised by financial historian Peter Bernstein. As time horizons extend out, the range of possible future outcomes widens dramatically. While the market often extrapolates short-term trends and worries about all the things that can happen, Sleep argued that investors should focus on exploiting the fact that “fewer things will happen than can happen.”

The goal is to understand the long-term probability distribution – the likely range of actual business outcomes – and position portfolios accordingly. That means filtering out the noise of daily market fluctuations. It requires analytical skill to identify robust businesses and psychological strength to remain steadfast amidst the market’s echo chamber of short-term fear and greed.

-

Investing in ‘robust’ business models

Sleep coined the ‘robustness ratio’ as a measure of sustainable advantage. The ratio compares the customer value provided by a business to the profits retained by the company. This was used to reinforce the most distinctive business model Nomad invested in – ‘Scale Economics Shared’ – whereby scale advantages are leveraged to repeatedly lower prices for customers, forgoing profits to reinforce long-term customer value.

This concept was used to analyse Costco, which delivered $5 of customer value for every dollar retained by the company. Sleep later saw the same obsession with sharing scale benefits with customers at Amazon, which became Nomad’s most successful investment.

How Montaka incorporates Sleep’s principles

At Montaka, we build upon this foundation. We have incorporated Sleep’s principles in building our own investment philosophy:

- Our philosophy is to identify advantaged businesses poised to win from major structural transformations.

- We recognise, as Sleep did, that the market routinely underestimates how long truly exceptional companies will grow for. That leads to cycles of ‘underestimation-surprise-upgrade’ that compound, driving outsized returns.

- Our competitive edge lies in our analytical process that identifies these winners and, crucially, in our psychological alignment with our investors who provide the patient capital necessary to see our long-term theses play out.

Two Sleep-inspired case studies

Sleep’s core principles can be found in many of Montaka’s portfolio businesses.

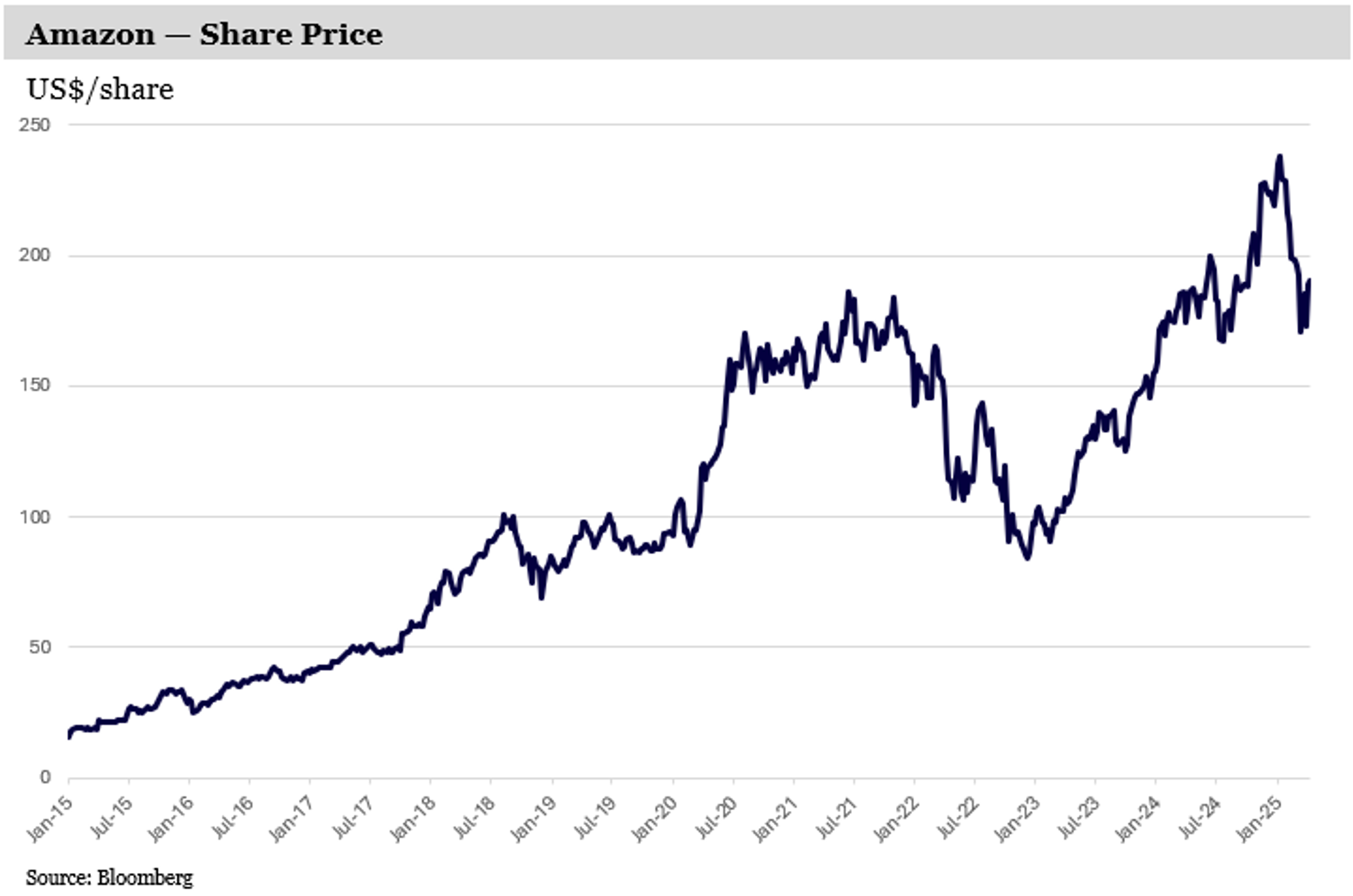

- Consider Amazon today. 2023 and 2024 studies by analytics provider Profitero found Amazon’s prices were significantly lower (14-16%) than major US retail competitors. Decades after Sleep recognised it, Amazon is still relentlessly focused on lowering prices as it scales, directly benefiting customers. This creates immense loyalty and a formidable competitive moat. Customers save significantly more than the company retains in profit, making it incredibly difficult for competitors to match the value proposition. This philosophy has been embedded across Amazon’s suite of businesses, including AWS.

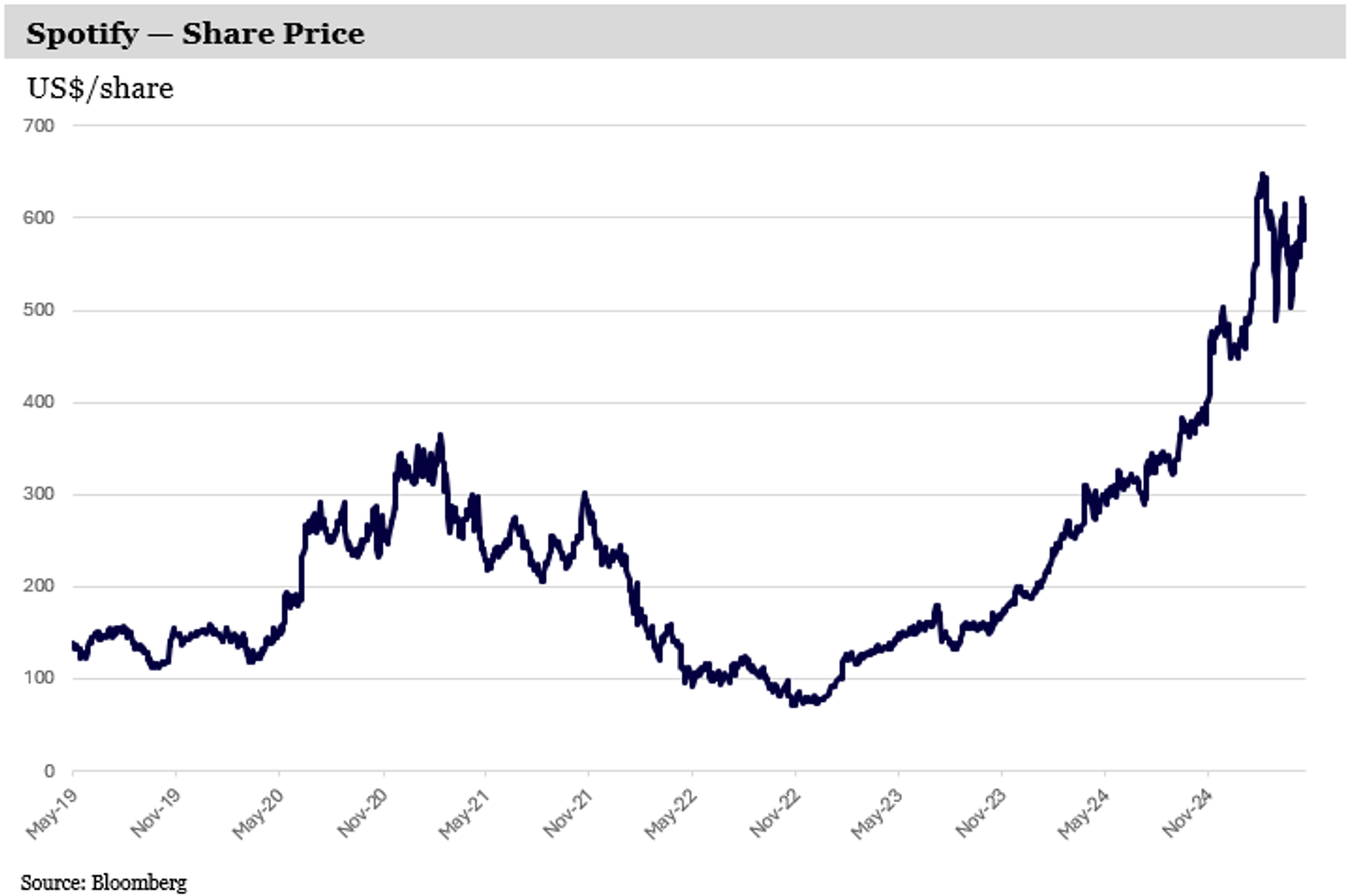

- Similarly, consider Spotify. We estimate its robustness ratio is over 8:1, even higher than Sleep’s Costco example. An individual US Spotify subscription costs $11.99 per month. Accessing a comparable suite of music, podcasts and audiobooks through alternative services would cost at least $26 per month. This implies a monthly customer saving of around $14. After paying out the majority of its revenue to artists, labels and creators, Spotify converts about 15% of its revenue into free cash flow. This means that for every $11.99 subscription, Spotify generates roughly $1.80 in free cash flow. Therefore, the customer saves approximately $14 for every $1.80 that Spotify earns (8 to 1). And in reality, most subscribers pay significantly less than $11.99 by sharing Duo or Family plans, increasing the ratio further. This significant value delivered to the customer solidifies Spotify’s market position and creates a powerful, defensible moat.

Thriving in Volatility: Our Edge in Today’s Market

The current market environment underscores the importance of this long-term, focused approach. Stock prices have experienced significant volatility as markets grapple with shifting economic forecasts and geopolitical uncertainties, including unpredictable policy announcements that can change market sentiment overnight. The market often reacts emotionally, extrapolating short-term news into long-term forecasts and widening that ‘cone of uncertainty’ with possibilities rather than probabilities.

This is where Montaka’s competitive advantage – our analytical framework combined with patient investors – truly shines. We do not react emotionally to headlines or short-term price swings. Instead, we continuously assess how evolving macro factors might genuinely impact the long-term probability distributions for our portfolio companies.

We focus on identifying the structurally advantaged winners capable of navigating and ultimately thriving beyond the current cycle. Market volatility, driven by the noise the market struggles to discount, often presents opportunities.

Our shared commitment to a long-term perspective, grounded in identifying businesses with the most robust competitive advantages, allows us to navigate market turbulence effectively and continue building wealth for you over the decades to come.

Note: Montaka is invested in Amazon and Spotify.