|

Getting your Trinity Audio player ready...

|

By Chris Demasi

Listed equity markets in 2022 have certainly left investors depressed. Looking ahead it can be difficult to see how investors can be optimistic about the rest of the year. War, lockdowns, commodity and product shortages, decades-high inflation, fast-rising interest rates, and recession concerns don’t instil hope in share markets. Investors could be forgiven for seeing share market investing in this environment is futile.

But abandoning listed equities would mean missing out on the opportunity to make substantial gains in the long run. Investors in this market just need to adopt the right investment approach, which means taking a cue from private equity investing.

Private equity funds invest in businesses that are not publicly traded, often acquiring entire companies that they hold for years before selling. The best private equity managers, like Blackstone, KKR and Carlyle Group, who collectively manage almost US$2 trillion, have doubled investor capital every five or so years over the course of several decades.

There are six key elements to adopting a private equity investing approach in public markets.

1. Take a long-term view

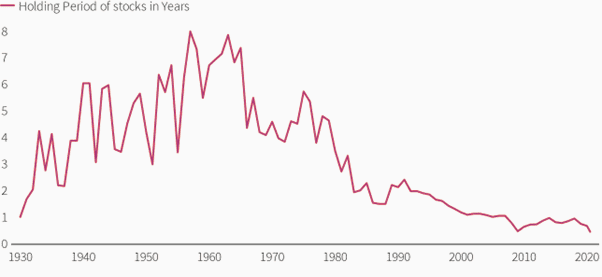

Firstly, private equity funds take a long-term view. They typically acquire whole businesses and sell them to realize profits after five years on average, though that can sometimes extend to ten years or more.

In contrast, analysis conducted by Reuters has shown that the average stock holding period is less than six months and has become even shorter in recent years.

This means private equity is concerned with value creation over long horizons rather than outguessing other traders over short periods.

Holding period of stocks over time

Source: NYSE, Reuters

2. Focus on business fundamentals

Private equity focuses on improving business fundamentals to drive value over the long term, much like the owner of a business – because they are owners of the business. [LINK: Market correction: Don’t panic. Act like a business owner]

Over time, growth and operating performance drive earnings power and multiply business values. Carlyle Group recently disclosed that 80% of its long-term fund returns were driven by growth and operating improvements at portfolio companies, with leverage and market timing making just a small contribution.

On the other hand, public market investors too often become entranced by daily stock prices, taking them as an indicator of success or failure which can constrain long-term performance.

3. Prioritise absolute returns

Private equity funds do not pay attention to market indexes or benchmark comparisons. Rather, they concentrate on what their investments will be worth years into the future and aim to deliver strong absolute returns.

Public market investors can become slaves to relative returns over short horizons, which limits their ability to make investments in great long-term opportunities because they worry that share prices might diverge from market performance in the near term.

4. Ignore volatility

Private equity investors also view risk differently to many public market investors. In private equity, risk is the possibility of permanent impairment of capital or a reduction in the earnings power of the business, as distinct from volatility of share prices.

This means that private equity investors make investments where the chance of loss over years is low and the upside is high, rather than managing for a smoother share price chart along the way. Some of the best investments over the course of history have had huge share price declines, but ultimately delivered shareholders fantastic results. [LINK: Drawdowns: Even ‘God’s portfolio’ can’t avoid them]

5. Concentrated portfolios

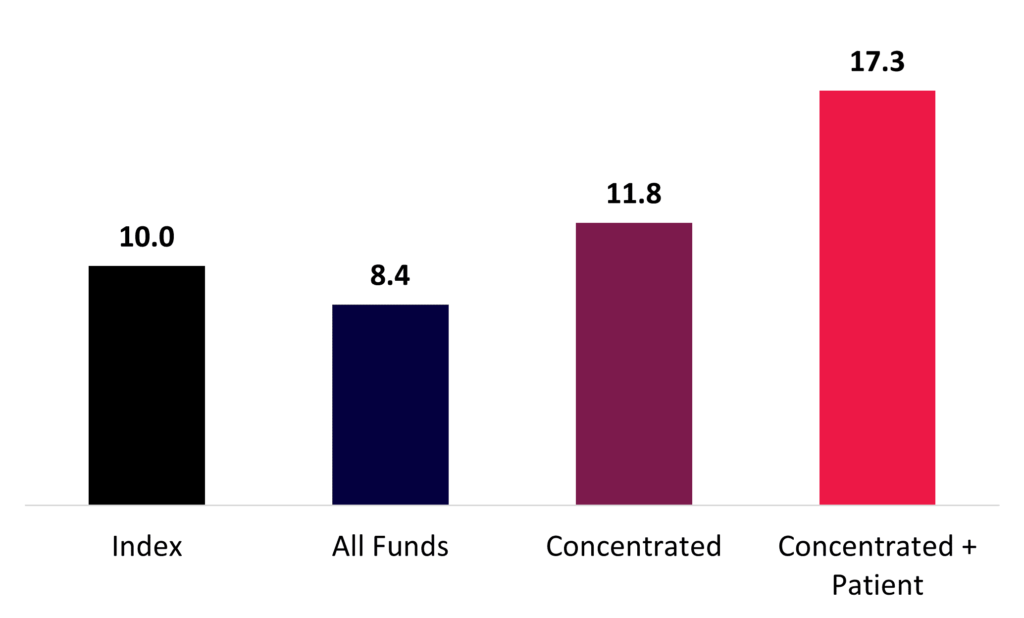

Private equity funds run portfolios of around a dozen holdings, which would be considered super concentrated in the public equity domain. But that focus allows private equity managers to concentrate their investments in their best ideas, which may cluster in certain sectors or geographies.

Of course, many of the best-performing public equity managers have run the most concentrated portfolios. Yet most managers follow more diversified strategies which reduces volatility and tracking error to the market but also dilutes potential return. [LINK: Concentrated and Patient: How Active Investing Wins]

Stock fund manager returns from 1990 to 2015

Multiples of money (x)

6. Thorough bottoms-up research

Finally, it is often said that many people spend more time researching their next refrigerator purchase than the stocks in their portfolio. The adage likely applies to many stock market investors.

On the other hand, private equity investors undertake thorough research and detailed diligence of target companies and their industries. This deep bottoms-up analysis provides insight into the workings and underlying economics of the business that will drive long-term value.

Combining private and public investing

The obvious question for investors is – why not just invest in private equity funds?

Because public equity investing brings a set of advantages for investors that can’t be replicated in private markets.

Liquidity

Even though daily stock price quotes can distract listed equity investors, a ready quote for shares can be a major advantage when treated properly.

If stock prices overshoot to the upside, then years’ worth of returns could be brought forward, and investors can capitalise by taking profits early and redeploying the proceeds into the next opportunity. On the other hand, if stock prices fall, investors can increase their holdings in attractive long-term opportunities.

An active trading market also allows public equity investors to adjust their holdings should their thesis change or prove to be wrong, or if there are better opportunities that emerge elsewhere. These options are not readily available in the private markets.

Cheaper prices

When a private equity fund makes an investment by acquiring a publicly listed company, it usually does so by offering the target’s shareholders a control premium of 30% or more to the current share price. And if there are multiple potential acquirers interested in the same company, like other private equity funds or corporate buyers, then the premium can be bid up well beyond this mark.

On the other hand, when public equity investors make an investment, they buy a small share of a company by purchasing its stock on exchange among many other buyers, and without the need to pay a takeover premium. This represents a discount that accrues to the performance of share market investors over their private market peers.

Repeatable opportunities

While private equity investors undertake in-depth research to support their investment decisions, they often only get one opportunity to put their hard work to good use.

Once the company that the private equity firm has targeted is bought, or sold to another party, or remains unsold, much of the work comes to an end. Of course, it may be used for similar investments down the track should the opportunity arise, but even so it will never be the exact same company.

In the world of public markets, no work ever goes to waste. Rather, it has an almost infinite shelf life. If it turns out that the investor passes on the opportunity to invest in the shares of a company today, conditions or prices may change tomorrow, and the work can be used again to make an investment decision.

Capturing superior returns

While public equity markets have been tough recently, there’s still good reason to believe that outstanding returns can be made by investors in listed share markets around the world.

Montaka’s portfolio companies, including Amazon, Blackstone, and Spotify, are all growing their long-term earnings power and business values even as the macroeconomic environment softens, geopolitical tensions rise, and financial markets seem more volatile in the near term.

By applying the best of private equity’s methods in the public equity markets Montaka’s funds are staying the course in these excellent businesses, confident of achieving superior compound gains in the future.

Note: Montaka is invested in Amazon, Blackstone, Spotify KKR and Carlyle Group

Chris Demasi is a Portfolio Manager with Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or leave us a line on montaka.com/contact-us

Read our latest whitepaper on why AI is the most important theme today: