– Amit Nath

Legendary investor Warren Buffett purchased more stocks in 2022 (US$34bn net buying) than in the prior fifteen years combined (US$31bn)!

Yet many investors and commentators are insisting stocks are still too expensive and that corporate bonds are cheap.

So what is a value investor like Buffett seeing in this market?

There are libraries worth of viewpoints trying to understand whether something is cheap or expensive. But in this blog post, we will explore three key valuation perspectives that are vital in helping investors decide whether to buy or sell stocks:

- Equity Risk Premium (ERP)

- Corporate bond spreads; and

- How to correctly measure them, with a hand from NYU professor Aswath Damodaran

Our conclusion contradicts the prevailing doctrine that stocks are expensive and corporate bonds are cheap.

In fact, the opposite is likely true.

1. ERP: Stocks haven’t been this cheap since the GFC

So, what is ERP (Equity Risk Premium) and what is it telling us about today’s market?

It is the premium an investor demands above the risk-free rate (i.e. yield on a US treasury bond) to compensate them for the risk of investing in a company. The name says it all “Equity Risk Premium”.

ERP measures the risk-and-reward trade-off from investing in stocks. A higher ERP indicates investors are being paid a higher premium to own stocks; and a lower ERP means they are receiving a lower premium.

Given the premium is a function of risk, when investors are overly fearful, or excessively exuberant, deafening market narratives can emerge in the short term that don’t reflect reality. When ERP is high, it’s usually after a period of drawdown and investors want nothing to do with stocks, or are very skeptical of them – like now.

But that may open an opportunity for the astute investor. This disconnect between market narratives and reality is what Warren Buffett refers to in his famous contrarian quote when he advises investors to be “fearful when others are greedy, and greedy when others are fearful”.

So what would Buffett say about the current investing environment?

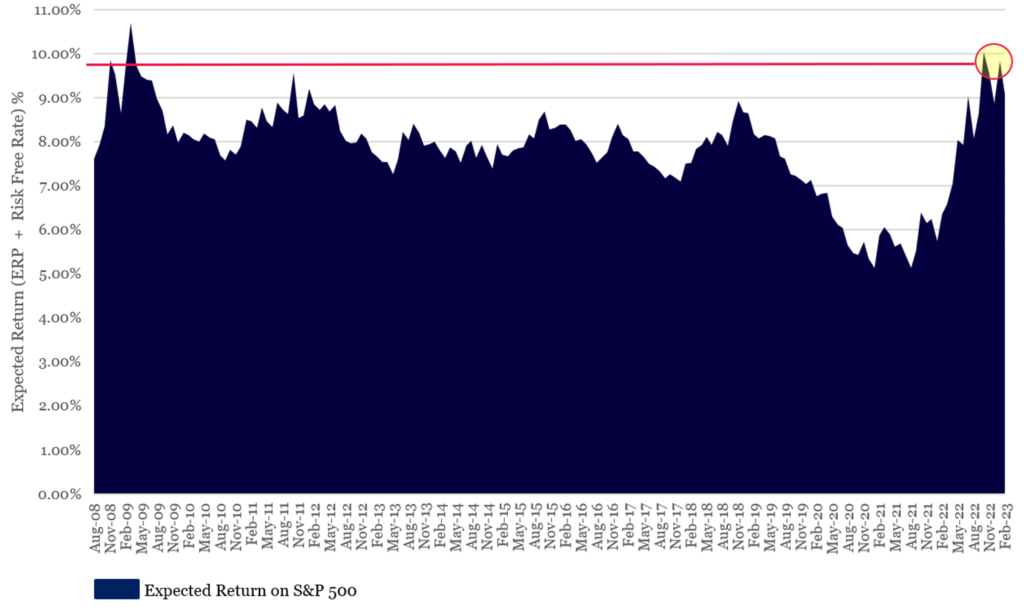

The following chart may provide some insight into his perspectives today.

Expected Return Implied by the Market (S&P 500)

Source: Stern School of Business, NYU (Professor Aswath Damodaran), Montaka

Despite what many investors believe, the expected return available in today’s market rivals the environment immediately following the 2008/2009 financial crisis. That’s probably why Buffett has been on a buying spree.

Investing back in 2008/2009, of course, was extremely uncomfortable and likely produced some short-term paper losses for those that attempted to participate during that period.

(As many of us will remember, this was precisely the time when Buffett was most actively buying stocks, similar to what he’s doing today.)

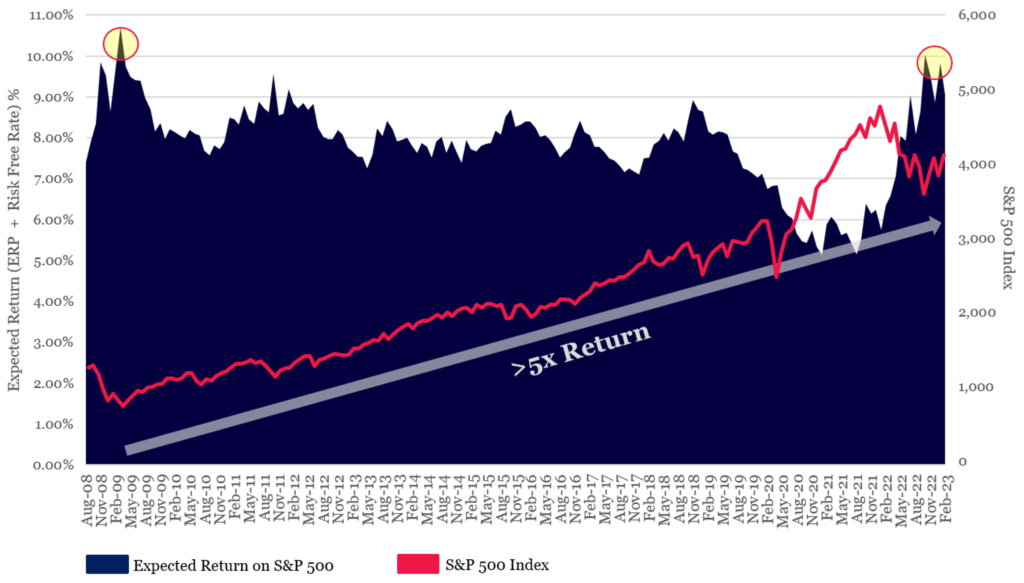

Elevated Expected Return Delivered Substantial Gains for Investors over Time

Source: Bloomberg, Stern School of Business, NYU (Professor Aswath Damodaran), Montaka

2. Bond spreads: Corporate bonds are expensive (relative to stocks)

Many investors are also saying that corporate bonds are cheap relative to stocks, but is that true? Looking at corporate bond spreads can help us.

Similar to the ERP, corporate bond ‘spreads’ represent the premium an investor is paid to own corporate bonds over the risk-free government bond rate.

Bond spreads indicate the creditworthiness of a borrower and how much additional yield an investor is being paid to take credit risk, instead of buying risk-free government bonds.

A higher bond spread indicates a borrower is perceived to be riskier and will be required to pay a higher spread to compensate investors for this. Conversely, a lower credit spread implies that the borrower is perceived to be less risky.

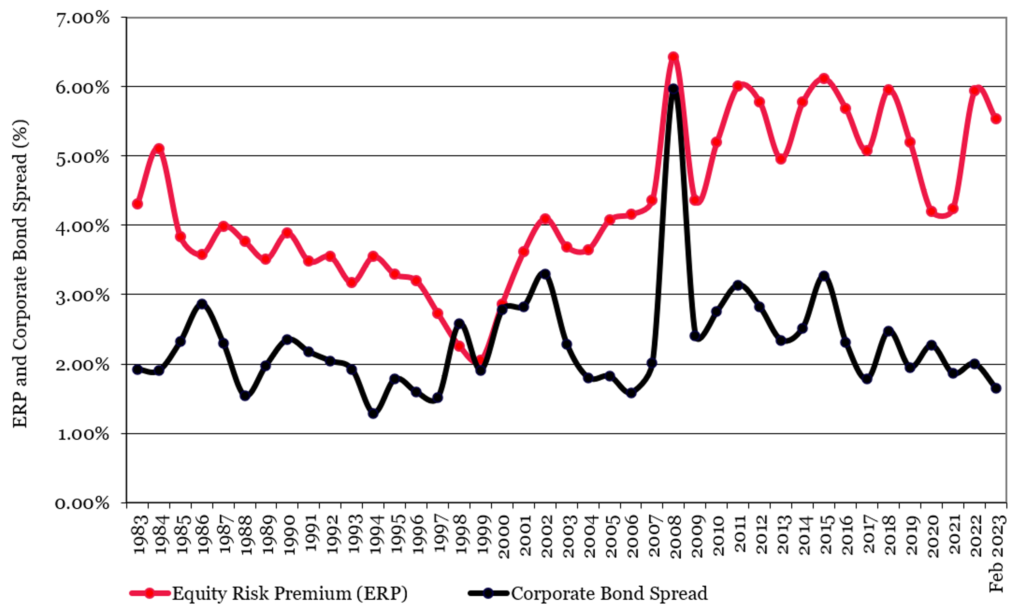

From the chart below, we can see that generally, the two premiums, (or spreads), maintain their distance: bonds are usually less risky than equities and hence have a lower spread.

However, when divergences occur it can be a signal that stocks or bonds are cheap or expensive relative to each other.

If we look back through the last 40 years of ERP and corporate bond spread history, we notice marked periods of extreme convergence, such as the lead-up to the 1999/2000 Dot-Com bubble and during the 2008/2009 financial crisis.

Equity Risk Premium (ERP) Versus Corporate Bond Spreads

Source: Stern School of Business, NYU (Professor Aswath Damodaran), Montaka

Note: Data is averaged over 12-month periods, hence the 2020 pandemic dislocation is smoothed out

(Given the speed with which markets dislocated and rebounded during 2020, we do not see a significant spike/convergence in 2020. However, if we were to zoom in on this period alone, we would see stocks and corporate bonds reacted very similarly to 2008/2009.)

Relative to the past, bond spreads today are much closer to the bottom of their long-term range (i.e. expensive) compared to ERP, which is closer to the top of its range (cheap).

In fact, it is probably better to own risk-free government bonds than corporate bonds right now given how low the spread has become.

Equities on the other hand remain extremely attractive, as ERP continues to present a compelling value proposition relative to the past.

3. Damodaran’s ERP: Make sure you are calculating it correctly because stocks are a buy!

Some investors would still argue that stocks are expensive.

They use a common methodology to calculate ERP where you simply take the current earnings yield on the S&P 500 and deduct the 10-year treasury yield.

In today’s market, you end up with an ERP of ~1.5%.

But this method fails to capture the fact that corporate earnings grow over time and exist into perpetuity. Whereas bond coupons are fixed and mature on a specific date and value (par) in the future.

The danger is that, if you simply take the current earnings yield on the S&P 500 and deduct the 10-year treasury yield, you may just capture a cyclical trough in earnings and underestimate growth and terminal value appreciation in your earnings yield estimate and hence ERP.

To overcome this problem, a renowned professor of Finance at NYU, Aswath Damodaran, has created a far more rigorous and accurate methodology for estimating ERP.

Damodaran publishes the monthly ERP implied by the S&P 500 based on a 5-year DCF (discounted cash flow), consensus earnings estimates and U.S. treasury yields (we have utilized professor Damodaran’s work in all of the charts presented above).

Damodaran currently calculates ERP at ~5.5% which is nearly four times what the widely used shortcut method for ERP delivers (i.e. you end up with an ERP of ~1.5% by cutting the corner).

The simple, shortcut methodology which is broadly referenced, may ultimately lead an investor to do the exact opposite of what would deliver a profit maximising return on investment.

In other words, the prevailing doctrine is exactly wrong as it screams at an investor to sell … rather than buy.

Run your own race and don’t get distracted by the crowd

Having a clear perspective around ERP, bond spreads and correctly measuring them is fundamental to making a good investment. The prevailing doctrine around ERP is highly imprecise and some of the loudest voices in the market are bellowing that stocks are expensive, whereas Montaka’s assessment says the opposite is true. We know one thing for sure – we will run our own race and let logic lead the way.

Tech is dead? Think again. Montaka’s new white paper argues that far from dying, tech is entering a remarkable new era of growth with huge opportunities for investors.

To request a copy of the full whitepaper & know the top 5 stocks poised to lead the tech recovery, please share your details with us:

Why Buffett is Buying: 3 perspectives that show stocks are still cheap

– Amit Nath

Legendary investor Warren Buffett purchased more stocks in 2022 (US$34bn net buying) than in the prior fifteen years combined (US$31bn)!

Yet many investors and commentators are insisting stocks are still too expensive and that corporate bonds are cheap.

So what is a value investor like Buffett seeing in this market?

There are libraries worth of viewpoints trying to understand whether something is cheap or expensive. But in this blog post, we will explore three key valuation perspectives that are vital in helping investors decide whether to buy or sell stocks:

Our conclusion contradicts the prevailing doctrine that stocks are expensive and corporate bonds are cheap.

In fact, the opposite is likely true.

1. ERP: Stocks haven’t been this cheap since the GFC

So, what is ERP (Equity Risk Premium) and what is it telling us about today’s market?

It is the premium an investor demands above the risk-free rate (i.e. yield on a US treasury bond) to compensate them for the risk of investing in a company. The name says it all “Equity Risk Premium”.

ERP measures the risk-and-reward trade-off from investing in stocks. A higher ERP indicates investors are being paid a higher premium to own stocks; and a lower ERP means they are receiving a lower premium.

Given the premium is a function of risk, when investors are overly fearful, or excessively exuberant, deafening market narratives can emerge in the short term that don’t reflect reality. When ERP is high, it’s usually after a period of drawdown and investors want nothing to do with stocks, or are very skeptical of them – like now.

But that may open an opportunity for the astute investor. This disconnect between market narratives and reality is what Warren Buffett refers to in his famous contrarian quote when he advises investors to be “fearful when others are greedy, and greedy when others are fearful”.

So what would Buffett say about the current investing environment?

The following chart may provide some insight into his perspectives today.

Expected Return Implied by the Market (S&P 500)

Source: Stern School of Business, NYU (Professor Aswath Damodaran), Montaka

Despite what many investors believe, the expected return available in today’s market rivals the environment immediately following the 2008/2009 financial crisis. That’s probably why Buffett has been on a buying spree.

Investing back in 2008/2009, of course, was extremely uncomfortable and likely produced some short-term paper losses for those that attempted to participate during that period.

(As many of us will remember, this was precisely the time when Buffett was most actively buying stocks, similar to what he’s doing today.)

Elevated Expected Return Delivered Substantial Gains for Investors over Time

Source: Bloomberg, Stern School of Business, NYU (Professor Aswath Damodaran), Montaka

2. Bond spreads: Corporate bonds are expensive (relative to stocks)

Many investors are also saying that corporate bonds are cheap relative to stocks, but is that true? Looking at corporate bond spreads can help us.

Similar to the ERP, corporate bond ‘spreads’ represent the premium an investor is paid to own corporate bonds over the risk-free government bond rate.

Bond spreads indicate the creditworthiness of a borrower and how much additional yield an investor is being paid to take credit risk, instead of buying risk-free government bonds.

A higher bond spread indicates a borrower is perceived to be riskier and will be required to pay a higher spread to compensate investors for this. Conversely, a lower credit spread implies that the borrower is perceived to be less risky.

From the chart below, we can see that generally, the two premiums, (or spreads), maintain their distance: bonds are usually less risky than equities and hence have a lower spread.

However, when divergences occur it can be a signal that stocks or bonds are cheap or expensive relative to each other.

If we look back through the last 40 years of ERP and corporate bond spread history, we notice marked periods of extreme convergence, such as the lead-up to the 1999/2000 Dot-Com bubble and during the 2008/2009 financial crisis.

Equity Risk Premium (ERP) Versus Corporate Bond Spreads

Source: Stern School of Business, NYU (Professor Aswath Damodaran), Montaka

Note: Data is averaged over 12-month periods, hence the 2020 pandemic dislocation is smoothed out

(Given the speed with which markets dislocated and rebounded during 2020, we do not see a significant spike/convergence in 2020. However, if we were to zoom in on this period alone, we would see stocks and corporate bonds reacted very similarly to 2008/2009.)

Relative to the past, bond spreads today are much closer to the bottom of their long-term range (i.e. expensive) compared to ERP, which is closer to the top of its range (cheap).

In fact, it is probably better to own risk-free government bonds than corporate bonds right now given how low the spread has become.

Equities on the other hand remain extremely attractive, as ERP continues to present a compelling value proposition relative to the past.

3. Damodaran’s ERP: Make sure you are calculating it correctly because stocks are a buy!

Some investors would still argue that stocks are expensive.

They use a common methodology to calculate ERP where you simply take the current earnings yield on the S&P 500 and deduct the 10-year treasury yield.

In today’s market, you end up with an ERP of ~1.5%.

But this method fails to capture the fact that corporate earnings grow over time and exist into perpetuity. Whereas bond coupons are fixed and mature on a specific date and value (par) in the future.

The danger is that, if you simply take the current earnings yield on the S&P 500 and deduct the 10-year treasury yield, you may just capture a cyclical trough in earnings and underestimate growth and terminal value appreciation in your earnings yield estimate and hence ERP.

To overcome this problem, a renowned professor of Finance at NYU, Aswath Damodaran, has created a far more rigorous and accurate methodology for estimating ERP.

Damodaran publishes the monthly ERP implied by the S&P 500 based on a 5-year DCF (discounted cash flow), consensus earnings estimates and U.S. treasury yields (we have utilized professor Damodaran’s work in all of the charts presented above).

Damodaran currently calculates ERP at ~5.5% which is nearly four times what the widely used shortcut method for ERP delivers (i.e. you end up with an ERP of ~1.5% by cutting the corner).

The simple, shortcut methodology which is broadly referenced, may ultimately lead an investor to do the exact opposite of what would deliver a profit maximising return on investment.

In other words, the prevailing doctrine is exactly wrong as it screams at an investor to sell … rather than buy.

Run your own race and don’t get distracted by the crowd

Having a clear perspective around ERP, bond spreads and correctly measuring them is fundamental to making a good investment. The prevailing doctrine around ERP is highly imprecise and some of the loudest voices in the market are bellowing that stocks are expensive, whereas Montaka’s assessment says the opposite is true. We know one thing for sure – we will run our own race and let logic lead the way.

Amit Nath is the Director of Research at Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Tech is dead? Think again. Montaka’s new white paper argues that far from dying, tech is entering a remarkable new era of growth with huge opportunities for investors.

To request a copy of the full whitepaper & know the top 5 stocks poised to lead the tech recovery, please share your details with us:

This document was prepared by Montaka Global Pty Ltd (ACN 604 878 533, AFSL: 516 942). The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should read the offer document and consider your own investment objectives, financial situation and particular needs before acting upon this information. All investments contain risk and may lose value. Consider seeking advice from a licensed financial advisor. Past performance is not a reliable indicator of future performance.

Related Insight

Share

Get insights delivered to your inbox including articles, podcasts and videos from the global equities world.