|

Getting your Trinity Audio player ready...

|

By Amit Nath

Close to a trillion dollars has been invested in Artificial Intelligence (AI) infrastructure.

But investors are now asking – where will the return on investment (ROI) come from?

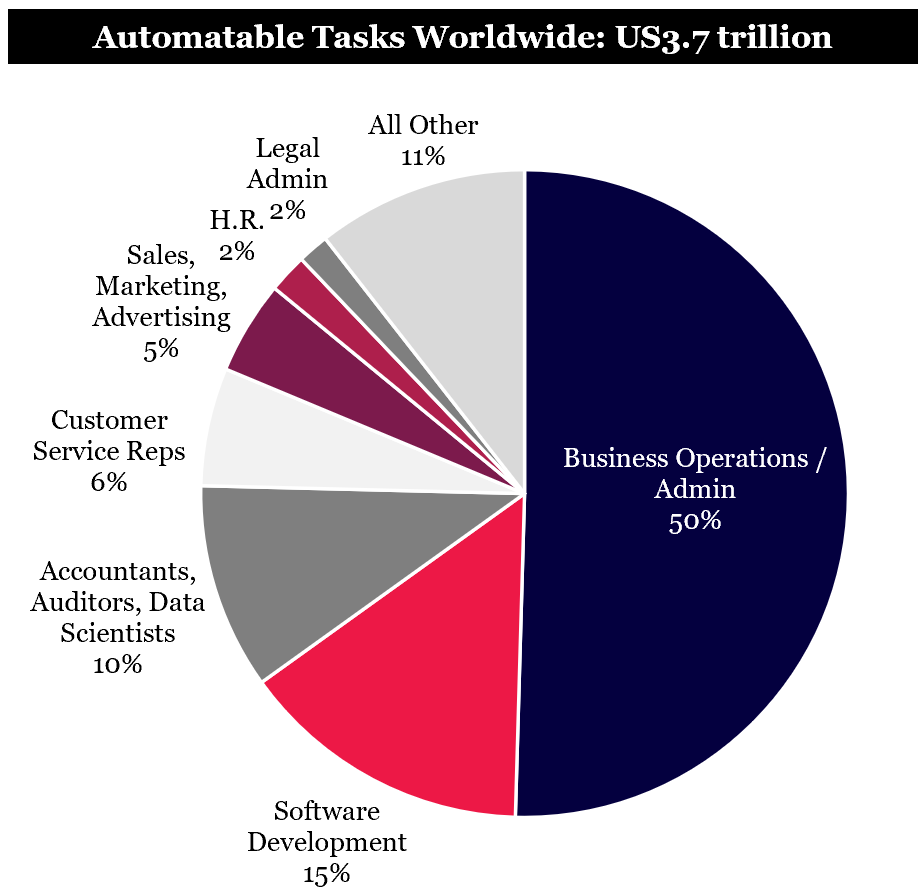

The answer might be staring investors in the face – namely AI-enabled ‘agentic automation’. That’s where AI agents step in to perform tasks carried out by humans, tasks which the world spends US$3.7 trillion.

The shift from human to digital labor presents a massive opportunity for enterprise software companies.

There are many winners from this shift, but Salesforce is one company that has quickly established a first-mover advantage in the nascent space of digital workers with its Agentforce platform.

AI’s Killer App: Agentic Automation

In a world where consumers can spend up to nine hours interacting with customer service to resolve a single issue, and more than 50% of consumers say they are extremely likely to switch brands after such an experience, businesses are desperate for solutions.

Enter AI agents.

AI agents are different from traditional software tools. Legacy automation uses a regimented process to execute pre-defined instructions. They are like a calculator which always gives the same result for the same input. Like 2 + 2 always equals 4.

AI agents, by contrast, can handle less well-defined tasks, in a non-deterministic way. They are similar to rolling a set of dice. You will likely get different numbers each time you roll. They can also adapt to changing inputs and interact through natural language interfaces like OpenAI’s ChatGPT of Google’s Gemini.

This allows AI agents to automate a broader range of functions previously performed by humans, effectively converting labor into software.

As mentioned, some $3.7 trillion is spent worldwide per year on labor costs for tasks that can be automated, and $1.5 trillion of that is in the US alone.

These functions are largely in the back office, software development, finance department and customer service areas where AI tools available right now can perform critical functions.

Tasks Humans Do that AI Agents Could Perform

Source: U.S. Bureau of Labor Statistics, Redburn Atlantic, Montaka

Unlocking Oceans of ROI

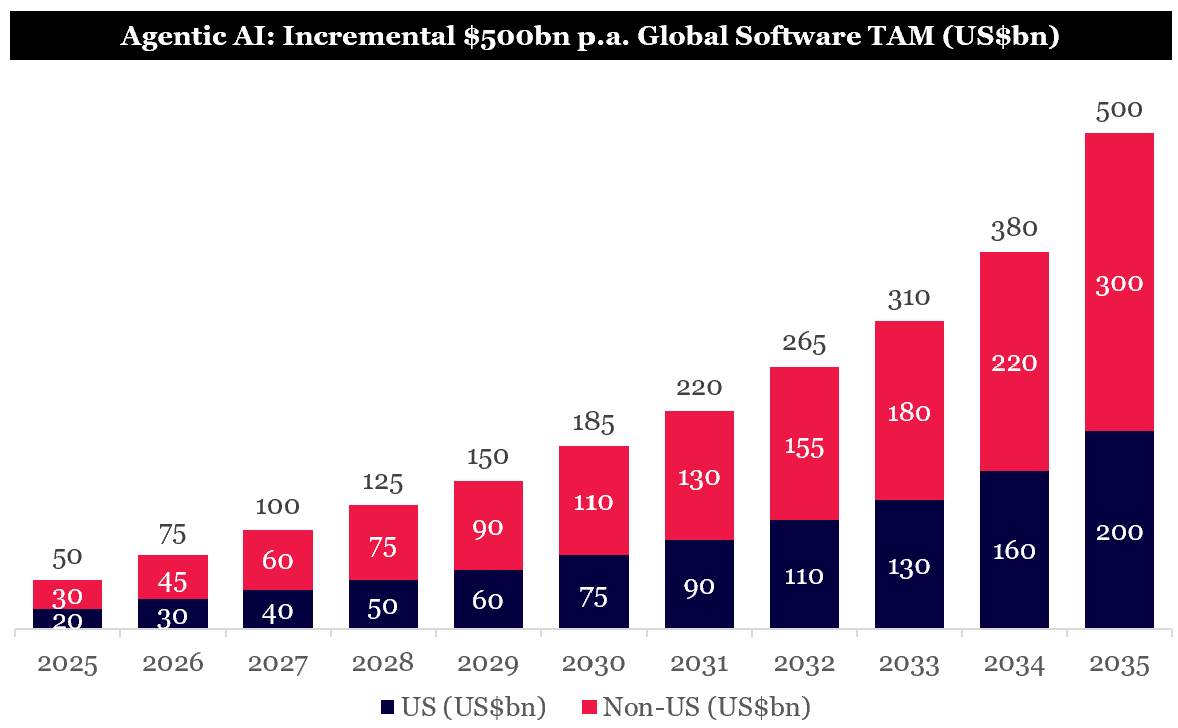

Given Agentic AI can replace an estimated $3.7 trillion in labor costs companies pay today. The enterprise software enablers of Agentic AI would participate disproportionately in the $500 billion boost to the industry’s annual revenue, as it augments human labor with digital agents.

So companies worldwide could spend $500 billion on agentic AI and receive a $3.2 trillion net boost to profitability by cutting headcount. That’s an extraordinary ROI and >6x return.

A digital labor force also scales much more cost effectively than humans, adding another margin expansion lever for businesses.

Obviously, such a major realignment of labor would be significant for the world economy and human resource pool. The shift, however, is expected to be gradual and be offset with aging populations (retirements), reskilling, new industry creation (AI enabled) and the resurgence of older ones (reshoring of manufacturing).

Agentic Automation Represents a Vast, High Value Use Case, for the Software Industry

Source: Estimates based on U.S. Bureau of Labor Statistics, OECD, Redburn Atlantic, Montaka

Note: Non-US includes EU, Switzerland, Japan, South Korea, Brazil, Mexico, Chile and South Africa

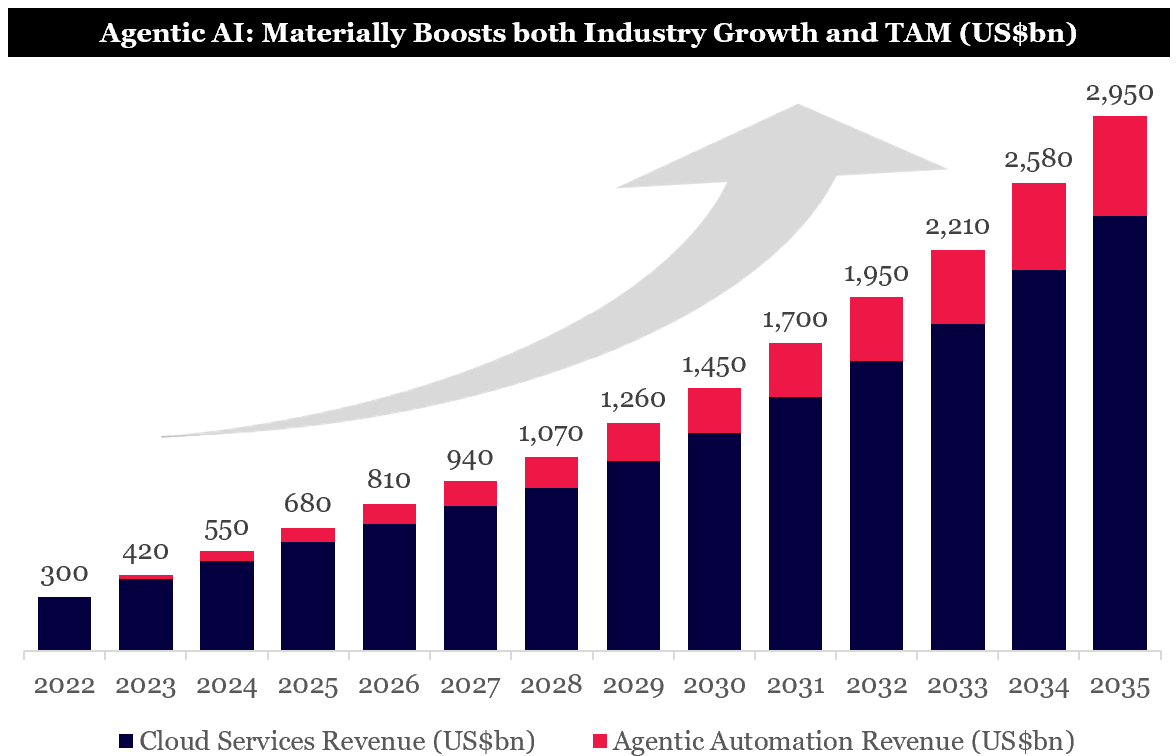

Agentic automation could materially accelerate growth in the global cloud and software industries from 18% to 24% (5-year CAGR).

That translates into a 25% larger ‘total addressable market’ (TAM), or an incremental cumulative revenue over 10 years of $3 trillion that didn’t exist before.

So, who is going to win this highly desirable prize?

AI Agents Sharply Accelerate Software Industry Growth

Source: Gartner, U.S. Bureau of Labor Statistics, OECD, Redburn Atlantic, Montaka

Note: ‘Cloud Services Revenue’ includes IaaS, PaaS and SaaS

Who Wins in an Agentic AI World

We anticipate Agentic AI will generate significant value for select enterprise software companies driven by three key factors:

- Data Reinforces the Moat: The effectiveness of Agentic AI is enabled by access to high quality, commercially curated datasets which can be accessed in real-time. Consequently, we see a substantial strengthening of competitive advantages for vendors – such as Salesforce, ServiceNow, Microsoft and even SAP – possessing entrenched ‘systems of record’ infrastructure that house large volumes of proprietary customer data.

- First to Optimize Internally: Architects of Agentic AI are leveraging the technology internally first. This helps them to realize immediate efficiency gains in critical functions such as software engineering and sales, creating margin expansion tailwinds, employee productivity growth and also demonstrate what is possible to customers (virtuous cycle). In fact, Salesforce isn’t hiring any more engineers this year and Alphabet noted 25% of all code is generated by AI internally now. Brian Millham, COO of Salesforce, said:

- “Since launching [AI Agents] on our Salesforce help portal in October [2024], Agentforce has autonomously handled 380,000 service requests achieving an incredible 84% resolution rate and only 2% of the requests required human escalation.

- Value Based Pricing (TAM Expansion): We believe customers will accept and even pursue alignment around delivered value and price paid for Agentic AI software. Hence in a scenario where significant labor overhead is replaced by agents, we see an accelerated and substantially larger revenue opportunity for leaders in this space.

The Agentforce Platform (Salesforce)

But one of the biggest winners will be Salesforce.

Salesforce’s agentic AI platform Agentforce gives the company an ambitious entry into the multi-trillion-dollar digital labor market. It is effectively an operating system where human labor can be augmented with digital labor.

Early adopters of Agentforce are already seeing impressive results:

- OpenTable implemented Agentforce for customer service and according to its Senior VP, George Pokorny: “Three weeks in, it is handling 73% of all restaurant web queries. This is a 50% improvement from our previous tool.”

- In a recent conversation Montaka had with a medium-sized bank, the CIO reported significant success with Agentforce and anticipated increasing its spend with Salesforce by ~50% in the coming year or two.

- Technology consultant Valoir found using a platform optimized for agentic AI development like Salesforce Agentforce enabled organizations to deliver autonomous AI agents an average of 16 times faster than “do-it-yourself” approaches while increasing accuracy by 75 percent.

The proof is in the pudding. Agentforce attracted 3,000 paying customers within 90 days of its launch. It ended its latest financial year with $900 million of AI and data cloud revenue – up a staggering 120% year on year.

What This Means for Investors

For those watching Salesforce’s strategic evolution, Agentforce has several important implications:

- Expanded market opportunity: By targeting the multi-trillion digital labor market, Salesforce is expanding well beyond traditional customer relationship management (CRM) into a much larger addressable market.

- Competitive differentiation: The combination of Data Cloud, CRM data, and workflow tools creates a compelling competitive advantage and moat against competitors.

- Recurring revenue potential: Agentforce creates new revenue streams while encouraging deeper platform adoption across departments.

Taken together, this sketches out a highly attractive future for Salesforce which continues to go underappreciated by the market and its share price.

Beyond Salesforce, Montaka is looking to capitalize on the potential of agentic AI by investing in businesses that hold proprietary customer data assets; possess deep domain expertise; and provide platforms that enable Agentic AI development, including ServiceNow and Microsoft.

Amit Nath is the Director of Research at Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Note: Montaka is invested in ServiceNow, Microsoft & Salesforce.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stock picks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us: