|

Getting your Trinity Audio player ready...

|

-Andrew Macken

When other investors make recommendations you find strange, chances are they are just as smart and talented as you, but they’re simply playing a different game. As financial author, Morgan Housel, put it: most of the time you’re just a marathon runner yelling at a powerlifter!

There are myriad ways to invest money – across different asset classes, different time horizons, passive or active, fundamental or technical, right through to hard-core quantitative approaches.

It’s little wonder many investors are left feeling confused and uncertain about the path they are pursuing, particularly in today’s complex market.

But there is a straight-forward approach to identifying great investment opportunities that clarifies the game we play at Montaka.

Below we share the four simple steps of this approach which, if followed, provides investors with the best chance of achieving superior long-term compounding.

1. Identify reliable transformations

The first step is to identify transformations – that is, long-term structural changes in the world. There are many transformations today, including the AI revolution, the transition to cleaner energy sources, the growth in alternative assets, and the growth in digital marketing and commerce.

The key is that the change must be reliable over a long period of time. Investors need to be wary of cyclical changes being labeled as structural themes by overzealous press outlets.

For example, it wasn’t too long ago that commodity prices were to ‘structurally’ increase. And yet, with the world’s largest consumer of hard commodities, China, in an industrial recession, it didn’t take much for commodity prices to fall instead of rise.

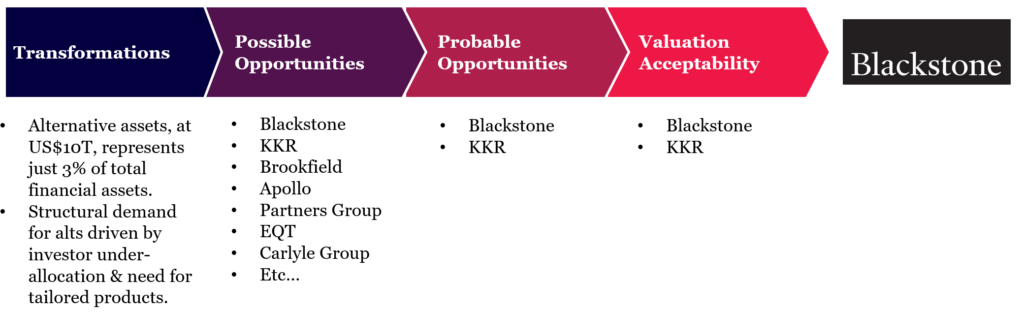

The alternative asset management (‘alts’) space is a good example of an industry undergoing a large structural transformation which we believe will result in supernormal asset growth over the coming decade (and that will disproportionately favor the leading managers).

The industry has approximately US$10 trillion aggregate assets under management (AUM) today. While this sounds enormous, it’s a tiny fraction of the $300 trillion total of global stocks, bonds and real estate.

Growth in alts will continue to be driven by three forces:

- Partnering with insurers – which represent a $30 trillion pool of assets;

- Greater servicing of retail and private wealth channels – which represent more than US$80 trillion in assets; and

- Increasing Asian allocations to alts – which are currently running at a penetration that is one-quarter of North America’s.

Structural transformations can also be subtle and build slowly over decades. The adverse demographics of Japan, Europe, or China, for example, represent a transformation in the ratio of the working-age population to retirees.

2. Map out the set of possible opportunities

Given a reliable transformation, the second step requires investors to map out of the various associated supply chains. A supply chain is the network of companies involved in producing each intermediate product, or service, required to ultimately deliver value to the end consumer.

Supply chains within transformations can get complex quickly, so one simple approach is to start with a company that sells to the end-consumer. Analyze their cost structure to see what goods and services they need supplied to them so they can serve their customers. Then map out the set of companies that are vendors for these intermediate goods and services. The process can then be repeated for these vendors, and so on.

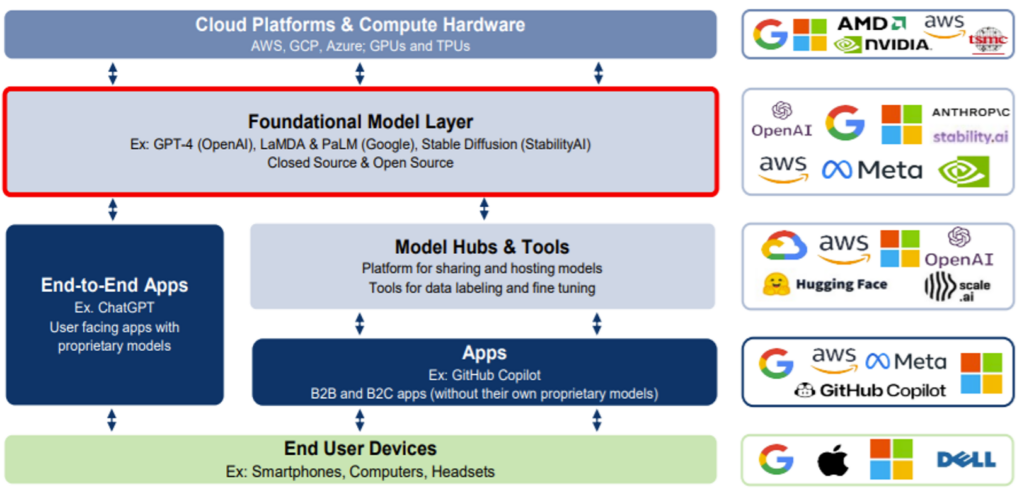

Last year, for example, Morgan Stanley published a simplified map of supply chains related to AI. One can think about the different subsectors – and their constituent players – required to deliver AI-infused services to end consumers.

That includes TSMC, which produces silicon chips designed by Nvidia, AMD and others. It also includes the likes of Amazon, Microsoft, Google and Meta who run enormous computing clouds at scale; as well as OpenAI, Anthropic and others, who specialize in designing foundation AI models. And it includes the numerous applications, such as Microsoft Office and Spotify, that leverage all of the above to deliver great experiences and value to end-consumers.

Mapping out the AI supply chain

Source: Morgan Stanley; a16z

This step gives us a large list of possible opportunities. Many investors will stop here. In fact, thematic ETF investing usually involves the simple aggregation of this list. And for themes that are having their moment in the sun, the rising tide typically lifts all boats.

But over the long term, superior investment returns are more likely to be sustained by those businesses on the list that have durable advantages. That takes us to the next step.

3. Identify the subset of probable opportunities

Step 3 is the most underapplied and underestimated step, in our view. It requires us to filter our list from Step 2 and focus on businesses which likely have enduring advantages.

Business advantages come in several forms. When you seek to identify advantages (or their absence), the simplest question to ask is: “What valuable attribute does this business have that others cannot easily recreate?”

If the answer is “not much”, the business in question is probably not advantaged.

But some businesses have extraordinarily valuable attributes that are near impossible for others to recreate. A few examples:

- Meta has a social network used by 3.2 billion people every day.

- Microsoft has more than one billion people using MS Office for work.

- S&P Global is the gold-standard and regulatory-required credit rating on fixed income securities.

- UnitedHealth’s Optum is the largest healthcare delivery platform in the world, providing data-enhanced services for more than 100 third-party health-plan partners.

- Spotify knows the daily listening and playlist preferences of more than 500 million consumers around the world.

Then there are cases for which the jury is still out. Take electric vehicles, for example. There is a clear transformation. Adoption is growing structurally and the transformation is well supported by auto manufacturers and regulators. But competition is intense. Tesla had the early jump and has built up a wonderful dataset from its fleet of in-use vehicles. But Chinese competition has accelerated and now operates at a scale that calls Tesla’s advantage into question.

A durable advantage is not academic. It determines the likelihood of high economic returns being generated by the business for a sustained period. Investing in companies with those with advantages tilts the likelihood of better investing outcomes in your favor.

4. Test for valuation acceptability

For each business that makes the cut from Step 3, the final step is to ensure that the market-implied expectations built into the business’ stock price are unreasonably low – and, therefore, the stock is undervalued.

By ‘expectations’, we mean the key ‘value drivers’ of the business: revenue growth, profit margins, and capital investments required to generate growth.

A stock price is effectively a numerical representation of what the market expects for these value drivers. When the market-implied expectations are too low, then the stock is undervalued. Over time, as the business outperforms these expectations, the stock should re-rate upwards.

One business we believe satisfies all four criteria is Blackstone, the world’s leading alternative asset (‘alts’) manager.

As we described above, the alts space is undergoing a very large structural transformation as investors increase their allocations to the asset class.

In the alts industry, history shows that growth favors the largest, biggest, most trusted brand names, with the longest track records. This greater scale allows the big brand to attract talent, access to deal flow, diversify across geographies and products, and attract clients – which further drives scale. So, there is a ‘flywheel’ dynamic here. We believe this represents a durable advantage and is very difficult for competitors to recreate.

Blackstone’s earnings power will likely inflect upwards in coming years as significant assets raised and deployed three years ago are crystallized at higher values and recycled back into the business – generating even higher fees.

This growth is effectively locked in. It is coming. And it requires no additional capital investment to attain. We believe the market-implied expectations represented by Blackstone’s current stock price do not adequately reflect this – and so the stock remains undervalued.

* * *

In four simple steps, we believe investors can substantially tilt the odds of superior long-term investing returns in their favor. Of course, this is not the only way to invest – and many have succeeded with vastly different approaches.

The objective of the game Montaka is playing is to increase the chances of superior long-term compounding for investors. And we believe that, by identifying and owning high probability leaders in large structural transformations when they are undervalued, we stand a good chance of winning.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us:

Note: Montaka is invested in Blackstone, KKR, LVMH, Spotify, Salesforce, ServiceNow, Meta, Alphabet, Alibaba, Tencent, S&P Global and Microsoft.

Andrew Macken is Chief Investment Officer with Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or leave us a line on montaka.com/contact-us