|

Getting your Trinity Audio player ready...

|

– Andrew Macken

The following is a summary of Montaka’s latest whitepaper titled: Why reports of tech’s death are greatly exaggerated

The launch of ChatGPT has sparked fresh interest in the massive potential of technology to continue to revolutionise our lives. The chatbot, developed by Microsoft-backed OpenAI has wowed people with its ability to use machine learning to produce human-like answers and content to questions.

After the extraordinary decline in technology stocks witnessed in 2022, many investors have been asking: is tech dead?

But as ChatGPT has shown, far from dying, tech is set to enter a new era of growth, dominance and profitability.

The 2022 downturn will lead to even higher future earnings than previously forecast because cost-cutting at tech companies will deliver higher future profit margins.

But perhaps most importantly, tech stocks will benefit from transformational waves of tech innovation, particularly in the field of ChatGPT-style AI.

The extraordinary price falls of many long-term-winning tech companies – including 5 we highlight below – mean investors can buy high-quality, reliably growing earnings streams very cheaply.

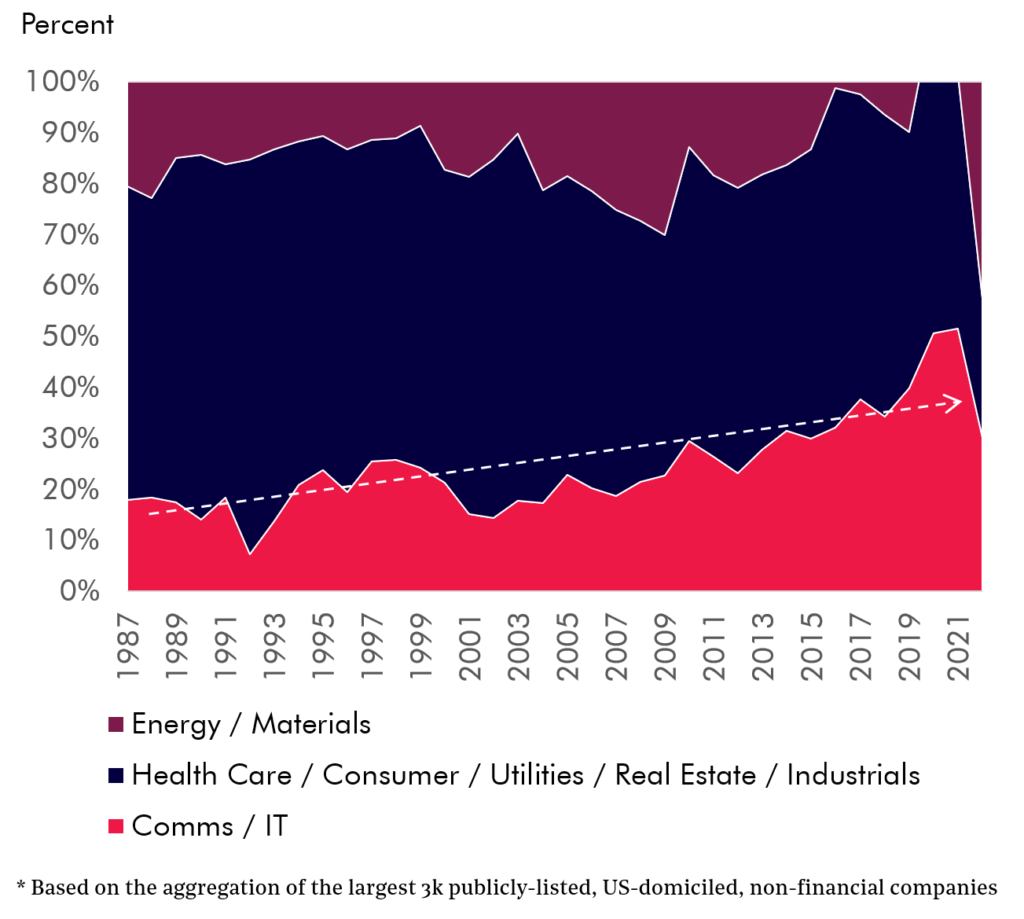

How tech came to dominate the economy

The tech sector has grown more rapidly than any other over the past four decades as it has penetrated more and more parts of the global economy.

Share of Aggregate Operating Profits*

Source: Bloomberg, Montaka analysis

That growth has also come with far superior profit margins, a powerful combination that has seen tech deliver a structurally increasing share of US corporate profits, which has flowed through to strong investment returns – even when the extraordinary stock price declines of 2022 are included.

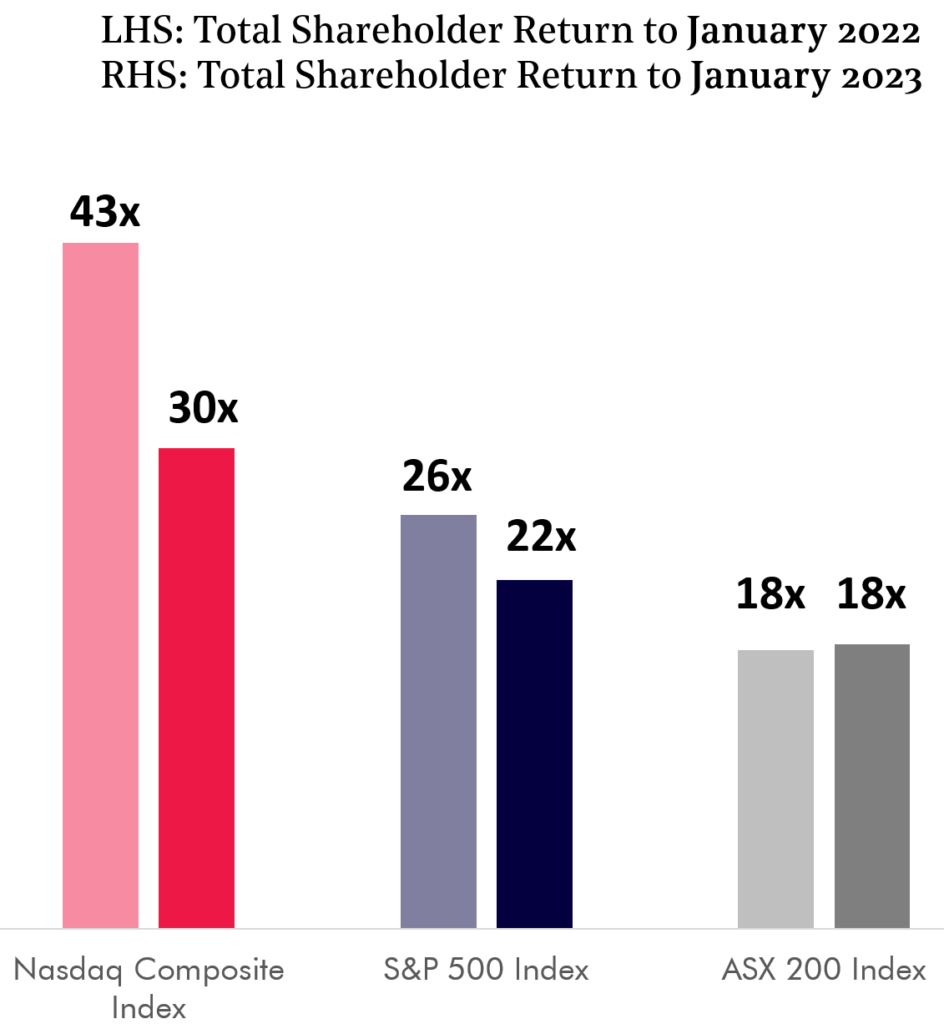

Comparison of Historical Returns (since Jan-1990)

Source: Bloomberg, Montaka analysis

Many of today’s tech leaders continue to show faster-than-average revenue growth and higher-than-average incremental profit margins. The two largest players in cloud computing, for example, Amazon (owner of AWS) and Microsoft (owner of Azure), are growing their cloud businesses by more than 20 percent per annum. These rates of growth are obviously well above the average growth rate of the broader economy – and are expected to continue, albeit with some moderation in the current environment, given the early phase of cloud adoption we are in today.

Montaka estimates the incremental operating profit margin of cloud computing in western markets to be 30-40% over the long-term. This level of profitability on future growth is also far above the average levels of profitability found in the broader economy.

And it’s not just the hyperscalers.

Montaka estimates that the incremental operating profit margins of the world’s leading (and entrenched) enterprise software-as-a-service businesses (SaaS), such as Salesforce and ServiceNow, are also north of 30%.

Moore’s Law: Why tech’s remarkable growth will endure

The aggregated tech sector is clearly growing at above-average rates of growth. And there are important reasons why this trend will continue as technology continues to expand into all walks of life.

The core enabler of this proliferation has been a powerful force: a huge increase in computing power at a rapidly declining cost. In tech circles, this dynamic is known as Moore’s Law and it describes how the number of transistors on a silicon chip – that is, the fundamental building blocks of compute – increases by approximately 10x every seven years.

Investing legend and Sequoia Capital Chairperson, Mike Moritz, observed in the mid-1990s that, as long as Moore’s Law continued to hold – and computing power continued to become exponentially cheaper – then the markets that tech can penetrate should keep getting larger and larger.

And certainly, this has been the case. The investment returns from this one insight alone have been staggering.

Today, breakthroughs in chip design – from proven forms of accelerated computing to several prospective forms of unconventional computing – are paving the way for Moore’s Law to continue.

At the same time, we are on the cusp of the next transformational wave that will accelerate tech proliferation even further: artificial intelligence (AI).

AI: the next transformational wave

AI will recast and refashion every aspect of life: how we consume, how we work, how we monitor industrial machines, how we deliver healthcare, how wars are won, and how we solve climate change.

Not only is software eating the world, but it is becoming a lot smarter at an accelerating rate and will continue to do so.

Why? Because of AI – and more specifically, machine learning (ML), the most common and practically applicable subset of AI today.

Think of Google’s predictive text in Search or Gmail, or its facial recognition in Photos; Tesla’s autonomous driving; or OpenAI’s ChatGPT[1] natural language model, which is generating billions of words per day in human-like sentences and paragraphs.

In 2022, several text-to-image creation tools have been unveiled, such as DALL.E-2, Midjourney, and Stability AI[2], as well as extraordinary new text-to-video creation tools, from the likes of Meta.[3]

Furthermore, large language models are expected to change the way humans interact with their technology. Increasingly, users will employ natural language (everyday language) to have an ongoing ‘dialogue’ with their technology so they can tailor it to specific uses.

Large language models have started to unlock extraordinary new uses of technology, such as automated content generation for corporate marketing teams[4], automated document review and processing, and even search, all at very low marginal costs.

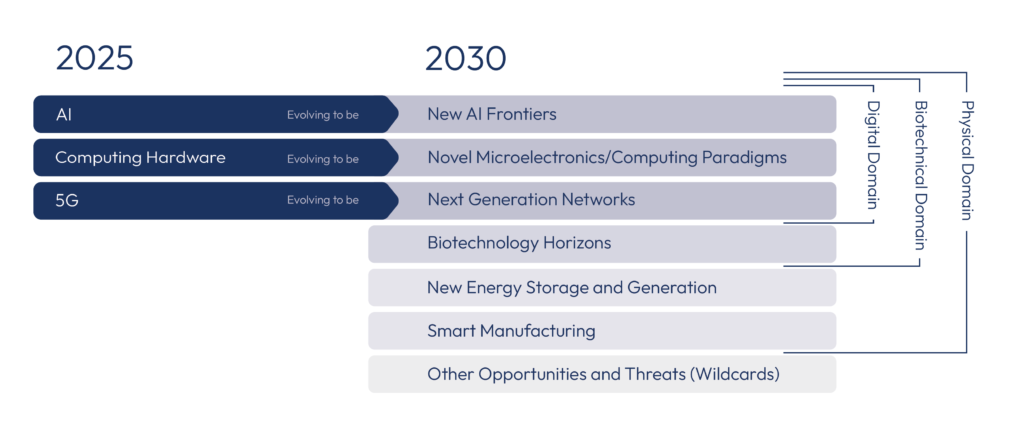

Over the coming decade, it is highly likely that AI will be the key enabler of most future waves of tech innovation. In a recent 189-page submission to the US Congress, the Special Competitive Studies Project, which is chaired by former Google CEO Eric Schmidt, identified the major areas of tech innovation, looking out to 2030.

The next wave of technological innovation

Source: Bloomberg

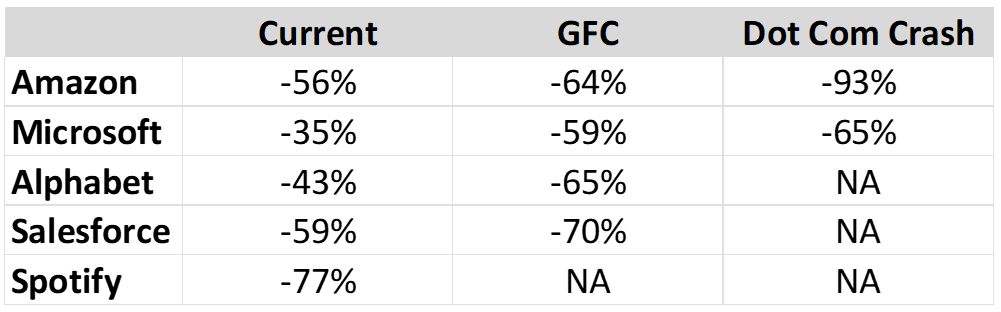

Big investment opportunities in tech today

Far from calling the ‘death’ of tech, the extraordinary price drawdowns of certain long-term winning tech companies are providing investors with remarkable investment opportunities – just as they did following the 2000/01 dot-com crash and the global financial crisis (GFC) of 2008.

Stock price drawdowns from prior 2-year high

Source: Bloomberg

Of course, not all tech companies have long-term durable advantages and investors need to be selective. But when we examine leading businesses they combine huge growth opportunities with cheap valuations.

Short-term macro headwinds have compressed valuation ‘multiples’ in the year of 2022. But we know that in the long run, equity returns are dominated by earnings growth, not changes in multiples. And our analysis leads us to place a high probability on the scale and reliability of the future earnings growth of selected, advantaged tech winners.

Tech is not dead. We believe the 2022 sell off in tech represents a significant investment opportunity.

To request a copy of the full whitepaper & know the top 5 stocks poised to lead the tech recovery, please share your details with us:

Note:

[1] WSJ: ChatGPT Creator Is Talking to Investors About Selling Shares at $29 Billion Valuation (January 2023)

[2] The Verge: Stability AI, proponent of hands-off AI image generation, gets a $1 billion valuation (October 2022)

[3] The Verge: Meta’s new text-to-video AI generator is like DALL-E for video (September 2022)

[4] (TechCrunch) AI content platform Jasper raises $125M at a $1.5B valuation (October 2022)

Montaka is invested in Amazon, Microsoft, Alphabet, Salesforce, Spotify and Salesforce.