|

Getting your Trinity Audio player ready...

|

– Andrew Macken & Chris Demasi

As the saying goes: there are decades where little happens, and there are weeks where decades happen. The weeks of the first quarter of 2023 fell squarely into the latter category.

The rate of increase in US interest rates has not been this high for more than four decades. In its mission to cool inflation, we are now observing some of the unintended financial consequences.

In a matter of weeks, we witnessed the end of Silicon Valley Bank – also four decades old; as well as Credit Suisse – which has been with us for more than 160 years.

To many, it is not entirely surprising to see things now starting to break. With approximately US$350 trillion of debt outstanding worldwide, and with an average maturity of about five years, it means that around US$70 trillion of debt needs refinancing every year. Anything that impedes the refinancing of this enormous stock of debt, such as very rapid monetary tightening, can lead to very large knock-on effects.

That said, the probability that we are currently facing another 2008 GFC remains low, in our view. Large banks are well-capitalized today, unlike 15 years ago, and today’s policymakers had a front-row seat to the GFC and will likely do whatever is required to prop up their banking systems.

But similar to 2008, however, stresses in financial markets do feed back to the real economy – and quickly. For example, in the weeks immediately following the collapse of Silicon Valley Bank, Citi observed in their credit card data the biggest decline in total retail spending since the pandemic began in April 2020.

At the same time, yields on 2YR Treasury Bonds collapsed – reflecting the market’s view that impending economic weakness will stop the Fed from increasing interest rates for the foreseeable future. For those interested in the historical record here, such a monthly change in the 2YR has not been observed for more than four decades, it was so severe.

Growth in the US economy, the world’s largest, will likely slow as the year progresses. On the one hand, this represents an ongoing headwind to corporate revenues and earnings. On the other hand, a slowing economy will help cool inflationary pressures and set the stage for an easing of interest rates over time.

What an irony if the collapse of Silicon Valley Bank was the best thing for Silicon Valley (due to renewed monetary easing on the horizon).

Historic moments were not just observed in the financial sector last quarter. Significant changes in geopolitics were also afoot. Iran has moved closer to Saudi Arabia. The Saudis are supporting Russia. And all were granting more influence to China – in just the last few weeks alone.

At the same time, the US is moving quickly to strengthen its strategic position relative to China. Export bans were recently placed on advanced semiconductor chips and machinery otherwise bound for Chinese military programs. Meanwhile, Australia was granted access to secret nuclear-power submarine technology under the historic AUKUS deal, which also happens to include explicit collaboration on the development of cyber, AI, advanced weaponry, and intelligence collection capabilities.

The most important bilateral relationship in the world is that between the US and China. And the evidence shows that both are seeking to rapidly build their strategic postures. In the US, a land of divided politics, the only unifying action between the left and the right seems to be that of showing strength against China. (A rapidly increasing probability that Chinese social media app, TikTok, will be banned in the US is the most recent case in point).

What is most extraordinary is that these recent events were probably not even the most significant of the quarter. Instead, the release of OpenAI’s most recent foundation AI model, GPT-4, is an historically momentous occasion – the implications of which are surely not yet understood.

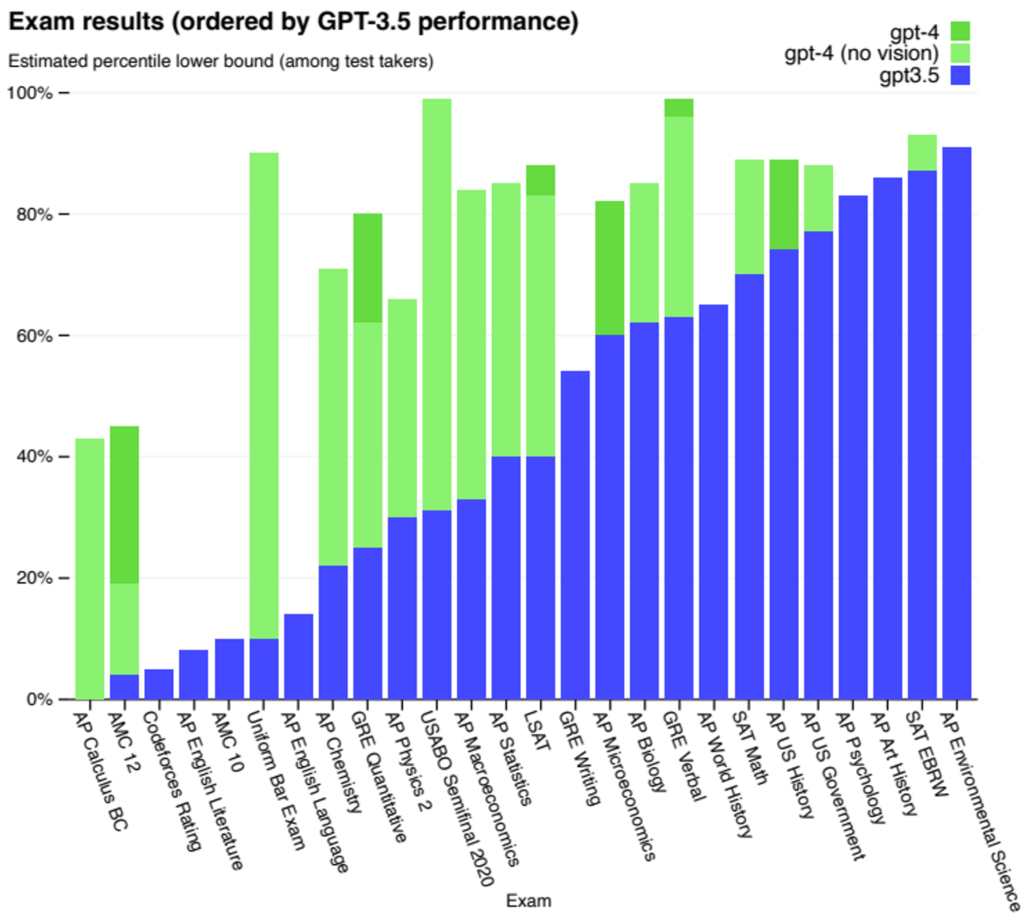

Here we have a model that can ace university-level exams. That is, it can read the exam questions on its own, reason well enough to deduce the answers, and write the answers in human-level sentences. Even more impressive (and potentially scary) is the extreme rate of improvement since the model’s prior version, GPT-3.5, approximately one year prior, as illustrated by the chart below.

Montaka has studied AI extensively for several years now and will continue to do so. In our conversations with current and future clients, many find it surprising that we actually spend relatively little time ‘projecting’ what the future of AI holds. Instead, we are simply observing and analyzing what has already started to happen today.

And the extent and speed of the advancements we are witnessing is nothing short of extraordinary. To illustrate, here are some reactions from experts who have experimented with GPT-4:

“I am totally aware that this sounds insane… I feel like I have crossed the Rubicon… To have a computer attempt to communicate not facts but emotions is something I would have never believed had I not experienced something similar.”

– Ben Thomson, Tech Analyst & Columnist, February 2023

“I had a most remarkable but unsettling experience last week… a demonstration of GPT-4… I could barely sleep that night. To observe an A.I. system — its software, microchips and connectivity — produce that level of originality in multiple languages in just seconds each time, well, the first thing that came to mind was the observation by the science fiction writer Arthur C. Clarke that ‘any sufficiently advanced technology is indistinguishable from magic.’”

– Thomas Friedman, New York Times Columnist, March 2023

“In my lifetime, I’ve seen two demonstrations of technology that struck me as revolutionary. The first time was in 1980, when I was introduced to a graphical user interface… The second big surprise came just last year [upon experiencing OpenAI’s GPT]… The development of AI is as fundamental as the creation of the microprocessor, the personal computer, the Internet, and the mobile phone.”

– Bill Gates, Founder of Microsoft, March 2023

And GPT-4 is not simply a model designed to wow journalists inside a research lab. Microsoft has already announced in recent weeks that it is currently integrating GPT-4 into its existing Microsoft 365 apps, including Teams, Excel, PowerPoint, Word and Outlook, under a new premium-tier offering called Microsoft 365 Copilot.

The ability for existing software leaders to incorporate seemingly ‘magical’ AI capabilities – and charge a premium – is a powerful new dynamic that Amit explores below in our case study on Microsoft. Importantly, this opportunity will be available only to a select few, with the core business models of many others at risk of being disrupted by the AI itself!

* * *

Montaka’s portfolio evolved modestly during the first quarter of 2023. We were recently presented with an opportunity to buy Bank of America (NYSE: BAC) cheaply following the fallout from the collapse of Silicon Valley Bank. ‘BofA’ is a large, well-capitalized, high-returning US bank that is perversely benefiting from stresses in the regional banking sector. Indeed, we are already observing US deposits flowing out of smaller banks, into larger banks. This is a bank that counts Berkshire Hathaway as its largest shareholder. And we were able to buy it at a price more than 40% cheaper than one year ago – and one that we believe represents attractive value.

We identified a similar tactical investment opportunity during the quarter in Advanced Micro Devices (NASDAQ: AMD). This is one of the world’s leading semiconductor chip designers. We believe we have invested in AMD cheaply and ahead of the following coinciding dynamics that will all play out over the coming year and beyond: (i) new product cycle in accelerator chips tailored for AI models; (ii) positive margin mix effect from new products; (iii) economic cycle of depressed core business rebounding; and (iv) acceleration of synergy unlock from recent Xilinx acquisition.

While BofA and AMD represent relatively small investments within Montaka’s portfolio, our research processes and team of generalists are well-equipped to pick up ‘dollars on the ground’ when we see them. We believe these types of investments, despite their typically shorter holding periods, will be additive to Montaka’s returns over time. That said, we foresee that Montaka’s long-term destination will be overwhelmingly driven by the success of Montaka’s core ‘compounder’ investments, including in the areas of alternative asset management, and enterprise software.

And even here, we will be tactical when the facts and our analysis calls for it. During the first quarter, for example, we substantially scaled back the size of Montaka’s investment in Alphabet. While this business retains many opportunities for long-term profitable growth, the near-term profitability of its core Search business is at risk due to some of the developments we have observed recently in the field of AI. We hope we can scale the position back up at a later date at greatly reduced prices.

We thank you again for your ongoing partnership and patience. We continue to invest following our processes and analysis. And we believe Montaka’s portfolio is very well positioned for the enormous opportunities that are developing as a result of the many changes we are currently seeing in the world. And we also thank the entire Montaka team for their ongoing commitment to client service, best practices, and evolution wherever possible.

Note:

Montaka is invested in Microsoft, AMD, Bank of America