|

Getting your Trinity Audio player ready...

|

By Amit Nath

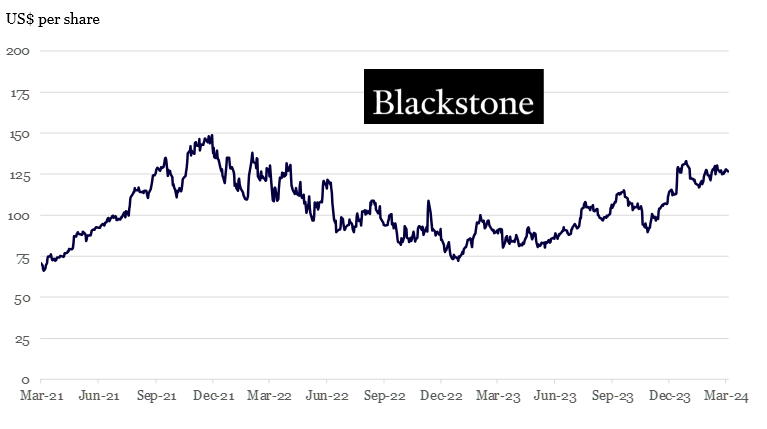

Many investors may still view Blackstone through the stereotypical private equity lens as a swashbuckling hostile takeover merchant. But there is more to Blackstone than meets the eye. After decades of building investor trust, asset diversification and cutting-edge data advantages, the alternate asset management giant exhibits a stealthy undervaluation. Below, we explore 6 reasons why this financial powerhouse deserves a fresh look and why we see significant upside for the stock.

Source: Bloomberg, Montaka Global

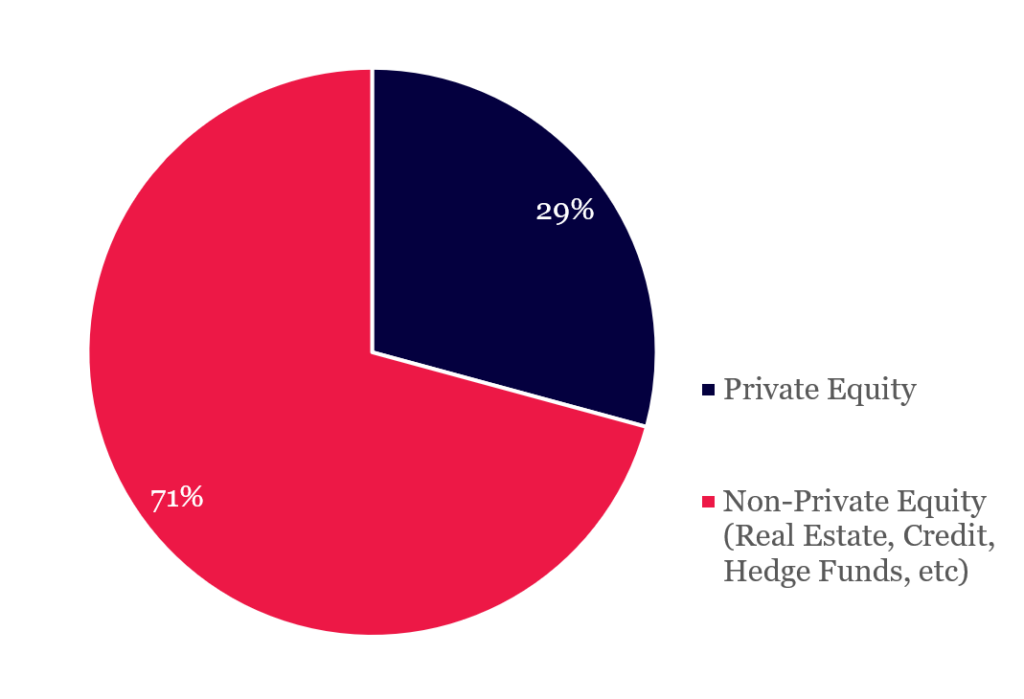

1. Much more than just ‘private equity’

Blackstone may be known for its prowess in private equity (leveraged buyouts). However, the business has significantly diversified its capital sources. Over the last 15-20 years, non-private equity assets have outgrown private equity assets by around 70%. They have increased 20-fold, taking total Assets Under Management (AUM) to more than $US1 trillion. More than 70% of Blackstone’s AUM are now in non-private-equity strategies.

Blackstone has >US$1 trillion AUM Largely Outside Private Equity

Source: Company filings, Montaka Global

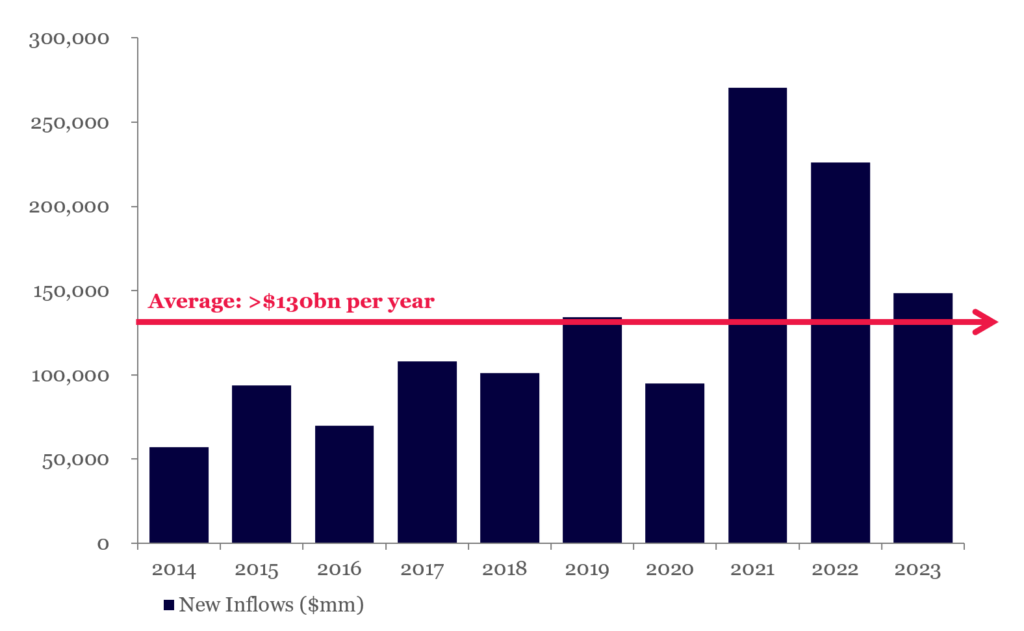

2. Blackstone’s ability to raise new capital is incredible

Over the last decade, Blackstone has raised an incredible $130 billion in new inflows each year, on average. The company has been able to access a far larger range of investors and end markets (e.g. insurance, private wealth, retirement, etc) because of stellar returns, a broadening array of asset classes, and pools of capital measured in the tens of trillions.

New Capital Inflows (US$ billion)

Source: Company filings, Montaka Global

3. Superior data advantages

Blackstone has access to vast, proprietary datasets that it uses to generate insights and make more informed investment decisions. This data includes information on companies, industries, and markets that are not available to the public.

Blackstone, for example, owns 230 private companies, has more than 12,000 real estate assets and is one of the largest lenders in the world. The company has over 50 data scientists on the payroll to exploit this trove of data.

When Blackstone completes a deal, a data scientist ensures all business data signals are tracked, aggregated and reported in real-time to allow leaders to make better investment decisions.

Blackstone believes it is at least eight years ahead of the industry in its approach to data and its ability to modify its portfolio ahead of significant industry and macro shifts.

Two recent examples of its data advantages bearing fruit include:

- Blackstone dramatically repositioned its commercial real estate portfolio well before the asset class showed any signs of stress (which we discuss further below).

- The company identified, and made investments, based on non-consensus perspectives around the trajectory of inflation, including the persistence of input cost growth and rising wage pressures. That enabled Blackstone to insulate itself from the effects of rising interest rates.

This source of this competitive advantage remains significantly underappreciated in the Blackstone story and is likely to scale as the business continues to grow. As Stephen Schwarzman, Chairman and CEO of Blackstone, says: “Our access to information is an enduring competitive advantage here at Blackstone, and this advantage grows as we grow larger.”

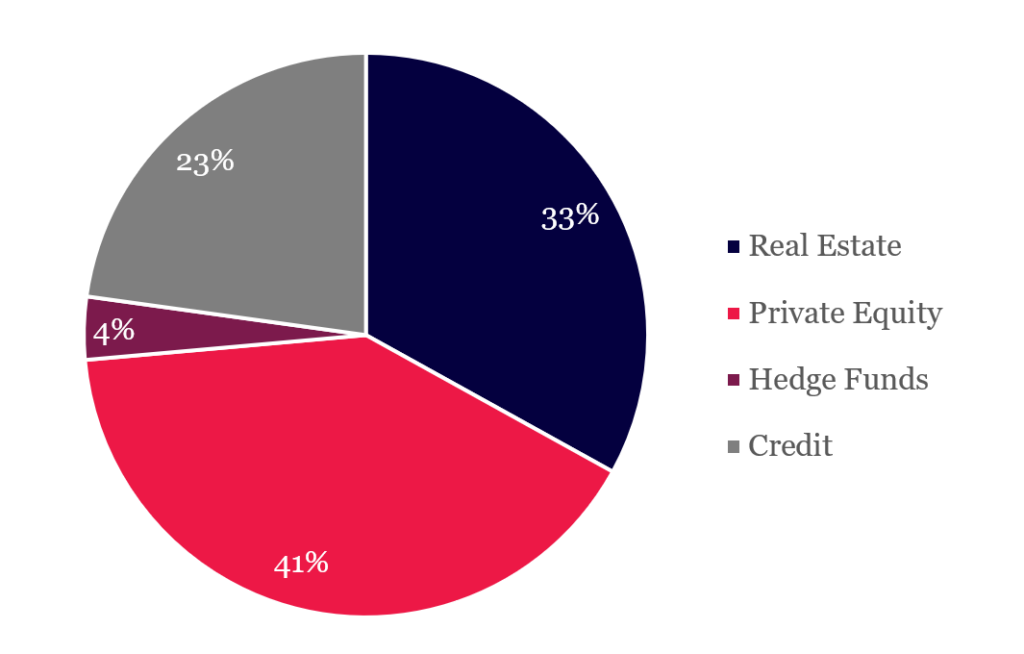

4. Industry-leading ‘dry powder’

Blackstone has ~$200 billion of investible capital, known as ‘dry powder’, which is the most of any alternative asset manager in the industry.

This ‘on-demand’ capital allows Blackstone to take advantage of industry downturns and buy assets at discounted prices much faster than competitors that need to locate financing first.

The dry powder shows the level of Blackstone’s appeal to investors and the trust it has established. There aren’t many investment managers in the world that can attract such an enormous pool of on-demand capital to be used ‘in case’ they see an opportunity.

Blackstone’s dry powder is also diversified across a range of asset classes, including corporate private equity, real estate, credit and hedge funds. This lets it take advantage of a variety of environments where various assets fall in-and-out of favor. Credit and parts of commercial real estate, for example, are attractive now, whereas corporate private equity is relatively less attractive.

Dry Powder (~US$200 billion)

Source: Company filings, Montaka Global

5. Expertly navigated commercial real estate exposures

Much has been written about the challenges in Commercial Real Estate (CRE), particularly office space. With interest rates elevated and work-from-home dynamics driving utilization down, offices are particularly at risk.

Wouldn’t Blackstone, as the world’s largest private commercial property owner, be severely vulnerable?

Not necessarily.

Blackstone leveraged its data advantages (discussed earlier) and over the past decade it improved the quality of its property portfolio by increasing exposure to structurally growing and attractive real estate markets.

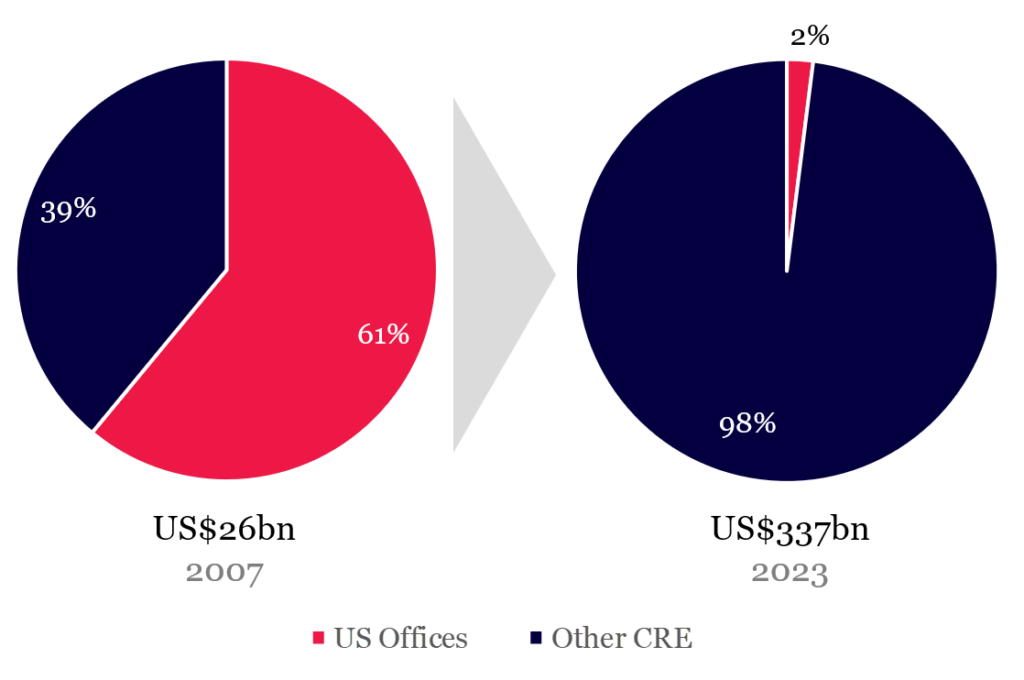

Today, its major investments in CRE include data centers, logistics assets, warehouses, student housing and medical labs. US office space only accounts for ~2% (2023) of the total Blackstone real estate portfolio. That’s considerably lower than the ~61% exposure it had ahead of the financial crisis (2007).

Today U.S. Offices are an Immaterial Part of Blackstone’s Real Estate Portfolio

Source: Company transcripts, Montaka Global

6. Blackstone’s valuation is misunderstood

Blackstone’s valuation is largely misunderstood by the market. While it may appear to trade on a notionally elevated multiple of recurring management fees (aka Fee Related Earnings or FRE), there is a durable component of performance fees (aka Carry), that the market is not including.

Additionally, there is enormous, embedded growth within the business from prior new capital inflows (particularly from 2021 and 2022, as shown earlier). These inflows are yet to be fully invested but will generate significant earnings in the future.

Finally, Blackstone operates an incredibly capital-efficient business model that requires virtually no investment to generate sustained and high earnings growth.

Very few businesses on the planet can compound earnings at double-digit rates for sustained periods of time without significant investment. Even the ‘hyperscalers’, such as Amazon and Alphabet (Google) with all their advantages, need to spend billions of dollars on servers, data centers, networking equipment to earn their high rates of return.

Blackstone doesn’t have this requirement due to the nature of their business. Given its numerous competitive advantages, and place as the industry gold standard, the normalized (“fair multiple”) ascribed to their earnings streams should naturally be higher on a headline basis.

Best days ahead

Blackstone has built a substantial moat over several decades, and today has enormous opportunity to further penetrate massive new markets like insurance and private wealth, continue compounding data advantages and leverage its incredible scale.

Blackstone has been a long-term holding for Montaka Global and is one of our largest positions. We continue to believe Blackstone’s best days lie ahead, with significant upside on the table for shareholders.

Amit Nath is the Director of Research at Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us:

Note: Montaka is invested in ServiceNow.