|

Getting your Trinity Audio player ready...

|

By Amit Nath

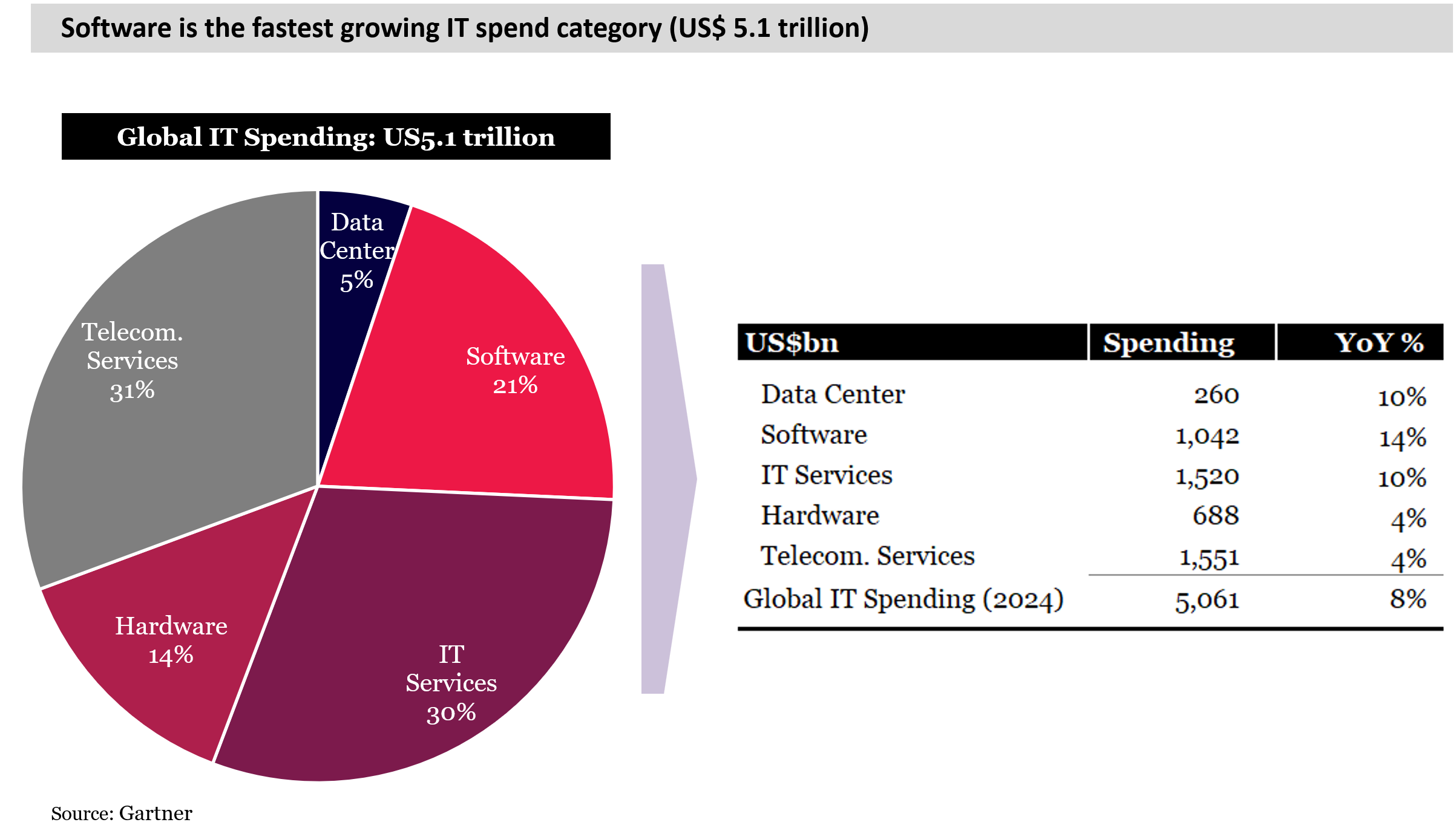

The world will spend $US5.1 trillion on Information Technology (IT) in 2024. More than $1 trillion of this will be spent on software, primarily for large companies and governments.

Not only is software an extraordinarily large market, it is also growing extraordinarily quickly at 14% per year – nearly five times the rate of global GDP growth of 3% (2024).

This bucket of IT spending – often referred to as ‘enterprise software’ – represents an enormous prize.

Over the last several decades, companies and governments have stitched themselves a fragmented patchwork quilt of niche software points solutions attached to expensive IT services agreements.

Not only has the situation become wildly expensive, but it has also snowballed into unmanageable and brittle software spaghetti backends that are fraught with fragility and business interruption risk.

Increasingly, however, a special set of enterprise software companies – Microsoft, ServiceNow and Salesforce – are emerging to win this prize by offering dominant solutions.

These three companies are not only delivering ‘Software-as-a-Service’ (SaaS) but also functioning as thriving platforms. Those platforms are enabling their solutions to bleed across and absorb parts of adjacent IT categories such as IT services (software implementation and support) and data centers (servers, storage, networking). These buckets themselves represent trillion-dollar opportunities.

There are four main drivers of the platforms’ growing dominance, which is set to power their share prices into the future.

1. The talent crucible: tech giants versus internal teams

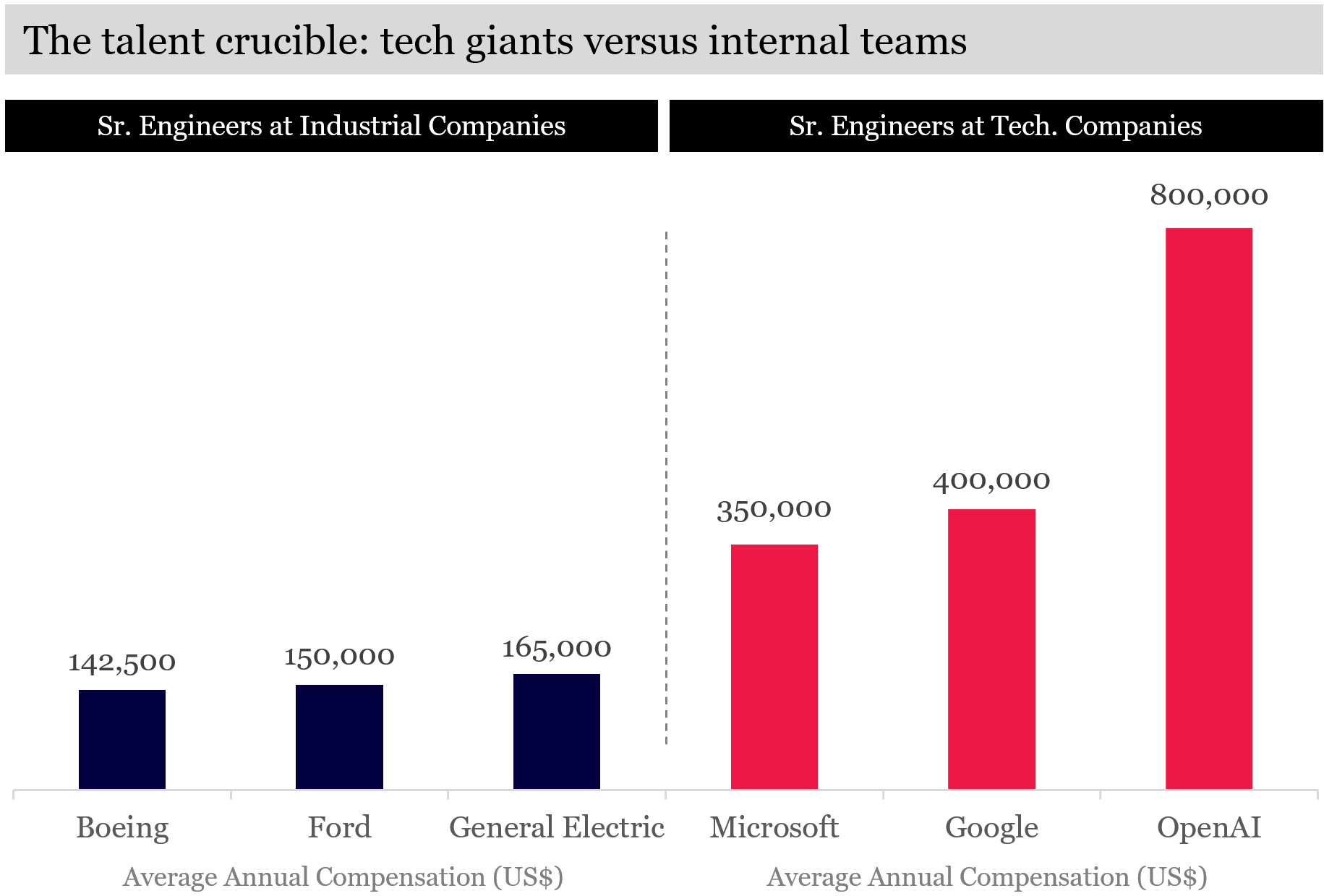

Firstly, the enterprise software platforms are winning the vital war for talent.

Over his seven decades of investing, Warren Buffett has consistently emphasized the importance of ‘moats’ – sustainable competitive advantages.

Talent is one of the most formidable moats in the digital age. Tech behemoths consistently outbid and out-recruit enterprises when it comes to top-tier engineering talent.

Tech companies are magnets for high-performing talent

Source: Glassdoor, Levels.FYI, Michigan Tech, Montaka

This brain drain leaves companies grappling with legacy systems riddled with ‘technical debt’ – the cost of maintaining outdated code.

As Ward Cunningham, a pioneer in agile and resilient computing architectures, notes: “Technical debt is like financial debt; it accrues interest over time and can eventually bankrupt a company”.

2. The consolidation conundrum: less is more

Enterprises have historically accumulated a vast array of point solutions – software tools designed for specific tasks. Each new task or function often brings with it a new point solution or niche implementation. Over time this creates an unruly haystack of software (massive tech debt).

Managing these disparate systems brings with it increased errors, higher maintenance costs, lower productivity, less scalability and exponentially more security vulnerabilities.

Over time, the accumulation of tech debt can render a system so unstable and difficult to maintain, that it becomes virtually unusable, requiring a complete rewrite.

The solution? Consolidation.

The large enterprise software platforms literally take hundreds of point solutions and consolidate them into their unified ecosystems, streamlining workflows and reducing the burden of integration.

“We’re seeing situations where we can literally consolidate hundreds of systems into the [Service]Now Platform, take out huge costs [and] give the customer a great experience,” says Bill McDermott, CEO of ServiceNow.

3. The cybersecurity imperative: a rising tide of threats

The digital world is a battlefield and cyberattacks are the weapons of choice.

While smaller vendors don’t stand a chance, we are even seeing well-regarded, scale, cybersecurity operators such as Crowdstrike, struggle with the complexity of IT backends and how prone to unintended consequences they have become.

In mid-July 2024, Crowdstrike unintentionally took out 8.5 million customer systems, bringing hospitals, airlines, banks and many other businesses to a complete standstill. It was the largest IT outage in history.

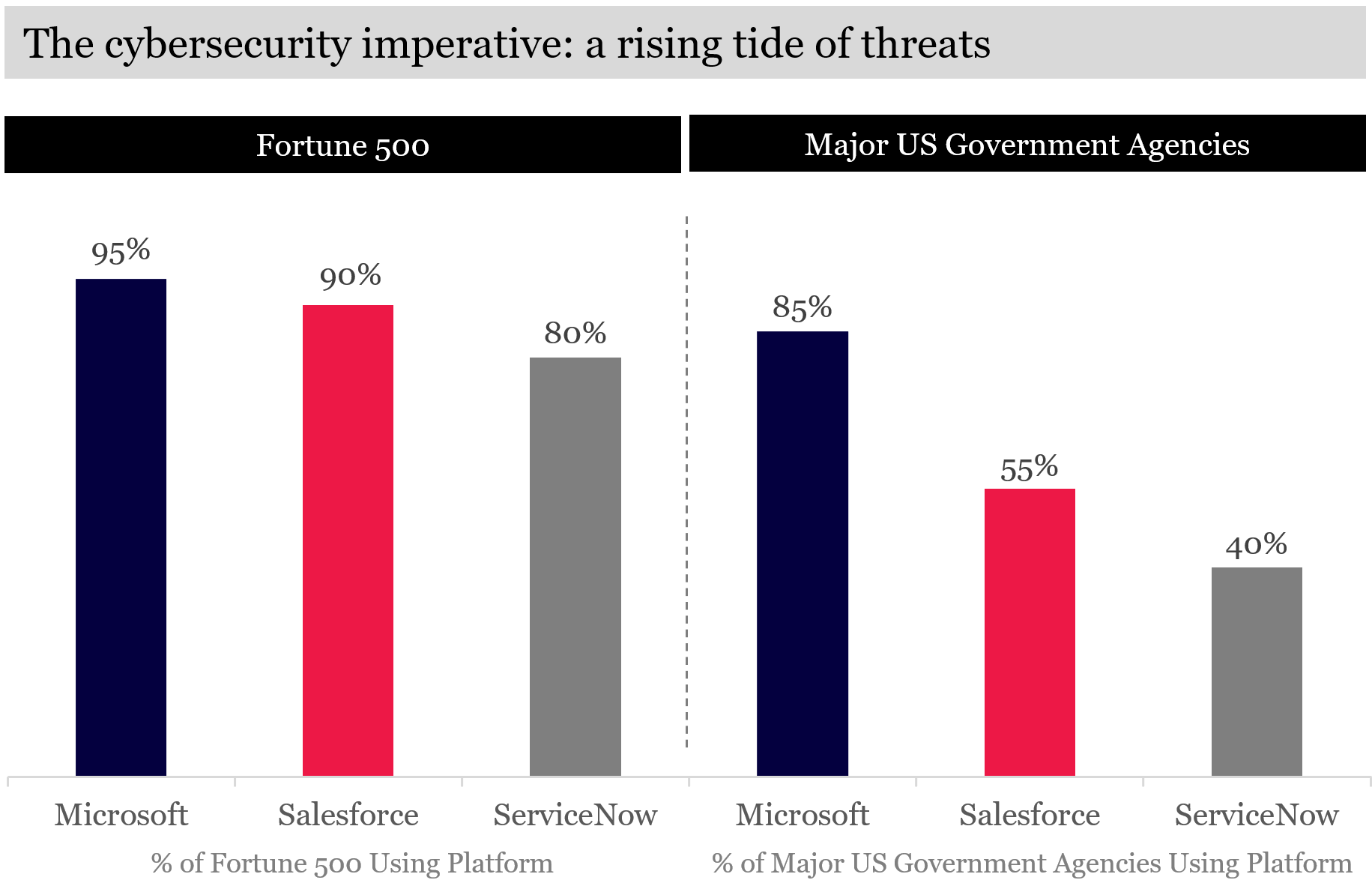

Multinational corporations and government agencies are increasingly turning to enterprise software platforms, trusting in their fortified defenses and robust architectures to provide the greatest chance of combating vulnerabilities and risks.

This is demonstrated by the proportion of Fortune 500 and major US government agencies that use these powerful enterprise software platform. Microsoft, Salesforce and ServiceNow are deeply represented within these multi-trillion-dollar cohorts.

Significant penetration of mission-critical customers globally

Source: Microsoft, The Tech Report, Ascendix, Montaka

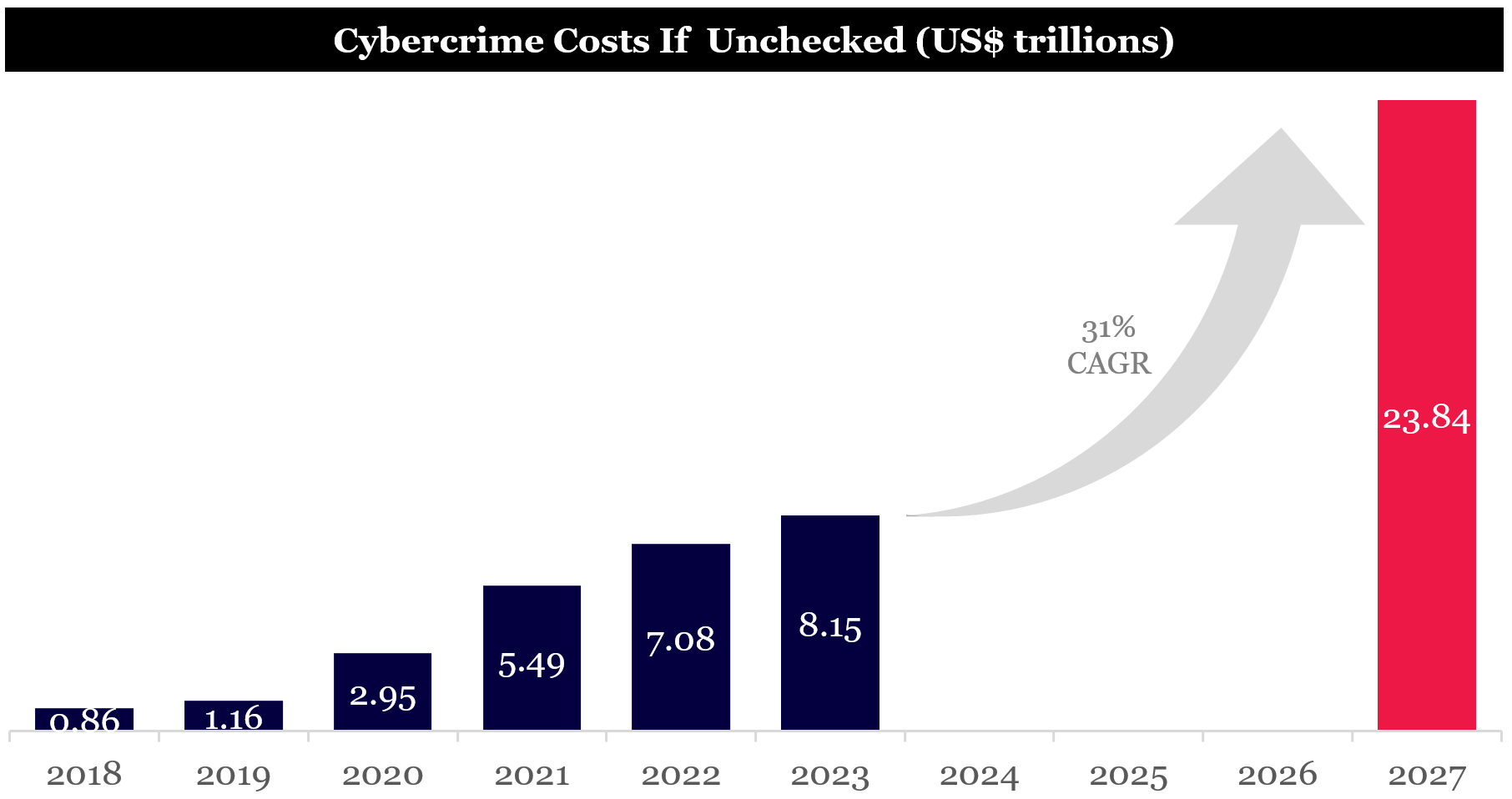

The increasing intensity of hacks and system flaws is likely to remain a persistent threat for decades to come. The U.S. government has estimated global cybercrime costs could triple from $8 trillion (2023) to $24 trillion by 2027 if left unchecked. This is a frightening number, but it creates an enormous incentive for technology firms to innovate and offset the multi-trillion-dollar dead-weight loss cybercrime represents.

Only a handful of companies are equipped to handle a complete response, mitigate the risks and deliver a holistic value proposition to customers, including the enterprise software platforms, Microsoft, Salesforce and ServiceNow.

Cybercrime represents a mind-boggling cost to the world

Source: U.S. Agency for International Development (USAID), Montaka

4. The AI advantage: data is the new oil

Artificial Intelligence is reshaping industries, and large platforms hold the trump card: data.

They’ve accumulated vast datasets over decades, providing the fuel for AI algorithms to learn and improve.

Smaller vendors simply can’t compete in this data-driven arms race.

Data, for example, is a major component of Salesforce’s competitive advantage. It holds 250 petabytes of highly curated and customer-specific data in its systems.

To put this in context, the Library of Congress, the largest library in the world, holds an estimated 235 terabytes of data (a thousandth of what Salesforce has).

“We’re now managing more than 250 petabytes of data for our customers. This is going to be absolutely critical as they move into artificial intelligence…[and generate] a level of productivity and profitability they’ve just never been able to see before,” says Marc Benioff, co-founder & CEO of Salesforce.

Investing in the future

If we view this all together, the implications for investors are clear:

- Talent Moats: Companies with strong engineering cultures and the ability to attract top talent are poised to win.

- Platform Power: The consolidation trend favors large, integrated platforms.

- Security Focus: Cybersecurity is non-negotiable in the digital age.

- Data Dominance: Companies and governments that leverage data will have a significant edge in the AI era.

Given this current environment and changing dynamics, we believe Microsoft, ServiceNow are Salesforce are high-quality businesses with a strong likelihood of long-term success

All three have entrenched customer relationships, scale distribution, product-market-fit and limited competition in key areas.

These companies check boxes in multiple ways.

Perhaps most importantly, all three remain significantly undervalued with respect to the durability and degree of value-generative growth that is contained within their businesses. Montaka holds significant positions in all three companies.

Amit Nath is the Director of Research at Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stock picks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us:

Note: Montaka is invested in ServiceNow, Microsoft & Salesforce.