|

Getting your Trinity Audio player ready...

|

– Lachlan Mackay

Back in 2019, we pitched US big-box specialist hard-surface flooring retailer, Floor & Decor, as our stock pick at the Sohn Conference.

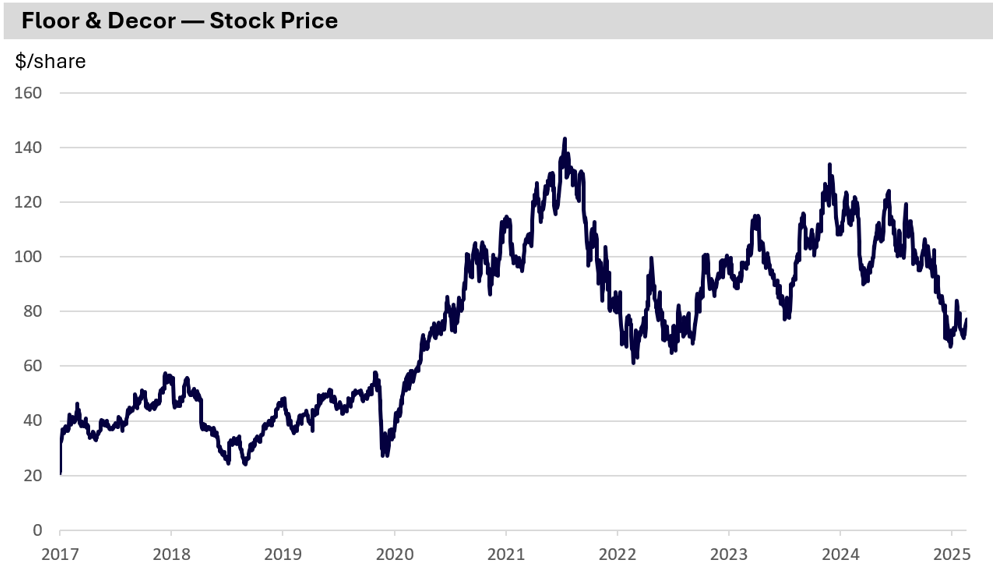

Since Sohn, Floor & Decor has grown its business through the pandemic, subsequent years of record low housing turnover and the recent tariff announcements. We believe these external challenges have been extrapolated by the market; meanwhile, Floor & Decor exhibits an even stronger business case than it did in 2019 and is poised to accelerate its growth over the coming years.

Below, we answer six key questions to demystify Floor & Decor’s performance and potential.

-

Let’s start with the housing market in the US. What’s the backdrop there today? And what does this mean for Floor & Decor?

The US is experiencing a multi-year cyclical downturn in housing market activity, with the number of transactions falling despite a relatively solid broader economy. Yet looking further out, the underlying structural growth drivers of the US housing market have never been stronger.

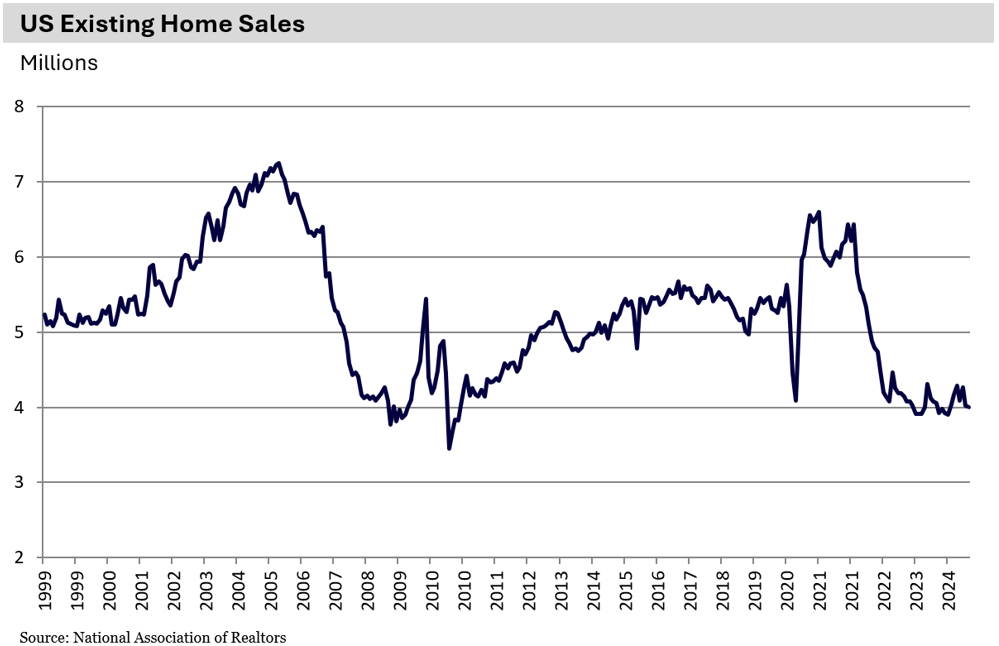

Existing home sales, which are a major driver of flooring demand, are down at levels we haven’t seen since the 2008 Global Financial Crisis. The primary reason for this is persistently high US interest rates; the 30-year fixed mortgage rate has been hovering around 7% for the past three years, a noticeable jump from 3-4% during the last decade.

About 60% of existing mortgages are locked in at rates at or below 4%. Naturally, if you have one of those great rates, you’re ideally not choosing to sell and refinance at 7%.

That’s effectively frozen a large portion of the housing market. And with that, the associated flooring replacements.

New housing starts are also quite subdued, running at 1960s levels. That’s shocking considering the US population is now growing at around 3.3 million people per year, much higher than the two million annually back in the ‘60s.

So new home construction hasn’t kept up with population growth, meaning there’s been an undersupply for the last two decades.

Moreover, the existing stock of US homes is getting older, with a median age of 44 years; many homes are even 70 or 80 years old. Older homes need to be renovated and improved more frequently, including new flooring.

A record $11.5 trillion exists in tappable home equity today – 50% higher than 2019 levels. So there’s plenty of funding available for home improvement projects once homeowners are comfortable with interest rates.

These factors have combined to slow down Floor & Decor’s business in the near-term. While the timing of a rebound is uncertain, we expect lower interest rates to unlock these large and durable drivers of pent-up demand.

-

Let’s now consider the hard surface floor industry in the US. What does that market structure look like and who have been the winners and losers in terms of market share over time?

The US hard surface flooring industry is valued at about US$40 billion annually. The market has a mix of a few large, well-known retailers and thousands of smaller, independent stores.

Although the market has been flat for the last three years, it should return to its structural GDP-plus growth. Hard floors are increasingly replacing carpet, evidenced by hard surface flooring’s market share expansion from 45% of the total flooring market a decade ago to around 60% today. We expect this trend to continue as older floors are replaced due to hard surface flooring’s long-term durability, ease of cleaning and aesthetic appeal.

Breaking down the market share over time, it’s clear who’s winning and losing.

As the only player that’s consistently gaining market share, Floor & Decor is the standout winner. They’re the second largest player in the market. Home Depot, while still the biggest, has seen its share remain flat over the past five years. And Lowes has experienced a slight decline in its share.

It is the thousands of smaller independent retailers that have felt the real pain. Unlike Floor & Decor, who have the scale to source direct from manufacturers, the independents typically buy inventory from distributors, which drives up their costs.

They therefore can’t match Floor & Decor’s everyday low pricing strategy, and their product range is much smaller. Floor & Decor even offers the same design and installation services that helped independents compete with Home Depot and Lowes. As a result, the independents are steadily losing market share.

We expect this trend to continue, and frankly, the longer the current market downturn lasts, the tougher it will be for these independents, which will only accelerate Floor & Decor’s market share gains.

We wouldn’t be surprised to see Floor & Decor overtake Home Depot in market share by 2030.

-

Looking inside the business itself, what are Floor & Decor’s competitive advantages and how are those evolving over time?

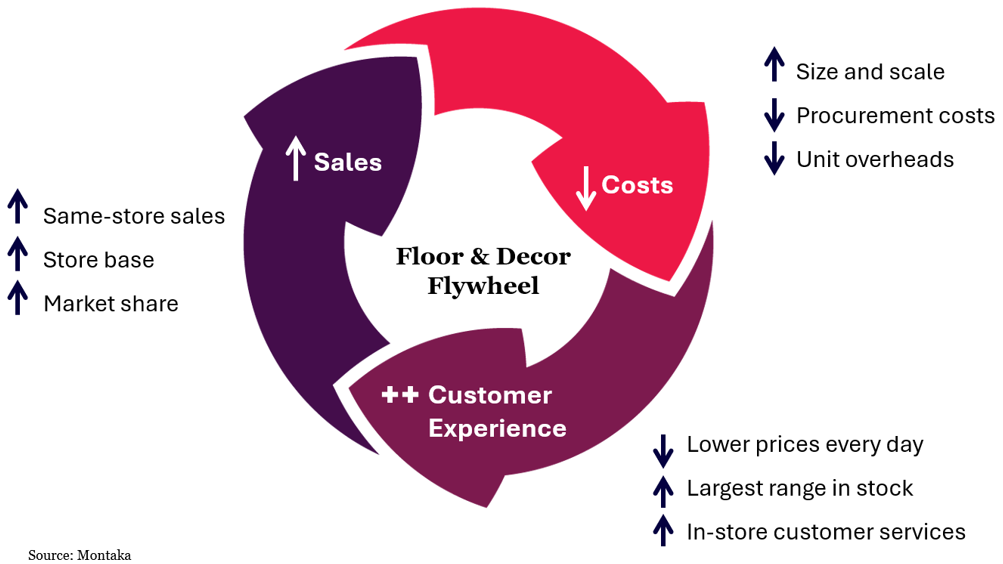

Floor & Decor’s competitive advantages are deeply rooted in its ‘flywheel’ business model, which continually reinforces the strength of the business over time:

- First, specialisation and economies of scale are key. Unlike general big-box retailers, such as Home Depot and Lowe’s, which dedicate a small fraction of their space to flooring, Floor & Decor specialises entirely in hard surface flooring. This gives them unmatched purchasing power with their over 240 global suppliers. As they grow and their market share increases, this scale advantage only gets stronger, and gives them even more bargaining power with manufacturers who rely on Floor and Decor as an increasingly important customer.

- Second, the customer value proposition and experience are central. Floor and Decor pass on those reduced costs to customers through consistently lower prices. When combined with an enormous selection (around 4,400 unique inventory pieces per store) and excellent in-store customer service, this drives adoption, trust and greater market share. Their ability to maintain and expand competitive price gaps is crucial.

- Finally, their store rollout strategy and the maturation of their store base are evolving advantages. With 254 stores and a long-term target of 500+ in the US, Floor and Decor have a substantial runway for growth.

-

What do the economics of each Floor & Decor store look like? And how are these combining with the company’s store roll out program to form the aggregated financial statements today?

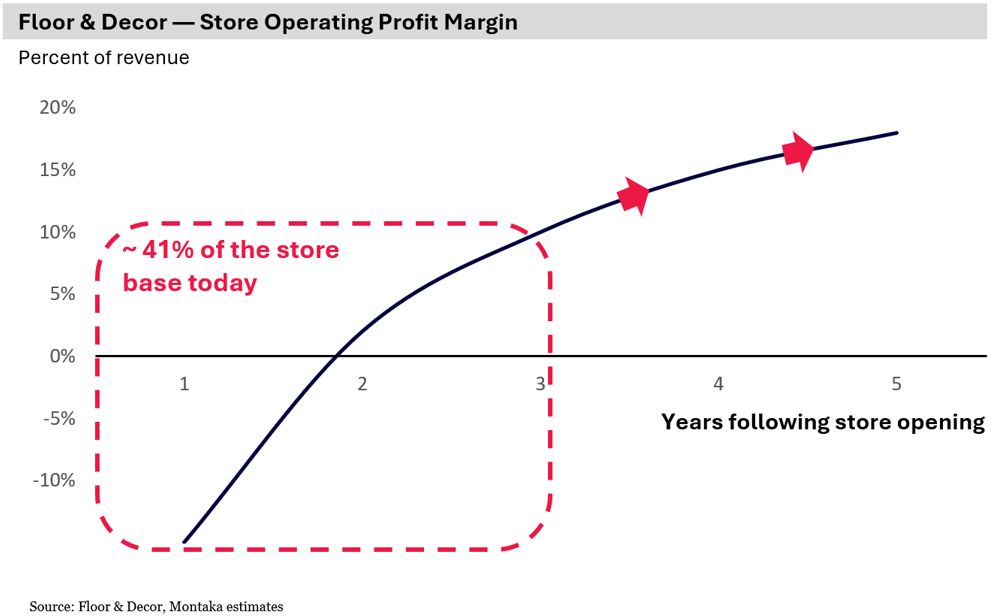

The economics of an individual Floor & Decor store follow a predictable trajectory: they start unprofitable and become increasingly profitable with age.

In its first year, a new store typically operates at a negative profit margin because sales are low while fixed costs and initial setup expenditures are high. By year three, however, the store has typically ramped up and generates mid- to high-single-digit operating profit margins. By then, the store is generating 50% cash-on-cash returns from the initial outlay. Beyond that, as they fully mature, individual stores can achieve impressive operating profit margins in the mid- to high teens.

Currently, almost half of their 254 stores are three years old or younger. This means a significant portion of their business is still marginally profitable at best, clouding the aggregate profitability.

Floor & Decor’s 500+ store rollout program is a continuous growth engine. Despite this challenging market, they’re still opening another 20 new stores this year. And these stores are truly enormous – the newly opened warehouse serving NYC spans 1.2 hectares.

Although the ongoing rollout masks the underlying profitability of the mature store base, it will shine through over the coming years as stores mature and the market rebounds.

-

How is the company managing the current tariff situation in the US?

The US import tariffs are affecting the entire industry; however, Floor & Decor’s structural advantages allow them to manage the changing situation more effectively than smaller competitors. Their scale and direct purchasing relationships with over 240 suppliers across 26 countries gives them leverage and flexibility to mitigate increased costs.

Since the 2018 tariffs, Floor & Decor has shifted sourcing from China, dropping from 50% to under 5% of sales by the end of this year. The US is now their largest supplier and, remarkably, gross margins increased throughout this transition.

Smaller independents rely on distributors to source product, who hold the bargaining power to pass on tariff costs to retailers, adding to their already higher cost base.

Interestingly, as tariffs are forcing competitors to raise prices, Floor & Decor has flexibility to expand the price difference between their products and competitors’, a key feature of their flywheel model. This builds trust with customers and could accelerate their market share gains.

So, while tariffs present a challenge for the industry, they actually reinforce Floor & Decor’s competitive position.

-

Why do you think the company is undervalued – and therefore an attractive investment opportunity today?

Recent conditions have masked the strength of Floor and Decor’s flywheel business model and underlying earnings power, creating a highly attractive investment opportunity.

Putting everything together, here’s what it means for the company’s financial future:

- Revenue: Currently US$4.5 billion, revenue is poised for significant growth from new store openings, the maturation of its large cohort of young locations, and an eventual market rebound.

- Profit Margins: The 6-7% operating margin is temporarily depressed by market weakness and the costs of the maturing store base. However, gross margins have risen throughout this period, proving strong cost management. As conditions improve, we expect operating margins could double.

- Overall Earnings Power: Current profitability is not indicative of the business’ true potential. The underlying tailwinds discussed could drive Floor & Decor to US$1 billion in annual operating profit by 2030.

Given Floor & Decor’s market cap is just US$8 billion today, we have a significant margin of safety in a high quality, growing business and expect to realise a home run investment over the long term.

Note: Montaka is invested in Floor & Decor.