|

Getting your Trinity Audio player ready...

|

In late June of this year Le Bourget Airport in north Paris played host to the 52nd Paris Air Show. The event is held every other year and provides manufacturers – primarily Airbus and Boeing – the opportunity to showcase their aircraft to potential customers and, more importantly, to negotiate deals for new planes. This year over 1,200 orders and commitments for planes worth more than US$100 billion were announced, demonstrating the continued strong demand from airlines. Behind the scenes Airbus management provided some deeper insights into the industry tailwinds that will sustain this demand over the next two decades. In this note we explore a few of them.

Replacement almost as important as growth

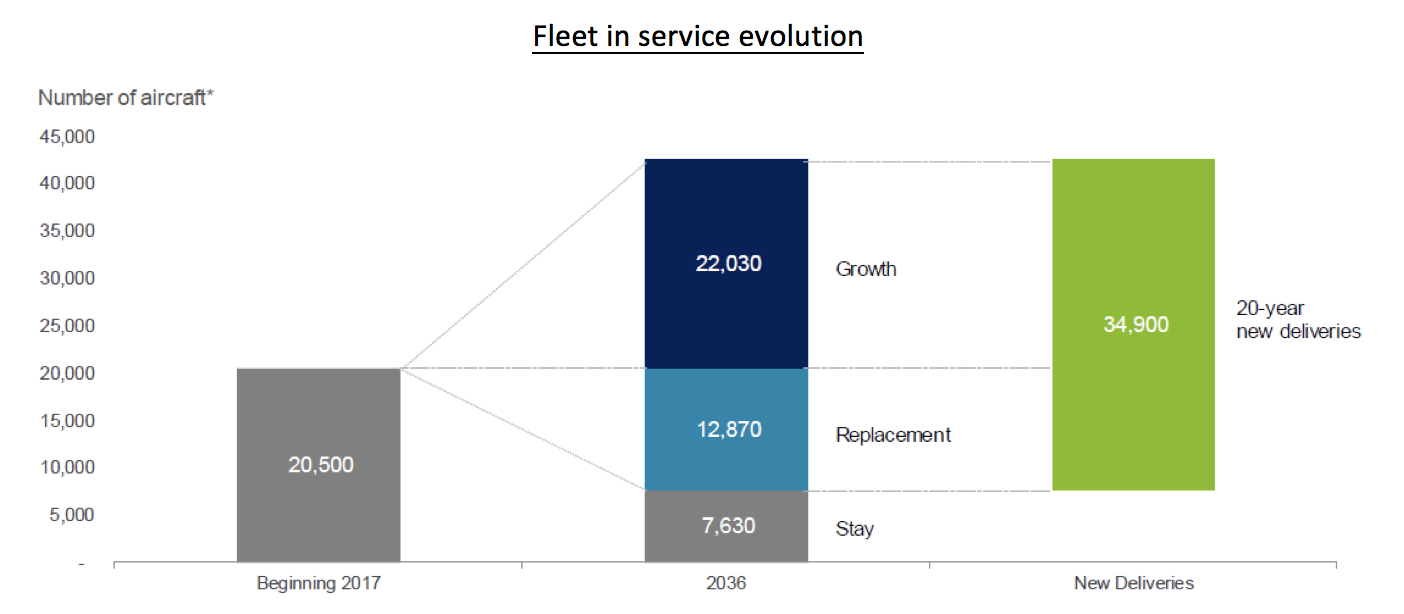

Airbus estimates that there are currently just over 20,000 aircraft in service around the world, and that this should expand to more than 42,000 by 2036. While this doubling in the global fleet of planes will require an additional 22,000 aircraft over 20 years the opportunity for manufacturers is even greater again.

Although a plane can last 30 years or more, they do become uneconomical or undesirable to operate with the passage of time, and ultimately find their way to the scrap heap. This means that over the same period another 13,000 planes will be required just to replace older models. Said another way, roughly 2 in every 5 planes forecast for delivery by 2036 are needed for airlines just to keep operating at current levels. This is a significant proportion of expected demand which is virtually certain to materialise.

Growth underpinned by emerging middle class

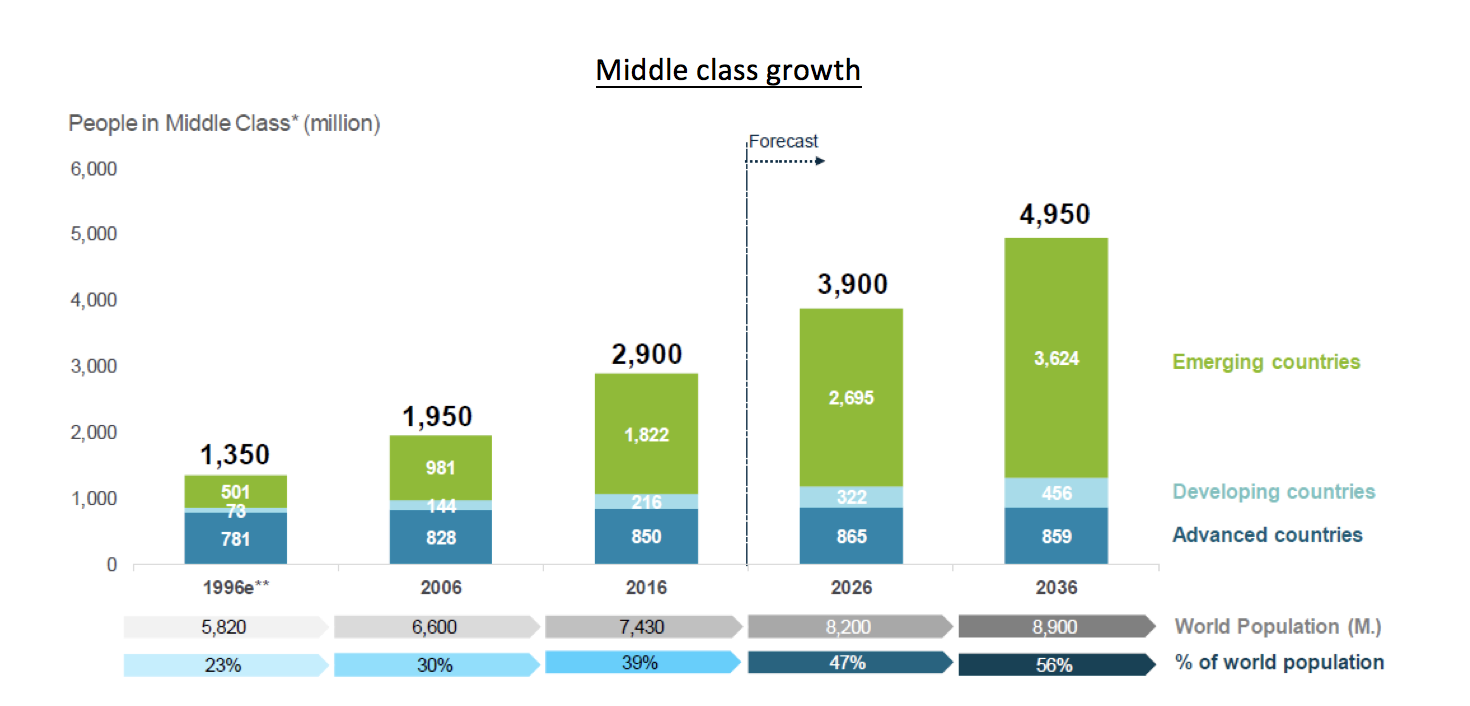

Over Airbus’ 20 year forecast period the middle class population is expected to almost double, driven primarily by emerging nations. Today the world’s middle class, defined as those households earnings between US$20,000 and US$150,000 each year, totals 2.9 billion and represents almost 40% of the total world population. In 2036 the ranks of the middle class should swell by 2.1 billion to 5 billion, representing 56% of the total world population. Moreover, the increase is virtually all driven by emerging countries.

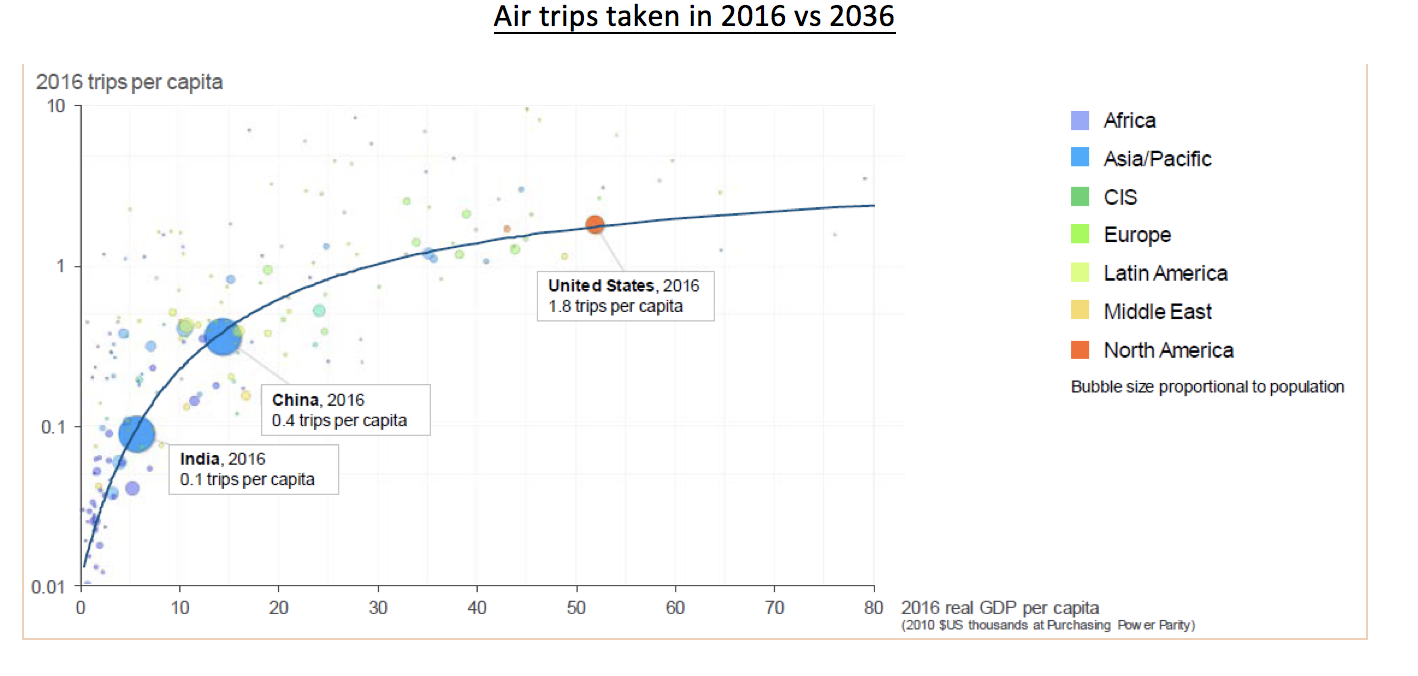

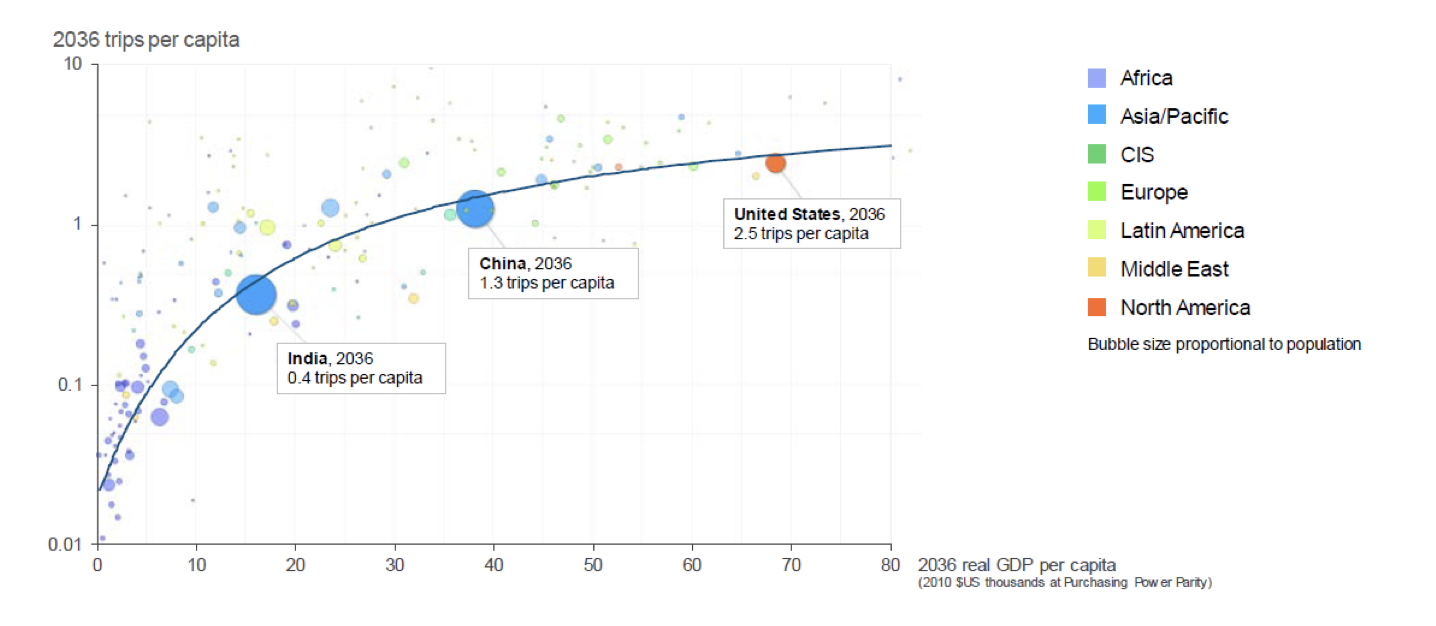

As the emerging middle class increases, more people will find themselves with discretionary income which can be spent on flying, among other luxuries. Consider that just 3 in 10 people from emerging countries took a flight in 2016, compared to 1.8 trip per American person per year. However, with the benefit of higher incomes, 8 out of 10 people in emerging countries will be flying by 2036.

No more room

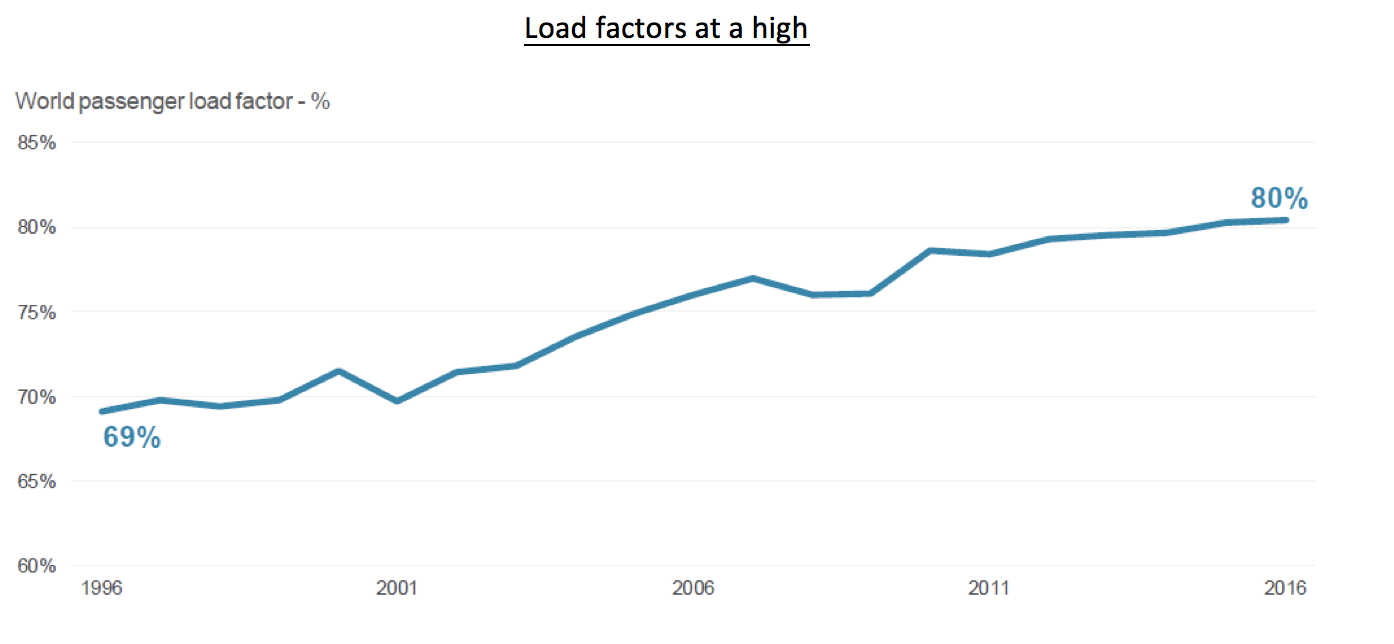

All of this growth in air passenger traffic will require an expansion in airline fleets. And this requirement is exacerbated by the strain currently being experienced by the world’s aircraft. Over the past 20 years load factors, or the “occupancy” rate of the average passenger plane’s seats, has increased from 69% to a current high of 80%. Accounting for necessary latency (an airline always needs to hold extra seats for peak season) there is not much potential to sweat these assets any harder. The only way to support growth in the both the long run and the short run is to operate more planes.

Airbus backlog well positioned

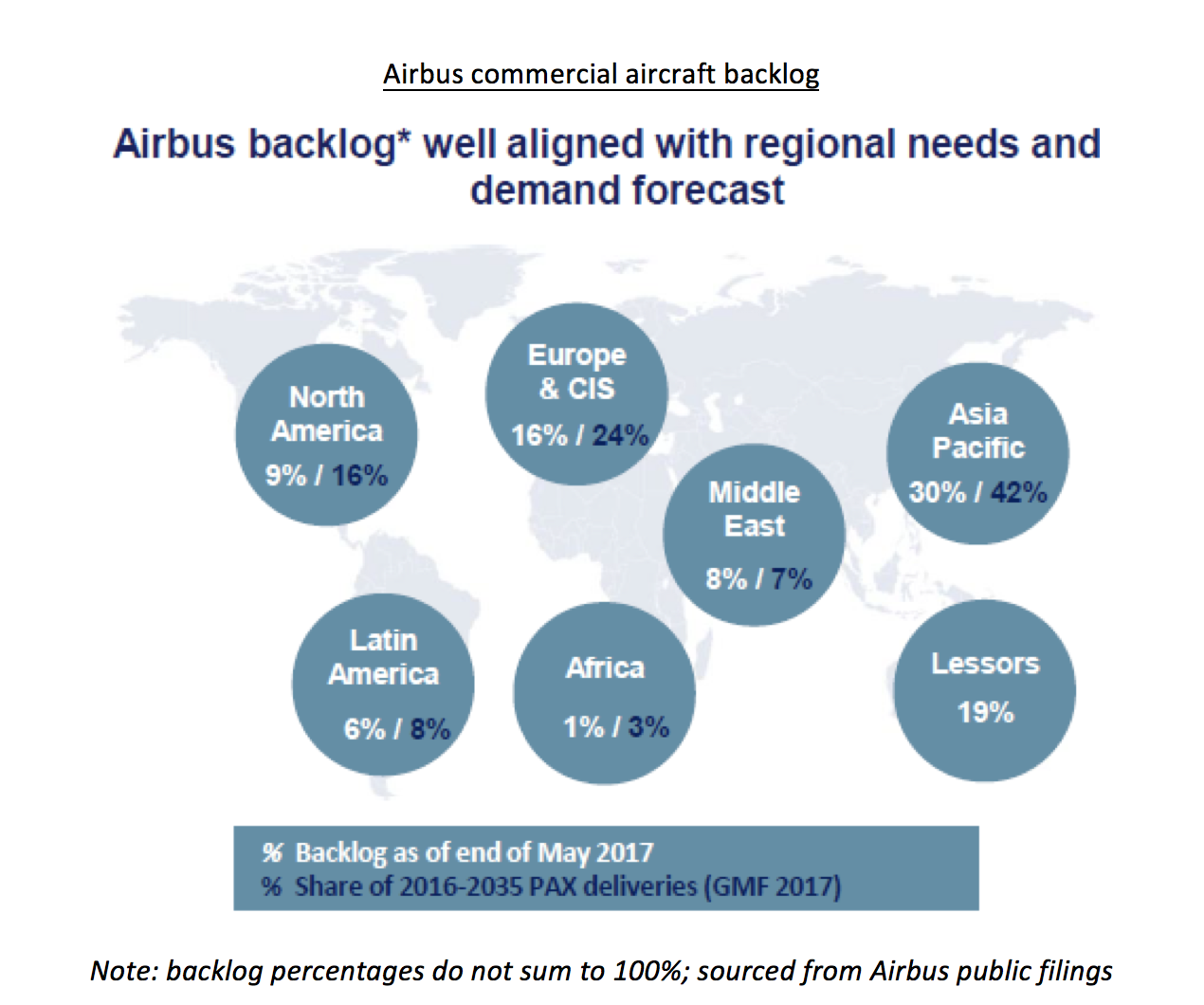

Against this backdrop Airbus has a backlog of orders stretching a decade into the future compared to its current rate of production. That is, Airbus has orders for almost 7,000 planes compared to 688 which it delivered to customers last year.

Furthermore, Airbus’ backlog is well aligned with demand, with 30% of orders marked for delivery to Asian airlines and another 19% to be received by lessors, who will in turn lease out the planes primarily to Asian and other emerging airline lessees.

A word on market implied expectations

Using Airbus’ forecast of almost 35,000 deliveries over the next 20 years implies 5%-plus average growth in the number of annual plane deliveries through 2036. However, at the current share price of around €74 our analysis suggests that the market is expecting only relatively flat growth in unit deliveries in the next two decades – and little to no upward pricing, even as new models are released. This is a source of variant perception and leads us to believe that despite a 41% rally in the Airbus share price the past year, the stock is still cheap.

Montaka owns shares in Airbus.

![]() Christopher Demasi is a Portfolio Manager with Montgomery Global Investment Management.

Christopher Demasi is a Portfolio Manager with Montgomery Global Investment Management.

To learn more about Montaka, please call +612 7202 0100.