|

Getting your Trinity Audio player ready...

|

The Montaka team has recently done some research on the Chinese death care industry. Clearly a unique space both as an investment opportunity and otherwise, I thought our insights might be novel and interesting for our readers. The industry is underpinned by a deep connection to China’s cultural history, with traditional funeral processes such as cremation observed for over 5000 years. Confucianism forms the backbone of Chinese ethics, which promotes filial piety and is manifest in the extravagant funerals performed for deceased family members.

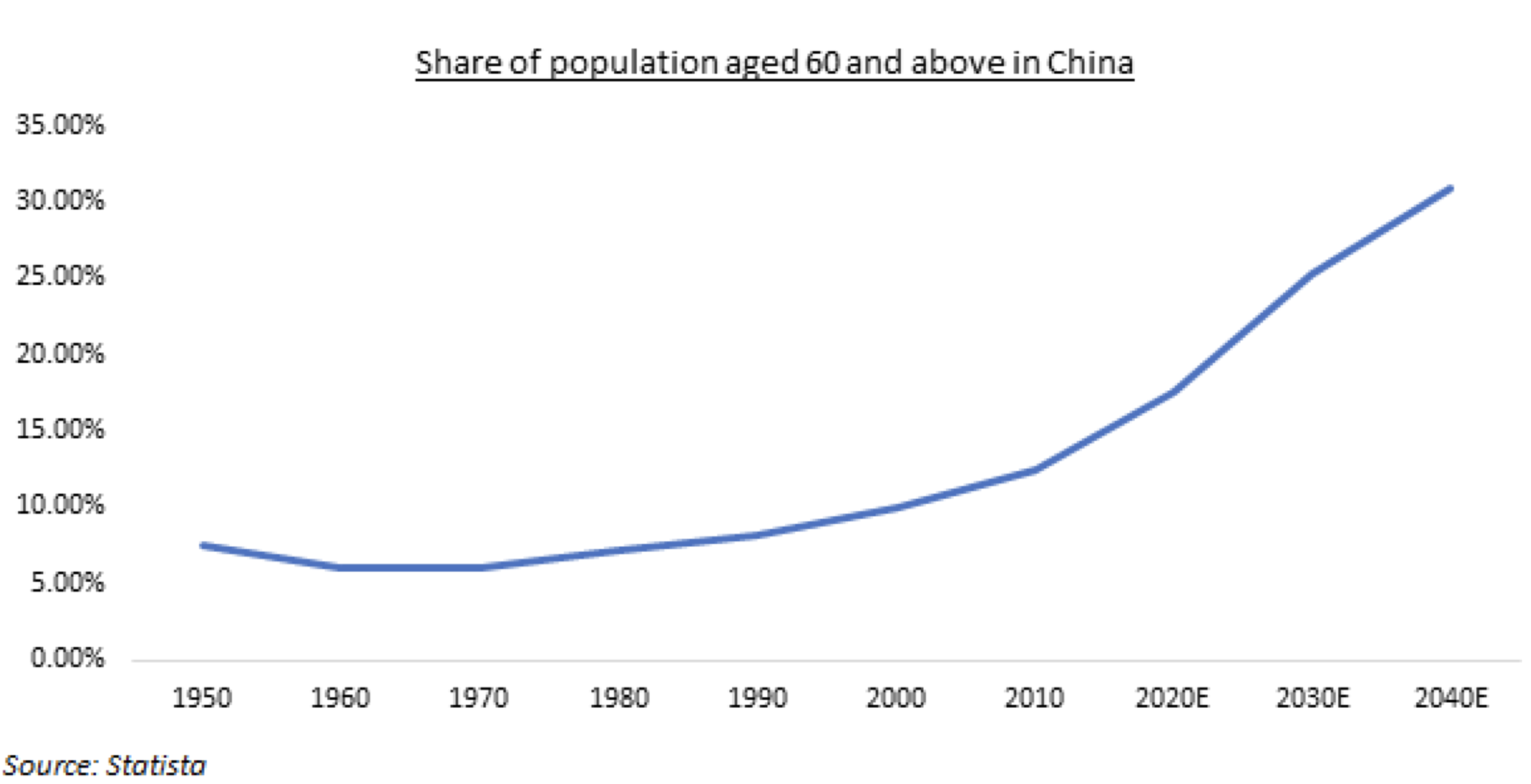

China is not only home to one fifth of the world’s population but also the fastest aging population in the world. 220 million Chinese were over 65 years old in 2016. And with nearly 10 million deaths in 2017, China’s death care market is the largest in the world.1According to the UN, it will take China just 20 years from 2017 for their proportionate elderly population to double from 10% to 20%. By comparison, it took Germany 61 years and Sweden 64.

As such an important part of Chinese culture, the market is highly fragmented and dominated by local government welfare services to ensure accessibility for lower income families. However, the private industry emerged in the 1980s to take advantage of shifting regulation and has grown at up to 30% per year by offering high quality, personalised services to China’s expanding urban middle class.

The urbanisation of Chinese cities has resulted in an overcrowding of many major areas. This population density has had a range of effects on the cemetery industry. With such little urban space, the government has stopped granting certificates to develop new cemetery land. For instance, in Shanghai no new land has been approved for over 10 years and no new certificates for 20. This means the incumbent players in the private market have full control of the scarce supply of burial plots and, with that, their rapidly growing price. Moreover, the average size of a burial plot has shrunk considerably. A 5-6 square metre burial plot now costs over RMB15,000 (US$2,174) and can be occupied dozens of family members. The limited supply of land forms part of the unique barriers to entry into the death services market, where regional reputability takes decades to establish and a natural psychological resistance restricts the potential employee base.

Fu Shou Yuan International Group (FSY) is the largest private death service business in China. They began operating in Shanghai in 1996, where their original cemetery park still generates over 50% of their total revenues today. Since listing publicly on the Hong Kong Stock Exchange in 2013, the company asserted itself as an effective monopolist in multiple cities through aggressive M&A expansion. The fragmentation of the market and difficulty to acquire one of the few certificates in each city mean that FSY have become the only company with operations in more than one province.

While operating in many cities, Shanghai remains key to growth. In our discussions with industry experts we learnt that unlike the rest of the industry where nepotism and illegal practices are common, FSY’s business is completely market driven. Not only do FSY have control of the Shanghai market such that they can grow their average selling price as they wish, but with multiple revenue sources they can adjust their profit composition from their various business units.2The government has attempted to combat the consistent rise in market prices with a “1 plus 1” policy, where a welfare cemetery is added with every for-profit cemetery approval. However, the current state of non-approvals in major urban cities mean burial plot prices will continue to rise by market forces.

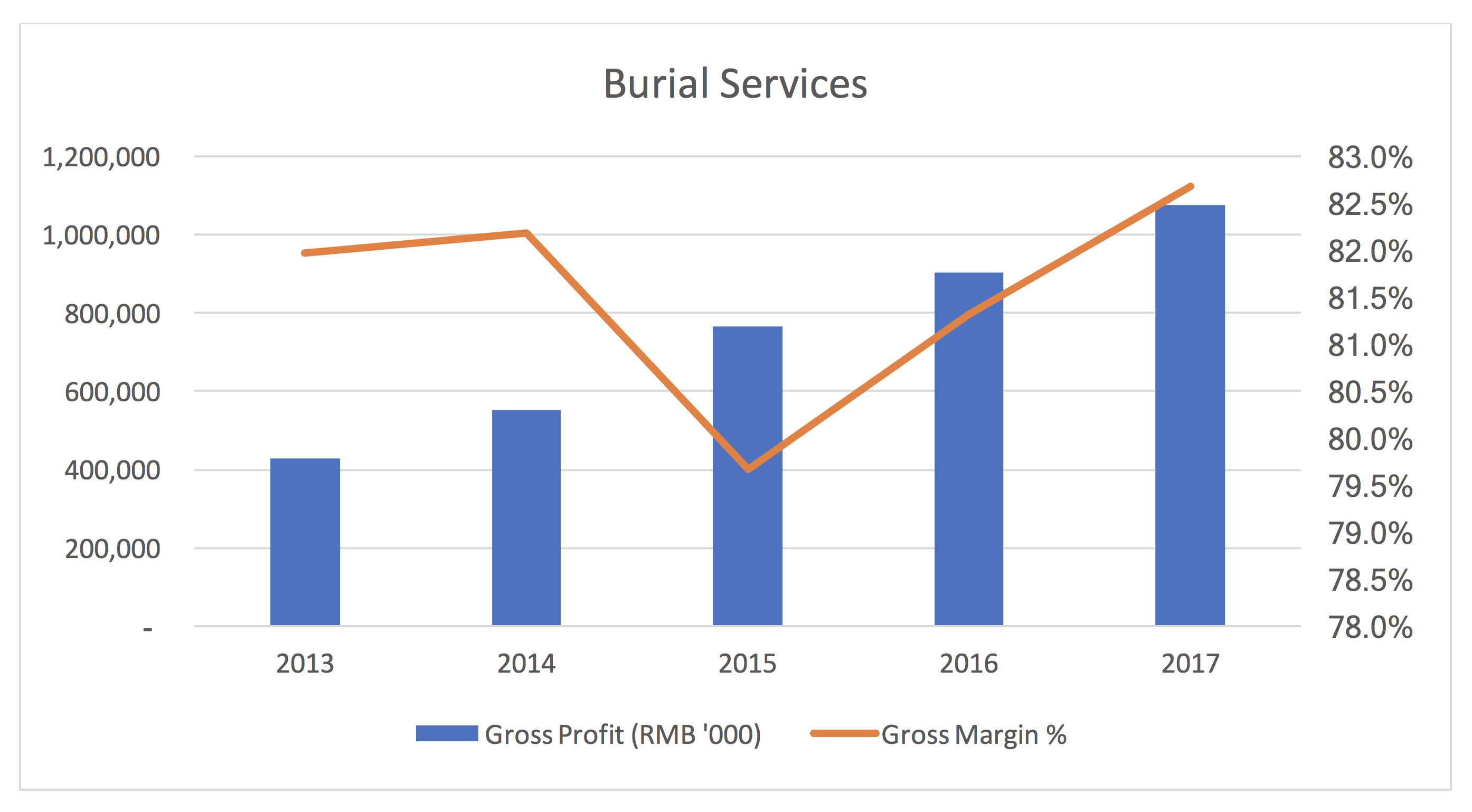

FSY currently have 2.2 million square metres of saleable land in China. Even their original cemetery park in Shanghai is only 40% full and the remaining land is expected to last 50-60 years. They make over 80% gross profit on burial services and management forecasts a continuation of their stable 10-15% organic sales growth in years to come, which industry experts agree is achievable.

Source: Company Reports

Whilst these burial services made up 86% of FSY’s 2018 revenue, the company is seeking another opportunity in funeral services. Today’s major industry trend is the government’s deregulation of the funeral service market, shifting state-controlled operations to private companies. Cremation is mandatory in much of China, with a 100% cremation rate in major cities. The government imposes that no business can profit from cremation, although added services such as urns, flowers, worship rooms and other funeral traditions can be capitalised on. FSY believe that ultimately demand for these services will be market oriented and have intensified their push to take any business off the government’s hands.

As with any company, FSY have some real challenges to overcome to sustain their business prospects. After establishing themselves in each new city, management has struggled to acquire local expertise to effectively run their operations. As such, many of their new cemeteries and funeral parlours are struggling to compete with established players and earning very little profit, some even less than the interest payments needed to finance their acquisition. It will likely take years to establish trust in each city, truly understand local cultures and learn how to compete effectively; however, industry experts tell us that the management of FSY are unparalleled and should have the experience to deliver over time. In the meantime, they are flexible in their established cemeteries such that they can increase price or volume to hedge against potential loss-making cemeteries.

Provided FSY can organise their local teams, China’s expanding middle class offers a major economic opportunity. By establishing businesses in lower tier cities, FSY has exposed themselves to China’s fastest growing wealth. Management hopes that this translates into increased demand for higher value services over time.

Nonetheless, a key industry risk is always going to be the somewhat unpredictable Chinese government. The government have not updated their core regulation model in over 20 years, and the competitive landscape has since become far more complex. New legislation is currently being drafted, and although FSY informed us that they are being included in discussions, their market orientation is clearly at odds with the government’s need to deliver affordable services to the population.

It has been exciting to learn about sacred Chinese culture through this lens. As the industry grows and changes with coming regulation, the Montaka team will continue to look for indications that FSY’s business fits our price to risk framework, ideally becoming a source of potential upside.

1China had approximately 9.88 million deaths in 2017 according to World Bank data

2ASP grew 7.5%, 17.2% and 8.9% the last 3 financial years respectively, per Fu Shou Yuan company reports

Lachlan Mackay is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Lachlan Mackay is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.