|

Getting your Trinity Audio player ready...

|

Trinity Industries (NYSE: TRN) is a U.S.-based manufacturer of freight and tank railcars; as well as a lessor of railcars. TRN benefited immensely from the crude-by-rail boom in North America over the last five years, given it was the largest supplier of tank railcars to that market. The Company’s revenues increased at an average rate of 34% per annum between 2010 and 2014, with operating profit growing at an incredible 44% per annum over the same period. Upon closer inspection of TRN’s accounting, however, it becomes clear that there’s more to this spectacular growth than meets the eye.

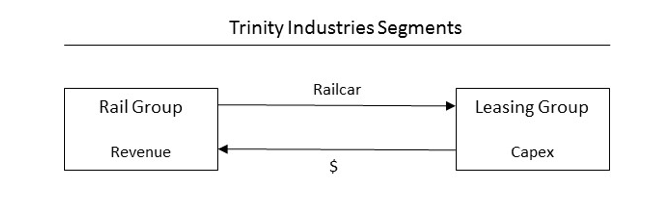

TRN’s dual role as both a manufacturer and lessor of railcars creates an opportunity for management to report numbers that appear more favorable than the reality of the business would suggest. A glance at TRN’s 4Q15 segment revenue growth helps illustrate this point.

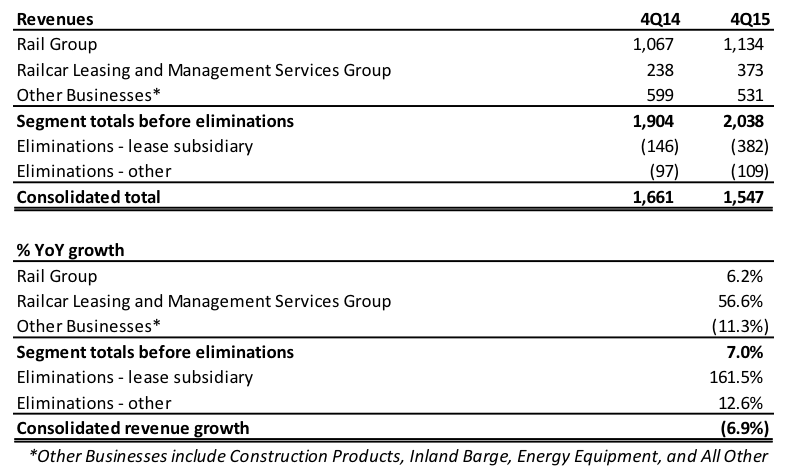

TRN’s two most important segments, the Rail Group and the Railcar Leasing Group, increased 4Q15 revenues by 6% and 57%, respectively. The strong performance of these key segments contributed to total segment revenue increasing by 7%. However, despite the robust segment performance, consolidated revenue actually decreased by 7%. As a result, if one were to simply look at the segment financials in isolation, they would be misled as to the true financial state of TRN.

Technique #1: Boosting perceived revenue growth of segments

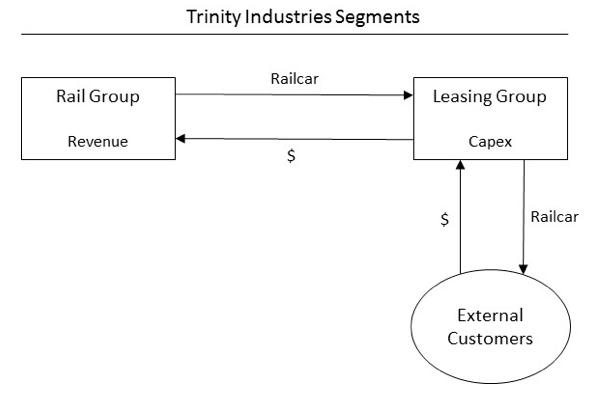

TRN’s Rail Group sells railcars to its Leasing Group, resulting in the recognition of revenue for the Rail Group. Using your Leasing Group to buy railcars from yourself has the effect of making the Rail Group segment revenue look larger than it actually is. In reality, this transaction is akin to taking money out of one pocket and putting it in the other.

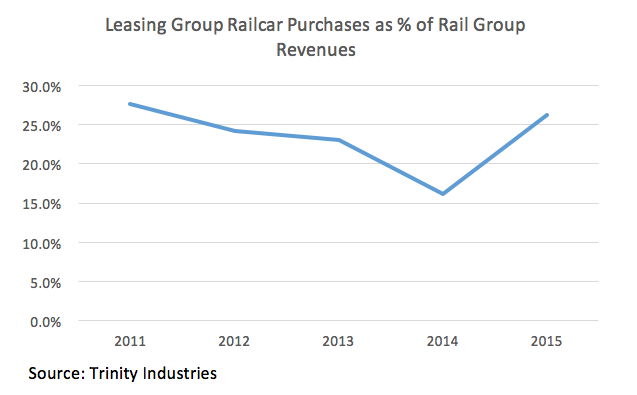

In FY15, Trinity’s sales of railcars to its own leasing business accounted for 26% of the Rail Group’s revenues, and these intercompany railcar sales have historically accounted for a material portion of the Rail Group segment’s revenues.

Although this technique improves the reported revenue of the Rail Group, accounting rules prohibit double-counting of revenue and this necessitates the elimination of this intercompany revenue upon consolidation of Trinity’s segments. The line item “Elimination – lease subsidiary” explains the aforementioned discrepancy between the 7% segment revenue growth and the 7% consolidated revenue decline; TRN must subtract from total segment revenue the portion of revenue it recognizes from selling railcars to itself.

It is worth examining how these transactions affect TRN’s financials to help make clear what is occurring.

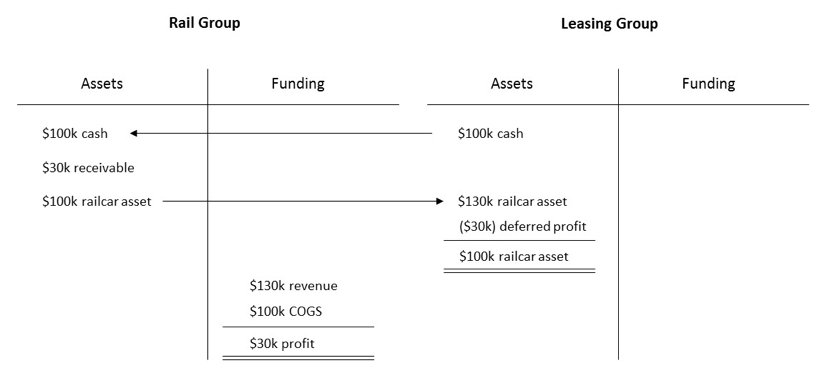

- Imagine that the Leasing Group pays $100k cash (accounted for as capex) for a railcar asset worth $100k from the Rail Group.

- How then does the Rail Group report a profit? Well it could simply create a notional price for the railcar that is greater than its cost – let’s say $130k. The Rail Group then reports revenue of $130k, cost of goods sold of $100k, and a $30k profit. Additionally, a $30k receivable would appear on the Rail Group’s balance sheet.

The offsetting item on the Leasing Group’s balance sheet is a $30k contra-asset account called “deferred profit” which reduces the notional value of the railcar asset of $130k back to its actual value, $100k, as shown below.

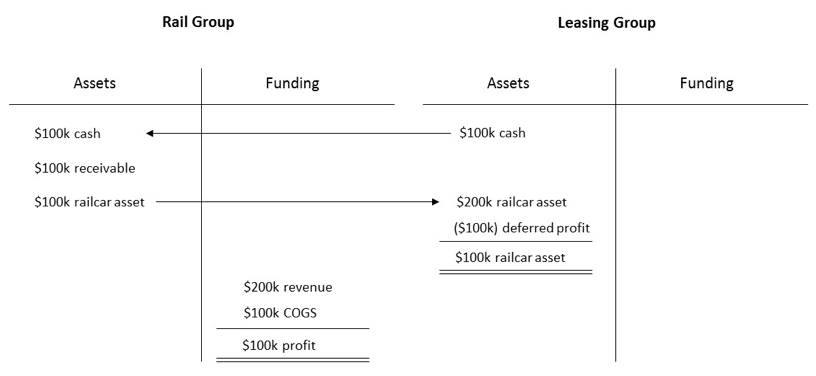

In this scenario, the Rail Group makes a $30k gross profit, or 23% gross margin. But what if TRN’s Rail Group were to sell the railcar for a notional $200k rather than the $130k used in the above example? This would have the effect of boosting the Rail Group’s perceived revenue even further, with its gross margin increasing to a juicy 50%.

In this scenario, the Rail Group makes a $30k gross profit, or 23% gross margin. But what if TRN’s Rail Group were to sell the railcar for a notional $200k rather than the $130k used in the above example? This would have the effect of boosting the Rail Group’s perceived revenue even further, with its gross margin increasing to a juicy 50%.

Somewhat curiously, the Leasing Group sells many of the railcars it bought from the Rail Group to external customers. It is worth questioning the rationale behind these transactions. Why wouldn’t the Rail Group, which is in the business of manufacturing and selling railcars, sell those railcars directly to external customers?

Somewhat curiously, the Leasing Group sells many of the railcars it bought from the Rail Group to external customers. It is worth questioning the rationale behind these transactions. Why wouldn’t the Rail Group, which is in the business of manufacturing and selling railcars, sell those railcars directly to external customers?

The answer is that it should make no difference; and economically this is the case. But optically, this arrangement allows the Leasing Group to report revenues and profits in addition to the revenues and profits reported by the Rail Group for the same railcars.

The answer is that it should make no difference; and economically this is the case. But optically, this arrangement allows the Leasing Group to report revenues and profits in addition to the revenues and profits reported by the Rail Group for the same railcars.

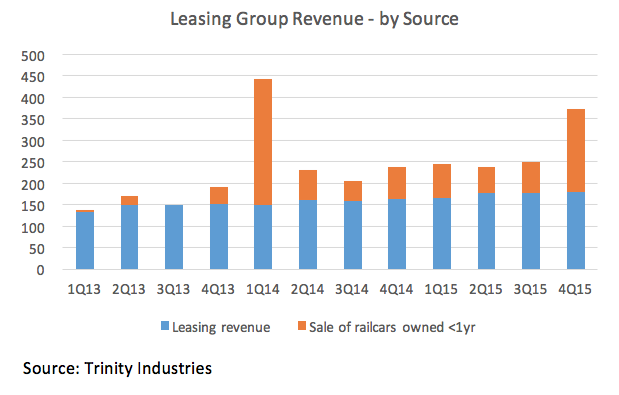

The above chart reveals that, in some quarters (4Q15 and 1Q14), a very significant portion of Leasing Group revenue is from the sale of railcars. Segment revenue growth in these quarters is boosted materially by these sales. The optical enhancements don’t end with just revenues, however. TRN management are also able to make the leasing business look more profitable than it actually is.

Technique #2: Boosting perceived profitability of the Leasing Group

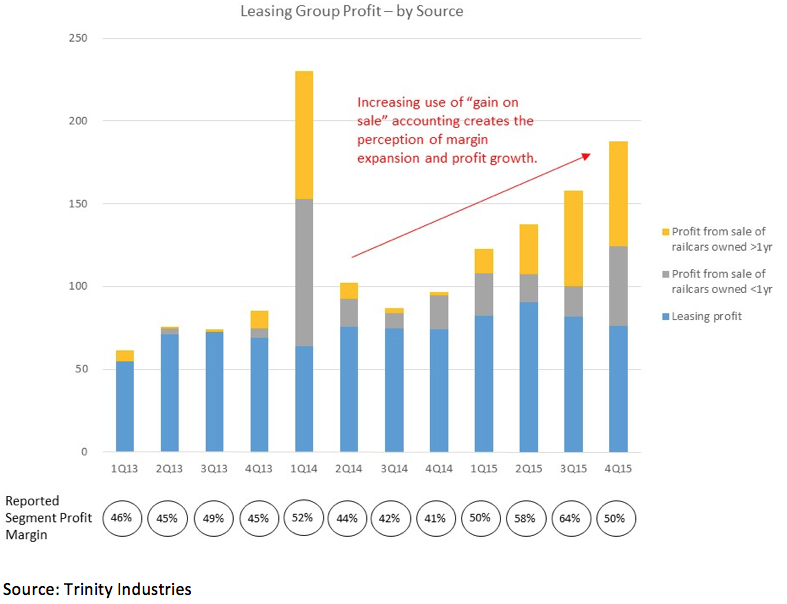

In addition to selling railcars owned for less than one year, TRN’s Leasing Group can also sell railcars owned for more than one year. This distinction is important from an accounting perspective. The accounting rules distinguish between the sale of assets that are owned for less than one year; and those that are owned for greater than one year:

- For railcars owned for less than one year, the proceeds from the sale are recognized as revenue and there is an associated cost of sales. For example, a railcar might be sold for $130k that costs $100k. The gross margin on this sale would be 23%.

- For railcars owned for greater than one year, no revenue is recognized upon sale. Instead, a gain on sale is recognized if the asset is sold for greater than its book value. Because this is a gain, there are no costs recognized against this form of income through the Profit and Loss Statement. In this sense, the profit margin on this incremental form of income is 100%.

The above points are crucial in understanding how TRN’s reported profits of its leasing business appear better than they truly are. As can be seen in the chart below, the yellow portion of the bars represents profit from the sale of railcars owned for more than one year. The lumpiness of these sales is particularly notable, given the outsized impact on profits these sales have.

This is not the first time that TRN management has sold railcars to boost the Leasing Group’s profits. The reported 1Q14 segment result was superficially strong due to a significant number of sales made of railcars owned for more than one year. This result helped propel TRN stock to an all-time high. Coincidentally, just a short number of months after this inflated result was reported, TRN management sold more than $20 million of stock. Unfortunately for remaining shareholders, the TRN share price proceeded to halve over the subsequent 3 months.

Why might management be resorting to such measures to artificially boost their segment results yet again? Well it just so happens that the previously lucrative tank car market they were selling into is now grossly oversupplied. Lease rates for these tank cars have cratered and railcar orders for TRN have fallen off a cliff. Consider that the number of railcar orders received by TRN in 4Q15 declined by an astonishing 86% from the prior year!

TRN’s ability to weather the railcar glut is weakened by the fact that its debt is larger than its market capitalization. Moreover, TRN has a number of off-balance sheet operating lease arrangements whereby it sells railcars into a trust, enters into a long-dated operating lease agreement for the railcars, and then subleases these railcars to third-party customers. Repayments on these operating lease agreements are similar in nature to interest repayments on debt, in that they represent an obligation that TRN must pay. The fact that these obligations are held off-balance sheet understates the true financial leverage of the business.

Unfortunately for TRN, its non-railcar businesses are unlikely to provide a source of reprieve for shareholders. One of TRN’s other segments which manufactures highway barriers was sued and had a District Court enter a judgment of $682m against Trinity, an enormous sum in light of TRN’s $2.5bn market capitalization. Despite the unfavorable court ruling, TRN maintained that it had independently tested the highway barriers with favorable findings. TRN has made no accrual for this potential loss.

Given the tumultuous set of events that have besieged the Company, it becomes much clearer why TRN management are doing all they can to make things seem better. Regardless, the future looks less than bright for Trinity Industries.

* * *

Montaka is short the shares of Trinity Industries (NYSE: TRN).

![]()

George Hadjia is a Research Analyst with Montgomery Global Investment Management. To learn more about Montaka, please call +612 8046 5000.

![]()

Andrew Macken is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.