Montaka Global

- Complex ETF

Extension Fund

ASX: MKAX

FUND OVERVIEW

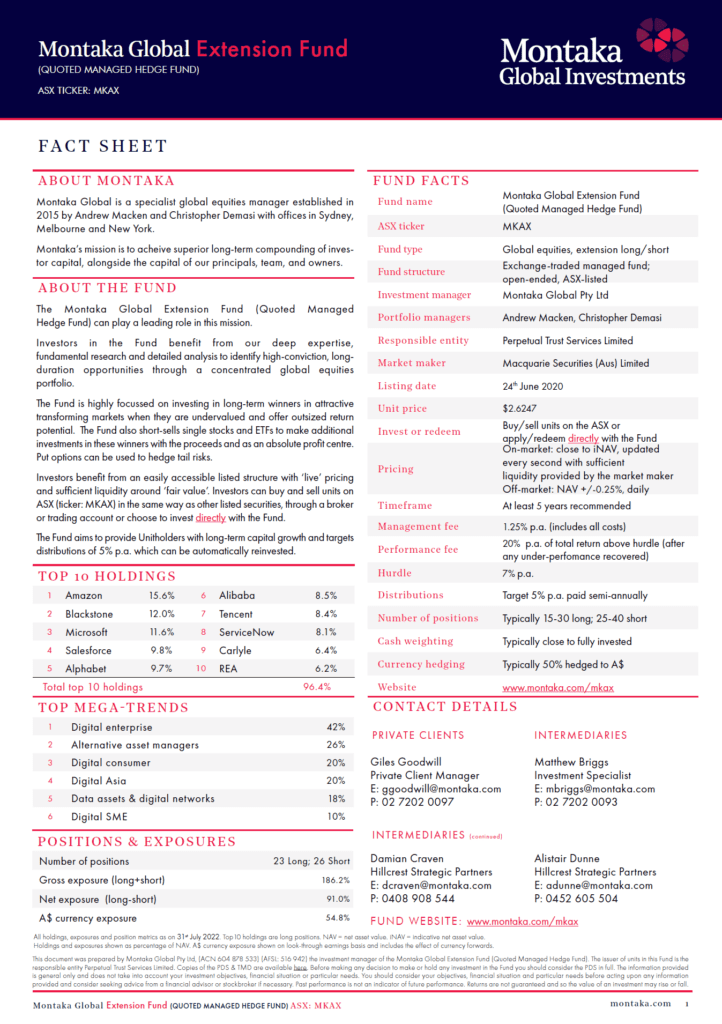

The Montaka Global Extension Fund – Complex ETF (ASX: MKAX) is highly focussed on investing in long-term winners in attractive transforming markets when they are undervalued and offer outsized return potential. The Fund also short-sells single stocks and ETFs to make additional investments in these winners with the proceeds and as an absolute profit centre.

Investors benefit from an easily accessible listed structure with ‘live’ pricing and sufficient liquidity around ‘fair value’. Investors can buy and sell units on the ASX (ticker: MKAX) in the same way as other listed securities, through a broker or trading account or they can also choose to invest directly with the Fund.

- ASX-listed with additional direct unlisted access

- Concentrated portfolio of typically 15-30 long and 25-40 short positions

- Long-term capital growth

- Target distributions 5% p.a.

- Inception June 2020

- View the Fact Sheet for more information

Zenith Product Assessment (Nov 2024)

“[Our] conviction in the Fund is underpinned by the highly capable investment team.”

HOW TO INVEST

3 easy ways to access the Montaka Global Extension Fund – Complex ETF (ASX: MKAX)

-

Invest through the ASX

Invest through the ASX

-

Invest directly with the Fund

Invest directly with the Fund

-

Speak to a Financial Adviser

Speak to a Financial Adviser

How to invest ?

- Open your online broking or stock trading platform account

- Use the ASX ticker ‘MKAX’

- Select an amount to invest or the quantity of MKAX units to buy

Additional information:

View the price:

*iNav

$0.00

Last Updated

dd.yy.mm

* The iNAV per Unit will be updated for foreign exchange movements in the Fund’s portfolio stocks by individual stock domicile and will also be updated in respect of stocks that have live market prices during the ASX Trading Day. The Fund may use one or more other index futures, such as S&P futures, as a proxy to account for movements in the Fund’s exposure to certain stocks and derivatives that do not have live market prices during the ASX Trading Day.

Contact us to know more

Please click below to complete the online application form

Or please email us at office@montaka.com to receive a copy of the application form.

Additional information:

Speak with your Adviser or Broker and let them know the ASX ticker code ‘MKAX’.

To locate an Adviser in your area you can visit one of the below associations:

Additional information:

Price

*iNav

$0.00

Last Updated

dd.mm.yy

* The iNAV per Unit will be updated for foreign exchange movements in the Fund’s portfolio stocks by individual stock domicile and will also be updated in respect of stocks that have live market prices during the ASX Trading Day. The Fund may use one or more other index futures, such as S&P futures, as a proxy to account for movements in the Fund’s exposure to certain stocks and derivatives that do not have live market prices during the ASX Trading Day.

Performance

| MKAX | |

|---|---|

| 1 month | -10.1% |

| 3 months | -11.5% |

| 6 months | -14.3% |

| 12 Months | -15.8% |

| 2 years (p.a.) | 12.6% |

| 3 years (p.a.) | 23.2% |

| 5 years (p.a.) | 7.5% |

| Since inception (p.a.) | 7.1% |

As at 31 January 2026

Fund inception date: 24 June 2020

Performance is net of fees and assumes distributions are reinvested. Past performance is not an indicator of future performance.

INVESTOR CENTRE

The Montaka unit register is maintained by Apex Fund Services Pty Ltd (formerly known as Mainstream Fund Services Pty Ltd)

By visiting the Apex Investor Centre, unitholders can:

View their holding details

- Register to receive Annual Reports electronically

- Access and update information held by our Unit Registry

- View information relating to dividend and transaction history & tax statements

- Provide the Tax File Number or ABN

- Download forms, change address details, update communication preferences and add or amend direct credit details.

When you visit the Apex Login page you will need your Security Reference Number (SRN) or Holder identification Number (HIN) to verify your identity. Your SRN/HIN is available on your holding/transaction and distribution statements.

For all other questions, please contact the Registry:

Apex Fund Services Pty Ltd

GPO Box 4968

Sydney NSW 2001

P: +61 1300 133 451 (toll-free within Australia )

F: +61 2 9251 3525

DISTRIBUTION

| Date | Distribution (A$) per unit | Reinvestment per unit |

|---|---|---|

| December 2025 | 42.91 cents | $3.8109 |

| June 2025 | 10.1 cents | $4.1168 |

| December 2024 | 11.1 cents | $4.3948 |

| June 2024 | 8.8 cents | $3.4853 |

| December 2023 | 7.4 cents | $3.0454 |

| June 2023 | 6.6 cents | $2.6820 |

| December 2022 | 5.6 cents | $1.9565 |

| June 2022 | 6.2 cents | $2.4717 |

| December 2021 | 10.5 cents | $3.8600 |

| June 2021 | 9.3 cents | $3.6569 |

| December 2020 | 8.6 cents | $3.3495 |

FAQs

The Fund invests in a portfolio of quality global equities listed on major global exchanges (The Long Portfolio) purchased at a discount to Montaka Global’s estimate of their intrinsic value. The Fund also seeks to profit through borrowing and short selling (The Short Portfolio) the securities of companies Montaka Global believes are, for example, deteriorating, misperceived and overvalued. From time to time, the Fund may employ tools to manage downside risk, including the purchase of listed put options and exchange traded funds.

The specific risks of investing in the Fund are described in section 5 of the PDS.

An active Exchange Traded Managed Fund (ETMF) is, most simply, a managed fund that is traded on a stock exchange such as the ASX. They are built like managed funds, but trade like shares, meaning that pricing is transparent and they can be bought and sold during any trading day just like ordinary shares.

Active ETMFs share many similarities with exchange traded funds (ETFs) but have one key difference: ETFs are “passively managed” and aim to track a particular benchmark or index, whereas ETMFs are “actively” managed by fund managers with the aim of outperforming a relevant benchmark.

There is no minimum investment amount.

Distributions are targeted to be paid semi-annually, being; end of calendar year and end of financial year. They should be received within 20 business days of each end of period.

Like an unlisted managed fund, the distributions might include income and realised capital gains of the fund and any additional amounts of cash, income or capital.

Yes. The default is for distributions to be reinvested; however, you can choose to have them paid out in cash.

You can update your distribution election by logging in to your portfolio at Apex Fund Services Pty Ltd and selecting the ‘Fund Name’, select ‘Settings’ then ‘Direct Credit’ and complete ‘Linked Bank Accounts’.

If you are using the ‘Single Holding’ login, you will be unable to update your election online, the ‘Request for Direct Credit Payment Form’ will be required which you can obtain by getting in touch with Fundhost.

For additional transparency, MKAX will disclose an indicative net asset value (iNAV) which is updated regularly during the trading day. The purpose of the iNAV is to provide investors with an intra-day view of the ‘fair value’ for the Fund. The iNAV will be updated for foreign exchange movements in the Fund’s portfolio of stocks and will also be updated in respect of stocks that have live market prices during the trading day. The Fund may use one or more other index futures, such as S&P futures, as a proxy to account for movements in the Fund’s exposure to certain stocks and derivatives that do not have live market prices during the ASX Trading Day.

You can access the iNAV on this page.

You can sell units in MKAX via your trading account or preferred broker, just like you would a share on the ASX.

Alternatively an off-market redemption request can be submitted directly with the unit registry.

No commissions are paid by us to any financial advisers or brokers.

DOCUMENTS & LINKS

GET IN TOUCH

If you are a current investor and need assistance with change of details, tax statements, please contact the unit registry, Apex Group on +61 1300 133 451 (toll free within Australia) or email mgim@apexgroup.com

When you visit the Montaka Web Portal, you will need your security reference number (SRN) or Holder Identification Number (HIN) to verify your identity. Your SRN/HIN is available on your holding/transaction statement.

Montaka Global Pty Ltd AFSL: ABN 62 604 878 533, AFSL No. 516942 (previously known as MGIM Pty Ltd) is the investment manager and can be reached on 02 7202 0100 or email at office@montaka.com

- Zenith Rating Disclaimer:

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned November 2024) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines.

This research rating requires to be read with the full research report that can be found on the issuers website (or upon request) together with our full disclaimer that is found on the front cover of our research note. We require readers of our research note to obtain advice from their wealth manager before making any decisions with respect to the recommendation on this note. The note is not general advice just financial information without having regard too the financial circumstances of the reader.

- You should read the Product Disclosure Statement (PDS) and Target Market Determination (TMD) before deciding to acquire the product.

- The issuer of units in Montaka Global Extension Fund- Complex ETF is The Fund’s responsible entity Perpetual Trust Services Limited ACN 000 142 049 (AFSL 236648). The Product Disclosure Statement (PDS) contains all the details of the offer.

- Copies of the PDS and TMD are available for download on this web page under the ‘Documents’ header. Before making any decision to make or hold any investment in the Fund you should consider the PDS in full. An investment in the Fund must be through a valid application form attached to the PDS. You should not base an investment decision simply on past performance. Past performance is not an indicator of future performance. The investment returns of the Fund are not guaranteed, and so the value of an investment may rise or fall.

- The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon this information and consider seeking advice from a licensed financial advisor if necessary.

- This Fund is appropriate for investors with “High” risk and return profiles. A suitable investor for this Fund is prepared to accept high risk in the pursuit of capital growth with a medium to long investment timeframe. Investors should refer to the Target Market Determination (TMD) for further information.