|

Getting your Trinity Audio player ready...

|

It’s that time of year again. Every September, Apple hosts its annual iPhone launch event at its Cupertino campus, unveiling the next iteration of the company’s bestselling product. This year marks a continuation of the three-phone line-up that began last year with the iPhone 8, 8 Plus and the X. Speculation abounds about whether the new line-up of iPhones can at least match the success of last year’s iPhone X, or whether Apple is about to face another iPhone 6s moment.

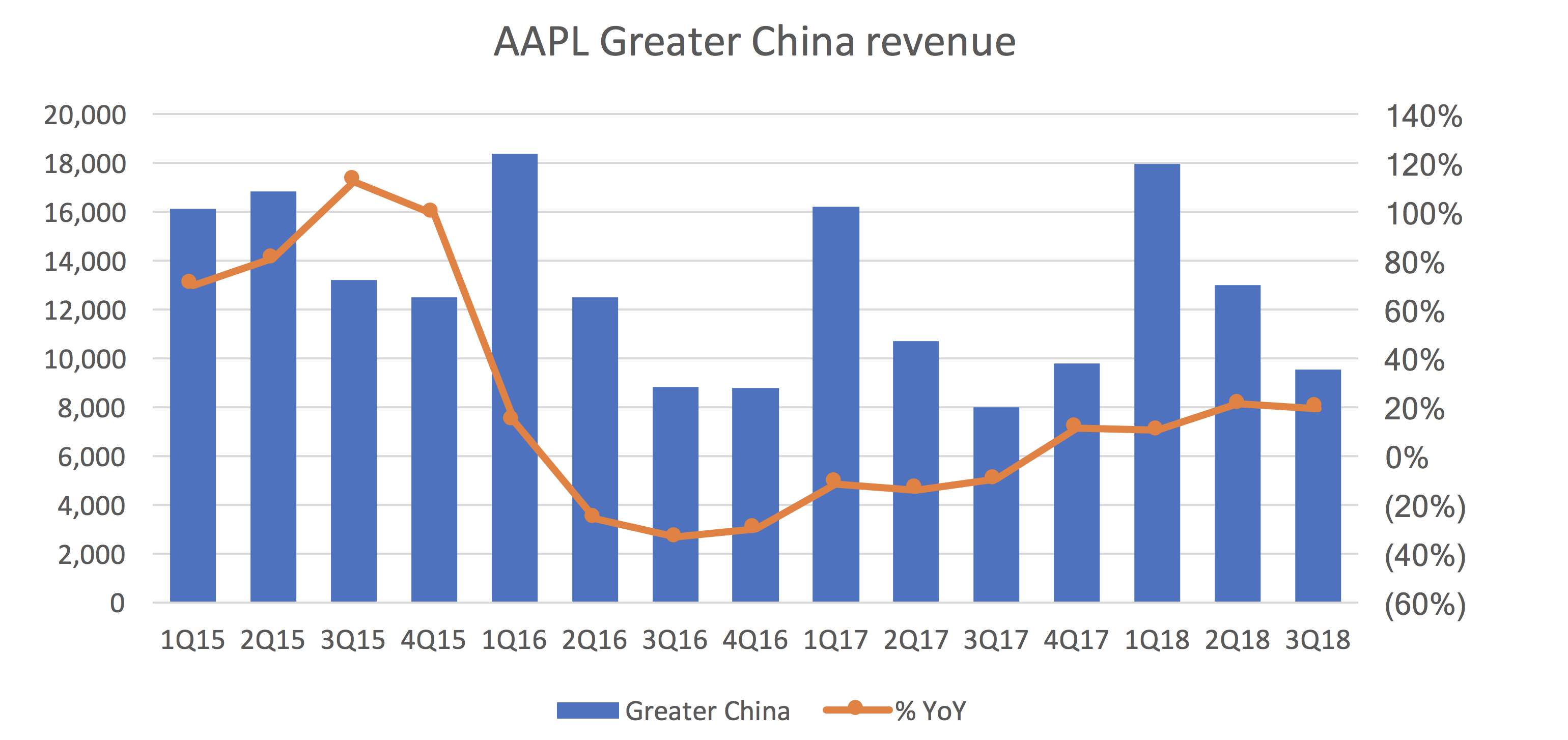

In September last year, I wrote a blog on the new $1,000 iPhone X and speculated that it would lead to a recovery of Apple’s Greater China business, which had been in a slump since the launch of the iPhone 6s. As it turned out, Chinese customers (and many ex-China customers) were unphased by the massive price tag, and the iPhone X became the best-selling high-end smartphone of 2017-18 and helped push up the iPhone’s average selling price (ASP) by 12% to $728.

It seems Apple took this apparent price inelasticity to heart when setting prices for the new iPhones. The base model iPhone XS keeps the $999 price tag of last year’s iPhone X, but the larger iPhone XS Max starts from $1,099 to as high as $1,449. The lower-priced iPhone XR rounds out the range at $749, which is $50 higher than the launch price of the iPhone 8, which in turn was $50 higher than the iPhone 7 (one can see a pattern emerging here).

The other interesting thing to note is that Apple has flipped the iPhone hierarchy. Last year, the iPhone X was positioned as the optional super-premium phone, one that you could aspire or “reach up” to. This year, Apple clearly intends its customers to buy the XS or XS Max and has accordingly priced the XR as a “reach down” or poor man’s iPhone. The last time Apple priced down a phone was the plastic 5C, which was widely considered a flop.

The question now, of course, is whether Apple has pushed pricing too far on what is really an iterative upgrade to the original iPhone X. Whereas the iPhone X was sufficiently differentiated from the iPhone 8 (and all previous iPhones) to justify the $300 price premium, the iPhone XS Max and XR share substantially the same internal hardware, with the only notable differences being a slightly larger OLED screen, stainless steel edges and dual cameras on the XS Max compared to an LCD screen, aluminium edges (not plastic!) and a single camera on the XR. Is that worth a $350 premium?

Well, that depends on who you ask. To me, it seems Apple is clearly playing on the vanity of Chinese consumers. In the previous blog, I mentioned how there were three groups of smartphone buyers in China: those who want the best phone that money can buy, those who enjoy the prestige of owning the highest-status phone, and those who are price sensitive. The two price insensitive groups clamoured to buy the iPhone X because it was a phone that couldn’t be mistaken for anything else (unlike the iPhone 6-6s-7-8 generation). But the new iPhone XS looks identical to the X, so the only way to establish or maintain status is to upgrade to the visibly larger iPhone XS Max. And Apple cleverly discontinued the iPhone X, so those people hoping to upgrade to the X this year at a cheaper price will be forced into the XS. It would also not surprise me if Apple’s sales data pointed to a similar mentality with its US and European customers, albeit to a lesser degree, which justified Apple’s pricing decisions.

Separately, there is the question of whether the iPhone X pulled forward demand in the same way that the iPhone 6 supposedly did, such that those who would have upgraded to the XS this year had already upgraded to the X last year. While a possibility, this is hard to support by the numbers – year-to-date iPhone shipments are up a measly 0.4%, which hardly seems like a pull forward of demand. While we can all agree that the iPhone X did not unleash an iPhone “supercycle”, it would be a stretch to write off the iPhone XS and XS Max as a repeat of the iPhone 6s. Even if next year’s iPhone shipments remain flat, the higher prices of the new iPhones plus the larger edge-to-edge form factor of the iPhone XS Max should still drive a healthy increase in ASP.

The Montaka funds own shares in Apple (Nasdaq: AAPL)

![]() Daniel Wu is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Daniel Wu is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.