|

Getting your Trinity Audio player ready...

|

-Phill Namara

Following March 2020, as we mentioned previously on the blog [See-Here], the United States’ Federal Reserve (“Fed”) established a series of facilities and programs, designed to support the flow of credit to primary dealers and the corporate bond market. For companies not large enough to lean into the fixed-income capital markets, their outlook remains subdued as they have had difficulty obtaining financing. We believe this backdrop has created opportunity for the alternative asset managers.

The Main Street Lending program, a facility established by the Fed, was designed to provide bridge financing for small to medium-sized businesses following March, with lending capacity up to $300m per borrower. “As of mid-August, eligible lenders participating in the program had issued $497m in loans, backed by Federal Reserve purchases. This level of utilization reflected only 0.07% of lending capacity for the $600 billion loan.” Lacklustre capacity utilisation could have arisen from the under-vocal lenders supporting the program or the complex eligibility rules prevented certain borrowers from participation. (Epstein, Markus & Kaminsky, 2020). Regardless of the reasons why, low levels of loan participation and tightening credit conditions suggest that there remain many private businesses in need of financing.

Management teams at some of the largest alternative asset managers, who are sitting on approximately $2.5 trillion of dry powder globally, have been notably optimistic about their positioning following the outbreak of the virus and the regulatory response. During the most recent quarterly earnings calls in October, executives at KKR highlight how they were able to “ lean in when the market was dislocated…[we] invested and committed $42bn so far this year around the world and across strategies. We were prepared to lean into dislocation coming into the spring and our preparedness has paid off“. Year-to-date, KKR has raised 80% more AUM than in the prior corresponding period during 2019. It is not only KKR that benefited, executives at Caryle Group saw “good deal flow in our opportunistic credit funds as mid-cap private companies have a growing need for transitional capital”. Carlyle Group too was able to opportunistically raise $19bn in AUM year-to-date, mostly within their credit and hedge fund businesses.

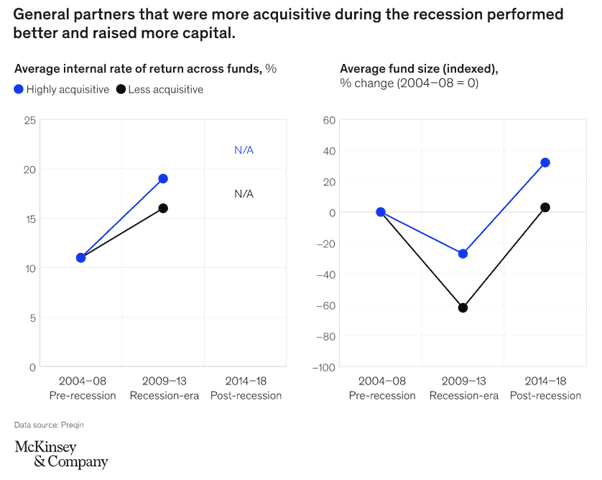

Whilst the outlook for many middle-market, private businesses may not look as rosy as it once did, this current dislocation should continue to provide great opportunities for the alternative asset managers to provide opportunistic capital in order to strengthen balance sheets. Further, research conducted by McKinsey found private equity returns during the GFC, a similar recessionary period, were higher than those during more stable times.

We at Montaka believe that the anti-fragility and opportunistic capabilities of these alternate asset managers position them as long-term winners in the structurally attractive private capital markets.

Credit:

Epstein, S., Markus, J. and Kaminskky, N., 2020. Modest Use of Main Street Lending Program Reported as Federal Reserve Continues to Fine Tune Its Features. Haynes Boone, p.1.

Phill Namara is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.