|

Getting your Trinity Audio player ready...

|

-Chris Demasi

At Montaka, we regularly talk about our key stock holdings, such as Amazon, Microsoft, and Blackstone.

These ‘compounders’ are a cornerstone of the portfolio and deliver superior long-term returns. They are advantaged companies with strong positions in attractive markets that allow them to sustainably grow their earnings power long into the future.

While compounders are our primary focus, we also make another special type of investment that we call ‘outliers’.

If compounders are today’s known long-term winners, then outliers are highly likely to become long-term winners in the future, or the compounders of tomorrow.

Below we answer 6 questions to help investors understand what makes an outlier stock and the role they play in our portfolio.

What is an ‘outlier’ stock?

Outliers should have exceptionally high return potential. And that typically comes about because it is much earlier in its journey in the lifecycle of a company.

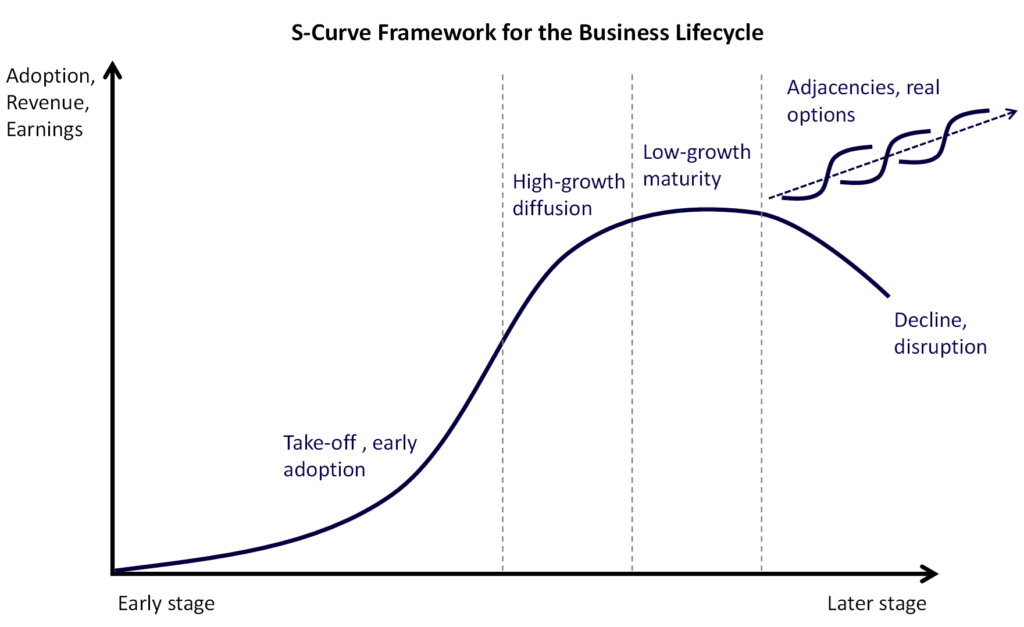

If we think about the S-curve of a business lifecycle, outliers are the early-stage companies on the left-hand side. They are on their way to taking off, and that usually means that they’ve got a lot of promising growth and value creation ahead of them.

Source: Montaka; E. M. Rogers: Diffusion of Innovations (1962)

The quid pro quo is that extraordinary success is never certain – or at least not as certain as we see with compounders.

When people talk about S-curves and business life cycles, there’s a foregone conclusion that you start life as a small business and you go on to great things, but there’s also a risk that may not happen.

But if it does happen, the rewards can be amazing.

How are outliers different from other types of stocks in the Montaka portfolio?

Our portfolio is dominated by what we call ‘compounders’, which includes the likes of Microsoft, Blackstone, and Amazon.

They’re much more established businesses that have been around for a while. They’ve established a set of business advantages which has allowed them to thrive, and typically provides them with a virtually impenetrable economic moat.

Compounder businesses already have high margins, high returns on capital, and still have strong growth profiles. They’re able to find new markets and new customers to be able to expand their businesses and create more and more value over time.

So, there’s a much higher degree of certainty and confidence around what’s achievable for a compounder. The range of business outcomes isn’t as wide as an outlier.

Why do you include outliers in the Montaka portfolio? What role do they play?

Successful outliers can add significantly to the return potential of the portfolio.

Outliers combine the large payoffs from early-stage success with the power of rapid growth as they go on to become compounders.

So, we think outliers represent an opportunity to really add meaningfully to the power of the portfolio’s returns by complementing the compounders.

How much of the Montaka portfolio is typically allocated to outliers?

It’s much smaller than compounders because of the different risk profile of outliers.

At any point in time, we would only allocate a maximum of up to 20% to outlier positions, and that’s typically going to be spread across several names.

No one position is going to be overly large, especially compared to what we do in the compounders.

And what we try to do is look for companies in that set of outliers that have different value drivers and risk factors as well, so that they’re mostly unrelated and uncorrelated to each other.

How do you size outlier positions in the portfolio? Do you double down when the stock price trades down?

We deal with outliers differently in another way, too.

With compounders, when you see them sell off, it’s usually an opportunity to add more to the position, as long as you believe in the business and the growth potential.

With outliers, we’re less sensitive to price and more sensitive to building business value and seeing outliers demonstrate progress towards future success.

That means if the stock price trades off heavily, you won’t necessarily see us add to the holding as much as we would with a compounder.

We’re going to make a lot of money if we get outliers right anyway. And we don’t want to continue doubling down, at least on a cost basis, because there isn’t that same level of certainty looking out into the future as you find with compounders.

It’s a way to control risk for a different type of investment, while still having the opportunity to make exceptional returns.

What is an example of an outlier stock?

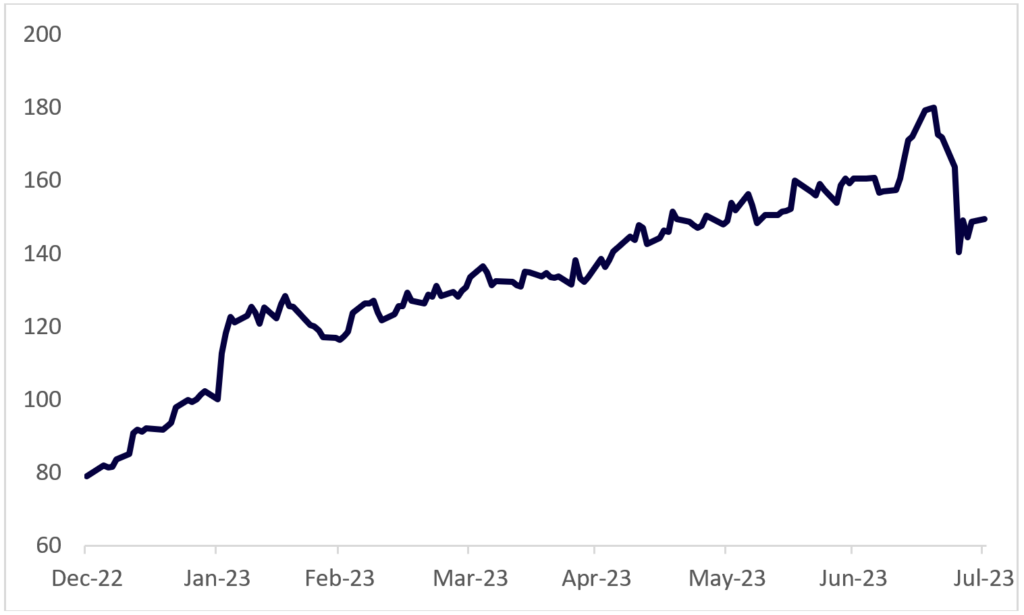

Spotify is our largest outlier.

It has performed so well this year that it’s crept up into the top 10 stock holdings in the portfolio.

Spotify share price 2023YTD

Source: Bloomberg

Even though Spotify is the leading digital music streaming platform in the world with over half a billion users, it’s still establishing itself, so we see it as quite early in the business lifecycle.

Spotify still faces formidable competition from the large technology platforms like Apple Music, YouTube Music and Amazon Prime.

But Spotify continues to impress us because its leading that pack of large, strong competitors.

Spotify has been able to grow its user base rapidly, expand the paid subscriber base, and improve profit margins to the point where they’re now past the investment phase and starting to generate positive earnings.

Spotify recently reached break-even profitability and is a bit beyond break even cash flows.

While we’re confident in Spotify being successful in future, it’s a different degree of confidence compared to our compounders.

It’s not like Microsoft, where we are highly confident that they have already won in cloud computing. That’s already been determined in our minds. There would have to be something dramatic to disrupt that market and Microsoft’s position in it.

Spotify is still building out its capabilities and competing furiously against its competitors to make sure that it stays in that number one position and does become the winner of the future.

And if it does, then we can see the stock being a 10-bagger over the rest of this decade.

Read our whitepaper on why AI is the most important theme today:

Chris Demasi is the Portfolio Manager for Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or leave us a line on montaka.com/contact-us

Note: Montaka owns shares in Spotify and Microsoft.