Insights

Artificial intelligence, widening inequality, and intensifying competition for critical resources are converging to create a more volatile global landscape. This article explores how these forces intersect and what they mean for the future of geopolitical stability.

State of the Union: AI, resource competition and inequality increase geopolitical instability

Artificial intelligence, widening inequality, and intensifying competition for critical resources are converging to create a more volatile global landscape. This article explores how these forces intersect and what they mean for the future of geopolitical stability.

The AI Bubble Debate: Why Investors Should Re-examine the Evidence

Are we really in an AI bubble… or are most people simply misreading the data? Our latest whitepaper challenges five popular assumptions driving today’s bubble narrative.

Quarterly Video: Q4 2025

We unpack the major structural shifts shaping the global landscape, review 2025’s highly dispersed market returns, discuss key portfolio augmentations during Q4, and share a preview of Montaka’s latest ‘AI Bubble’ whitepaper

Beyond the Beach: Montaka’s Summer Investing Guide

While most people use the summer to switch off, we suggest a different approach: plugging in. This year’s Summer Investing Guide highlights three key essays from 2025, one podcast, and a book recommendation to get you set for the new year.

LVMH & the Curious Case of Veblen Goods

Discover how LVMH leverages the Veblen effect to defy traditional economics. Learn why higher prices increase demand for luxury goods and what makes LVMH a compelling long-term investment opportunity.

Beyond stock picking: The 3 big ideas that underpin Montaka’s portfolio construction

Most investors focus solely on which stocks to buy. But at Montaka, we believe how you construct your portfolio is equally critical. Discover how we build concentrated portfolios using Compounders, Outliers, and risk-based capital allocation to deliver sustainable long-term returns.

Podcast | Beyond the AI hype: Understanding Cloud Computing’s Real Moats

What do Costco, Spotify, and a flooring retailer have in common? They all harness a rare business superpower: the flywheel effect. Join Andy and Lachie as they reveal how patient capital, psychological discipline, and customer obsession create unstoppable companies—and how you can spot them early.

Update from the PM – December 2025

Volatility returned in Nov: Bitcoin -20%, S&P 500 -5%, Tech down while Healthcare & Energy surged. Amid the noise, Alphabet soared +14% on Gemini 3’s AI breakthrough. Bubble fears? We break them down.

Podcast | Why High PE Ratios Don’t Always Mean Overvaluation

Andy shares our investment philosophy and why traditional metrics like PE ratios can be misleading when evaluating companies with transformational growth potential.

Update from the PM – November 2025

Earnings season is here: Meta & Blackstone show strong fundamentals, yet stocks dip on short-term narratives. Do short-term moves matter when long-term AI-driven growth is clear?

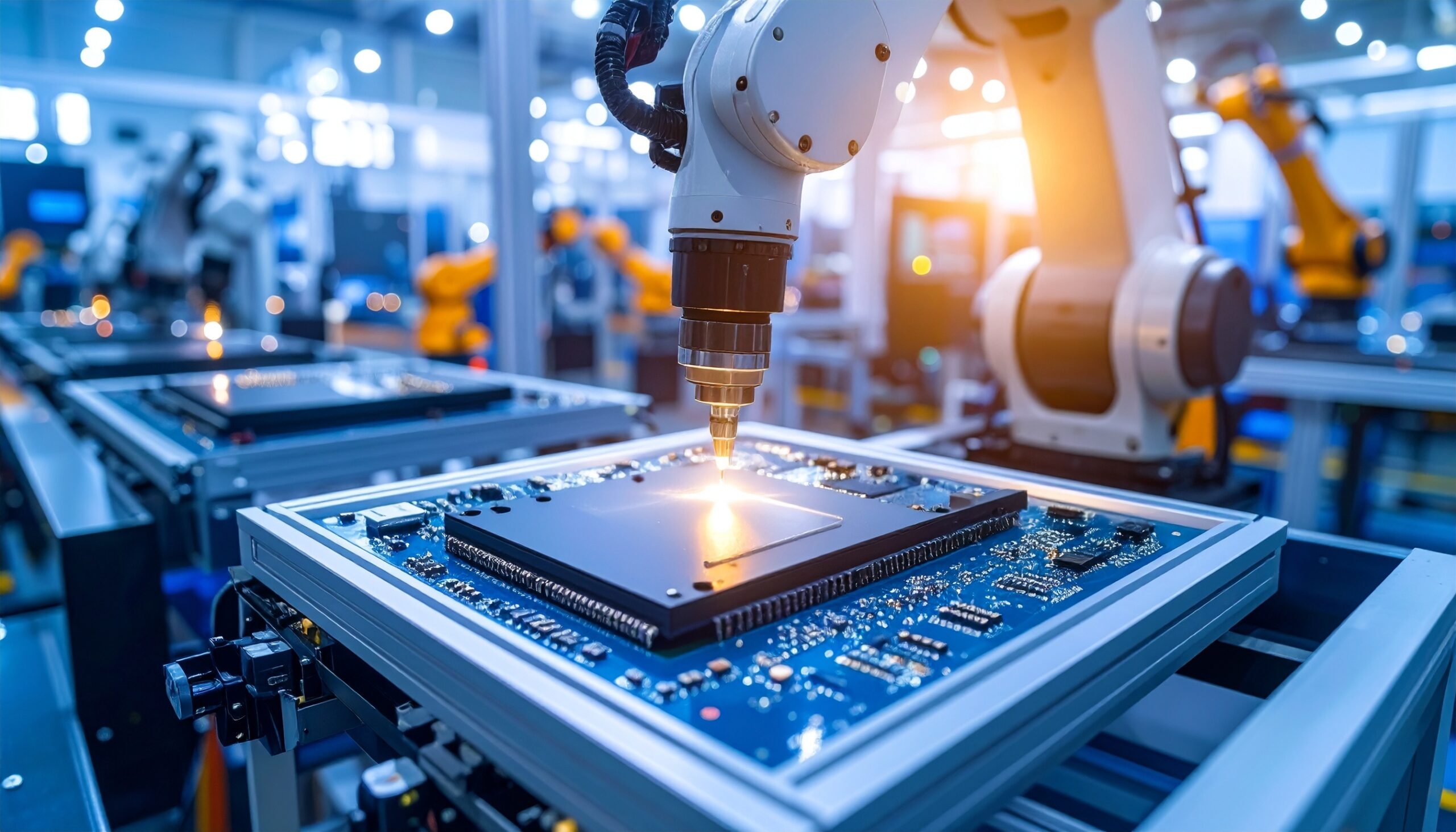

From Transistors to Transformations: Building AI’s Digital Backbone

As AI demand explodes, the industry has pivoted to something even more powerful: advanced packaging technologies that deliver up to 40x better performance than traditional scaling.

My investing story: Introducing our new Senior Analyst, Tim Le

Discover how Montaka’s new Senior Research Analyst, Tim Le, went from medical student to investment professional and why he wanted to join Montaka.