– Andrew Macken

The US stock market recently hit fresh all-time highs. But then we learnt that US inflation in the month of October was 6.2%, the highest annual rate in 31 years.

Many investors are naturally now fearing three ‘facts’ have emerged from the current situation: equities as an asset class are stretched and this is ‘as good as it gets’; that likely interest rate rises will crunch stocks; and finally, that there are no undervalued stocks providing buying opportunities in the market today.

But for strong, though perhaps counterintuitive, financial and economic reasons, these three fears are likely myths. We believe that equities continue to represent attractive, long-term value; structural deflationary forces will keep rates relatively low; and there are great companies available today at cheap prices.

There is a danger that if investors fall for these myths they will bail out of equities and miss out on their long-term wealth-building potential.

Myth 1: Equities are overvalued

While investors fear that equities are overvalued, the fact is that equities are better value than other asset classes. Investors are being paid unusually high returns for taking on equity risk compared with the likes of bonds.

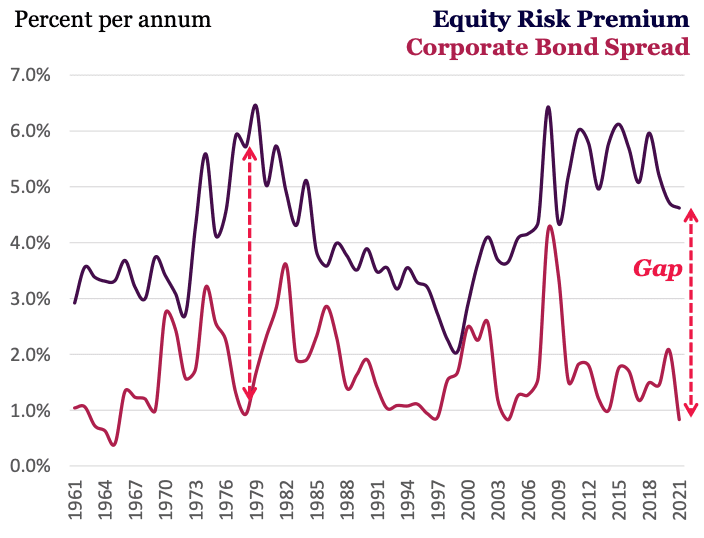

A good measure of the value of equities is the ‘gap’ between the equity risk premium (ERP) and the bond spread (how much corporate bonds yield above government bonds). The ERP is the extra return investors get for owning stocks, rather than risk-free government bonds.

Historically, the gap between the ERP and bond spread has averaged around 2%. The gap has been as wide as 5% percent when equities were relatively cheap. It has also fallen close to zero when equities were expensive, such as during the 1999 tech bubble. (During this 20-year period of the gap closing, equities compounded at 18 percent per annum!)

The ‘Gap’ between ERP and Corporate bond spread

Source: NYU Stern (Damodaran); Bloomberg; Montaka Global

The gap today is around 4%, so well above average. As equity prices have soared since the depths of the pandemic, the ERP has reduced. But spreads in other asset classes, such as bonds, have also reduced.

On a relative basis, therefore, equities remain just as attractive as they did in 2019 when the S&P 500 was lower by one-third.

Myth 2: We have entered a structural inflationary cycle

The second fear is that interest rates will keep rising and slam the breaks on equities. But equity prices are actually more likely to keep rising in the long term.

For the gap between the equity and bond spread to normalise from 4% today to the long-term average of 2%, equities must perform better than bonds going forward.

Despite the current inflation worries, equity prices are more likely to rise because higher bond yields (resulting lower bond prices) are unsustainable, in our view. Strong, long-term, structural disinflationary forces will continue to pressure interest rates to much lower levels than we’ve observed historically.

For a start, populations are aging across the world. The working-age cohort in major economies, such as China and Europe, are shrinking as more people retire, which will logically reduce economic growth over time. Governments will also have to ramp up spending on pensions and healthcare. That lower economic growth will push down interest rates.

The soaring power of compute and big data is also creating of an increasing array of intelligent applications which require few, if any, humans to operate. Less demand for labour over time is disinflationary.

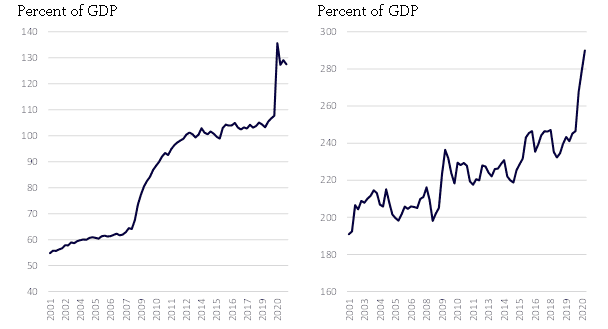

US Federal public debt Global, non-financial corporate debt

Source: Bank of International Settlements; Federal Reserve Bank of St. Louis

And the huge debt loads of governments and corporates, which has surged post-pandemic, means interest rates cannot increase materially and sustainably. If rates do rise, consumers, corporates and governments will spend less – all at the same time – to meet higher interest costs, which in turn cuts economic growth and forces interest rates back down.

So, notwithstanding short periods of slightly higher bond yields to reflect the economic cycle, a long-term regime of historically low interest rates appears likely. And if that is so, then the longer-term prospects for equities remain attractive.

Myth 3: It feels like most stocks are overvalued today

Despite the positive outlook for equities, some investors will still argue that many stocks are overvalued. But while that is true, a subset of stocks are materially undervalued, including Meta Platforms (formerly Facebook) and China’s Tencent.

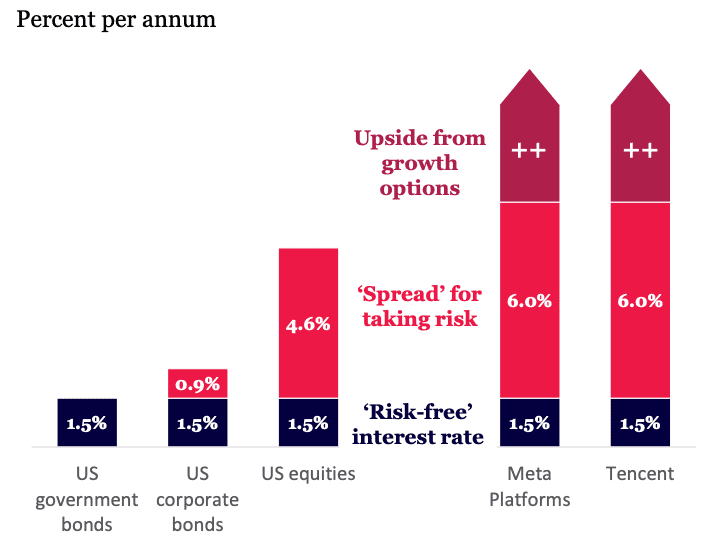

Even if you only considered their existing core businesses, both Meta and Tencent are cheap. Based on 2022 earnings, the earnings yield of both Meta and Tencent’s core business is around 4.5%. If you subtract a risk-free rate of, say, 1.5% you get a spread of 3.0%.

Not so attractive, you might suggest. But by 2025, that same spread has increased to more than 6.0% due to earnings growing organically over this time.

Compensation for taking risk – comparison

Source: Bloomberg; Montaka Global estimates

What’s more, both Meta and Tencent have large, high-probability growth options tied to the ‘metaverse’, e-commerce, artificial intelligence and cloud computing. As these growth options are monetised, the ‘spread’ of the shares of these companies increases even further.

On this basis, Meta and Tencent appear to be highly attractive investment opportunities.

Hold the line on equities

The message to investors is to remain selective based on clear-minded, fact-based analysis. We continue to believe that equities offer materially better value than bonds, in general today. And this belief is based on detailed, ‘first-principles’ analysis.

Of course, not all equity investments are created equal. Many stocks are overvalued today – but some are materially undervalued.

If investors can patiently accumulate and own these undervalued businesses, it will steadily drive their compounding higher. And over the long-term, compounding in equities at rates of return well above those in cash or bonds, will lead to dramatically outsized wealth accumulation.

Maintaining high exposure to equities is the key element to building wealth through investments. Don’t fall for these 3 myths and give up on the remarkable long-term wealth building power of equities.

Note: Montaka is invested in Meta & Tencent.

Andrew Macken is the Chief Investment Officer at Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or chat with us on https://montaka.com/

3 market myths that threaten to derail investors’ long-term wealth

– Andrew Macken

The US stock market recently hit fresh all-time highs. But then we learnt that US inflation in the month of October was 6.2%, the highest annual rate in 31 years.

Many investors are naturally now fearing three ‘facts’ have emerged from the current situation: equities as an asset class are stretched and this is ‘as good as it gets’; that likely interest rate rises will crunch stocks; and finally, that there are no undervalued stocks providing buying opportunities in the market today.

But for strong, though perhaps counterintuitive, financial and economic reasons, these three fears are likely myths. We believe that equities continue to represent attractive, long-term value; structural deflationary forces will keep rates relatively low; and there are great companies available today at cheap prices.

There is a danger that if investors fall for these myths they will bail out of equities and miss out on their long-term wealth-building potential.

Myth 1: Equities are overvalued

While investors fear that equities are overvalued, the fact is that equities are better value than other asset classes. Investors are being paid unusually high returns for taking on equity risk compared with the likes of bonds.

A good measure of the value of equities is the ‘gap’ between the equity risk premium (ERP) and the bond spread (how much corporate bonds yield above government bonds). The ERP is the extra return investors get for owning stocks, rather than risk-free government bonds.

Historically, the gap between the ERP and bond spread has averaged around 2%. The gap has been as wide as 5% percent when equities were relatively cheap. It has also fallen close to zero when equities were expensive, such as during the 1999 tech bubble. (During this 20-year period of the gap closing, equities compounded at 18 percent per annum!)

The ‘Gap’ between ERP and Corporate bond spread

Source: NYU Stern (Damodaran); Bloomberg; Montaka Global

The gap today is around 4%, so well above average. As equity prices have soared since the depths of the pandemic, the ERP has reduced. But spreads in other asset classes, such as bonds, have also reduced.

On a relative basis, therefore, equities remain just as attractive as they did in 2019 when the S&P 500 was lower by one-third.

Myth 2: We have entered a structural inflationary cycle

The second fear is that interest rates will keep rising and slam the breaks on equities. But equity prices are actually more likely to keep rising in the long term.

For the gap between the equity and bond spread to normalise from 4% today to the long-term average of 2%, equities must perform better than bonds going forward.

Despite the current inflation worries, equity prices are more likely to rise because higher bond yields (resulting lower bond prices) are unsustainable, in our view. Strong, long-term, structural disinflationary forces will continue to pressure interest rates to much lower levels than we’ve observed historically.

For a start, populations are aging across the world. The working-age cohort in major economies, such as China and Europe, are shrinking as more people retire, which will logically reduce economic growth over time. Governments will also have to ramp up spending on pensions and healthcare. That lower economic growth will push down interest rates.

The soaring power of compute and big data is also creating of an increasing array of intelligent applications which require few, if any, humans to operate. Less demand for labour over time is disinflationary.

US Federal public debt Global, non-financial corporate debt

Source: Bank of International Settlements; Federal Reserve Bank of St. Louis

And the huge debt loads of governments and corporates, which has surged post-pandemic, means interest rates cannot increase materially and sustainably. If rates do rise, consumers, corporates and governments will spend less – all at the same time – to meet higher interest costs, which in turn cuts economic growth and forces interest rates back down.

So, notwithstanding short periods of slightly higher bond yields to reflect the economic cycle, a long-term regime of historically low interest rates appears likely. And if that is so, then the longer-term prospects for equities remain attractive.

Myth 3: It feels like most stocks are overvalued today

Despite the positive outlook for equities, some investors will still argue that many stocks are overvalued. But while that is true, a subset of stocks are materially undervalued, including Meta Platforms (formerly Facebook) and China’s Tencent.

Even if you only considered their existing core businesses, both Meta and Tencent are cheap. Based on 2022 earnings, the earnings yield of both Meta and Tencent’s core business is around 4.5%. If you subtract a risk-free rate of, say, 1.5% you get a spread of 3.0%.

Not so attractive, you might suggest. But by 2025, that same spread has increased to more than 6.0% due to earnings growing organically over this time.

Compensation for taking risk – comparison

Source: Bloomberg; Montaka Global estimates

What’s more, both Meta and Tencent have large, high-probability growth options tied to the ‘metaverse’, e-commerce, artificial intelligence and cloud computing. As these growth options are monetised, the ‘spread’ of the shares of these companies increases even further.

On this basis, Meta and Tencent appear to be highly attractive investment opportunities.

Hold the line on equities

The message to investors is to remain selective based on clear-minded, fact-based analysis. We continue to believe that equities offer materially better value than bonds, in general today. And this belief is based on detailed, ‘first-principles’ analysis.

Of course, not all equity investments are created equal. Many stocks are overvalued today – but some are materially undervalued.

If investors can patiently accumulate and own these undervalued businesses, it will steadily drive their compounding higher. And over the long-term, compounding in equities at rates of return well above those in cash or bonds, will lead to dramatically outsized wealth accumulation.

Maintaining high exposure to equities is the key element to building wealth through investments. Don’t fall for these 3 myths and give up on the remarkable long-term wealth building power of equities.

Note: Montaka is invested in Meta & Tencent.

Andrew Macken is the Chief Investment Officer at Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or chat with us on https://montaka.com/

This content was prepared by Montaka Global Pty Ltd (ACN 604 878 533, AFSL: 516 942). The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should read the offer document and consider your own investment objectives, financial situation and particular needs before acting upon this information. All investments contain risk and may lose value. Consider seeking advice from a licensed financial advisor. Past performance is not a reliable indicator of future performance.

Related Insight

Share

Get insights delivered to your inbox including articles, podcasts and videos from the global equities world.