|

Getting your Trinity Audio player ready...

|

Readers may be familiar with brands such as Artline, Esselte, Marbig and Rexel. These are office product brands owned by ACCO Brands (NYSE: ACCO), a U.S.-based manufacturer of office products and accessories. ACCO has grown revenue at a 3.3% annual rate over the last 6 years. However, a closer analysis reveals that this is in fact misperceived growth, and the economic reality facing ACCO’s business performance is a different picture to the reported results of the company.

ACCO sells office and academic products such as staplers, shredders, diaries, notebooks, folders and an assortment of other stationary products. These categories are structurally challenged as consumer behavior is inexorably shifting to digital tools such as notebook computers and tablets, rather than the more traditional paper notebook variants that ACCO sells.

Furthermore, the channels that ACCO sells these products into are struggling. Around one quarter of ACCO’s sales are to Staples and Office Depot, the two big-box office superstores in America. Staples’ 4Q16 comparable store sales, for example, fell an enormous 7% YoY, with reported sales falling by an even greater amount due to store closures. Staples has announced 70 store closures in North America for 2017, 4.5% of its circa 1,500 stores in North America. Office Depot is similarly planning store closures in 2017, in effect reducing ACCO’s office superstore distribution channel.

These brick and mortar sales channels for office supplies and accessories are being pressured by changing consumer habits as well as by Amazon, more specifically the Amazon Business initiative first announced in April 2015 to allow businesses to purchase office supplies from the e-commerce behemoth. But while shifts from brick and mortar channels to Amazon Business might seem like a neutral event, given that ACCO is just the supplier for these channels, it is highly likely that selling to Amazon will be margin dilutive for ACCO.

As Jeff Bezos says, “your margin is my opportunity”, and it underscores a fundamental tenet of selling anything on Amazon: you’ll gain access to Amazon’s huge base of users, but at the cost of giving away enough margin necessary for Amazon to maintain the lowest prices. So in other words, the sale of an ACCO product on Amazon Business is almost certainly going to be less profitable than selling in other channels.

(It is worth noting that Amazon Business is planning to enter the Australian office supply market, a move which Wesfarmers is reported to have been aware of prior to putting their Officeworks business up for sale.)

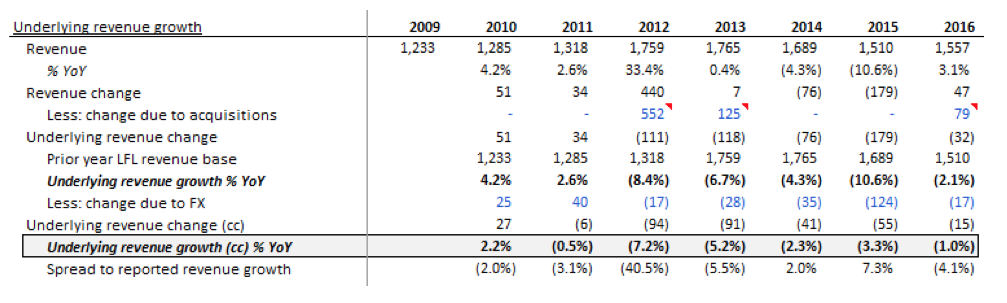

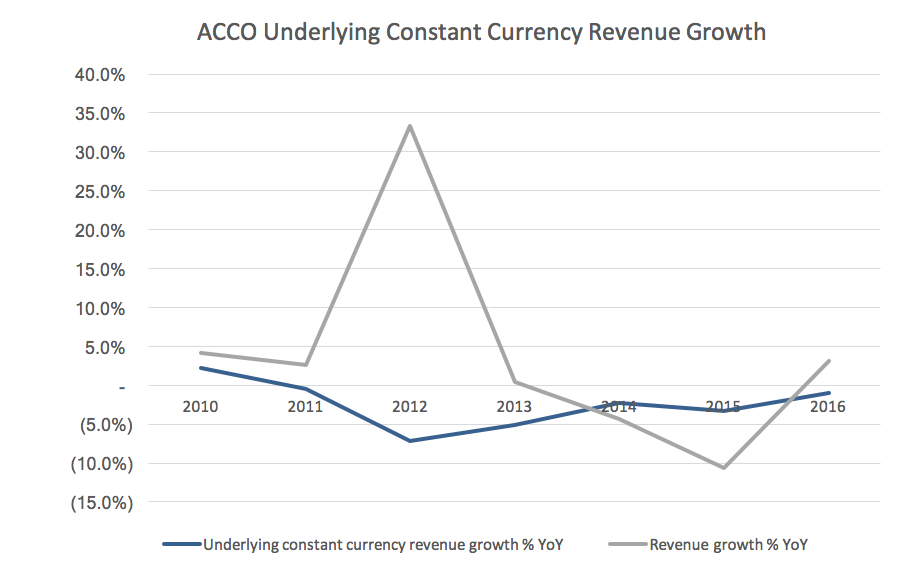

In addition to the structural headwinds faced by ACCO, our short thesis also involves an element of misperceived growth. While ACCO has grown revenues at a 3.3% CAGR since 2010, this has been driven primarily by the incremental revenue from acquisitions. So while this reported revenue growth rate might appear respectable, it is not an accurate representation of ACCO’s underlying revenue growth.

From the 10-K and 10-Q company filings, it is possible to adjust a company’s reported revenue and strip out the effects of acquisitions and currency movements to derive an underlying revenue growth rate. In doing so, it becomes clear that ACCO’s underlying constant currency revenue declined at a -3.3% annual rate since 2010, a far cry from the reported 3.3% revenue CAGR over the same period.

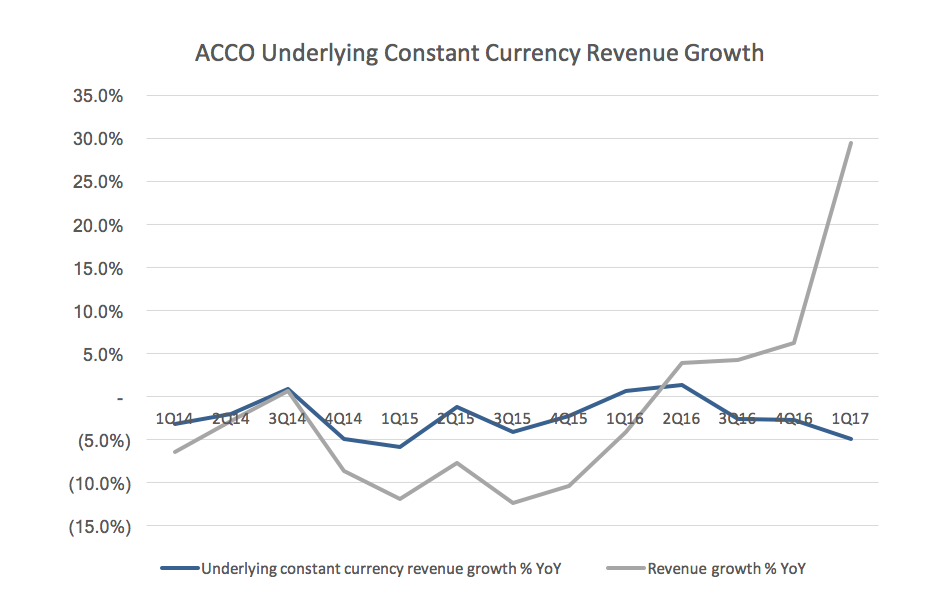

More interesting is the fact that underlying revenue declines have accelerated in recent quarters.

We recently initiated a short in ACCO, after the share price rallied significantly in late 2016. Our thesis is predicated on the following points: (i) ACCO sells products that are structurally pressured, with material exposure to the office superstore channel that has a shrinking store footprint; (ii) the company has meaningful leverage, and assumed a large unfunded pension obligation in a recent acquisition; and (iii) the share price was incorporating unduly optimistic expectations around revenue growth and margins – namely +1.5% revenue growth forever and stable margins. After announcing an underlying revenue growth deterioration in the recent 1Q17 earnings result, ACCO’s share price has declined by ~10%.

Montaka is short the shares of ACCO Brands (NYSE: ACCO).

![]() George Hadjia is a Research Analyst with Montgomery Global Investment Management.

George Hadjia is a Research Analyst with Montgomery Global Investment Management.

To learn more about Montaka, please call +612 7202 0100.