|

Getting your Trinity Audio player ready...

|

– Lachlan Mackay

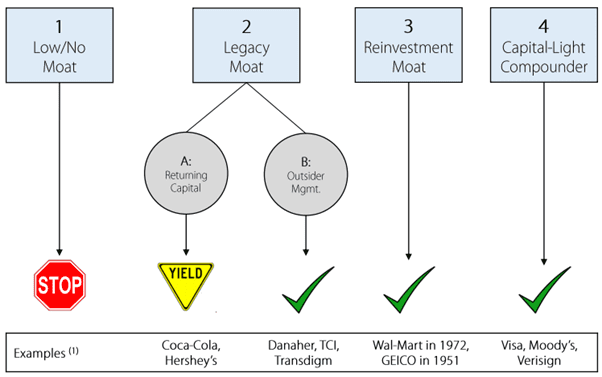

Connor Leonard utilises his value investing philosophy to run a concentrated public securities portfolio at Investors Management Corporation (IMC), a private holding company modelled after Berkshire Hathaway. Leonard applies a simple yet effective filtration process to identify prospective investments. Leonard’s framework buckets businesses into four categories: low/no moat, legacy moats, reinvestment moats and capital-light compounders. In this post we are going to focus on reinvestment moats.

Source: IMC ValueX Vail 2017 Presentation

Personally, reinvestment moats and capital-light compounders are superior models to the outsider management legacy moat. Outsider management requires an exceptional capital allocator such as Warren Buffett (Berkshire) or Mark Leonard (Constellation Software), who are rare talents running unique businesses with focused M&A programs.

A legacy “moat” was coined by Warren Buffett to identify high quality businesses whose durable competitive advantages entrenched their market position, enabling them to earn outsized returns on capital over the long-term. A reinvestment moat has a core business with these qualities plus opportunities to redeploy incremental capital back into the business. For example, Amazon spent over $50 billion in capex in 2020 and their online retail marketplace continues to expand decades after its launch.

Leonard suggests there are two ways to identify a reinvestment moat, both have their own flywheel format. (1) Low-cost production with scale advantages and (2) two-sided networks.

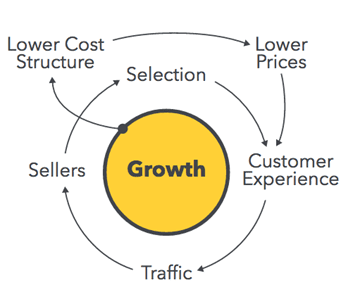

Low-cost scale flywheels are best explained by Nicholas Sleep. Sleep’s “scale economics shared” concept guided his investments in Costco and Amazon in the early 2000s. He identified their business model of passing on the advantages of lower costs of production at expanding scale onto customers in further reduced prices. In Costco’s case, this flywheel entrenched their moat as they reinvested in both their customers and new stores, expanding the business across the United States. Amazon’s digital format allow them to apply these cost savings at a global scale and as such their flywheel continues spinning strongly today.

Amazon’s flywheel. Source: PointsofSale.com

Two-sided networks are fundamental to our digital world. Bill Gurley defined such a network as one that provides a better experience to customer “n+1000” than it did to customer “n” directly as a function of adding 1000 more participants to the market. Obvious examples are everywhere, including in many of Montaka’s portfolio businesses – Amazon.com, Instagram, realestate.com.au, Spotify, WeChat. These businesses have the power to become compounding machines as both buyer/demand and seller/supply become further entrenched over time, providing ever-more reinvestment opportunities. Powerful data analytics capabilities have created new business cases that are especially advantaged, many of which will grow stronger as machine learning applications continue to expand.

Leonard goes on to explain that many reinvestment moats are hidden in plain sight. Value investors often miss them because they are unable to commit to a reasonable price. As we often write, common valuation heuristics are limiting; P/E and other ratios will always make a quality reinvestment moat appear expensive. Instead, one must study the core business’ returns on invested capital (legacy moat) and compare it to incremental returns on reinvested capital. Then simply let the power of compounding work its magic.

Montaka owns shares in Amazon, Facebook, REA group, Tencent and Spotify.

Lachlan Mackay is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.