|

Getting your Trinity Audio player ready...

|

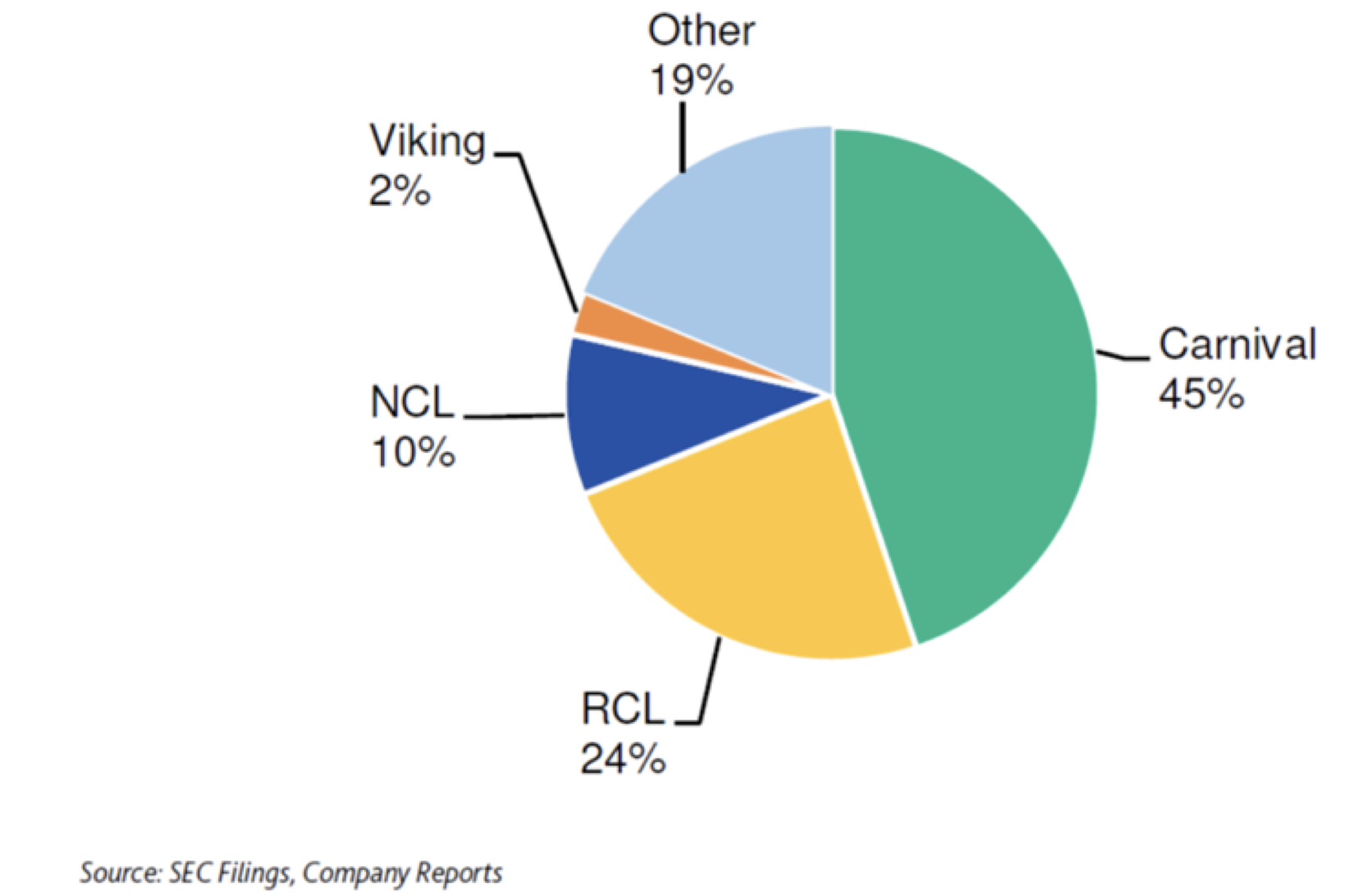

The team at Montaka Global recently looked at the cruise line industry and thought it might be interesting to share some of our insights with our investors and friends of the firm. The cruise line Industry is highly consolidated with the three largest players representing ~80% of industry revenues. Carnival / CCL is the world’s largest cruise line operator (45% market share by revenue) with the next two largest operators, Royal Caribbean / RCL (24%) and Norwegian Cruise Line / NCLH (10%) significantly smaller.

Cruise Lines are a Highly Consolidated Market

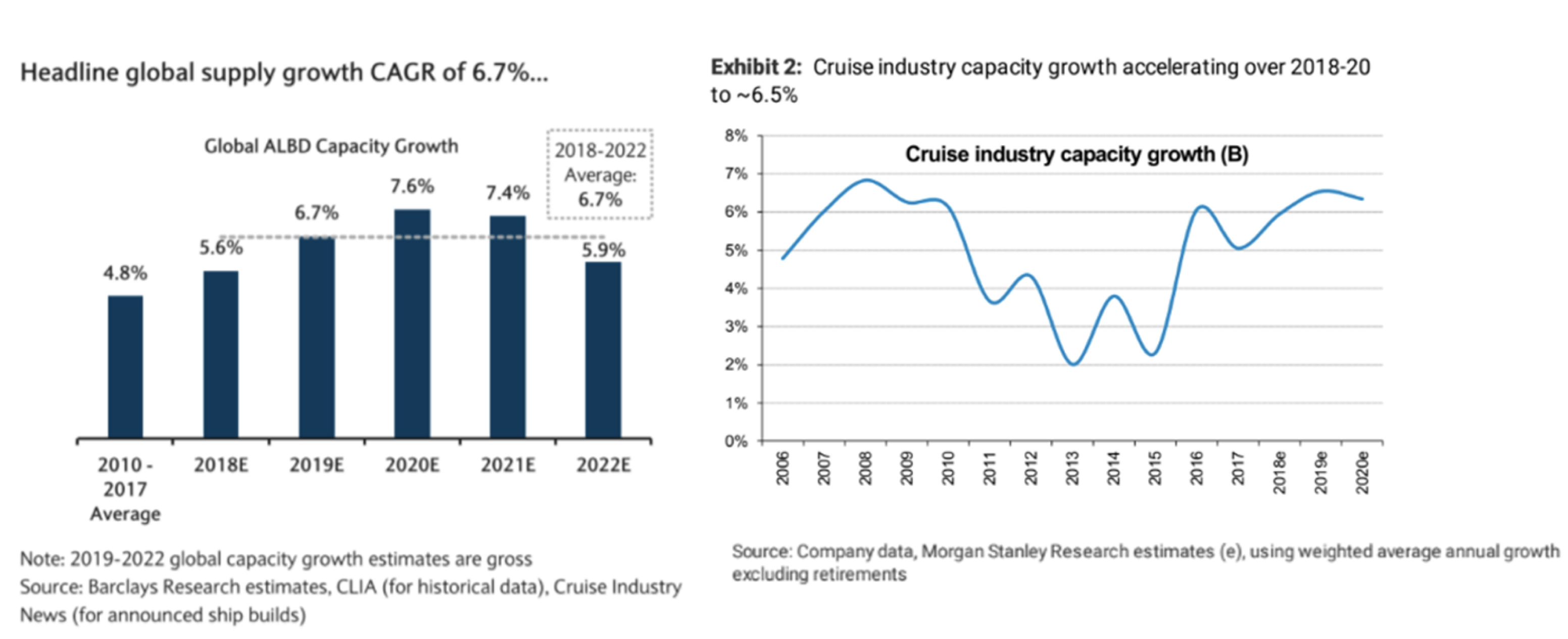

Currently the market is mixed on the prospects for the industry as significant passenger capacity is expected to hit market in the near-to-medium term. Specifically, industry capacity will grow at ~6.7% CAGR from 2018 through 2022, which is higher than ~4.8% CAGR seen from 2010-2017 which is causing some concern about oversupply. Following this period however, supply growth will slow to ~2.0% CAGR (from 2022-2027) which is much more aligned to general global growth however we need to get through an initial digestion phase first.

Given the nature of cruise line capacity (i.e. ships), we can obtain good visibility on supply by looking at shipyard pipelines which are available out to 2027. These indicate no new supply can be added before 2023 (capacity full) and given there are only three shipbuilders responsible for nearly all of the world’s passenger cruise ship supply, we can narrow our focus (they include Fincantieri from Italy, STX Europe from Norway and Meyer Werft from Germany).

Global Cruise Line Capacity Expected to be Added Well Above Recent Trend

Given the incoming ship supply, demand may need to increase to absorb it (more customers / penetration), ageing ships may need to be retired (reduce existing supply) or the market may dislocate and lead to significant headwinds for the major cruise line operators requiring heavy discounts in order to clear the added capacity. This would present a significant setback for the cruise line operators.

That said, the market has historically expanded as capacity is introduced. In other words, as more cruise capacity was dropped into the market, demand matched the supply and penetration rates have grown (without cruise lines discounting prices significantly). This of course indicates cruising may be a penetration story, which will certainly be tested in the coming years as significant supply enters the market.

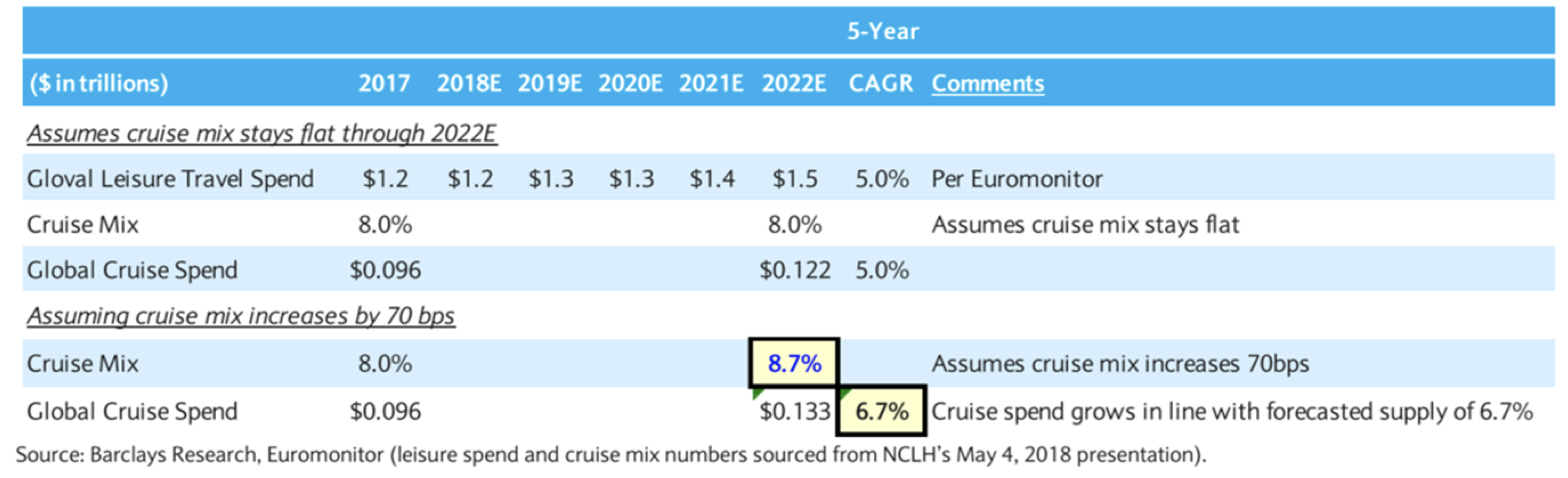

To frame the potential penetration story, let’s look at cruising as a component of the Global Leisure Travel market in which people spend ~$1.2 trillion annually and the industry is growing at ~5% per year. Of this market, cruising represents ~8% ($96 billion) meaning that cruise lines would need to expand its penetration of the market by ~70bps (to 8.7% or $122 billion) in order for it to absorb all of the incoming supply (6.7% CAGR) through 2022. While this doesn’t sound too difficult on the surface, we will need to see evidence of this occurring before becoming too attached to this perspective, as the dollars required for this move are a very significant (+$26 billion).

Cruise Spend Would Match Supply Growth if Penetration Improved ~70bps (from 8.0% to 8.7%)

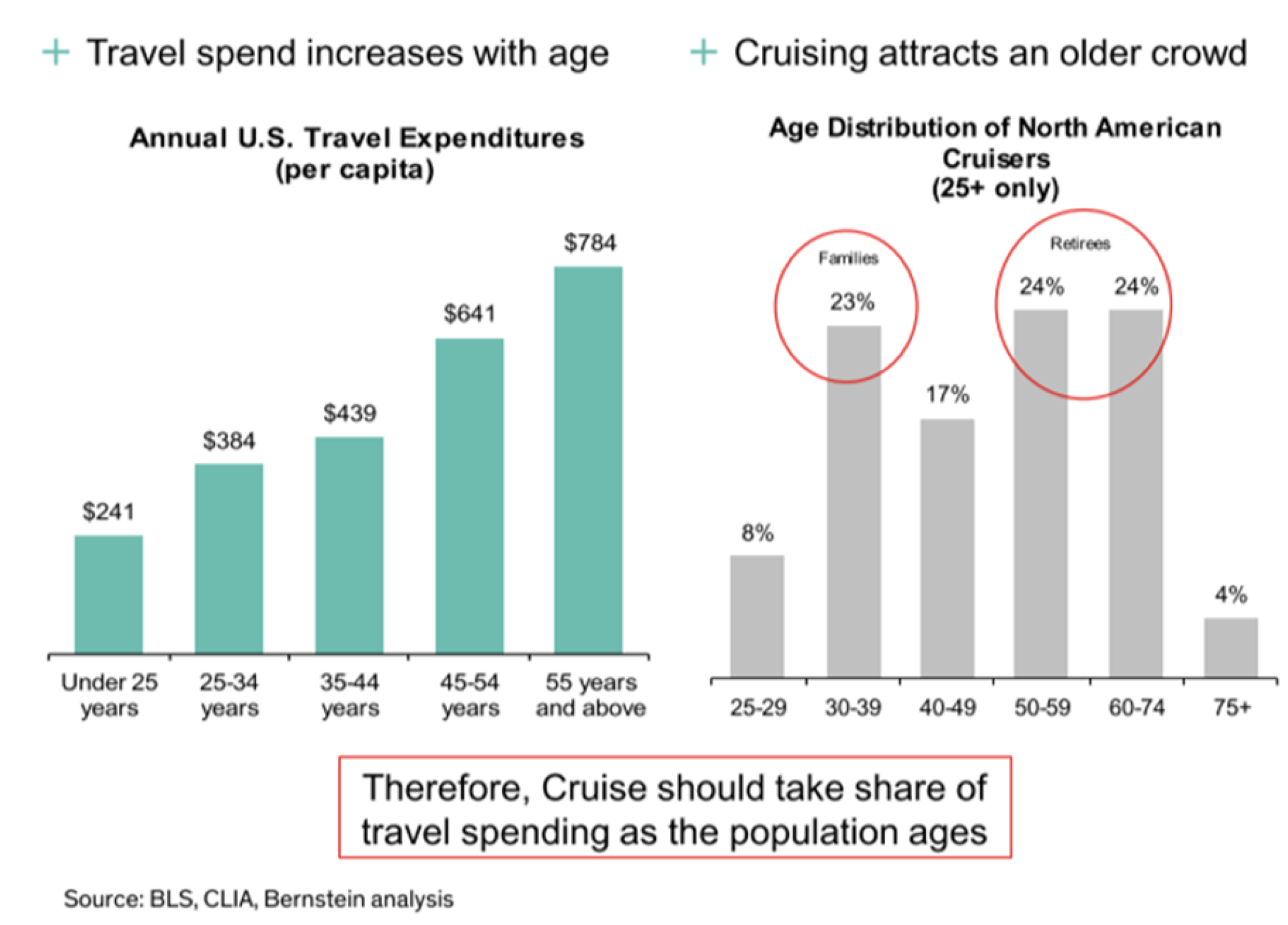

Another source of demand for cruise line capacity may come in the form of ageing demographics, which are expected to organically absorb part of the incoming supply. Given most cruisers are older, with more than 50% of cruise line customers aged 50+ years, the effects of aging, increasing retirements and people living longer will potentially account for >20% incoming cruise supply over the next 5 years.

Cruise Lines Well Positioned to Benefit from the Ageing Population

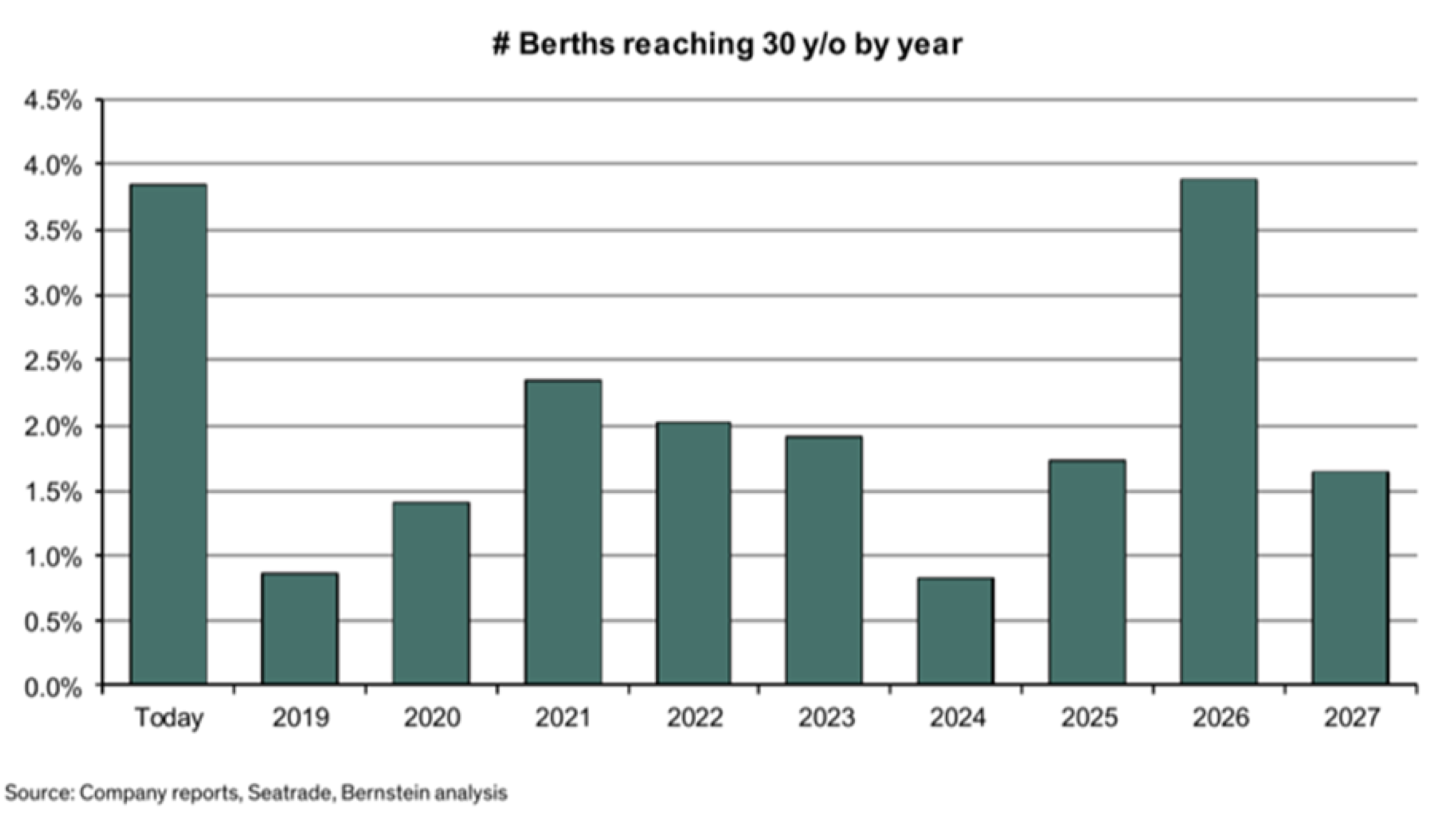

Finally, ageing ship capacity may cause retirements to accelerate which would also remove supply. Currently 3.5-4.0% of total global cruise line capacity is 30+ years old with another 6.5-7.0% of capacity turning 30+ years old through 2022. This would take total global capacity that is 30+ years old to 10-11% and represents ~35% of the supply that will be added to the industry over that period. While cruise ships are depreciated over 30 years in the industry, often cruise lines operate ships beyond this age, hence retirements are difficult to predict and may not offset as much supply as might otherwise be expected.

Cruise Industry’s Fleet is Rapidly Ageing

As the industry embarks on this significant test of the penetration thesis the team at Montaka Global will patiently observe the market for indications of its validity, or a price reaction that discounts the risk sufficiently, such that we don’t have to buy-in or pay for the thesis upfront, and may choose to own it as a source of potential upside.

Amit Nath is a Senior Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Amit Nath is a Senior Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.