|

Getting your Trinity Audio player ready...

|

While there is no physical shortage of iron ore on earth (fourth most abundant element on the planet), from time to time markets forget this overarching fact and in response to transient supply disruptions, can materially distort price levels of the commodity. The current iron ore market exhibits such characteristics visible from the price of the major iron ore products (58%, 62%, 66% Fe (iron) grade) soaring by up to ~76% (58% Fe) since the start of 2019 alone.

Iron Ore Prices(58%, 62%, 66% Fe Grades) Rebased to 100 (YTD)

Source: Bloomberg

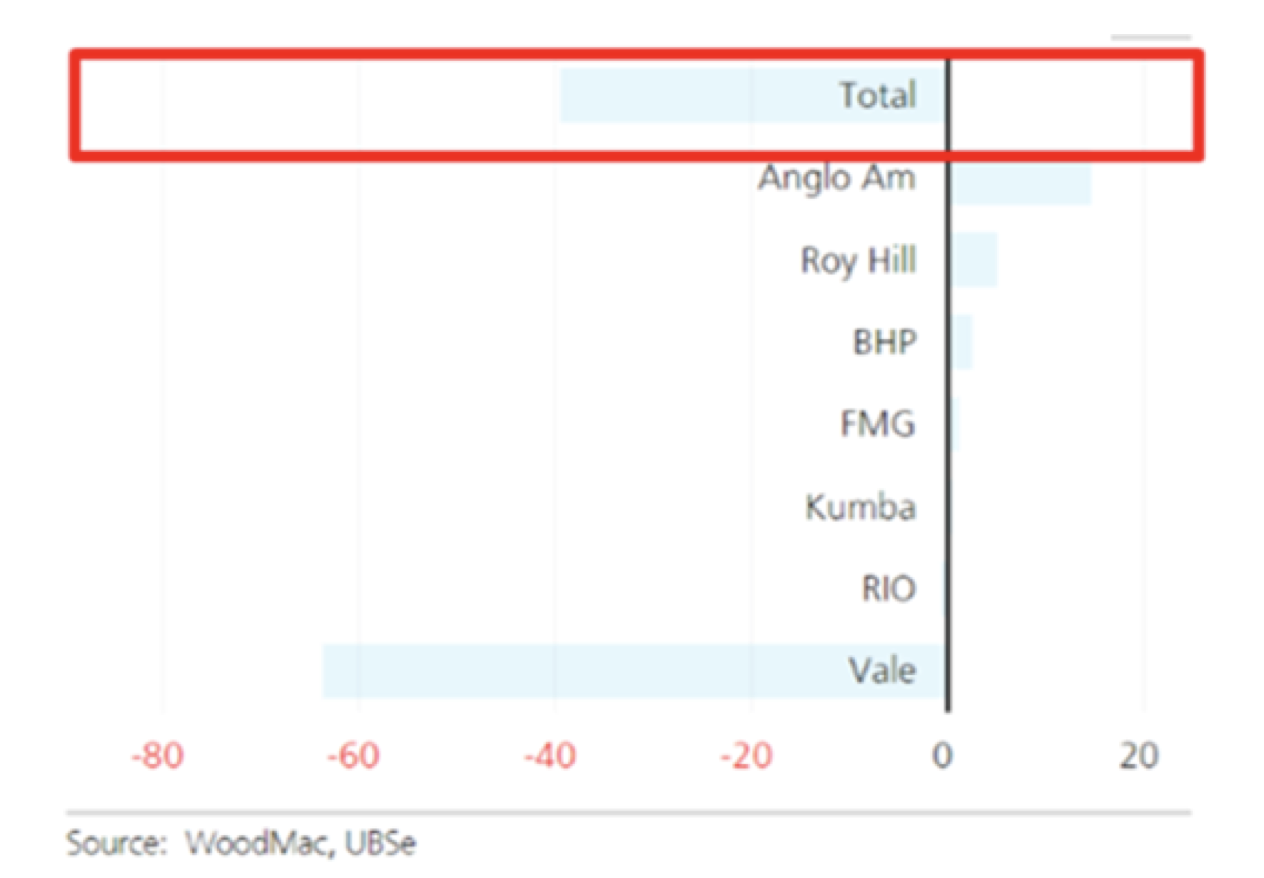

To understand what caused this huge surge in prices we need to go back to January 25, 2019 when a major dam collapsed in Brazil and triggered a series of mine closures across the country. Vale, the 2nd largest exporter of iron ore in the world (behind Rio Tinto and ahead of BHP), was most impacted, announcing that it may be unable to deliver up to ~75 million tonnes (Mt) or 20% of its expected 2019 production as a result (Vale revised 2019 guidance from 382Mt to 307-332Mt). In addition, severe weather and hurricanes in Australia impacted iron ore exports causing Rio Tinto and BHP to cut guidance taking out ~20Mt of supply that would have otherwise been available in the market, and creating a supply deficit in 2019 relative to what was available in 2018.

Change in Iron Ore Supply (2019 vs 2018)

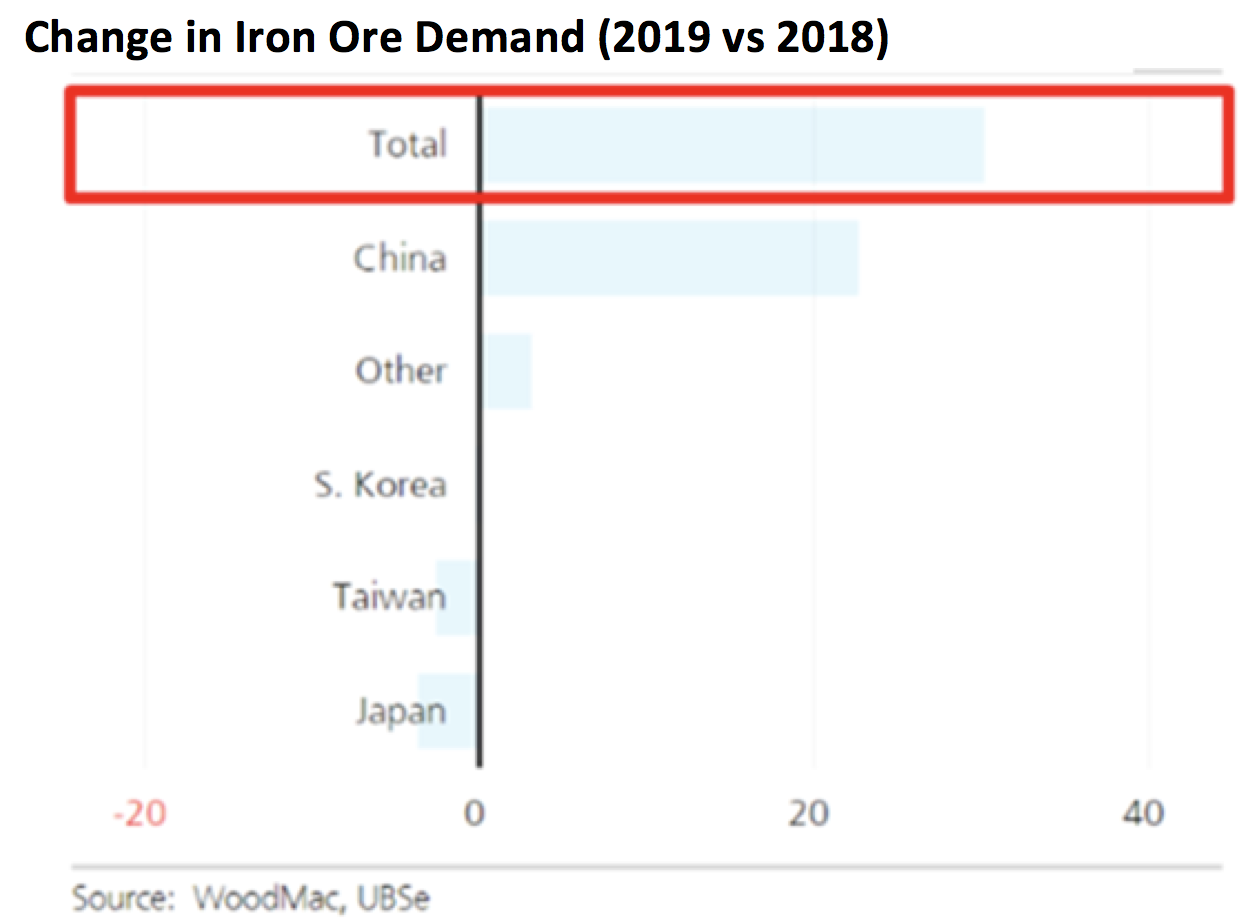

In addition to iron ore supply tightening, stimulus measures adopted by the Chinese government in January 2019 led to Chinese steel production rising by 10% YoY through April 2019. Given China is responsible for more than 50% of global steel products (the primary end market for iron ore) the impact of this swing created a sharp increase in iron ore demand. This combined with the supply tightness created the price squeeze we have seen so far in 2019.

Change in Iron Ore Demand (2019 vs 2018)

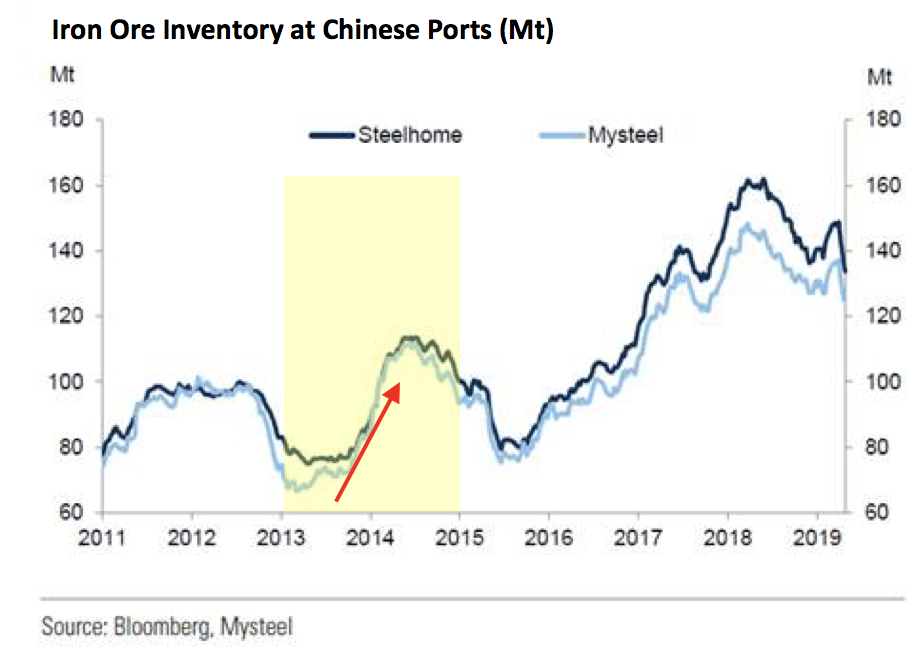

A popular narrative in the market currently which calls for prices to continue moving higher is the trajectory of iron ore inventories at Chinese ports. Many believe that up to 65% of the ~135Mt inventory balance is unavailable (already sold), which leaves China with only 3-4 months of available stock (at current run-rate steel production) before they run out of supplies in Q3 2019, which would potentially cause prices to soar.

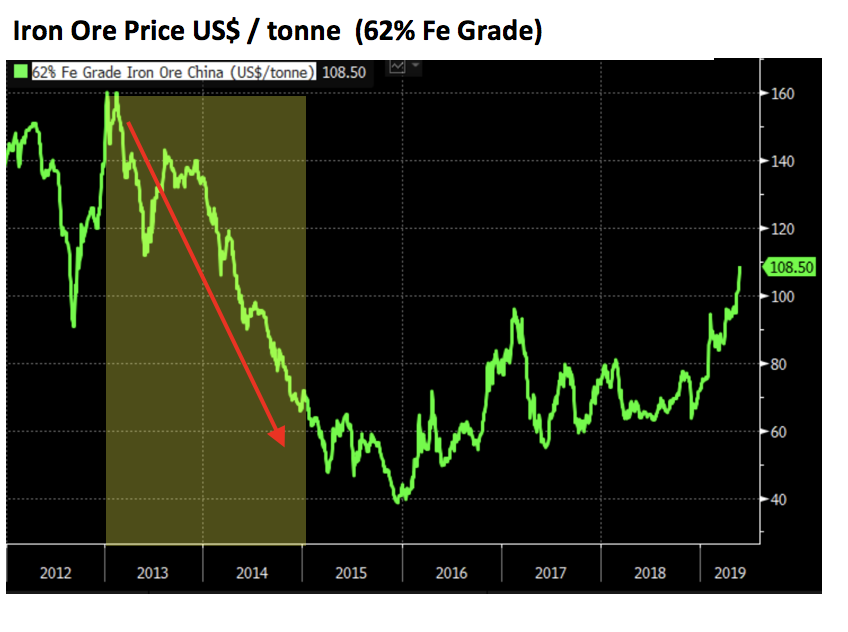

While we cannot predict what iron ore prices will do, one thing that is perhaps demonstrable is that Chinese port inventories are not a particularly good lead indicator for prices. For instance, over the two-year period starting2013 and ending 2014, Chinese iron ore port inventories nearly doubled (from ~65Mt to ~120Mt) while prices collapsed >60% (from ~US$160/t to ~US$60/t). In fact, prices went on to fall another ~33% (from ~US$60/t to ~US$40/t) in 2015 despite Chinese port inventories falling by approximately the same amount (~33%), the exact opposite of the prevailing narrative around iron ore prices today.

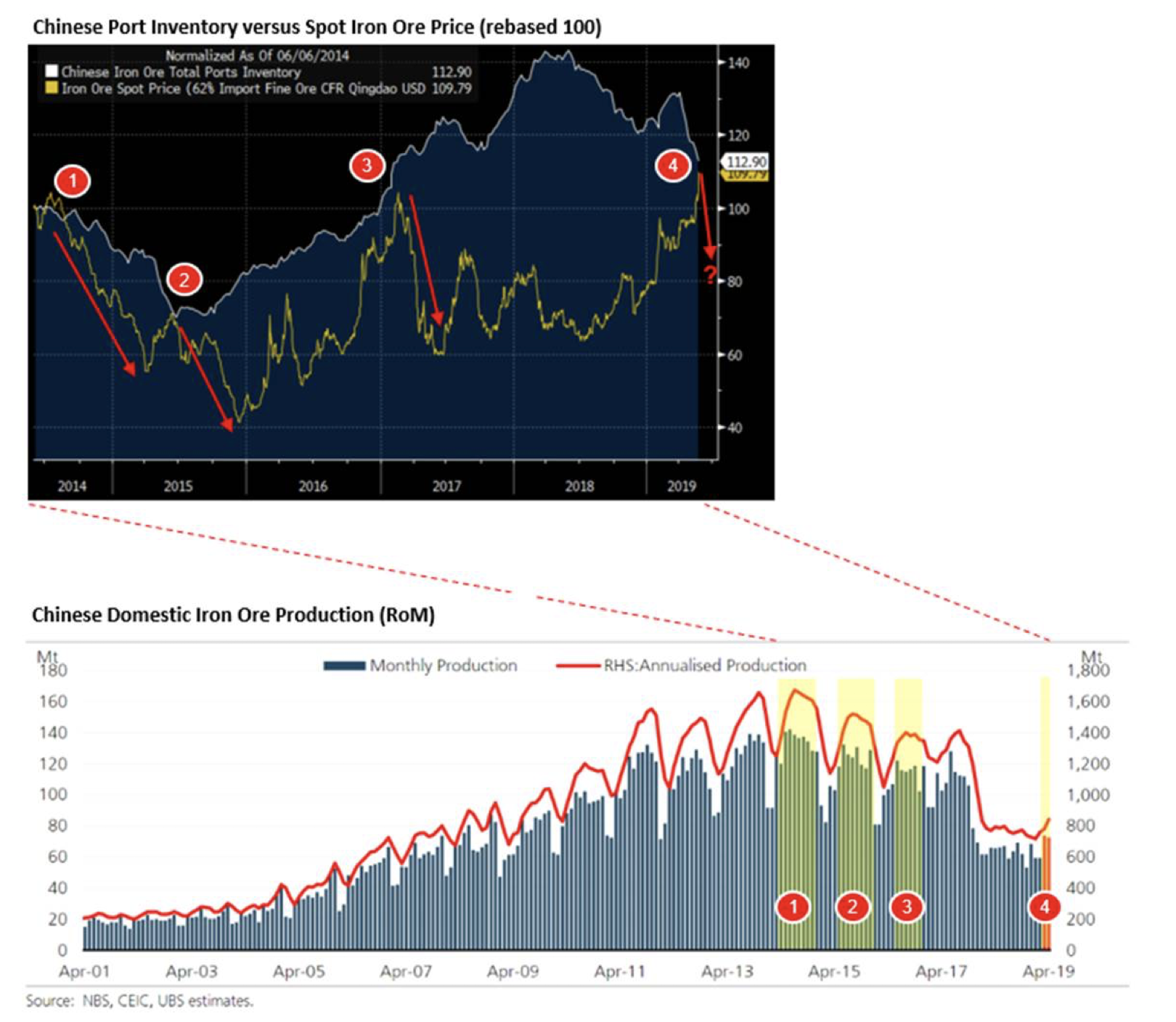

Perhaps of greater interest to iron ore price observers is not what Chinese port inventories are doing, but rather what Chinese iron ore producers have done in the face of high prices. In the charts below we have identified 4 points (marked #1, #2, #3, #4). The first chart maps the relative movement of Chinese port inventories to spot iron ore prices. Over the last 5 years when these two converge on a relative basis we have seen a marked increase in Chinese domestic iron ore production. This may be thought of as incentive prices for domestic producers being met which draws down incremental supply. This is then followed by an extremely sharp price drop for seaborne iron ore supply as Chinese import demand falls. In fact, prices dropped ~45% following #1, ~40% following #2, ~45% following #3 and if we are at the beginning of #4 we are yet to see a meaningful price response, however we can see Chinese domestic volumes starting to increase.

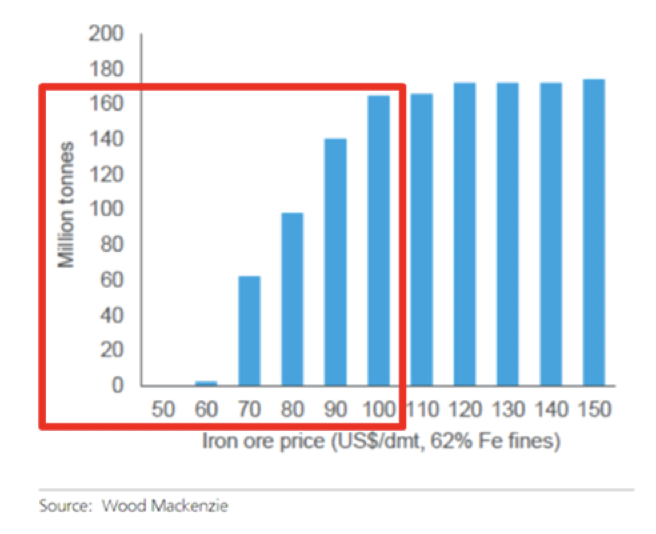

It should be noted that Chinese domestic iron ore volumes have meaningfully decreased over the last couple of years due to strict environmental regulations, high production costs relative to imports and steel mill preference away from low-grade iron ores (boosting steel quality and furnace efficiency). However, the lost volumes from the market are predominantly very high quality (65-66% Fe grade from Vale) and their elimination has caused lower quality iron ore products to significantly increase in price, largely eliminating the key drivers of why Chinese domestic production was reduced (i.e. pollution, efficiency, quality, etc). Hence it should be no surprise that we are seeing and increasingly hearing that Chinese domestic iron ore mines are being restarted, particularly given iron ore prices are now above US$100 / tonne (62% Fe). Based on the incentive curve (chart below), up to 160Mt of Chinese iron ore volume may be economic at current price levels (US$100/tonne) incentivizing their return to the market. We note however that it is unlikely all of this supply will return to the market as it is estimated that only ~40Mt is required to fill the market deficit, which once filled would coincide with a precipitous unwind of the substantial iron ore price increases we have seen so far in 2019, making a significant amount of Chinese supply uneconomic again.

Chinese Domestic Iron Ore Production – Incentive Prices for Mine Restarts (US$ / tonne)

Curiously, despite the significant increase in iron ore prices, Chinese steel producers have not increased the price of rebar and hot rolled coil (HRC), the two primary benchmark steel product. In fact, they have done the opposite and reduced steel prices in the face of sharp increases in iron ore (primary ingredient in steel) which obviously would pressure margins. This behavior may indicate that demand is extremely weak in China (no pricing power), the government is subsidizing / forcing producers to keep prices low or fresh iron ore supply is imminent in the Chinese market (hence no need to raise prices).

Iron Ore (62% Fe Grade) vs Key Steel Product Prices (US$/t) in China

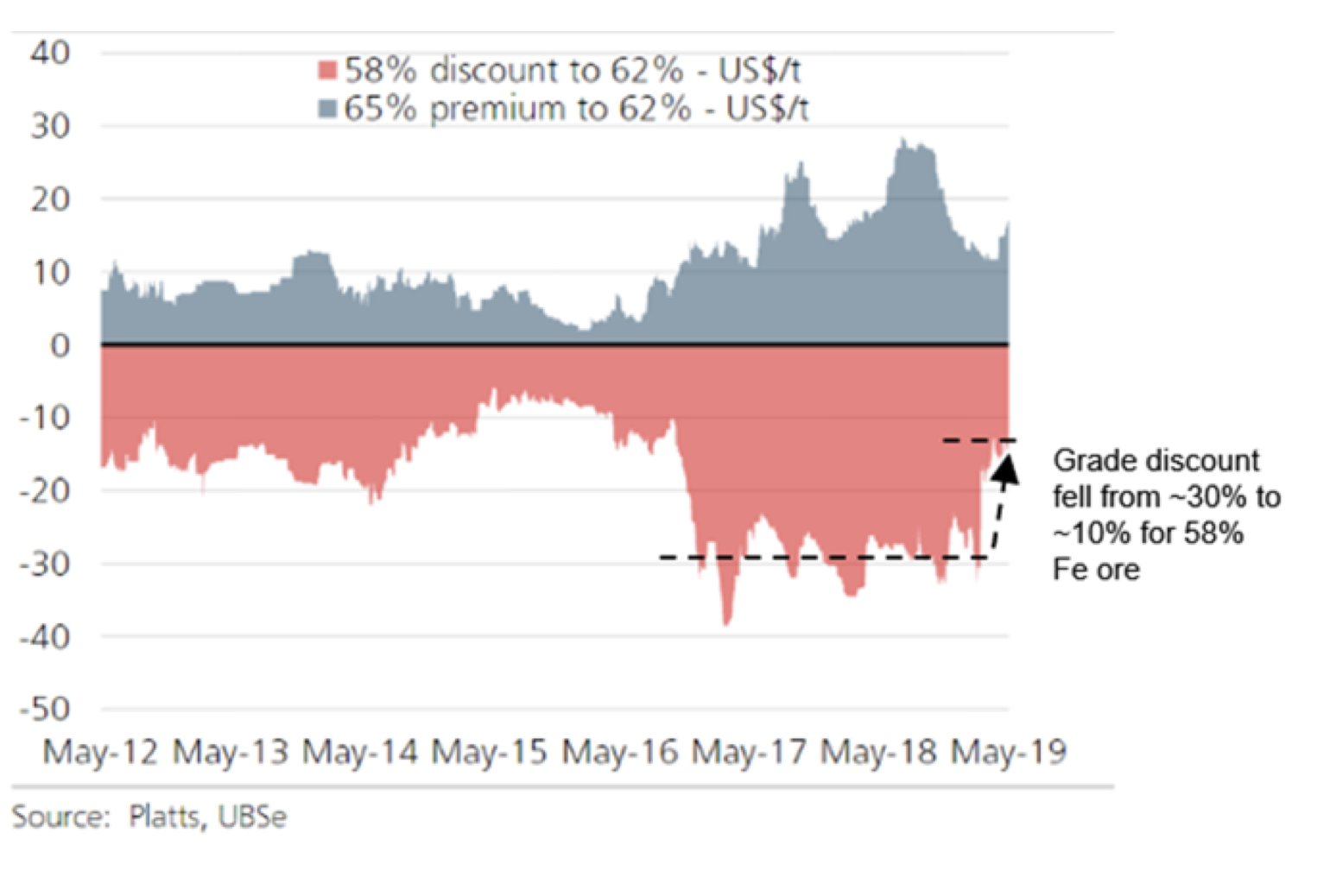

Given that the disrupted volumes we discussed earlier are unlikely to remain out of the market permanently and a Chinese domestic supply response may be on its way, it is increasingly likely that low grade iron ore producers that have benefited most from this environment will see valuations unwind towards pre-supply disruption levels observed at the start of 2019. To quantify this benefit, historically the discount on inferior iron ore products relative to the benchmark (i.e. 58% Fe versus 62% Fe aka “the benchmark”) has been ~30%, however this discount has now fallen to just ~10% on the back of supply tightness and in some cases has caused share prices to increase by more than 100% YTD. Once volumes return to the market (Vale, BHP, Rio, China, etc.), low grade iron ore producers that have benefited most from the supply disruption will see this temporary benefit return to being a permanent disadvantage. Montaka Global is carefully positioned on the short side to benefit from such an unwind in the iron ore market as the situation evolves.

Lower Quality Iron Ore(58% Fe Grade) Has Benefited Most from the Supply Disruption

Amit Nath is a Senior Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Amit Nath is a Senior Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.