|

Getting your Trinity Audio player ready...

|

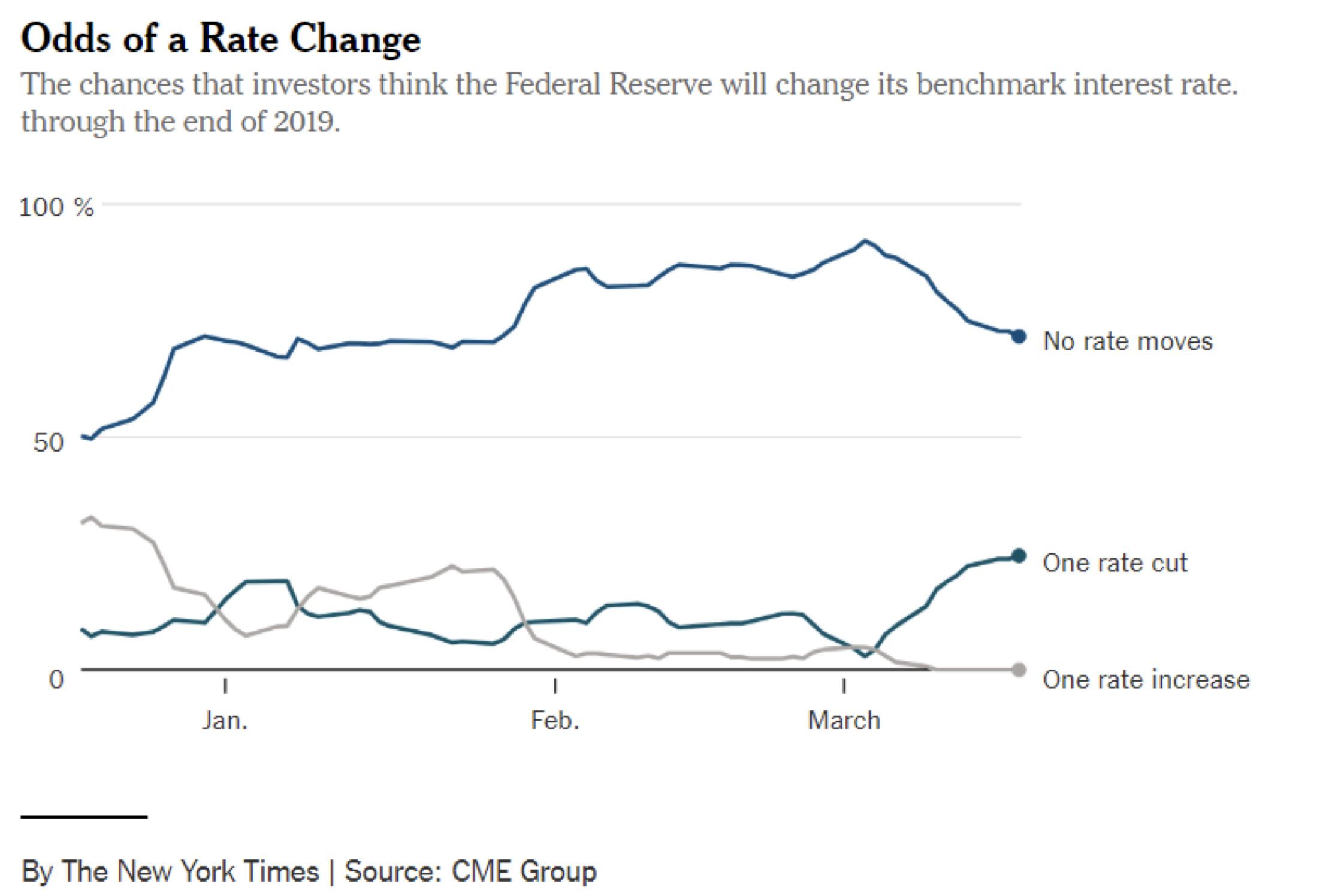

In December, when US equities were in freefall over concerns about trade, the economy and Federal Reserve tightening, the Fed decided to raise interest rates for the fourth time in 2018 and reaffirmed its autopilot QT stance, sending stocks to their first intraday bear market since the GFC. Having realised their mistake and with the S&P 500 up 21% since December lows, the Fed has done a full 180 and now not only expects to keep rates flat in 2019 in line with investor expectations, but also to taper the taper – that is, to rein in its balance sheet roll-off.

This kind of abrupt swing from hawkish to dovish monetary policy is of course fodder for Wall St. One could mount a credible argument that it was the “out of touch” pace of Fed tightening (in the face of mixed to negative US and global economic data) that caused the steep selloff in the fourth quarter, and likewise an expectation that the Fed would ease its tightening drove an equally steep recovery in early 2019. Trade uncertainty may have also played a part, although optimism following the Trump-Xi dinner in Argentina was very short lived, and the two countries are at best slightly closer to reaching a comprehensive deal now than months ago. Indeed, the only thing that has swung as hard as the stock market over the last 6 months is the Fed.

More interesting to prudent investors is whythe Fed has decided to reverse course on monetary tightening. The Fed talks about being “data dependent” in its approach to monetary policy decisions, and its members’ newfound patience to “wait and see” signals closer adherence to that approach in light of recent mixed economic data. Of greater concern is the fact that the Fed’s economic outlook has deteriorated since December. The Fed now expects 2.1% GDP growth in 2019 and just 1.9% in 2020, down from 2.3% and 2.0% respectively in December. Fed Chairman Jerome Powell attributed this downbeat projection to signs of weakness in consumer spending and business investment, slower job growth (albeit off a very strong year), and a substantial economic slowdown in Europe and China. The fiscal stimulus from the Trump tax cut is also expected to wear off as the year progresses. Surprisingly, Powell even left open the possibility of a rate cut – “The data are not currently sending a signal that we need to move in one direction or another,” he said.

It is slightly ironic, then, that the stock market reacted so violently to the Fed’s December rate hike yet remains completely sanguine towards the numerous concerns that now give pause to the Fed’s rate hike path, highlighting yet again that it is the change in interest rates and the size of the Fed’s balance sheet that drive near-term equity market movements. Consider that according to Factset, first quarter earnings estimates for the S&P 500 actually show a year-over-year decline of 3.6%, a 640-bps downward revision from the 2.8% growth expected on December 31.

In an environment where global economic uncertainty is on the rise yet the market is rediscovering its complacency (the S&P 500 is now barely 2% off its record high), the ability to construct a global portfolio that is resilient in any economic environment and to vary one’s net exposure to the market becomes paramount to generating attractive risk adjustedreturns. As the market sold off in December, we increased the net exposure of the Montaka fund as individual stocks in our long portfolio de-risked irrationally, allowing our investors to capture additional upside as the market bounced back earlier this year.

The Greenspan put lives on for now, but the prudent investor must surely ask – if the Fed ends the tightening cycle with lower rates and a bigger balance sheet than is “necessary to efficiently and effectively implement monetary policy”, how much firepower will the Fed have the next time the economy and/or the market needs to be bailed out? As far as capitulations go, the Federal Reserve press conference on Wednesday may be one for the ages.

![]() Daniel Wu is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Daniel Wu is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.