Make sense of the global investment landscape with timely updates, articles and videos from our investment experts

Montaka

- Active ETF

Global Fund

ASX: MOGL

Montaka Global

Long Only Fund

Montaka Global

- Complex ETF

Extension Fund

ASX: MKAX

Sydney

Suite 2.06, 50 Holt Street

Surry Hills, NSW 2010

Australia

Copyright © 2022 Montaka Global

Privacy | Terms | Disclaimer | FSG | TMD

Harvard looking for short-sellers

A couple of weeks ago, the Financial Times published an article highlighting the cautiousness Harvard’s $38 billion endowment fund was now exercising with respect to its outlook for global financial markets.

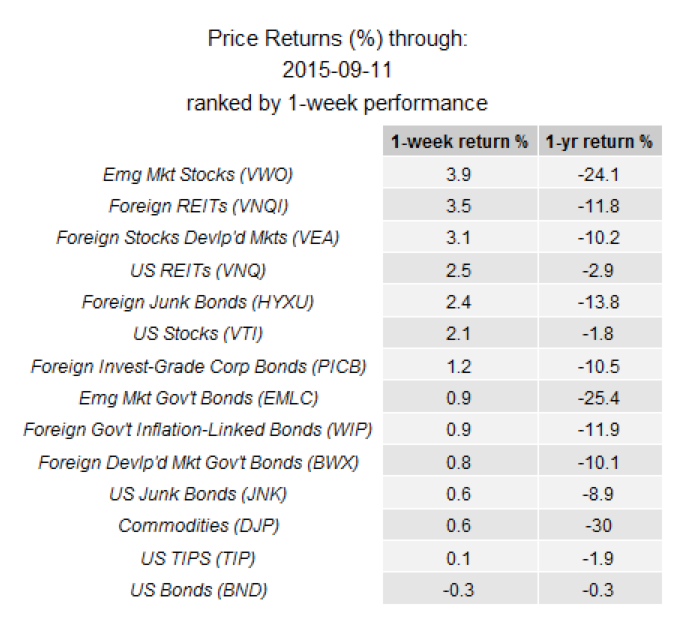

It’s perhaps little wonder. Take a look at the table below circulated by economic observer, Cullen Roche, last month. Every single major asset class has negative one year returns!

In the case of Harvard, they have put the call out to investment managers with expertise in short selling. As investors in Montaka will already know, holding a well-constructed short portfolio in parallel to one’s long portfolio of investments serves two key objectives: (i) to dramatically increase the downside-protection of the overall portfolio; and (ii) to allow the investment manager of the short portfolio to add value through superior stock selection.

In the current volatile market environment, in which downside risk clearly persists, a well-constructed short portfolio is enormously valuable to investors.

This content was prepared by Montaka Global Pty Ltd (ACN 604 878 533, AFSL: 516 942). The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should read the offer document and consider your own investment objectives, financial situation and particular needs before acting upon this information. All investments contain risk and may lose value. Consider seeking advice from a licensed financial advisor. Past performance is not a reliable indicator of future performance.

Related Insight

Share

Get insights delivered to your inbox including articles, podcasts and videos from the global equities world.