|

Getting your Trinity Audio player ready...

|

Throughout the year, members of the Montaka team will travel to visit companies and talk to people on the ground. This scuttlebutt approach has in the past paid dividends, whether it’s gaining insights about the companies in the Montaka portfolio, or generating prospective investment ideas. In a recent trip to San Francisco earlier this month, I heard from a number of technology, media, and telecommunication companies, learning new insights and sparking investment ideas.

Some of the key themes from these discussions were AI and machine learning, the constant innovation of ad products (being led by Facebook), and the re-emergence of IT spending growth in the U.S.

Artificial Intelligence (AI)

In a presentation Sheryl Sandberg, the COO of Facebook, gave an example of how artificial intelligence was being implemented by Facebook to help companies interact with their customers. Kia launched a Messenger bot and ran click-to-Messenger ads through Facebook Messenger. These ads targeted people who were interested in a certain Kia car model, and prompted them to communicate with the bot via Messenger. Users could message the bot for price quotes, vehicle specifications, and the like.

Through integrating AI into the user experience, Kia saw 2x the conversion via that engagement in Facebook Messenger, compared to consumers coming directly to Kia’s own website. Facebook indicated that they will continue to invest heavily in AI, and that some of these plans are very long term (i.e., 10 years plus) initiatives.

The importance of AI and machine learning, and the opportunity for these technologies to be used to sharpen a firm’s product offering was illustrated by the CTO of Adobe, Abhay Parasnis. Parasnis gave an example of how Sensei, which is Adobe’s core platform bet around AI, uses AI and machine learning so that the system can identify searched images based on specified criteria.

For example, by integrating Sensei into Adobe’s Lightroom product, users can intelligently search all of the photos in their library without having to tag or classify any of the images. For example, a user may want to locate an image of a “sunrise”. By using machine learning, Sensei is able to distinguish between a sunrise on a beach, and, say, a sunrise at the Golden Gate Bridge. As more people use this functionality, Adobe gathers more data, and the machine learning algorithms analyze this data to further improve the user experience. Through Sensei, Adobe is parlaying its data trove into a meaningful competitive advantage in various ways; once the ball gets rolling, it becomes difficult for competitors with weaker data capabilities to catch up.

Technology shifting the advertising landscape

With user time shifting from the Facebook platform to Instagram (Facebook owns both of these businesses), Facebook has had to grapple with the inherent differences of these platforms when thinking about monetization (via ads). Facebook has traditionally been more of a text-based medium, whereas Instagram is highly visual, being predominantly images and video. However, this provides different ad format opportunities.

Sandberg gave an example of Buck Mason, a small men’s clothing retailer based out of Venice, California. This business ran Instagram Stories ads that encouraged people to “swipe up” and shop for shirts. Buck Mason was able to show specific products to Instagram users, and in this instance were targeting men aged between 25 and 54 who were living in the U.S. However, Facebook also had the capabilities to run what Sandberg referred to as “Lookalike Audiences”. Essentially when a business is getting traction with certain audiences, Facebook’s algorithms are able to target similar users who are also likely to be interested, which raises the chances of converting that engagement to a sale.

During this visit to San Francisco, I met with an ex-Facebook employee who now runs a marketing consulting firm. He likened advertisers’ use of Facebook to getting hooked on a drug. Once advertisers begin using Facebook, they become accustomed to the granular targeting capabilities which result from the incredibly rich and informative data Facebook collects on each of us, via its Facebook, Instagram, Whatsapp, and Messenger platforms. There are genuine switching costs if an advertiser wants to consider shifting their ad budgets to another digital channel; that advertiser simply cannot continue to run the same ad campaigns that target specific cohorts that they did on Facebook, given that these ad platforms don’t have the same richness of data on their users.

Re-emergence of IT spending growth in the U.S.

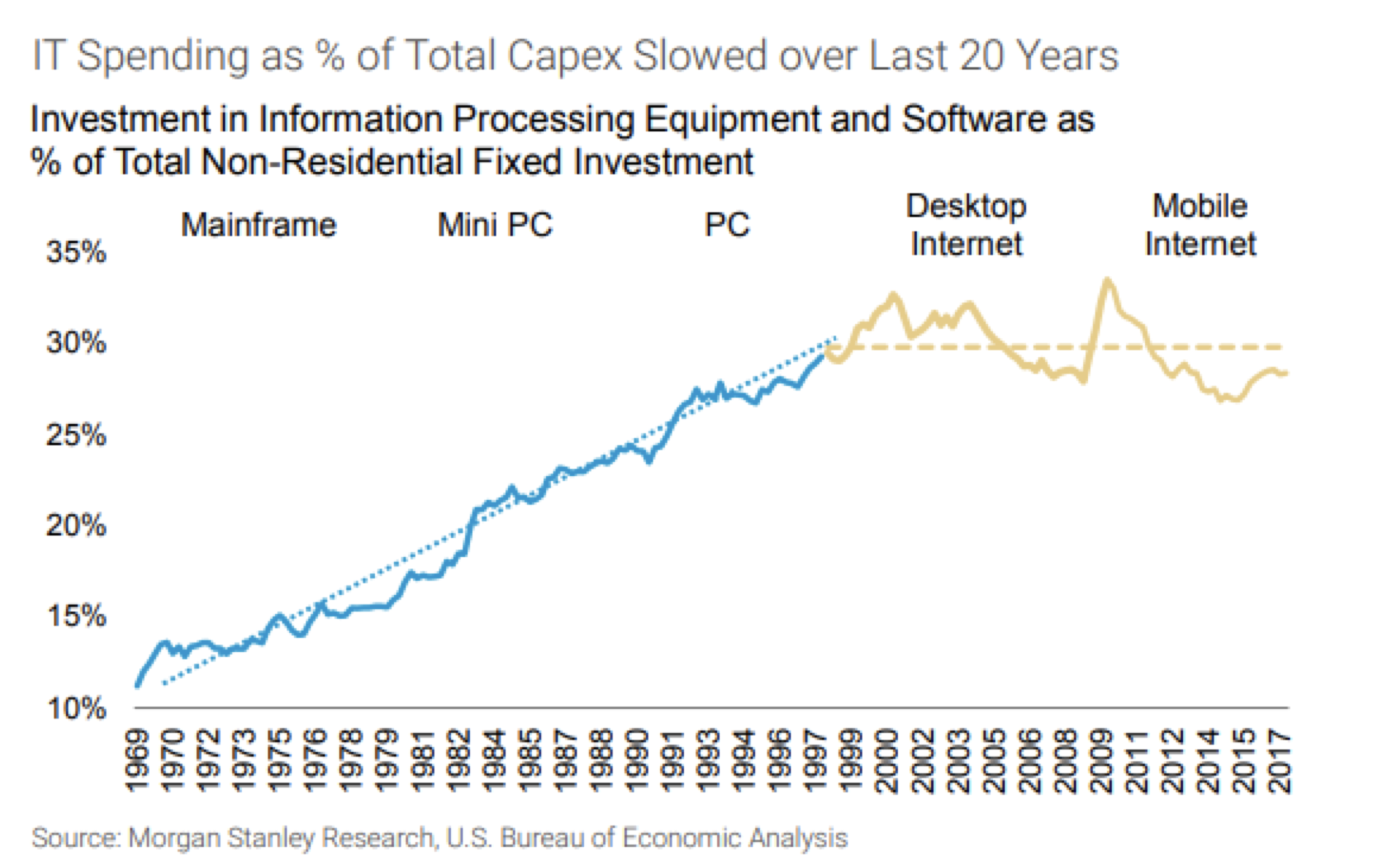

As can be seen from the graph below, growth in IT spending as a percentage of capex has been stagnant for many years. While part of this reflects the mechanics of a transition to the cloud being made by many firms, which shifts capex to opex, there is the view held by many that firms have been underinvesting in IT, particularly if we consider the 20 years of range-bound IT spend as a percentage of business capex.

More recently, CIO expectations for US IT budget growth are starting to accelerate, and this is likely a reflection of synchronous global economic growth, the benefits of repatriated cash, and the desire of firms to take advantage of accelerated depreciation rules under the recent tax reforms. This is likely to create opportunities on the long side, but has also given us pause for IT software and hardware businesses that we were actively considering as short candidates, given that they would also benefit from this tailwind.

The above points are just snippets of some of the interesting themes explored on the San Francisco trip. The Montaka team seeks to stay on top of these global megatrends to best identify actionable ideas that will contribute to strong returns for our investors.

Montaka owns shares in Facebook (Nasdaq: FB)

![]()

George Hadjia is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.