|

Getting your Trinity Audio player ready...

|

In the first part of this series we explored the concept of a valuation range as the first critical input into determining an appropriate position size for a stock. As promised in the previous instalment, today’s blog will address how this input interacts with a second critical variable to form a “roadmap” that guides us to more optimal position sizing decisions.

Last week’s post revealed that understanding the distribution of potential value outcomes for a stock allows us to make 3 important determinations:

- We can identify a potential bargain at a given share price quote, based on quantitative derivations of upside potential and downside risk;

- As the share price changes (all else equal) the relative attractiveness of the bargain available also changes. A higher share price means less upside potential and more downside risk, and conversely a lower share price means greater upside potential and less downside risk;

- Our position size should reflect the relative attractiveness of the investment opportunity, necessitating a change in position size as the share price changes (again, all else equal). A higher share price means a smaller positon, and a lower share price means a bigger position.

In the example of REA Group, once we had determined our range of values for the stock, we could see that the current share price of $56 represented good value and we allocated “say” 5% of our portfolio to REA. Moreover, if the share price were to fall to $45 the value equation would improve and we would hypothetically increase our weighting to REA to “say” 8%. But if the share price were to rise the deal would become less appealing and we would reduce our proportional allocation to REA to “say“ 2%. Why “say”?

The first input into the algorithm helps us to frame relative position sizes, but it doesn’t say much about the absolute size of a portfolio holding. At this point we need to introduce a second key variable into the discussion to provide a frame of reference and help us to pin the appropriate absolute position size. This second critical input is conviction.

Conviction represents a subjective assessment of the degree of confidence in an investment opportunity. The conviction level of a stock is a numerical representation of our depth of understanding of the business (knowing what is publicly knowable) combined with an assessment of the inherent level of predictability in the business (knowing what is unknowable and appreciating the potential gravitas of “unknown unknowns”). For a long position our conviction level could theoretically range from zero to the fund’s mandated maximum position size of 10%*. Said another way, the conviction level is the maximum position size a portfolio manager would be willing to take if the share price fell to a level that represented zero downside risk.

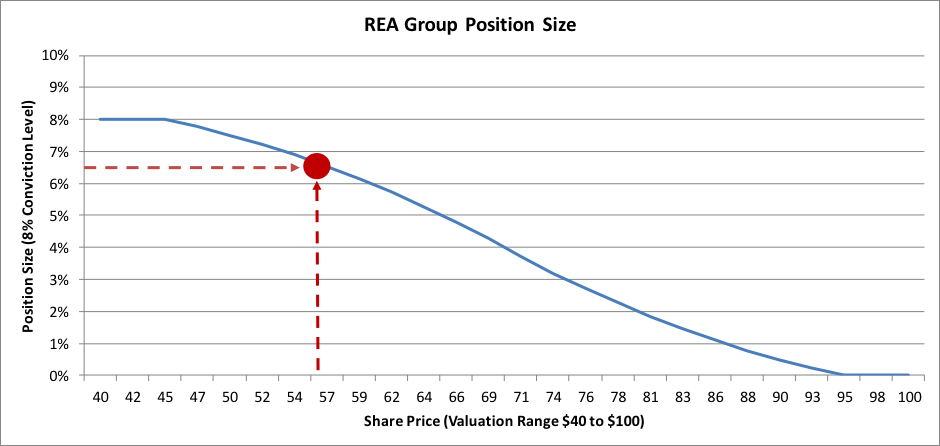

The exact number selected to represent the conviction level is not a precise science. Rather, the portfolio manager’s judgement is key to selecting a conviction input that appropriately reflects his or her level of insight into the business and its stock. The conviction level then acts as the vertical axis, with valuation ranges as the horizontal axis, on the portfolio position size roadmap. Let’s return to the REA example to see how this works in practice.

REA is a business we have followed for quite some time. REA has been one of the largest (and sometimes the largest) long positions in both global funds since their inception in July 2015 and was a key holding in the pre-launch model portfolios. Necessarily, our research into REA has been deep and broad. Our analyses have provided significant insight into how the REA business works. And these efforts have accumulated over many years. Additionally, our colleagues in the domestic business own a position in REA and provide independent thoughts for us to corroborate. REA is also a business which we believe can be well understood with few important drivers to focus on, albeit some of these variables may be more difficult than others to predict precisely. Suffice to say our conviction level for REA is high. In this example we may determine an 8% conviction level is appropriate for REA. The following chart then illustrates how the conviction axis interplays with the value range axis for REA.**

Based on this roadmap graphic, we are now able to omit “say” from our position size suggestions. Using a conviction level of 8% and a valuation range between $40 and $100 per share, we can see that at the current share price of $56 the roadmap guides us to a 6.5% weighting in REA (the big red dot). Of course moving to the left the roadmap guides us to an 8% sizing at a share price of $45, and moving to the right the roadmap guides us to around 2% sizing at a share price of $80.

Combining value range and conviction allows the creation of a roadmap which acts as a comprehensive guide to position sizing at the individual stock level. However, the roadmap is not prescriptive nor final. Rather it is a tool to ensure position sizing decisions are grounded in logic and helps to remove human biases. Ultimately the portfolio manager must determine the position size based on individual merit of the stock, and in the context of the broader portfolio. This is the third and final variable which we will look at in part 3 of the series next week.

***

*The 10% mandated maximum position size was determined as a balance between concentration and humility. At the maximum 10% weighting the the portfolio is able to benefit meaningfully from the portfolio manager’s most attractive investment ideas. At the same time, in the event that downside risks materialized, the negative contribution to the overall portfolio performance would be contained. The mandated maximum position size for a short positon in Montaka is 5%.

**Note the conceptual shape of the chart slopes downward from left to right, reflecting smaller/larger positions at higher/lower share prices.

Montaka owns shares in REA Group.

![]() Christopher Demasi is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.

Christopher Demasi is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.